Houseware Market Size 2024-2028

The Houseware Market size is forecast to increase by USD 130.6 billion and is estimated to grow at a CAGR of 5.96% between 2023 and 2028. The market is experiencing significant growth, driven by the introduction of innovative houseware products featuring new designs and bright colors that cater to evolving consumer preferences. Additionally, the rise of private label brands is intensifying competition, offering consumers affordable alternatives to established brands. However, the market also faces challenges from unorganized players who often undercut prices, making it essential for organized players to focus on kitchen tools and their product quality, brand building, and customer service to maintain market share. Overall, the market is poised for growth, with trends leaning towards sustainability, convenience, and personalization.

What will be the size of the Market During the Forecast Period?

To learn more about this report, Download Report Sample

Market Dynamics and Customer Landscape

The market encompasses a wide range of products designed for use in the home, including Cookware, Bakeware, Tableware, Kitchen Appliances, Bathroom Essentials, Home Organization, and Household consumer products. These items cater to various residential units and housing units, with Cookware and Bakeware being essential for food preparation, Bathroom appliances for personal hygiene, and Home Organization products for maintaining an orderly living space. Houseware Products also include Air Purifiers, Furniture, Textiles, and Home Aesthetics, which add utility and design elements to the home. The Market has seen significant growth in recent years due to the increasing demand for high-quality Houseware Products. However, the market is also plagued by the presence of Counterfeit products and Low-quality offshoot products, which can negatively impact consumer trust and market growth. The e-commerce industry has played a pivotal role in the distribution and sales of Houseware Products, offering convenience and accessibility to consumers. Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Key Market Driver

The market is being driven by the introduction of new designs and bright colours by companies. This trend is fueled by increasing consumer demand for stylish products that allow them to showcase their unique sense of style in the kitchen. The availability of a wide range of distinctive colour offerings has helped to spur sales of brightly coloured and fashionable houseware products, such as kitchenware.

Consumers are often willing to purchase new products because of their unique style, which appeals to their individuality, resulting in increased purchasing frequency that exceeds normal product replacement cycles. The demand for houseware products with new and bright designs is expected to continue increasing during the forecast period, driven in part by the younger generation's interest in buying products that express a unique sense of style. Hence, such factors are driving the market growth during the forecast period.

Significant Market Trends

An increase in the availability of private-label brands is the primary trend in the global market. The growth of private labels in the market is expected to increase. Retailers are increasingly focused on delivering value at a lower cost, resulting in a surge in private-label sales. This trend is especially prevalent in developing countries, where private-label houseware products account for a significant market share. Private-label products are typically distributed through supermarkets, discount outlets, and hypermarkets. Distributors of private-label products are also working to improve procurement processes and quality control.

Furthermore, some private label players offer premium houseware products. Innovative retailers in developed countries are developing private label lines that offer better quality than national brands. As private-label products become more widely available and sophisticated, they are becoming more widely accepted. Additionally, economic downturns in many countries have reinforced the credibility of private labels as cheaper alternatives to branded goods, creating awareness across different demographic groups. Hence, such factors are driving the market growth during the forecast period.

Major Market Challenge

High competition from unorganized players is a major challenge to the growth of the global market. Established companies in the market face tough competition from unregistered, unorganized players who offer similar products. In this scenario, brand reputation and pricing become key distinguishing factors between organized and unorganized players. The market is highly competitive, with players ranging from small firms specializing in specific products to large multinational corporations.

Moreover, competition in the market is dependent on factors like product type and pricing. Vendors compete based on various parameters like pricing, product design, brand recognition, and service. The low operating cost and investment required is an advantage for unorganized players who target consumers with cheaper, low-quality offerings, posing a significant challenge to well-established manufacturers. Hence, such factors are hindering the market growth during the forecast period.

