Intelligent Pigging Market Size 2024-2028

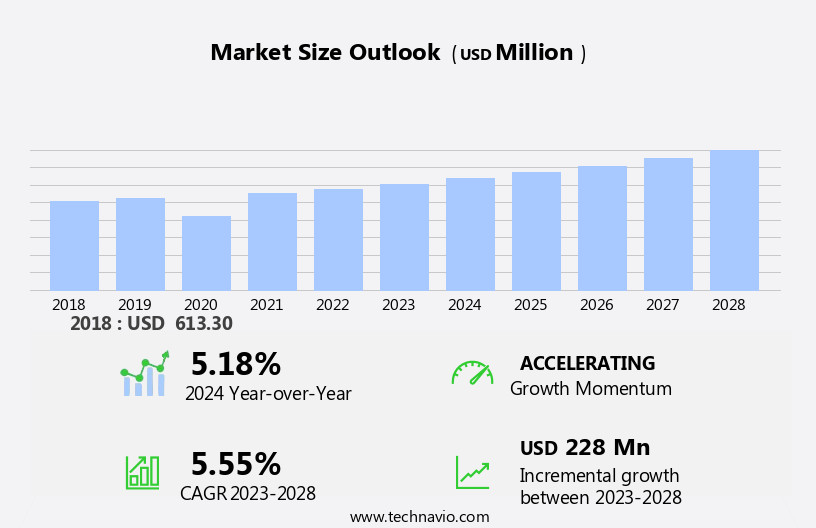

The intelligent pigging market size is forecast to increase by USD 228 million at a CAGR of 5.55% between 2023 and 2028.

- The market is experiencing significant growth due to the increasing adoption of this technology for enhancing pipeline efficiency and productivity. One of the key drivers is the additional applications of intelligent pigging over traditional pigging, such as real-time data collection and analysis, which enables proactive maintenance and improved operational performance. Another growth factor is the advances in pipeline inspection technologies, including the integration of sensors and artificial intelligence, which enable more accurate and comprehensive data analysis. However, the market also faces challenges, particularly in the complexities associated with small-diameter pipelines, where the implementation of intelligent pigging requires specialized equipment and expertise. Overall, the market is expected to continue growing as the benefits of intelligent pigging become increasingly apparent to pipeline operators in various industries.

What will be the Size of the Intelligent Pigging Market During the Forecast Period?

- The market encompasses the use of advanced technologies, such as ultrasonic and caliper pigs, for pipeline inspection and cleansing activities. This market is driven by the increasing demand for pipeline safety and efficiency In the oil and petroleum gas industry. Pipeline projects, particularly those involving shale formations, present unique challenges due to the presence of gas hydrates and other deposits that can affect pipeline wall thickness and integrity.

- Intelligent pigging solutions enable the detection of corrosion, deformities, and other inner wall issues, ensuring the safe and reliable transport of oil and gas. These technologies offer significant benefits in terms of pipeline length and inspection time, making them a cost-effective solution for pipeline operators. Ultrasonic technology, in particular, plays a crucial role in crack and leak detection, enhancing pipeline safety and reducing operational downtime.

How is this Intelligent Pigging Industry segmented and which is the largest segment?

The intelligent pigging industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Gas

- Oil

- Technology

- Magnetic flux leakage

- Ultrasonic

- Caliper

- Geography

- North America

- Canada

- US

- Europe

- UK

- APAC

- China

- Middle East and Africa

- South America

- North America

By Application Insights

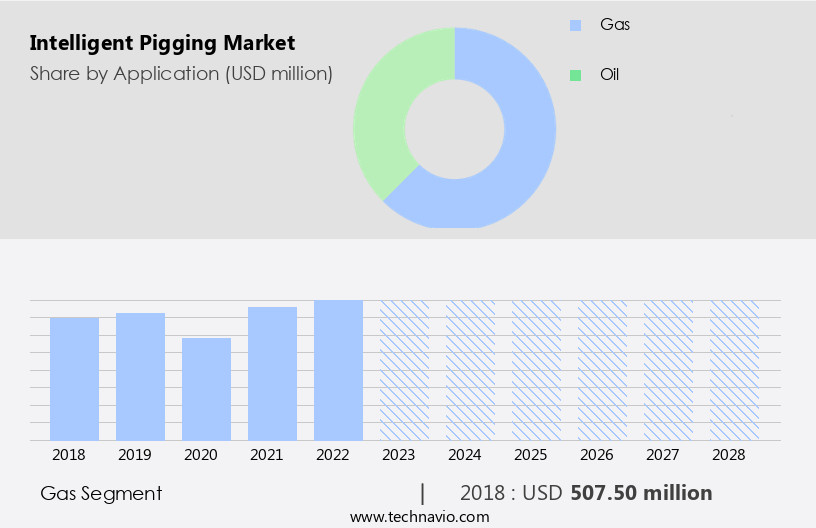

- The gas segment is estimated to witness significant growth during the forecast period.

