Home And Garden Products B2C E-Commerce Market Size 2025-2029

The home and garden products b2c e-commerce market size is forecast to increase by USD 49.62 billion, at a CAGR of 13.4% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing trend towards online shopping and the widespread adoption of smartphones. The convenience and accessibility offered by e-commerce platforms have led to a rise in consumer spending in this sector. The emergence of omnichannel retailing further enhances the shopping experience, allowing consumers to seamlessly transition between online and offline channels. However, this market also faces challenges, most notably the criticality of efficient logistics management.

- This overhead cost can significantly impact profitability and requires strategic planning and investment in technology and infrastructure. Companies seeking to capitalize on market opportunities and navigate challenges effectively must focus on optimizing their logistics networks and leveraging technology to enhance the customer experience. With the rise in online sales, ensuring timely and cost-effective delivery has become a major concern for retailers. Payment gateways facilitate seamless transactions, while influencer marketing and customer lifetime value strategies foster brand loyalty.

What will be the Size of the Home And Garden Products B2C E-Commerce Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The home and garden B2C e-commerce market continues to evolve, driven by shifting consumer preferences and advancements in technology. Averaging an impressive growth rate, this sector encompasses a wide range of products, from cleaning supplies and bath linens to small appliances, hand tools, and decorative accents. Pricing strategies vary, with some retailers focusing on competitive pricing to attract customers, while others differentiate through offering premium products and exceptional customer service. Storage solutions, a crucial aspect of home organization, are increasingly being addressed through smart home devices and digital marketing efforts.

Lawn mowers and gardening tools are popular seasonal items, requiring efficient order fulfillment and shipping logistics. E-commerce platforms provide essential infrastructure, enabling features like marketing automation, search engine optimization, and product catalog management. Product sourcing and supply chain optimization are ongoing concerns, with inventory management and returns processing playing significant roles in maintaining customer satisfaction. Home improvement projects often involve large purchases, necessitating careful consideration of product descriptions, customer ratings, and reviews. Outdoor furniture, lighting fixtures, and patio heaters are popular choices for enhancing living spaces. User experience, including website design and mobile commerce, is paramount in attracting and retaining customers.

Security systems and home automation add convenience and peace of mind, integrating with smart home devices and influencing the market's future direction. Pest control and irrigation systems cater to specific niches, while power tools and gardening equipment cater to DIY enthusiasts. Data analytics and social media marketing provide valuable insights into consumer behavior and trends. The home and garden B2C e-commerce market remains dynamic, with continuous shifts in consumer demands, technological advancements, and business strategies. Embracing these changes through effective pricing, storage solutions, smart home devices, payment gateways, influencer marketing, customer service, and e-commerce platforms is essential for success.

How is this Home And Garden Products B2C E-Commerce Industry segmented?

The home and garden products b2c e-commerce industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Home decor

- Home improvement products

- Others

- End-user

- Commercial

- Household

- Distribution Channel

- Online marketplaces

- Direct-to-consumer

- Specialty retailers

- Subscription-based platforms

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Application Insights

The home decor segment is estimated to witness significant growth during the forecast period. The market encompasses a wide range of items, including cleaning supplies, bath linens, small appliances, hand tools, and more. Customer experience plays a pivotal role in this market, with factors such as product descriptions, website traffic, and user experience influencing consumer behavior. Conversion rates are impacted by various elements, including customer service, email marketing, and search engine optimization. Product reviews and customer ratings contribute significantly to purchasing decisions. Shipping logistics and returns processing are essential components of the customer journey. Decorative accents, lighting fixtures, and home automation devices are popular categories, reflecting the growing trend towards smart homes.

Inventory management, pricing strategy, and supply chain efficiency are crucial for businesses to remain competitive. E-commerce platforms provide essential tools for order fulfillment, mobile commerce, and marketing automation. Product sourcing and catalog management are also significant challenges. The home improvement sector is a significant contributor to the market, with outdoor furniture, gardening tools, and irrigation systems gaining popularity. Pest control and security systems are other essential product categories. Data analytics and social media marketing are essential for businesses to understand customer preferences and target their marketing efforts effectively. Overall, the market is dynamic and evolving, with businesses adapting to changing consumer demands and market trends.

The Home decor segment was valued at USD 20.56 billion in 2019 and showed a gradual increase during the forecast period.

The Home and Garden Products B2C E-Commerce Market is flourishing as eco-conscious consumers drive demand for sustainable gardening products and space-saving vertical gardening systems. Retailers are integrating smart sprinklers to appeal to tech-savvy, green-thumbed shoppers. Advanced customer segmentation and behavioral targeting strategies are reshaping marketing campaigns, enabling personalized experiences and increased conversion rates. Seamless order tracking is now a standard expectation, enhancing post-purchase satisfaction. With rising mobile traffic, platforms prioritize mobile responsiveness and website speed, ensuring users enjoy smooth browsing and swift checkouts. A refined user interface (UI) plays a crucial role in capturing attention and improving navigation.