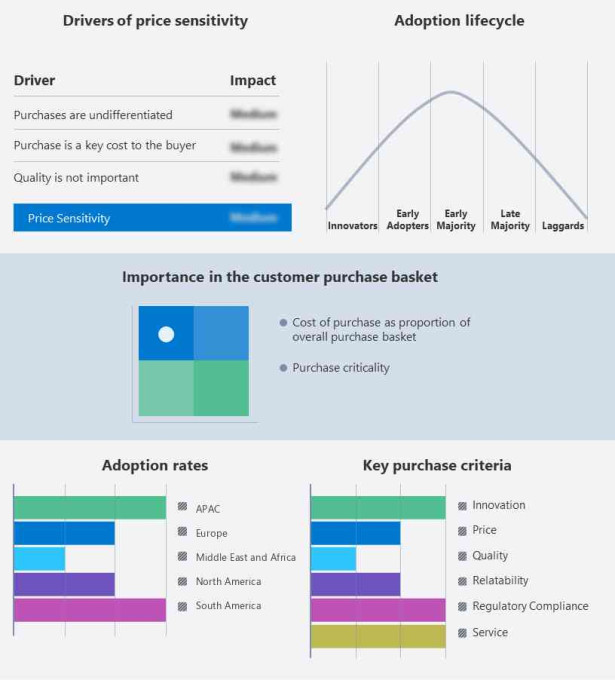

Market Customer Landscape

The market research report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their growth strategies.

Market Customer Landscape

Who are the Major Market Players?

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the houseware market.

Breville- The company offers housewares such as Kettles, Air Purifiers, and Cookers. Also, This segment focuses on designing and manufacturing home appliances, and kitchen appliances, including bread makers, blenders, juicers, mixers, scales, kettles, ovens, microwaves, toasters, meat grinders, steamers, grills, and food processors.

The report also includes detailed analyses of the competitive landscape of the market and information about 15 market players, including:

- Bed Bath and Beyond Inc.

- Conair Corp.

- Hamilton Housewares Pvt. Ltd.

- Helen of Troy Ltd.

- Inter IKEA Holding B.V.

- Lenox Corp.

- Libbey Inc.

- Lifetime Brands Inc.

- LocknLock Co.

- Newell Brands Inc.

- Nordic Ware

- NORITAKE Co. Ltd.

- SEB SA Co.

- Steelite International Ltd.

- Target Corp.

Qualitative and quantitative analysis of vendors has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize vendors as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize vendors as dominant, leading, strong, tentative, and weak.

What is the Fastest-Growing Segment in the Market?

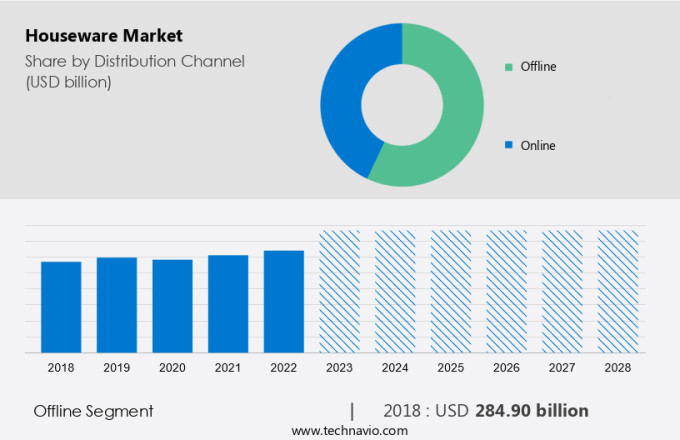

The market share growth by the offline segment will be significant during the forecast period. In this segment, vendors are also focusing on increasing their offline sales by widening their operations at different locations. This helps the company to generate and sell products efficiently and cater to every consumer category in large geographic areas. The huge growth in retail channels in different cities and regions will drive customer familiarization with different types of houseware. It will also increase the value of sales of the global market during the forecast period. Although the offline segment is losing its market share to the online channels, extensive marketing will leverage its sales at a steady rate. Such factors will increase segment growth during the forecast period.

Get a glance at the market contribution of various segments Request a PDF Sample

The offline segment was valued at USD 284.90 billion in 2018 and continued to grow by 2022. Houseware products such as cookware, bread makers, bakeware, and flatware are predominantly sold through offline retail stores. Supermarkets, hypermarkets, convenience stores, and warehouse clubs are popular offline distribution channels that offer these products in various sizes, packaging, and brands, thereby generating most of the global market's revenue. Although the COVID-19 pandemic disrupted the offline distribution channels, they have resumed their operations since the start of 2023, which is expected to have a positive impact on the offline distribution channels in terms of houseware sales at retail stores during the forecast period.

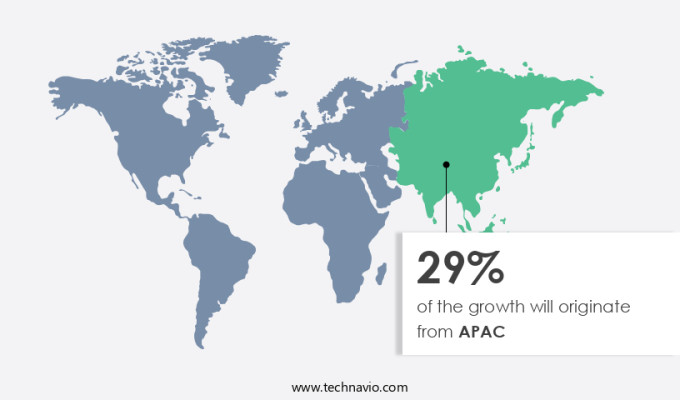

Which are the Key Regions for the Market?

