HoReCa Market Size 2025-2029

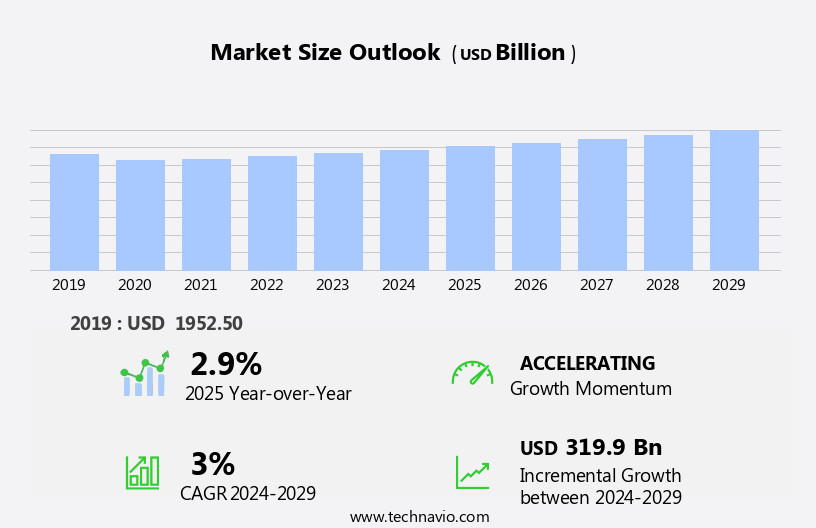

The HoReCa market size is forecast to increase by USD 319.9 billion at a CAGR of 3% between 2024 and 2029.

- The market is experiencing significant growth, driven by several key trends. The increasing demand for healthier food options and accommodations is a major growth factor. Consumers are increasingly conscious of their health and seek out restaurants and hotels offering nutritious meals and facilities. Another trend is the integration of technology in the HoReCa sector, with the adoption of digital menus, contactless payments, and online ordering systems. They also cater to specific dietary needs like gluten-free or vegan diets. However, the industry also faces challenges, such as the limited availability of skilled labor and staff. These issues are putting pressure on businesses to find innovative solutions to meet the evolving needs of consumers while maintaining profitability. Overall, the market is expected to continue growing, driven by these trends and challenges.

What will be the Size of the HoReCa Market During the Forecast Period?

- The market, encompassing food establishments such as restaurants, cafes, pizza eateries, and hotels, represents a significant segment of the global economy. This market is driven by various factors, including the growing trend of out-of-home consumption, the international tourism industry, and the Western culture of hospitality. The Horeca channel also includes commercial catering and food delivery services, contributing to its sizeable revenue generation. The Horeca sector is witnessing notable trends, including the increasing popularity of processed and packaged foods, as well as junk food. The tourism industry's growth continues to fuel demand for this market, with international tourists seeking diverse culinary experiences.

- Moreover, technological advancements in commercial equipment, food processing, and artificial intelligence (AI) in the form of chatbots and virtual assistants are transforming the industry, with food robots and contactless technologies becoming increasingly common. The market's size is substantial, with substantial hotel revenues generated from food and beverage sales. Meetings and events are another significant contributor to the market's growth, as businesses and individuals continue to prioritize face-to-face interactions. The sector's shift towards e-commerce and mobile applications is also noteworthy, enabling consumers to order food and make reservations with ease. Total imports of commercial equipment, food, and beverages further underscore the market's global reach and significance.

How is this HoReCa Industry segmented and which is the largest segment?

The industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Single outlet

- HoReCa chain

- Service Type

- Eateries and restaurants

- Hotels

- Cafes and pubs

- Geography

- APAC

- China

- India

- Japan

- South Korea

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- South America

- Brazil

- Middle East and Africa

- APAC

By Type Insights

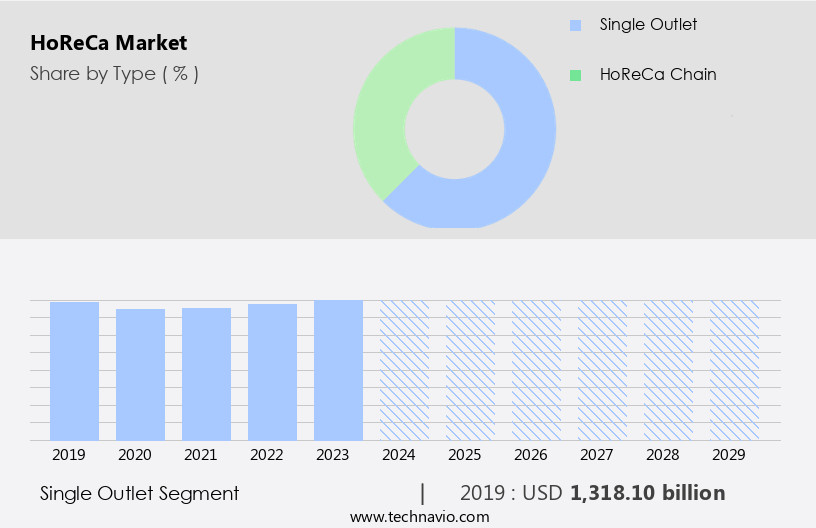

- The single outlet segment is estimated to witness significant growth during the forecast period.

The market encompasses various segments, including restaurants, cafes, hotels, and processed food industries. Single outlet establishments, such as independent pizzerias, junk food eateries, and fine dining restaurants, are a significant part of this sector. These businesses cater to consumers seeking unique dining experiences and personalized service. Seasonal changes and evolving consumer preferences necessitate continuous menu updates and innovation. The industry serves both domestic and international tourists, contributing to the tourism industry's growth. Business travelers, meetings, and events also contribute to the sector's revenue generation. Digital payment systems, AI personalization, and contactless technologies are transforming the HoReCa channel, enabling out-of-home consumption and commercial catering.

The sector's growth is influenced by factors like hotel revenues, food tourism, and the increasing popularity of food delivery services. E-commerce, online food ordering, and mobile applications have become essential tools for businesses to reach customers and increase sales. The market's success hinges on its ability to adapt to changing consumer demands and offer elevated hospitality standards.

Get a glance at the market report of share of various segments Request Free Sample

The single outlet segment was valued at USD 1,318.10 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

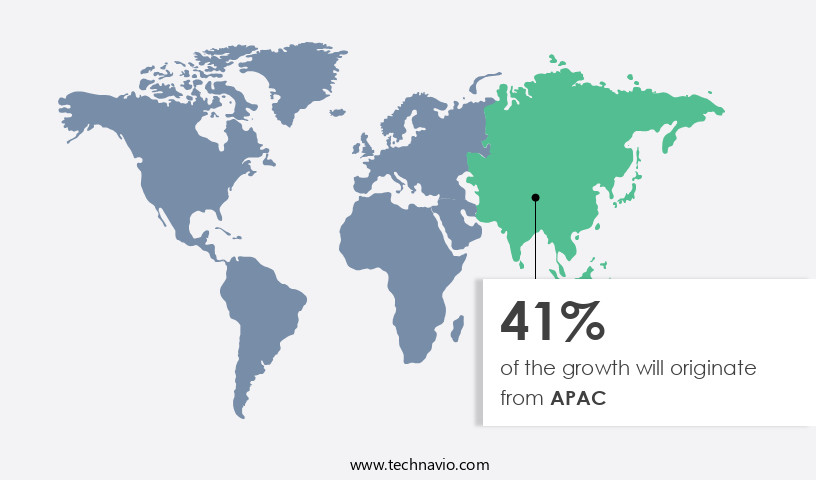

- APAC is estimated to contribute 41% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market in APAC is experiencing significant growth due to the region's expanding population and increasing urbanization. With over 4.77 billion people, APAC is witnessing a rise in disposable income and shifting consumer preferences, leading to the expansion of the HoReCa sector. International tourism plays a pivotal role in this growth, with countries like Thailand, Japan, and China witnessing a rise in tourist arrivals. This influx of tourists is driving the development of hotels and restaurants, contributing to the market's expansion in APAC. The market encompasses various segments, including food establishments, cafes, hotels, and lodging. Key sectors include processed foods, junk food, pizza eateries, food delivery, fine dining, food tourism, commercial catering, and out-of-home consumption.

The market is also witnessing the integration of digital payment systems, AI personalization, contactless technologies, mobile applications, e-commerce, and online food ordering. Seasonal changes and business travelers further boost demand. Joint ventures and HoReCa chains are also emerging trends In the market. The hospitality sector's revenues, particularly from hotels, meetings, and events, are on the rise. The market's growth is expected to continue as consumer preferences evolve and technology advances.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of HoReCa Industry?

Increasing demand for healthier food options and accommodations is the key driver of the market.

- The market, encompassing hotels, restaurants, and cafes, experiences a growing demand for healthier food alternatives and accommodations. Consumers prioritize well-being, leading establishments to adapt. Hotels expand their menus with nutritious options, while processed food and junk food eateries, such as pizza places, face increasing pressure to offer healthier alternatives. Food delivery services also adapt, with an emphasis on fresh and healthy meals. Cafes and pubs follow suit, providing a range of options for those seeking healthier refreshments. The tourism industry, including domestic and international tourists, drives this trend, as travelers look for lodging and dining establishments that cater to their health needs.

- Commercial catering and out-of-home consumption also reflect this shift, with businesses and organizations requesting healthier options for meetings and events. The HoReCa sector responds with innovations such as digital payment systems, AI personalization, and contactless technologies to enhance the customer experience. Additionally, the sector invests in e-commerce, online food ordering, and mobile apps for added convenience. The food budget for businesses and individuals continues to prioritize elevated hospitality standards, community engagement, and personalized service.

What are the market trends shaping the HoReCa Industry?

Integration of technology in HoReCa sector is the upcoming market trend.

- The market, encompassing food establishments such as restaurants, cafes, pizza eateries, and hotels, has been significantly transformed by technology integration. Mobile ordering and payment systems have become increasingly popular, with many restaurants and cafes offering apps or websites for customers to place orders and make payments using digital wallets like Apple Pay or Google Pay. This not only enhances the customer experience by saving time and reducing errors but also boosts business efficiency and profitability. Additionally, food delivery services have gained traction, enabling out-of-home consumption for domestic and international tourists. The hospitality sector, including lodging and dining services, has seen elevated standards with the adoption of contactless technologies, AI personalization, and e-commerce platforms.

- Seasonal changes and business travelers continue to drive demand In the HoReCa industry, with commercial catering and meetings and events being key revenue generators. The HoReCa channel also includes food processing and packaging, with processed food imports playing a significant role In the market. Overall, technology integration has revolutionized the HoReCa sector, providing personalized services, community engagement, and improved operational efficiency.

What challenges does the HoReCa Industry face during its growth?

Limited skilled labor and staff is a key challenge affecting the industry growth.

- The market, comprising food establishments such as restaurants, cafes, pizza eateries, and hotels, faces a significant challenge with the shortage of skilled labor. This labor shortage impacts various sectors, including hotels, where the tourism industry's growth results in high demand for staff like hotel managers, chefs, and waiters. The absence of a skilled workforce negatively influences the quality of service, potentially leading to customer dissatisfaction and decreased loyalty. Processed foods, including packaged items and junk food, have gained popularity due to their convenience, but their widespread use In the HoReCa sector may lower dining standards. To address this issue, businesses are exploring solutions like commercial catering, digital payment systems, AI personalization, and contactless technologies to enhance the customer experience and streamline operations.

- Additionally, partnerships through joint ventures and the expansion of HoReCa chains can help mitigate the labor shortage and maintain elevated hospitality standards. The tourism industry's growth, driven by both domestic and international tourists, necessitates the HoReCa sector's adaptation to meet the evolving needs of consumers. In the face of this challenge, the market continues to innovate, focusing on out-of-home consumption, meetings and events, and e-commerce to cater to the changing landscape.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Chick fil A Inc. - The company offers a chain of restaurants such as Chick-fil-A, known for its chicken sandwiches and exceptional customer service.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Dominos Pizza Inc.

- Hilton Worldwide Holdings Inc.

- Hyatt Hotels Corp.

- Inspire Brands Inc.

- InterContinental Hotels Group Plc

- ITC Ltd.

- Jack In the Box Inc.

- Little Caesar Enterprises Inc.

- Marriott International Inc.

- McDonald Corp.

- Papa Johns International Inc.

- Performance Food Group Co.

- Restaurant Brands International Inc.

- Starbucks Corp.

- Tata Sons Pvt. Ltd.

- The Coca Cola Co.

- The Wendys Co.

- Wyndham Hotels and Resorts Inc.

- YUM Brands Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market, encompassing food establishments and related services, continues to be a significant contributor to the global economy. This sector includes a diverse range of businesses, from cafes and pubs to restaurants, pizza eateries, and hotels. The market's growth is driven by various factors, including changing consumer preferences, seasonal fluctuations, and the tourism industry. The proliferation of processed foods and junk food has led to an increase in out-of-home consumption, with food delivery services becoming increasingly popular. The hospitality sector, which includes hotels, has seen a rise in demand due to both domestic and international tourism. Lodging and dining services are integral components of the tourism industry, with business travelers and tourists contributing significantly to revenue generation.

Moreover, joint ventures and collaborations have become common In the Horeca industry, with many businesses opting for single outlet operations as well as HoReCa chains. Fast food and fine dining establishments cater to different segments of the market, with the former focusing on affordability and convenience, and the latter on elevated hospitality standards and personalized service. Seasonal changes and trends influence consumer behavior, with food tourism gaining popularity in recent years. Digital payment systems, AI personalization, contactless technologies, mobile applications, and e-commerce platforms have transformed the way consumers interact with the Horeca industry. The adoption of these technologies has streamlined operations, improved efficiency, and enhanced the overall customer experience.

Furthermore, the Horeca channel also includes commercial catering and food processing. Food processing technologies, such as automation and robotics, have revolutionized the industry, leading to increased productivity and cost savings. Household food expenditure remains a significant portion of overall consumer spending, making the market an essential player In the global economy. The tourism industry's growth has led to increased demand for horeca services, with international tourists contributing significantly to revenue generation. Total imports of food and beverages have also risen, reflecting the globalization of the market. The market's dynamics are influenced by various factors, including changing consumer preferences, technological advancements, and economic conditions.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

191 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3% |

|

Market Growth 2025-2029 |

USD 319.9 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

2.9 |

|

Key countries |

US, China, UK, Japan, Canada, India, Germany, Brazil, South Korea, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this HoReCa Market Research and Growth Report?

- CAGR of the HoReCa industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the horeca market growth of industry companies

We can help! Our analysts can customize this horeca market research report to meet your requirements.