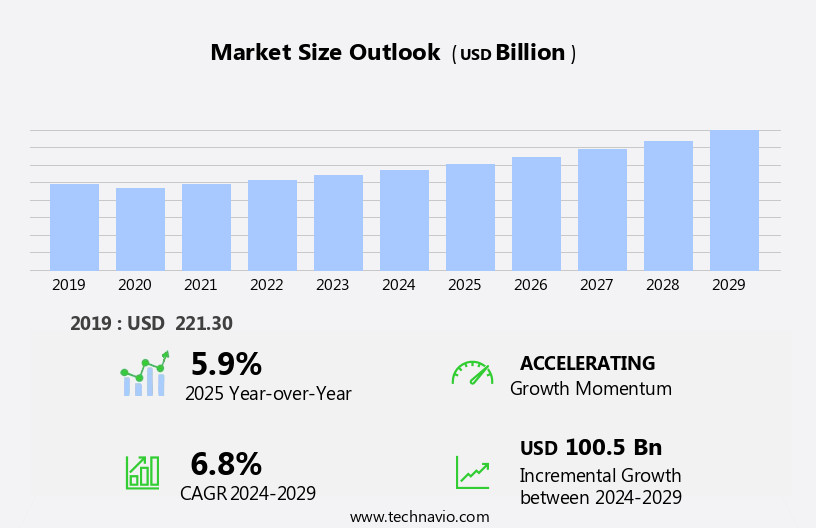

Hot Drink Market Size 2025-2029

The hot drink market size is forecast to increase by USD 100.5 billion at a CAGR of 6.8% between 2024 and 2029.

- The market is experiencing significant growth, driven primarily by the rising demand for premium and artisanal varieties. Consumers are increasingly seeking unique and high-quality hot beverages, leading to an expansion of the market. Additionally, advancements in brewing technologies have enabled producers to create more complex and nuanced flavors, further fueling consumer interest. However, this market growth is not without challenges. The competition from alternative beverages, such as Cold Brew Coffee and tea, poses a significant threat. As consumers explore various beverage options, hot drink producers must differentiate themselves through unique offerings, innovative marketing strategies, and competitive pricing.

- To capitalize on market opportunities and navigate challenges effectively, companies must stay abreast of consumer preferences and technological advancements, while also addressing the competition from alternative beverages.

What will be the Size of the Hot Drink Market during the forecast period?

- The market continues to evolve, with consumer preferences and trends shaping its dynamics. Fair trade coffee, a key player, gains traction due to growing awareness of ethical sourcing and sustainability. Brand loyalty is strong in this sector, with consumers seeking consistent flavor profiles and quality. Hot chocolate and tea blends cater to diverse taste preferences and health-conscious consumers, who value the health and wellness benefits of these beverages. Coffee shops remain a staple, offering a personalized experience and temperature control, while home consumption sees a rise due to convenience and the ability to customize brewing methods.

- Coffee origin plays a significant role in consumer choice, with a growing interest in the unique characteristics of different beans. Temperature control, whether for hot beverage consumption or iced coffee, is crucial for optimal taste and enjoyment. Health and wellness trends influence the market, with consumers seeking organic and herbal tea options and reduced caffeine consumption. The beverage industry adapts to these trends, with online retailers, espresso machines, coffee grinders, and coffee pods catering to changing consumer needs. Digital marketing and specialty coffee culture further fuel growth, with grocery stores and convenience stores stocking an expanding range of hot drink options.

- Brewing methods and water quality are essential considerations, with loose leaf tea, instant coffee, and tea infusers offering various solutions. The market's continuous unfolding is reflected in the emergence of new players and product innovations, ensuring a dynamic and evolving landscape.

How is this Hot Drink Industry segmented?

The hot drink industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Distribution Channel