Regional Analysis

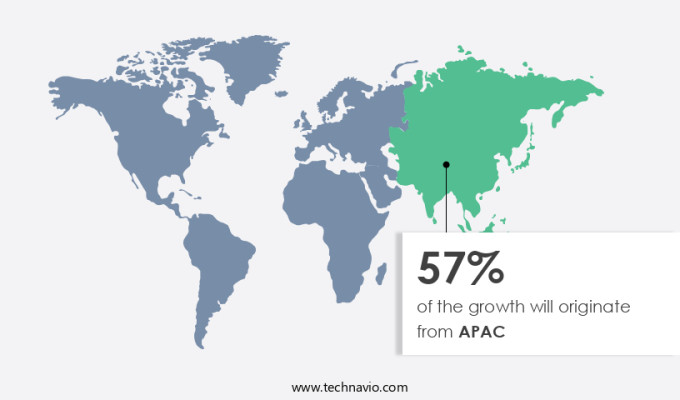

APAC is estimated to contribute 58% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in the Asia Pacific region is experiencing significant growth, driven by key contributors such as China, Japan, and South Korea. China's rapid economic expansion, increasing consumer spending power, and shifting shopping preferences are major catalysts. The country's vast Internet penetration and growing use of smartphones fuel the popularity of online shopping. Consequently, third-party e-retailers' websites offer a convenient and seamless shopping experience, further propelling the market's growth. Effective content marketing strategies, product descriptions, and customer reviews are essential for attracting and retaining customers. Average order values can be increased through targeted email marketing campaigns and personalized product recommendations.

Customer service and user experience are crucial elements, ensuring customer satisfaction and repeat business. Search engine optimization, inventory management, and supply chain optimization are essential for driving website traffic and improving conversion rates. Shipping logistics, pricing strategy, and returns processing are critical components of a successful e-commerce platform. Smart home devices, lighting fixtures, and small appliances are popular product categories, along with cleaning supplies, bath linens, and decorative accents. Marketing automation, digital marketing, and social media marketing are essential for reaching and engaging customers. Influencer marketing and affiliate marketing can also boost sales. Home improvement, outdoor furniture, and gardening tools are popular categories for homeowners and DIY enthusiasts.

Payment gateways and order fulfillment are essential for ensuring a smooth and efficient shopping experience. The market for home and garden products in the B2C e-commerce sector is continuously evolving, with trends such as mobile commerce, pest control, irrigation systems, and home automation gaining traction. Data analytics and customer ratings are valuable tools for understanding customer behavior and improving the overall shopping experience.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Home And Garden Products B2C E-Commerce Industry?

- The concurrent increase in online spending and smartphone penetration serves as the primary market catalyst. The market has experienced significant growth due to the increasing number of Internet users and the popularity of online shopping. With improved economic conditions and the availability of advanced technologies, consumers have embraced e-commerce platforms for purchasing home decor, small appliances, hand tools, lighting fixtures, irrigation systems, and pest control products. As of January 2023, there were 307 million active Internet users and 270 million active social media users in the US alone.

- Website design and user experience have become crucial factors in attracting and retaining customers, making it essential for businesses to invest in these areas. Overall, the market is expected to continue growing as more consumers turn to online shopping for convenience and access to a wider range of products. The emergence of m-commerce and the use of tablets with larger interfaces have further facilitated the decision-making process for online purchases. Product sourcing and supply chain management have also become more efficient, enabling businesses to offer competitive prices and quick shipping logistics.

What are the market trends shaping the Home And Garden Products B2C E-Commerce Industry?

- Omnichannel retailing, characterized by seamless integration of various shopping channels, is becoming an indispensable market trend. This approach allows businesses to meet customer preferences for convenience and flexibility in shopping experiences. The market is experiencing significant growth as consumers increasingly turn to online channels for purchasing home improvement items. This market encompasses various product categories, including storage solutions, lawn mowers, and smart home devices. To remain competitive, companies employ various strategies such as pricing, marketing automation, and digital marketing. Pricing strategies play a crucial role in attracting customers. Payment gateways ensure seamless transactions, while order fulfillment and mobile commerce facilitate convenience. Influencer marketing and affiliate marketing are effective methods to expand reach and build trust with potential buyers. Smart home devices, a growing segment within this market, offer advanced features and improved customer experience.

- Companies focus on enhancing the customer lifetime value by providing personalized recommendations and excellent customer service. Marketing automation tools help businesses streamline their marketing efforts and engage customers effectively. Digital marketing channels like social media and email marketing are essential for reaching a broad audience. As the market evolves, companies must adapt to meet changing consumer demands and preferences. By leveraging these strategies, home and garden product businesses can effectively engage customers and increase sales in the competitive e-commerce landscape.

What challenges does the Home And Garden Products B2C E-Commerce Industry face during its growth?