For more insights on the market share of various regions Request PDF Sample now!

APAC is estimated to contribute 29% to the growth of the global market during the forecast period. Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. The market in APAC is expected to grow at a significant rate during the forecast period. This growth rate is primarily propelled by the growing year-over-year replacement sales demand, especially in countries such as China and India, because vendors are introducing new innovative houseware products. The market in APAC is mainly growing due to the rising middle-class population, coupled with the growing disposable income, increase in employment rate, and changing lifestyles. Approximately 1.5 billion people are expected to enter the middle-income class (C and C-/D+ class) segment by 2035, which creates an immense opportunity for vendors of the market. The growing disposable income in the region has boosted the market's growth. Countries such as Japan, China, India, and Australia are some of the major houseware markets in the region. Hence, such factors are driving the market in APAC during the forecast period.

Segment Overview

The market research report provides comprehensive data (region wise segment analysis), with forecasts and estimates in "USD Billion" for the period 2024 to 2028, as well as historical data from 2018 to 2022 for the following segments

- Distribution Channel Outlook

- Offline

- Online

- Product Outlook

- Cookware and bakeware

- Kitchen tools and accessories

- Tableware

- Region Outlook

- North America

- The U.S.

- Canada

- Europe

- The U.K.

- Germany

- France

- Rest of Europe

- APAC

- China

- India

- South America

- Chili

- Argentina

- Brazil

- Middle East & Africa

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

- North America

Market Analyst Overview

An in-depth analysis of Cookware, Bakeware, Tableware, Kitchen Appliances, Kettles, Bathroom Essentials, Home Organization, and More. The Market encompasses a wide range of products, including Cookware, Bakeware, Tableware, Kitchen Appliances, Bathroom Essentials, Home Organization, and more. These Houseware Products cater to the needs of various Residential Units and Housing Units, such as Single-person households. The market for Housewares is diverse and expansive, with segments like Cookware and Bakeware, Bathroom Appliances, Household Consumer Products, and Home Furnishings. Furniture, Design, Textiles, Home Aesthetics, Utility, and Home Appliances are essential components of this market. The market is served through various channels, including Supermarkets and Hypermarkets, Specialty Stores, Online Retail, and Offline channels. The e-commerce industry and Online Marketplaces have significantly impacted the sales of Housewares, with consumers increasingly preferring the convenience of shopping from home. The Market is driven by factors like increasing disposable income, changing consumer preferences, and the growing popularity of online shopping. However, the market faces challenges from Counterfeit products and Lowquality offshoot products, which affect the market's growth and reputation. The market is competitive, with major players including Homewares Stores, Franchised Stores, and Departmental Stores, among others. The market is expected to continue growing, driven by innovations in Design, Utility, and Home Aesthetics.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

167 |

|

Base year |

2023 |

|

Historic period |

2018 - 2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.96% |

|

Market growth 2024-2028 |

USD 130.6 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.27 |

|

Regional analysis |

APAC, North America, Europe, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 29% |

|

Key countries |

US, China, Germany, UK, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Bed Bath and Beyond Inc., Breville Group Ltd., Conair Corp., Hamilton Housewares Pvt. Ltd., Helen of Troy Ltd., Inter IKEA Holding B.V., Lenox Corp., Libbey Inc., Lifetime Brands Inc., LocknLock Co., Newell Brands Inc., Nordic Ware, NORITAKE Co. Ltd., SEB Developpement SA, Steelite International Ltd., Target Corp., Tuesday Morning Inc., Tupperware Brands Corp., Whirlpool Corp., and Zepter International |

|

Market dynamics |

Parent market analysis, market growth analysis, market research and growth, market forecasting, market report, market forecast, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, Market growth and Forecasting, COVID 19 impact and recovery analysis and future consumer dynamics, Market condition analysis for forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the growth of the market between 2023 and 2028.

- Precise estimation of the size of the market size and its contribution to the parent market

- Accurate predictions about upcoming trends and changes in consumer behavior

- Growth of the kitchenware and market industry across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about vendors

- Comprehensive analysis of factors that will challenge the growth of market players

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch