Home Textile Retail Market Size 2025-2029

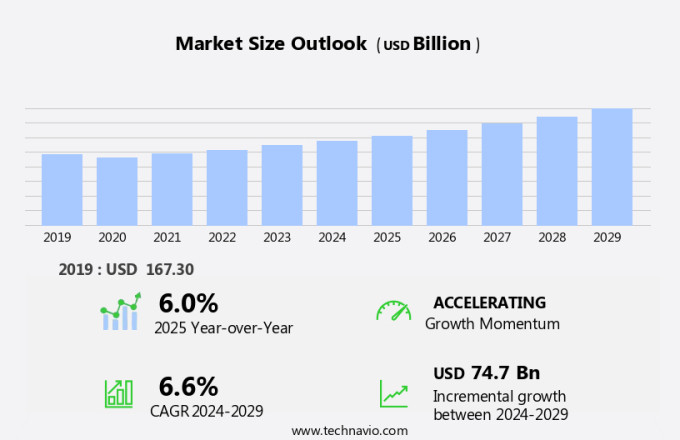

The home textile retail market size is forecast to increase by USD 74.7 billion, at a CAGR of 6.6% between 2024 and 2029.

- The market is experiencing significant growth, driven by key trends such as innovation and portfolio extension leading to premiumization. companies are expanding their distribution channels to cater to the increasing consumer demand. However, the market is also facing challenges, including the volatility of raw material prices. These price fluctuations can impact the profitability of retail vendors and manufacturers. To remain competitive, companies are focusing on product innovation and diversification, as well as implementing cost-effective sourcing strategies. Additionally, the use of sustainable fabrics and eco-friendly materials is gaining popularity among consumers, making it essential for retailers to adapt to this trend. Overall, the market is expected to continue its growth trajectory, with companies leveraging these trends and addressing challenges to capitalize on the opportunities presented.

What will be the Size of the Home Textile Retail Market During the Forecast Period?

- The market encompasses a wide range of products, including bed linen, bath linen, kitchen linen, upholstery, and floor coverings, catering to modern homes and homeowners seeking to enhance their interior design and house decoration. The real estate industry plays a significant role in driving demand for home textiles, as affluent consumers and millennials increasingly prioritize personalized, internationally inspired designs for their living spaces.

- The home textile industry offers various product categories, from furnishing fabrics to eco-friendly and synthetic fiber options, woven, knitted, or crocheted. Specialty stores and foreign brands dominate the organized retail sector, while e-commerce platforms continue to gain popularity. Eco-friendly and blend fiber products are emerging trends, reflecting consumers' growing awareness of sustainability and unique textures. Overall, the home textile market is a dynamic and evolving industry that caters to diverse consumer preferences and housing trends.

How is this Home Textile Retail Industry segmented and which is the largest segment?

The home textile retail industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Distribution Channel

- Offline

- Online

- Product

- BBO

- Bed linen

- Carpets and rugs

- Upholstery

- Others

- Geography

- APAC

- China

- India

- Japan

- South Korea

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- Italy

- Middle East and Africa

- South America

- APAC

By Distribution Channel Insights

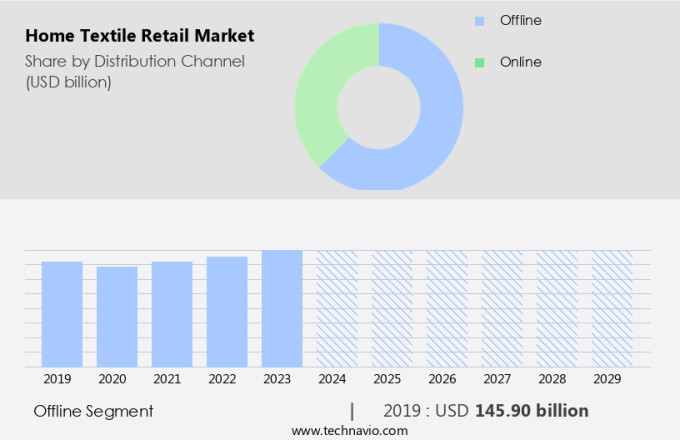

- The offline segment is estimated to witness significant growth during the forecast period.

Home textile products, including bath linens, kitchen linens, bed linens, and bedspreads, as well as curtains, are predominantly sold through offline distribution channels. Retail formats, such as specialty stores, hypermarkets, department stores, convenience stores, supermarkets, and warehouse clubs, dominate the global market. Consumers seek personalized home textile products, leading to increased demand. These retail channels generate a substantial portion of the market revenue. The offline distribution channel holds a significant market share, with retail formats being the primary contributors.

Get a glance at the Home Textile Retail Industry report of share of various segments Request Free Sample

The offline segment was valued at USD 145.90 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

- APAC is estimated to contribute 35% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The Asia Pacific region presents a substantial opportunity for international home textile brands to expand their reach in emerging economies, with China, Japan, and India leading the market. China, known for its export of home textiles, is driven by factors such as urbanization, increasing disposable income, and rising fashion consciousness towards home decoration. Urbanization and growing affluence in India and Japan are also contributing to the growth of the market in these countries. Additionally, markets in Thailand, Vietnam, South Korea, Indonesia, and Australia are significant contributors to the APAC home textile market. The region's home textile industry encompasses a wide range of products, including furnishing fabrics, bed linen, traditional blankets, and insulation materials.

In addition, key materials include higher twist yarns, wool, acrylic, polyester, nylon-based blends, and recycled cotton scraps and lyocell fibers. The market caters to various sectors, including housing, hospitality, healthcare, and exports, as well as tourist destinations and smart homes. E-commerce platforms have become a popular channel for retailing home textiles, catering to the millennial age group and DIY activities. The market offers a diverse range of styles, from timeless patterns and luxurious textures to classic color palettes and vintage aesthetics.

Market Dynamics

Our home textile retail market researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of the Home Textile Retail Industry?

Innovation and portfolio extension leading to premiumization is the key driver of the market.

- In the international market, modern homes seek out high-quality, innovative home textiles that enhance interior design and house decoration. Homeowners with affluent tastes prefer designs that align with the real estate industry's trends, such as classic color palettes, timeless patterns, and luxurious textures. Furnishing fabrics, including soft twist yarns and higher twist yarns in wool, acrylic, polyester, nylon based blends, and thermal blankets, cater to various consumer preferences. Curtains, blinds, shades, soundproof curtains, and blackout curtains are popular choices for window treatments, while insulation products ensure energy efficiency. Modern furniture, lights, and rooms benefit from home textiles, creating a cohesive and functional living space.

- The luxury fabric market and bedroom linen market have seen significant growth, with a focus on organic and sustainable products. Recycled cotton scraps and lyocell fibers are increasingly used in home textiles, appealing to eco-conscious consumers. Specialty stores, organized retail, and foreign brands dominate the market, while third-party sellers and importers/exporters cater to niche markets. The home décor industry, including tourist destinations, hospitals, smart homes, and transportation hubs like malls, airports, and movie theatres, presents ample opportunities for growth. The home textile industry includes product categories such as bed linen, bath linen, kitchen linen, upholstery, floor covering, and household textiles.

- The market is driven by the demand for functional and decorative products, catering to single person households, DIY activities, nuclear families, childless households, and residential construction activities. E-commerce platforms and the e-commerce sector, including smartphones and online retailing, have significantly impacted the market. The millennial age group is a key demographic, favoring eco-friendly products and synthetic fibers.

What are the market trends shaping the Home Textile Retail Industry?

Distribution channel expansion strategy by vendors is the upcoming market trend.

- The market encompasses a wide range of products, including furnishing fabrics for modern homes, bed linen, bathroom linen, kitchen linen, upholstery, floor covering, and more. Homeowners seek unique designs for interior decoration and house decoration, often influenced by international taste and trends. The real estate industry plays a significant role in the market, as modern furniture, lights, and rooms require accompanying textiles. Timeless patterns and luxurious textures, such as classic color palettes and vintage aesthetics, remain popular. The Luxury Fabric Market and Traditional Blankets segments cater to affluent consumers, offering soft twist yarns, higher twist yarns, and various fibers like wool, acrylic, polyester, nylon based blends, and thermal blankets.

- Curtains, blinds, shades, soundproof curtains, and blackout curtains are essential functional products. The market also includes insulation products and sustainable products like recycled cotton scraps and lyocell fibers. The home textile industry is expanding its reach through various channels, including transportation hubs like malls, airports, movie theatres, hospitals, and smart homes. E-commerce platforms are increasingly popular for selling home textile products. The global B2C e-commerce industry's growth is expected to continue during the forecast period, providing opportunities for home textile retailers. Single person households, DIY activities, nuclear families, and childless households contribute to the market's demand.

What challenges does the Home Textile Retail Industry face during its growth?

The volatility of raw material prices is a key challenge affecting the industry growth.

- The market encompasses a wide range of products including furnishing fabrics for modern homes, bed linen, bath linen, kitchen linen, upholstery, floor covering, and specialty stores offering foreign brands. Affluent consumers seek designs that align with their interior decor and house decoration, often influenced by international taste and classic color palettes. Modern furniture, lights, and rooms are adorned with timeless patterns and luxurious textures. The real estate industry plays a significant role in the home textile market, with housing, hospitality, healthcare, and exports to the tourism industry driving demand. The luxury fabric market, including thermal blankets, curtains, blinds, shades, soundproof curtains, and blackout curtains, caters to various consumer needs.

- However, rising raw material prices, primarily for cotton, wool, acrylic, polyester, nylon-based blends, and synthetic fibers, pose challenges for companies. These increased costs result in higher prices for consumers, limiting purchases. Unusual weather conditions, such as heavy snow, rain, storms, hurricanes, floods, tornadoes, or extended periods of unseasonable temperatures, further impact raw material availability and prices. Innovations in home textile sales include e-commerce platforms, recycled cotton scraps, lyocell fibers, and recycled materials, as well as third-party sellers, importers, and exporters.

- Smart homes, transportation hubs like malls, airports, and movie theaters, and various industries such as healthcare, hospitality, and housing, continue to fuel demand for home textile products. The millennial age group, DIY activities, and nuclear, single person, and childless households contribute to the growth of the household textile market. Functional and decorative products, natural and man-made fibers, and insulation products cater to various consumer preferences. The e-commerce sector, including smartphones and online retailing, offers convenience and accessibility for consumers.

Exclusive Customer Landscape

The home textile retail market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the home textile retail market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, home textile retail market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Amazon.com Inc. - The company offers home textile products under the brand name Solimo such as Solimo Natural Bounty 144 TC 100 percent Cotton Double Bedsheet with Two Pillow Covers.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Ashley Global Retail LLC

- Bed Bath and Beyond Inc.

- Industria de Diseno Textil SA

- Inter IKEA Holding BV

- Kohls Inc

- Lowes Co. Inc.

- Macys Inc.

- Ralph Lauren Corp.

- Restoration Hardware Inc.

- Springs Global

- Steinhoff International Holdings NV

- The Home Depot Inc.

- The Kroger Co.

- The Novogratz

- The TJX Companies Inc.

- Trident Ltd.

- Walmart Inc.

- Wayfair Inc.

- Welspun India Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a vast array of products designed to enhance the interior of living spaces. These textiles, which include fabrics for bed linen, bath linen, kitchen linen, upholstery, floor coverings, and various decorative items, serve both functional and aesthetic purposes. In modern homes, homeowners seek to create inviting and stylish environments, leading to a growing demand for innovative designs and high-quality textiles. Interior design trends continue to evolve, with an emphasis on timeless patterns, luxurious textures, and classic color palettes. Modern furniture, lights, and wall colors all influence the selection of home textiles. Vintage aesthetics and sustainable materials, such as recycled cotton scraps and lyocell fibers, have gained popularity among affluent consumers, reflecting international taste and a growing focus on eco-friendly products.

Further, the home textile industry caters to various sectors, including housing, hospitality, healthcare, and exports. This diverse market includes specialized stores, foreign brands, and organized retail outlets. The real estate industry plays a significant role in driving demand for home textiles, particularly in new residential construction activities and renovations. In the realm of functional products, insulation blankets, soundproof curtains, and blackout curtains have become essential for maintaining comfortable living conditions. Meanwhile, decorative products, such as curtains, blinds, and shades, serve to enhance the aesthetic appeal of rooms. The home textile industry has witnessed significant growth in the e-commerce sector, with platforms like smartphones and online retailing making it easier for consumers to access a wide range of products from the comfort of their homes.

Moreover, this trend has led to increased competition among retailers, necessitating innovative marketing strategies and product offerings. The home textile market comprises a diverse range of fibers, including natural fibers like cotton and man-made fibers like wool, acrylic, polyester, nylon-based blends, and synthetic fibers. The choice of fiber depends on various factors, including cost, durability, and environmental impact. The luxury fabric market, including traditional blankets and soft twist yarns, caters to consumers seeking high-end, premium products. Higher twist yarns and wool are popular choices for these items due to their superior texture and insulation properties.

|

Home Textile Retail Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

206 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.6% |

|

Market Growth 2025-2029 |

USD 74.7 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.0 |

|

Key countries |

US, China, India, Japan, Canada, South Korea, Germany, UK, France, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Home Textile Retail Market Research and Growth Report?

- CAGR of the Home Textile Retail industry during the forecast period

- Detailed information on factors that will drive the Home Textile Retail Market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the home textile retail market growth of industry companies

We can help! Our analysts can customize this home textile retail market research report to meet your requirements.