- Offline

- Online

- Type

- Coffee

- Tea

- Cocoa

- Packaging

- Sachets

- Tins

- Pods

- Consumer Segment

- Household

- Commercial

- Geography

- North America

- US

- Mexico

- Europe

- France

- Germany

- UK

- Middle East and Africa

- UAE

- APAC

- Australia

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

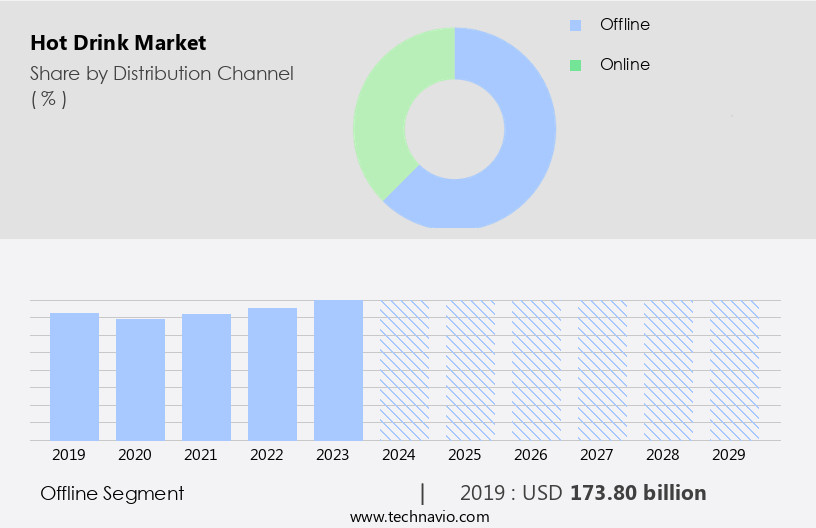

By Distribution Channel Insights

The offline segment is estimated to witness significant growth during the forecast period.

The market, comprising coffee, tea, and other heated beverages, holds a substantial position within the food and beverage sector. This discussion delves into the market segmentation via distribution channels, specifically focusing on the offline segment. Brick-and-mortar retail stores, supermarkets, cafes, and specialty shops constitute this segment. The offline distribution channel retains its importance, catering to consumer preferences and driving sales. For instance, specialty coffee shops epitomize the offline segment's significance, offering a harmonious environment for patrons to relish premium coffee origins, tea blends, and unique hot beverages. These establishments function as social hubs, providing personalized experiences through barista-prepared drinks, educational workshops, and community engagement.

The coffee culture thrives in these spaces, fostering a sense of unity among hot drink aficionados. Additionally, the offline segment encompasses cafes and coffee shops that prioritize fair trade coffee, health and wellness, and Organic Coffee, further catering to evolving consumer trends. Home consumption also plays a role, with coffee makers, hot water dispensers, and coffee grinders enabling consumers to create their beverages. Online retailers and convenience stores further expand accessibility, while temperature control and flavor profiles remain essential factors for both producers and consumers. In the beverage industry, brewing methods, such as French press, pour-over, and espresso machines, add to the diverse offerings.

The market landscape includes a wide array of options, from loose leaf tea and tea bags to instant coffee, flavored coffee, herbal tea, and coffee pods. The hot beverage consumption pattern extends to office settings and iced coffee, reflecting the versatility and ubiquity of these products. The tea culture, too, contributes to the market's growth, with digital marketing, tea infusers, and tasting notes playing a crucial role in engaging consumers. The market dynamics are shaped by various factors, including water quality, caffeine consumption, and consumer preferences. Overall, the market continues to evolve, offering a rich and diverse landscape for both producers and consumers.

The Offline segment was valued at USD 173.80 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 45% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in APAC experienced notable growth in 2024, holding a substantial share of the global industry. With diverse cultural tea traditions and an emerging coffee culture, APAC has become a significant contributor to innovation, consumption, and expansion in the hot drink sector. Consumer preferences, urbanization, and a growing middle-class population have fueled a surge in hot drink consumption in the region. Tea, a long-standing beverage in APAC, continues to shape the market, particularly in countries like China, Japan, and India. Meanwhile, the increasing popularity of coffee in South Korea, China, and Vietnam has solidified APAC's role as a key driver for growth in the coffee sector.

Hot chocolate and tea blends cater to health-conscious consumers seeking wellness benefits, while coffee shops offer personalized experiences. Temperature control, flavor profiles, and brewing methods have become essential factors in the market, driving demand for advanced coffee makers, espresso machines, and hot water dispensers. Online retailers, grocery stores, and convenience stores cater to home consumption, while office consumption sees a rise with the availability of single-serve coffee and coffee pods. Herbal tea, iced coffee, and flavored coffee cater to various consumer trends. Organic coffee, digital marketing, and tea infusers have gained traction in the market, emphasizing health and sustainability.

Coffee origin, caffeine consumption, and water quality have become crucial factors for consumers, leading to a growing interest in specialty coffee and coffee culture. Brewing methods, such as French press, pour-over, and cold brew, have gained popularity, offering unique tasting notes and experiences. In conclusion, the market in APAC is characterized by its rich cultural heritage, evolving consumer preferences, and a diverse range of products catering to various segments. The region's significance in the global hot drink industry is expected to continue, with continued innovation and expansion.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Hot Drink Industry?

- The surge in consumer preference for high-end and artisanal hot beverage options is the primary growth factor for the market.

- The market is witnessing a significant rise in demand for premium and artisanal beverages, including fair trade coffee and unique tea blends. Consumers are increasingly seeking elevated sensory experiences and distinct taste profiles, leading to a growing preference for specialty coffee and high-quality teas. One of the key factors fueling this trend is the rising popularity of single-origin, ethically sourced, and expertly roasted coffee beans. Consumers appreciate the exquisite nuances and flavor complexities offered by these specialty coffees, resulting in a heightened demand for pour-over, cold brew, and espresso-based beverages. Additionally, health and wellness concerns are driving the market, as consumers seek out hot drinks with natural ingredients and health benefits.

- Temperature control technology is also a significant factor, allowing for the creation of consistent and high-quality hot beverages at home. Overall, the market is evolving to meet the changing preferences of consumers, with a focus on artisanal, premium, and health-conscious offerings.

What are the market trends shaping the Hot Drink Industry?

- The current market trend reflects a significant focus on advancements in brewing technologies. As a professional in this industry, I can confirm that these innovations are shaping the future of brewing.

- The market is experiencing significant shifts due to advancements in brewing technologies. Single serve brewing systems, such as pod-based coffee and tea machines, have gained popularity for their convenience and efficiency. These systems enable consumers to easily prepare individual servings of hot drinks with minimal effort, using pre-portioned pods or capsules containing coffee grounds, tea leaves, or other beverage ingredients. This streamlined brewing process appeals to consumers seeking hassle-free preparation and reduced waste. Additionally, the market is witnessing an increasing preference for specialty brewing equipment, including espresso machines and coffee grinders, which cater to the growing trend of at-home barista culture.

- Overall, these advancements in brewing technologies are redefining consumer experience and market dynamics, making hot beverage consumption more accessible and enjoyable for consumers. Hot drinks, including coffee, tea, and caffeine-infused beverages, continue to be a staple in many households, with online retailers offering a wide range of options for consumers to choose from, including loose leaf tea, instant coffee, and various brewing methods.

What challenges does the Hot Drink Industry face during its growth?

- The growth of the beverage industry is significantly impacted by the intense competition among alternative beverage options.

- The market faces significant competition from alternative beverages, such as energy drinks and functional beverages, leading to shifts in consumer preferences and market dynamics. These alternatives offer consumers a quick energy boost and convenience, which has diverted attention from traditional hot drinks. The packaging and marketing strategies of energy drinks have further impacted the market share of hot drinks, particularly among demographics seeking immediate and portable sources of stimulation. Coffee pods and coffee makers continue to dominate the market, with personalized experiences and tasting notes becoming increasingly important to consumers. Herbal tea and iced coffee also remain popular choices, reflecting the diverse nature of the beverage industry and the evolving tea culture.

- Hot water dispensers have gained traction as well, providing a convenient and cost-effective solution for consumers looking to prepare their favorite hot drinks at home or in the office. Despite the competition, the market remains a significant player in the beverage industry, offering consumers a wide range of options to suit their tastes and preferences. Companies continue to innovate and expand their product offerings to meet the evolving demands of consumers, ensuring that the market remains dynamic and competitive.

