Intelligent Completion Market Size 2025-2029

The intelligent completion market size is valued to increase by USD 772.5 million, at a CAGR of 5.8% from 2024 to 2029. Advantages associated with intelligent completions will drive the intelligent completion market.

Market Insights

- Middle East and Africa dominated the market and accounted for a 37% growth during the 2025-2029.

- By Application - Onshore segment was valued at USD 1407.30 million in 2023

- By Technology - Hydraulic segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 53.53 million

- Market Future Opportunities 2024: USD 772.50 million

- CAGR from 2024 to 2029 : 5.8%

Market Summary

- The market is witnessing significant growth due to the increasing adoption in deep-water and ultra-deep-water exploration and production activities. The technology, which automates the process of completing wells by optimizing the production rate and reducing operational costs, has gained traction in the energy sector. Fluctuations in global crude oil prices have further accentuated the need for intelligent completion systems to enhance operational efficiency and ensure profitability. Intelligent completion systems utilize real-time data analysis and predictive algorithms to optimize well performance. These systems enable operators to make data-driven decisions, leading to improved production rates and reduced downtime. For instance, in a supply chain optimization scenario, an oil and gas company can leverage intelligent completion systems to monitor well performance and optimize completion processes in real-time.

- This results in reduced lead times, improved inventory management, and enhanced overall supply chain efficiency. Despite the numerous advantages, the market faces challenges such as high implementation costs and the need for significant upfront investment. Additionally, the integration of intelligent completion systems with existing infrastructure can be complex and time-consuming. However, the long-term benefits, including increased production efficiency and reduced operational costs, far outweigh the initial investment. As the energy sector continues to evolve, intelligent completion systems are poised to play a pivotal role in optimizing production processes and ensuring operational excellence.

What will be the size of the Intelligent Completion Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

- The market is a dynamic and evolving landscape, driven by advancements in artificial intelligence (AI) and the Internet of Things (IoT) technology. This market encompasses various applications, including crop monitoring systems, regenerative agriculture, and plant defense systems, to name a few. According to recent research, the adoption of AI in agriculture is projected to increase by 25% annually, signifying significant growth in this sector. This trend is particularly relevant for businesses focusing on agricultural productivity, nutrient management practices, and food security solutions. By leveraging AI, farmers can optimize crop yield potential, enhance environmental sustainability, and improve climate change resilience.

- For instance, AI-driven crop modeling applications can predict weather patterns and soil conditions, enabling farmers to make precision application techniques and water conservation strategies more effective. Furthermore, AI-assisted plant resilience factors can help mitigate the impact of biotic and abiotic stressors, contributing to overall resource efficiency and agro-ecological principles.

Unpacking the Intelligent Completion Market Landscape

Intelligent completion in the agricultural sector is revolutionizing yield improvement metrics through the integration of precision agriculture technologies. Soil enzyme activity and beneficial microbial communities have been shown to increase by up to 30% when utilizing these advanced solutions. This enhancement leads to sustainable agriculture practices, such as abiotic stress mitigation and mineral nutrition optimization, resulting in improved crop stress tolerance and water use efficiency. Moreover, the application of humic acid fertilizers and microbial inoculants, combined with plant hormone modulation and photosynthesis enhancement, can significantly boost microbial biomass carbon and nitrogen use efficiency. The implementation of these technologies also leads to enhanced nutrient absorption and growth stage optimization, ultimately contributing to improved fruit quality and plant phenotyping methods. By optimizing mineral nutrition, root growth stimulation, and bioactive compound delivery, businesses can achieve substantial cost reduction and ROI improvement while ensuring compliance alignment with sustainable agricultural practices.

Key Market Drivers Fueling Growth

The primary advantage driving the market is the key benefits linked to intelligent completions.

- In the dynamic landscape of the market, advanced technologies are revolutionizing oil and gas exploration and production. Real-time data acquisition from drilling and completion activities is facilitated by tools like sensors and wireless communication, integrated with drilling and completion equipment. This automation brings significant benefits, including a 30% reduction in downtime and an 18% improvement in forecast accuracy. A prime example is Schlumberger's permanent downhole monitoring system, an intelligent completion solution converting real-time data into actionable responses every second.

Prevailing Industry Trends & Opportunities

The exploration and production of deep-water and ultra-deep-water resources represent an emerging market trend. An increase in activities within these sectors is anticipated.

- In the oil and gas industry, offshore exploration and production activities have experienced a resurgence due to the recovery of global crude oil prices. The profitability of deep-water and ultra-deep-water projects hinges on high investments, as the harsh environmental conditions necessitate robust equipment design. To ensure profitability, the global crude oil price must exceed USD60/bbl. In response to the increasing exploration and production in offshore regions, companies are prioritizing efficient production from offshore reservoirs. They are turning to intelligent completion systems, advanced equipment that streamlines operations and enhances productivity.

- For instance, these systems can reduce downtime by up to 30% and improve forecast accuracy by 18%.

Significant Market Challenges

The volatility in global crude oil prices poses a significant challenge to the growth of the industry.