The natural gas industry is expanding due to the increasing availability of shale gas and liquefied natural gas supplies. Consequently, the construction of pipelines is anticipated to increase In the upcoming years. These pipelines, primarily owned and operated by national governments for energy security and self-sufficiency, face challenges such as stress, cracking, and internal and external corrosion. Intelligent pigging systems, which include caliper pigs and ultrasonic testing technology, play a crucial role in pipeline inspection. Advanced caliper technology enables the detection of deformities, defects, and wall thickness changes. Ultrasonic testing identifies corrosion, metal loss, and other forms of damage. These technologies enhance pipeline safety and efficiency, addressing concerns related to pipeline security and monetary conditions In the oil and gas industry.

Get a glance at the Intelligent Pigging Industry report of share of various segments Request Free Sample

The gas segment was valued at USD 507.50 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

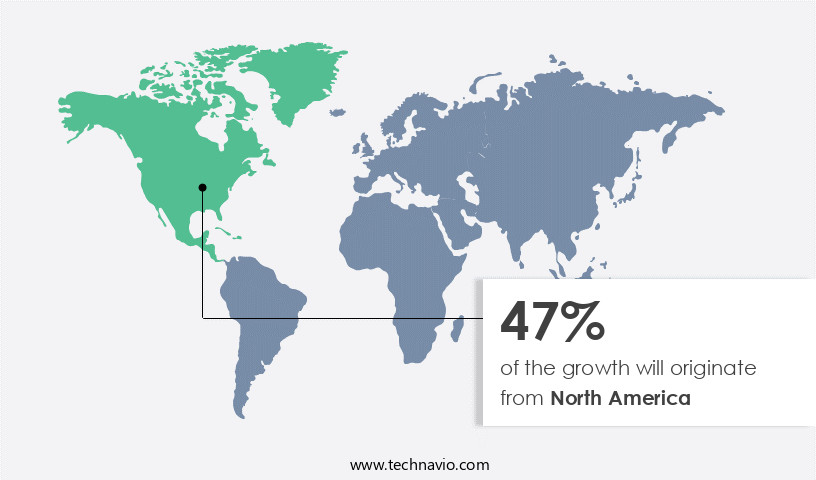

- North America is estimated to contribute 47% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market is experiencing significant growth due to the increasing number of pipeline projects in Texas, which is the largest oil-producing state In the country. With numerous pipelines under construction and planned for construction, the North American region, particularly the US, is at the forefront of this industry's expansion. These pipelines connect consumers and export terminals along the Gulf of Mexico coastline with major oil deposits such as the Permian Basin, Eagle Ford, and Barnett Shale. The oil and gas industry in Texas is thriving due to this influx of pipelines, accounting for approximately 40% of US oil production.

Advanced inspection technologies, including Caliper pigs and Ultrasonic testing, play a crucial role in ensuring pipeline safety and efficiency. Consumers, fuel stations, and oil and gas companies benefit from these inspections, which detect defects, deformities, corrosion, metal loss, pitting, and cracks & leaks. The implementation of an intelligent pigging system enables real-time data collection and analysis, enhancing pipeline diagnosis and maintenance. Despite intense competition, market leaders continue to invest in technology and monetary conditions remain favorable for pipeline infrastructure development.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Intelligent Pigging Industry?

Additional applications of intelligent pigging over traditional pigging is the key driver of the market.

- In the oil and gas industry, the importance of maintaining pipeline infrastructure cannot be overstated. Neglecting regular pipeline inspections and cleansing activities can lead to decreased pipeline safety and efficiency. Pigging, a process that involves the insertion of devices, referred to as pigs, into pipelines for inspection and cleansing, is a crucial aspect of pipeline management. These pigs travel through the pipelines, removing debris and dirt from the inner walls, while performing advanced inspections for defects such as corrosion, metal loss, pitting, cracks, and leaks. Caliper technology, an integral part of intelligent pigging systems, enables precise measurements of the pipeline's inner wall to diagnose deformities and wall thickness changes.

- Ultrasonic technology, another advanced method, is used for ultrasonic testing and ultrasonic tests to detect and assess the extent of corrosion and other defects. The implementation of these intelligent pigging systems is essential in addressing the challenges of aging pipelines and ensuring pipeline safety. The oil and gas industry, characterized by intense competition and monetary conditions, demands efficient and cost-effective pipeline inspection solutions. Consumers, including fuel stations and oil companies, rely on the reliable transportation of petroleum products, petroleum gas, and oil. Intelligent pigging systems, with their ability to perform multiple functions simultaneously, offer significant advantages over traditional inspection methods. GPS technology is often integrated into pigging systems, enabling real-time tracking and monitoring of pig movement along the pipeline length.

What are the market trends shaping the Intelligent Pigging Industry?

Advances in pipeline inspection technologies is the upcoming market trend.