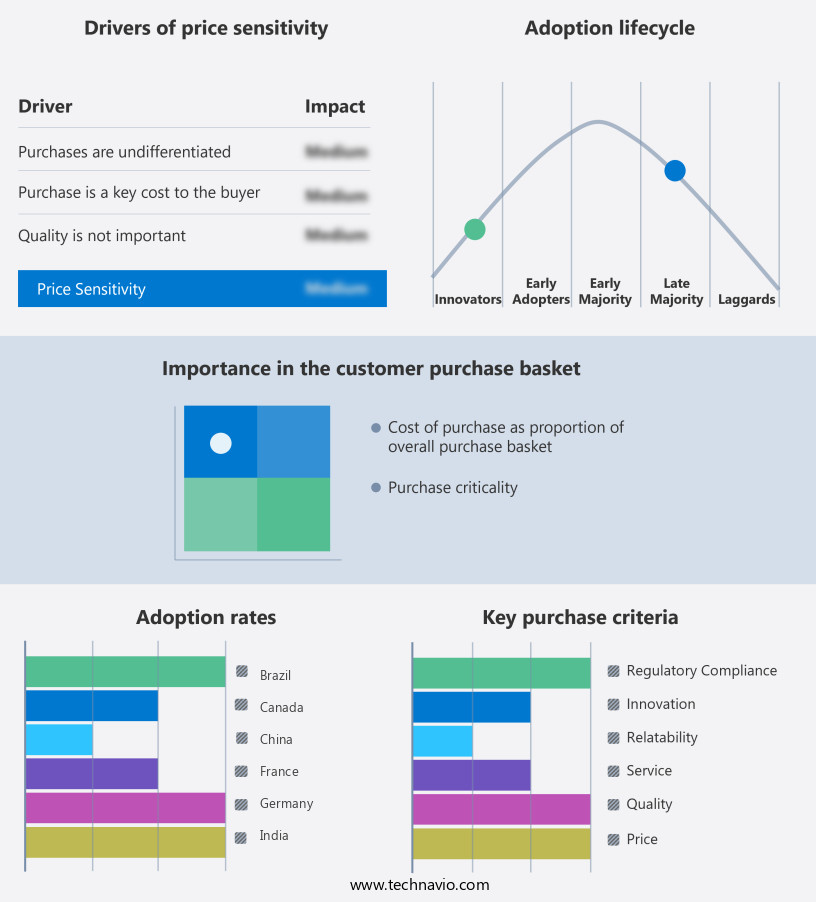

Exclusive Customer Landscape

The hot drink market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the hot drink market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, hot drink market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Ajinomoto Co. Inc. - The company specializes in providing a range of hot drink solutions, featuring 3-in-1 powdered beverages. These innovative offerings encompass both coffee and masala chai. By combining convenience and versatility, these products allow consumers to easily prepare their preferred hot beverage with minimal effort. The blend of premium ingredients ensures a rich and satisfying taste experience. This forward-thinking approach to hot beverage consumption elevates the everyday routine, enhancing moments of relaxation and enjoyment.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Ajinomoto Co. Inc.

- Bigelow Tea

- Coffee Day Enterprises Ltd.

- Colcafe Industria Colombiana de Cafe

- Cornish Tea Ltd.

- Costa Ltd.

- jacobs DOUWE EGBERTS B.V.

- Keurig Green Mountain Inc.

- Luckin Coffee Inc.

- LUIGI LAVAZZA SpA

- Mother Parkers Tea and Coffee Inc.

- Nestle SA

- Paulig Ltd.

- Reily Foods Co

- Starbucks Corp.

- Strauss Group Ltd.

- TEEKANNE GMBH and CO.

- The J.M Smucker Co.

- The Republic of Tea Inc.

- Unilever PLC

- Wuxi Huadong Cocoa Food Co. Ltd

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Hot Drink Market

- In February 2024, Nestlé, a leading player in the market, introduced a new line of Nescafe Gold blend coffee capsules, designed for use in Nespresso machines. This expansion aimed to cater to the growing demand for premium coffee capsules (Nestlé Press Release, 2024).

- In May 2025, Unilever and Starbucks announced a strategic partnership to develop and sell ready-to-drink tea and coffee products under the Lipton and Starbucks brands. This collaboration was expected to strengthen Unilever's position in the market and expand Starbucks' reach beyond its traditional retail outlets (Unilever Press Release, 2025).

- In October 2024, Dunkin Brands, the parent company of Dunkin' Donuts and Baskin-Robbins, completed the acquisition of the remaining 50% stake in its European joint venture, Dunkin' Brands Europe, from JAB Holding Company. This move enabled Dunkin' Brands to have full control over its European operations and growth strategies in the market (Dunkin Brands Press Release, 2024).

- In January 2025, Tetra Pak, a leading packaging solutions provider, launched a new plant-based mono-material for hot fill applications. This technological advancement was expected to reduce the environmental impact of hot drink packaging and increase consumer appeal for more sustainable options (Tetra Pak Press Release, 2025).

Research Analyst Overview

The market encompasses a diverse range of beverages, including tea and coffee, with various accessories and technologies shaping consumer experiences. Tea accessories, such as tea sets and brewing equipment, cater to the growing preference for specialty tea and traditional tea ceremonies. In contrast, smart coffee makers and coffee grinding technology enhance the convenience and customization of the coffee-making process. Ready-to-drink coffee and coffee concentrates cater to on-the-go consumers, while single-origin coffee and coffee subscription services appeal to those seeking a more authentic and consistent taste. Plant-based milk alternatives and herbal infusions broaden the horizons for consumers with dietary restrictions or unique taste preferences.

Coffee analytics and IoT in coffee machines provide valuable consumer insights, enabling businesses to tailor offerings and improve customer satisfaction. Sustainable coffee practices, organic tea, and loyalty programs further differentiate offerings and foster long-term relationships. Functional beverages, energy drinks, and mobile ordering add to the market's dynamism, while cold brew, nitro cold brew, and coffee roasting technology continue to innovate and captivate consumers. Coffee festivals and artisan coffee showcase the artistry and passion behind these beloved beverages. Consumer preferences for decaf coffee and functional ingredients continue to influence market trends, as does the integration of technology to enhance the overall coffee and tea drinking experience.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Hot Drink Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

192 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.8% |

|

Market growth 2025-2029 |

USD 100.5 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.9 |

|

Key countries |

US, Canada, China, Japan, Germany, India, UK, France, Brazil, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Hot Drink Market Research and Growth Report?

- CAGR of the Hot Drink industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the hot drink market growth of industry companies

We can help! Our analysts can customize this hot drink market research report to meet your requirements.