- The escalating importance of logistics management, which often results in significant overhead costs, poses a significant challenge to the growth of the industry. The market experiences significant challenges in areas such as logistics management and returns processing. These issues, including inadequate postal addresses and late product delivery, can increase overhead costs and erode profit margins. Moreover, these complications can negatively impact a company's brand image, potentially decreasing the customer base. International retailers based in the US and Western European countries often bear substantial losses due to these logistical problems. To improve delivery services, retailers hire additional field workers, which increases labor costs and further reduces profitability. User experience plays a crucial role in the success of home and garden product e-commerce businesses.

- Offering seamless experiences, from browsing to returns and refunds, is essential. Effective inventory management, home automation, and security systems integration are also vital components of a positive user experience. Data analytics and social media marketing are essential tools for businesses to understand customer preferences and behaviors. By analyzing customer ratings and reviews, companies can identify trends and improve their offerings. Social media platforms provide an opportunity to engage with customers, build brand loyalty, and generate sales. Power tools, patio heaters, gardening tools, and other home and garden products require proper handling and packaging during shipping. Ensuring these items arrive in good condition is essential to maintain customer satisfaction and minimize returns.

Exclusive Customer Landscape

The home and garden products b2c e-commerce market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the home and garden products b2c e-commerce market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, home and garden products b2c e-commerce market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Amazon.com Inc. - This company specializes in providing a range of home and garden products, including Christmas decorations and LED lighting, enhancing living spaces with style and functionality.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amazon.com Inc.

- BAUHAUS E Business Gesellschaft fur Bau und Hausbedarf mbH and Co

- Bed Bath and Beyond Inc.

- Costco Wholesale Corp.

- Godrej and Boyce Manufacturing Co. Ltd.

- Golden Acre Home and Garden

- Hennes and Mauritz AB

- Inter IKEA Holding B.V.

- Lowes Co. Inc.

- Lulu and Georgia Inc.

- Penney IP LLC

- Reliance Industries Ltd.

- Target Corp.

- Tesco Plc

- The Home Depot Inc.

- Ugaoo Agritech Pvt. Ltd.

- Walmart Inc.

- Wayfair Inc.

- Williams Sonoma Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Home And Garden Products B2C E-Commerce Market

- In January 2024, Wayfair, a leading home goods retailer, announced the launch of its new virtual interior design service, "Wayfair Pro," which allows customers to receive personalized design consultations and 3D room visualizations (Wayfair Press Release, 2024). This innovation aimed to enhance the online shopping experience and cater to the growing demand for personalized home solutions.

- In March 2024, The Home Depot entered into a strategic partnership with Google to integrate the retailer's products into Google Shopping, making it easier for customers to find and purchase home and garden products online (The Home Depot Press Release, 2024). This collaboration expanded The Home Depot's digital presence and reached a broader customer base.

- In May 2024, IKEA, the global furniture retailer, raised USD 1.5 billion in a bond issuance to finance its ongoing digital transformation and e-commerce expansion (Bloomberg, 2024). This significant investment demonstrated the company's commitment to strengthening its online presence and competing effectively in the growing market.

- In April 2025, Amazon Home Services, Amazon's home services marketplace, expanded its offerings to include home improvement and repair services, allowing customers to book professionals for various home projects directly through the platform (Amazon Press Release, 2025). This strategic move aimed to capture a larger share of the home and garden products market by providing a one-stop solution for customers' home improvement needs.

Research Analyst Overview

The home and garden B2C e-commerce market is witnessing significant advancements, with key trends shaping consumer behavior. Home security cameras and live chat support ensure customer satisfaction and safety, while fraud prevention measures safeguard online transactions. Indoor gardening kits cater to the growing interest in sustainable living, and subscription services offer convenience and personalized recommendations. Warehouse management and delivery optimization streamline operations, and targeted advertising and user experience (UX) enhance customer engagement. Smart thermostats, energy-efficient appliances, and automated lighting systems promote sustainability, while 3D product visualization and mobile app development cater to tech-savvy consumers.

Loyalty programs and email personalization foster customer loyalty, and voice assistants and virtual assistants simplify online shopping. Data encryption and eco-friendly cleaning products prioritize security and environmental consciousness, respectively. Overall, the market is witnessing a fusion of technology and sustainability, with a focus on user-centric solutions and seamless mobile experiences. Effective returns processing is crucial to maintaining a positive relationship with customers and reducing potential losses. In summary, the market faces challenges in logistics management, user experience, and returns processing. To succeed, retailers must focus on providing seamless experiences, effective inventory management, and efficient returns processing. Data analytics and social media marketing are valuable tools for understanding customer preferences and engaging with the audience.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Home And Garden Products B2C E-Commerce Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

220 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 13.4% |

|

Market growth 2025-2029 |

USD 49.62 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

11.6 |

|

Key countries |

US, China, India, Japan, South Korea, Canada, UK, Germany, Brazil, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Home And Garden Products B2C E-Commerce Market Research and Growth Report?

- CAGR of the Home And Garden Products B2C E-Commerce industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the home and garden products b2c e-commerce market growth of industry companies

We can help! Our analysts can customize this home and garden products b2c e-commerce market research report to meet your requirements.