- In the oil and gas industry, ensuring pipeline safety is of paramount importance. Traditional inspection methods have limitations in detecting minor defects such as metal loss, corrosion, and cracks, leading to potential oil or gas spills. Advanced caliper pigging technology, an innovation in pipeline inspection, is gaining traction in addressing these challenges. This non-destructive method uses caliper pigs equipped with ultrasonic technology to measure the inner wall's geometry and thickness of pipelines. Caliper technology provides precise data on deformities, pitting, and wall thickness, enabling early detection and diagnosis of defects. It is particularly beneficial for aging pipelines, where the need for thorough inspections is more critical.

- This technology's implementation in pipelines' networks contributes significantly to pipeline safety, reducing the risk of leaks and minimizing operational downtime. Advanced data platforms are integrated with GPS and ultrasonic tests to provide real-time information on pipeline conditions. These platforms help operators make informed decisions on cleansing activities, crack & leak detection, and pipeline maintenance. The intense competition In the oil and gas industry necessitates continuous improvement and monetary conditions favoring cost-effective and efficient solutions. Gas hydrates, shale, and other complex hydrocarbon sources are increasingly being exploited, further emphasizing the need for advanced pipeline inspection techniques. Intelligent pigging systems, using ultrasonic testing and caliper technology, offer a comprehensive solution to meet the evolving demands of the industry.

What challenges does the Intelligent Pigging Industry face during its growth?

Complexities associated with small-diameter pipelines is a key challenge affecting the industry growth.

- Intelligent pigging, a crucial aspect of pipeline inspection In the oil and gas industry, faces challenges in inspecting unpiggable pipelines. These pipelines, which can have small diameters, bends, or physical barriers, pose difficulties in pigging due to insufficient flow and friction. Unpiggable pipelines can carry various fluids, including oil, petroleum gas, and petroleum products, and come in diverse configurations such as valve, horizontal, diameter, elbow, vertical, and T-section joints. Advanced caliper pigs, equipped with caliper technology, are used to inspect these pipelines. This technology enables the detection of defects, deformities, corrosion, metal loss, pitting, and wall thickness changes on the inner walls of pipelines.

- Ultrasonic technology is also used in conjunction with caliper pigs for more precise diagnosis. Despite the challenges, the market for intelligent pigging systems continues to grow due to the increasing consumer base In the oil and gas industry and the need for pipeline safety. Monetary conditions and intense competition among manufacturers drive the implementation of these systems. The integration of GPS and data platforms further enhances the capabilities of intelligent pigging, allowing for real-time monitoring and analysis of pipeline inspection data. Inspection activities, including cleansing and crack & leak detection, are essential for maintaining pipeline infrastructure and ensuring pipeline safety.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, intelligent pigging market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Applus Services Technologies SL

- Baker Hughes Co.

- China National Petroleum Corp.

- Dacon Inspection Technologies Co. Ltd.

- Enduro Pipeline Services Inc.

- GeoCorr LLC

- i2i Pipelines

- Intertek Group Plc

- Mistras Group Inc.

- Naftoserwis Sp z o o

- NDT Global GmbH and Co. KG

- Pigtek Ltd.

- PIPECARE Group AG

- Romstar SDN BHD

- ROSEN Swiss AG

- Russell NDE Systems Inc.

- SGS SA

- Sidara

- T.D. Williamson Inc.

- Xylem Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Intelligent pigging is an advanced technology utilized In the oil and gas industry to ensure the optimal performance and safety of pipeline infrastructure. This non-invasive method involves the use of specialized pigs, or inspection tools, equipped with sensors and data processing capabilities. These intelligent pigging systems are designed to gather valuable information about the condition of pipelines, enabling operators to diagnose and address issues before they lead to significant problems. The oil and gas industry relies heavily on pipeline networks to transport petroleum products and natural gas. With the increasing age of pipelines and the growing demand for these resources, the need for effective pipeline inspection and maintenance has become more critical than ever.

Moreover, intelligent pigging offers a cost-effective and efficient solution to address the challenges posed by aging pipelines. Caliper technology, a key component of intelligent pigging, enables precise measurements of the inner wall of pipelines. This information is essential for identifying corrosion, metal loss, pitting, and other defects that can compromise pipeline safety. Ultrasonic technology, another advanced technique employed in intelligent pigging, is used for crack and leak detection. These technologies offer a more comprehensive diagnosis of pipeline conditions compared to traditional pigging methods. The implementation of intelligent pigging systems is a strategic priority for many oil and gas companies.

Furthermore, the monetary conditions In the industry have intensified competition, making it essential for operators to maintain pipeline safety and efficiency. Intelligent pigging provides valuable insights into pipeline conditions, enabling operators to optimize their maintenance schedules and reduce downtime. The oil and gas industry's reliance on pipeline infrastructure is vast, with pipelines transporting petroleum products and natural gas to fuel stations and various industrial applications. The network of pipelines spans thousands of miles, making regular and effective inspection a complex task. Intelligent pigging offers a streamlined solution, allowing operators to gather critical data and make informed decisions regarding pipeline maintenance and repair.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

163 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.55% |

|

Market Growth 2024-2028 |

USD 228 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.18 |

|

Key countries |

US, China, Canada, Russia, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the market growth of industry companies

We can help! Our analysts can customize this market research report to meet your requirements.