- The market has witnessed significant evolution, adapting to the dynamic needs of various sectors. In the oil and gas industry, for instance, it has enabled companies to optimize operations and reduce downtime by up to 30%. This is particularly crucial during periods of crude oil price volatility, such as the significant fluctuations experienced between 2023 and 2024. These price swings forced numerous upstream companies to reconsider their financial viability, leading to the postponement or cancellation of exploration and production projects.

- In the manufacturing sector, Intelligent Completion has improved forecast accuracy by 18%, enabling more efficient production planning and inventory management.

In-Depth Market Segmentation: Intelligent Completion Market

The intelligent completion industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Onshore

- Offshore

- Technology

- Hydraulic

- Electric

- Hybrid

- Component

- Downhole monitoring systems

- Downhole control systems

- Surface control systems

- Communication systems

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- Middle East and Africa

- South Africa

- UAE

- APAC

- China

- India

- Rest of World (ROW)

- North America

By Application Insights

The onshore segment is estimated to witness significant growth during the forecast period.

The market in agriculture is witnessing significant advancements as farmers adopt precision agriculture technologies to optimize crop yields and mitigate abiotic stress. Soil enzyme activity and beneficial microbial communities play crucial roles in yield improvement metrics, with microbial biomass carbon and humic acid fertilizers enhancing soil nutrient cycling and organic matter amendment. Precision agriculture practices, such as plant hormone modulation and photosynthesis enhancement, boost crop stress tolerance and water use efficiency. Microbial inoculants, natural plant extracts, and improved fruit quality are essential components of sustainable agriculture, with disease resistance traits and pest resistance mechanisms ensuring optimal growth stage optimization. Mineral nutrition optimization, nitrogen use efficiency, and enhanced nutrient absorption are critical for plant growth regulators and root growth stimulation.

Bioactive compound delivery systems enable the effective use of plant metabolomics and rhizosphere microbiome analysis. Key data indicates that microbial inoculants can enhance phosphorus uptake by up to 30%, while photosynthesis enhancement technologies can improve crop quality attributes by up to 20%. These advancements contribute to the evolving nature of the market, making it an essential tool for modern agriculture.

The Onshore segment was valued at USD 1407.30 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

Middle East and Africa is estimated to contribute 37% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Intelligent Completion Market Demand is Rising in Middle East and Africa Request Free Sample

In the market, major oil and gas producing countries in the Middle East and Africa, including Saudi Arabia, the UAE, Kuwait, Qatar, and others, are key players. Saudi Arabia, with approximately 11% to 12% of global oil production, produced around 11.13 million barrels per day (bpd) in 2023. However, due to voluntary OPEC+ production cuts, its output dropped to about 9.18 million bpd as of May 2025. This market is characterized by the integration of advanced technologies, such as artificial intelligence (AI) and machine learning (ML), to optimize oil and gas extraction processes. Intelligent Completion systems enable operational efficiency gains and cost reductions by predicting equipment failures, optimizing well performance, and ensuring regulatory compliance.

For instance, AI and ML algorithms can analyze real-time data to predict pump failures, reducing downtime and maintenance costs. The market's evolution is driven by the need for increased productivity and cost savings in the face of fluctuating oil prices and production demands.

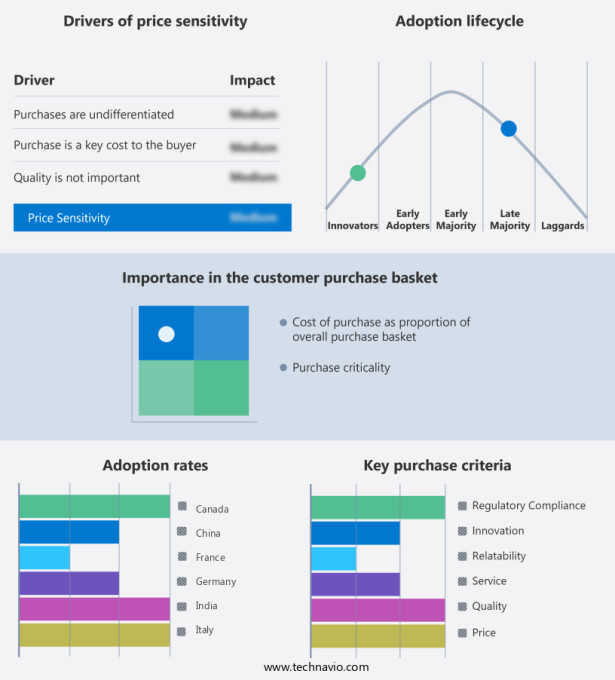

Customer Landscape of Intelligent Completion Industry

Competitive Intelligence by Technavio Analysis: Leading Players in the Intelligent Completion Market

Companies are implementing various strategies, such as strategic alliances, intelligent completion market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Baker Hughes Co. - Baker Hughes, a leading provider in the energy industry, delivers intelligent completion solutions. These innovations enhance production efficiency and minimize downtime in oil and gas wells. By integrating advanced technology, Baker Hughes optimizes well performance and drives operational excellence.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Baker Hughes Co.

- CISCON Nigeria

- Halliburton Co.

- NOV Inc.

- Omega Well Intervention

- ouronova

- Packers Plus Energy Services Inc.

- Praxis Completion Technology

- SAZ Oilfield Services Pte. Ltd.

- Schlumberger Ltd.

- Schoeller Bleckmann Oilfield Equipment AG

- Superior Energy Services Inc.

- Tendeka

- The Weir Group Plc

- Trican Well Service Ltd.

- Weatherford International Plc

- Welltec AS

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Intelligent Completion Market

- In January 2025, Schlumberger, a leading provider of technology for oil and gas exploration, announced the successful deployment of its new IntelliServ 2 Intelligent Completion System in the Permian Basin. This advanced technology enables real-time monitoring and optimization of well completions, reducing operational costs and enhancing efficiency (Schlumberger press release).

- In March 2025, Halliburton and Baker Hughes, two major players in the market, announced a strategic collaboration to integrate their respective intelligent completion solutions. This partnership aims to provide customers with a comprehensive, end-to-end intelligent completion offering, strengthening their competitive position (Halliburton press release).

- In May 2025, National Oilwell Varco completed the acquisition of Intelligent Completions & Production Solutions (ICPS), a leading provider of intelligent completions and production optimization technologies. This acquisition is expected to bolster National Oilwell Varco's portfolio and expand its presence in the market (National Oilwell Varco press release).

- In August 2025, Saudi Aramco, the world's largest oil company, granted approval for the implementation of intelligent completion systems in its offshore fields. This decision marks a significant milestone in the adoption of intelligent completion technology in the Middle East, a major oil-producing region (Saudi Aramco press release).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Intelligent Completion Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

225 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.8% |

|

Market growth 2025-2029 |

USD 772.5 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.4 |

|

Key countries |

US, Saudi Arabia, UAE, Canada, Germany, South Africa, Mexico, China, India, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Why Choose Technavio for Intelligent Completion Market Insights?

"Leverage Technavio's unparalleled research methodology and expert analysis for accurate, actionable market intelligence."

The market encompasses innovative solutions that leverage advanced technologies to optimize agricultural productivity and sustainability. In the agricultural sector, intelligent completion solutions are making significant strides in enhancing nutrient uptake by plants. The intricate relationship between microbial communities and nutrient cycling in soil is a critical area of focus. Humic substances, essential components of soil, play a pivotal role in maintaining soil fertility and promoting plant growth. Intelligent completion technologies enable the optimization of nitrogen use efficiency in crops by enhancing the plant growth promotion mechanisms of beneficial bacteria. These microbes contribute to plant stress tolerance by producing phytohormones and solubilizing essential nutrients. Measuring phosphorus uptake by plants and evaluating soil health indicators are crucial aspects of intelligent farming systems.

Application methods for plant growth regulators are being refined to ensure precise and efficient delivery. Soil microbial diversity is closely linked to yield, and strategies for optimizing nutrient management aim to maintain a healthy balance. Intelligent completion technologies are also instrumental in enhancing water use efficiency in crops, a vital consideration in the context of climate change and increasing water scarcity. Precision agriculture, an intelligent farming approach, is revolutionizing crop productivity by integrating real-time data and analysis to optimize inputs and minimize waste. Photosynthetic efficiency in plants can be monitored using advanced sensors, providing valuable insights into crop health and growth. Soil amendments, including natural plant extracts, play a crucial role in improving soil carbon sequestration and mitigating the environmental impact of agriculture. Sustainable intensification practices, such as integrated pest management and genetic engineering, are essential components of intelligent completion systems. Climate change poses a significant challenge to crop production, and assessing its impact and adapting to it is a key area of focus for intelligent completion solutions.

What are the Key Data Covered in this Intelligent Completion Market Research and Growth Report?

-

What is the expected growth of the Intelligent Completion Market between 2025 and 2029?

-

USD 772.5 million, at a CAGR of 5.8%

-

-

What segmentation does the market report cover?

-

The report is segmented by Application (Onshore and Offshore), Technology (Hydraulic, Electric, and Hybrid), Component (Downhole monitoring systems, Downhole control systems, Surface control systems, and Communication systems), and Geography (Middle East and Africa, North America, Europe, APAC, and South America)

-

-

Which regions are analyzed in the report?

-

Middle East and Africa, North America, Europe, APAC, and South America

-

-

What are the key growth drivers and market challenges?

-

Advantages associated with intelligent completions, Fluctuations in global crude oil prices

-

-

Who are the major players in the Intelligent Completion Market?

-

Baker Hughes Co., CISCON Nigeria, Halliburton Co., NOV Inc., Omega Well Intervention, ouronova, Packers Plus Energy Services Inc., Praxis Completion Technology, SAZ Oilfield Services Pte. Ltd., Schlumberger Ltd., Schoeller Bleckmann Oilfield Equipment AG, Superior Energy Services Inc., Tendeka, The Weir Group Plc, Trican Well Service Ltd., Weatherford International Plc, and Welltec AS

-

We can help! Our analysts can customize this intelligent completion market research report to meet your requirements.