Goat Milk Market Size 2024-2028

The goat milk market size is forecast to increase by USD 3.14 billion at a CAGR of 6.05% between 2023 and 2028.

- The market is witnessing significant growth due to several key factors. One of the primary drivers is the increasing demand for lactose-free and lower lactose dairy products. Goat milk, being naturally lower in lactose compared to cow's milk, is gaining popularity among consumers with lactose intolerance or sensitivity. Another trend influencing the market is the rising preference for flavored goat milk, especially among children and health-conscious consumers. However, the market faces challenges from stringent government regulations in goat milk production. These regulations ensure the safety and quality of goat milk products but also increase production costs. Producers must comply with these regulations to maintain market credibility and consumer trust. Overall, the market is expected to continue its growth trajectory, driven by consumer preferences and regulatory requirements.

What will the size of the market be during the forecast period?

- The dairy industry has witnessed a significant shift in consumer preferences towards healthier and more digestion-friendly alternatives. Goat dairy products have emerged as a viable solution for those with lactose intolerance, digestion problems, and allergies, offering a more natural and nutrient-dense choice compared to conventional dairy products. Goat dairy products, derived from goat's milk, have gained popularity among health-conscious consumers seeking alternatives to unhealthy lifestyles. These consumers appreciate the various health benefits associated with goat milk, including its high potassium, vitamin A, calcium, and protein content. The lactose intolerant population represents a substantial market segment for goat dairy products. Goat milk contains less lactose than cow's milk, making it an accessible choice for individuals who struggle with lactose intolerance. Moreover, goat milk is easier to digest due to its smaller fat globule size and shorter protein molecules.

- The infant population is another market segment that benefits from goat milk. Goat milk formula is a popular alternative to cow's milk formula, providing essential nutrients for growing infants. Goat milk's nutrient profile, including its high protein, calcium, and magnesium content, makes it an excellent choice for supporting bone health in infants. Goat dairy products offer a range of benefits for health-conscious consumers. They contain fewer calories, fats, and proteins than their cow milk counterparts, making them a suitable choice for those looking to manage their caloric intake.

How is this market segmented and which is the largest segment?

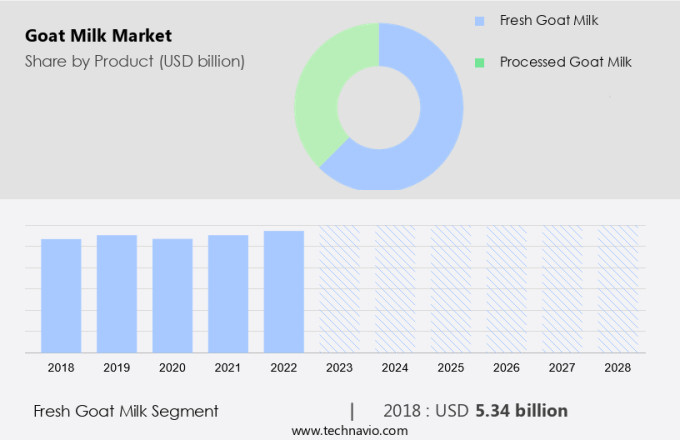

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Fresh goat milk

- Processed goat milk

- Distribution Channel

- Offline

- Online

- Geography

- APAC

- China

- India

- Europe

- France

- Spain

- North America

- US

- South America

- Middle East and Africa

- APAC

By Product Insights

- The fresh goat milk segment is estimated to witness significant growth during the forecast period.

Goat milk, specifically fresh goat milk (FGM), is a natural and easily digestible dairy product. Unlike pasteurized and processed cow milk, FGM is unadulterated and rich in essential nutrients. The small size of goat milk's lactose molecules makes it an ideal alternative for individuals with lactose intolerance. FGM contains protein A2 casein, which is easier to digest than protein A1 casein found in cow milk. Approximately 7% of children in the United States experience cow milk allergies, often due to reactions to alpha S1 casein or whey proteins. Goat milk's similar pH level to human milk and lower lactose content make it a suitable substitute for those affected. Furthermore, goat milk boasts a rich nutritional profile. It contains high levels of proteins, calories, and healthy fats. Additionally, it is a natural source of essential minerals such as magnesium and phosphorus.

Further, the liquid milk segment of the market is expected to grow due to its increasing popularity as a healthier alternative to cow milk. The production of goat milk relies on goat feed and raw material prices. As such, the cost of goat feed and raw materials can impact the market's growth. However, the demand for goat milk products, including cheese, remains strong. In conclusion, fresh goat milk offers numerous health benefits and is a suitable alternative for individuals with lactose intolerance or cow milk allergies. Its nutrient-rich profile, including proteins, calories, healthy fats, magnesium, and phosphorus, makes it an attractive option for consumers seeking a healthier dairy choice. Despite the impact of raw material prices on production costs, the demand for goat milk and its products, particularly cheese, is expected to drive market growth in the United States and beyond.

Get a glance at the market report of share of various segments Request Free Sample

The fresh goat milk segment was valued at USD 5.34 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

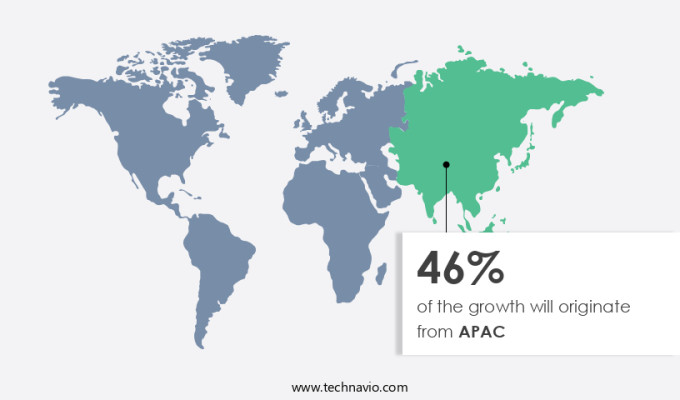

- APAC is estimated to contribute 46% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

Goat milk production is predominantly concentrated in Asian countries like India, Pakistan, and Bangladesh. The market for goat milk and related products is experiencing significant growth, with companies focusing on enhancing production techniques and optimizing supply chains. Various enterprises have entered the market, offering a range of goat dairy products. Meredith Dairy Pty Ltd. (Australia), for instance, provides marinated goat cheese, fresh goat cheese, goat curd, natural pot set goat milk yogurt, and cultured goat milk. The increasing prevalence of lactose intolerance and digestion problems, coupled with allergies to cow's milk, has led to a rise in demand for goat milk alternatives.

Further, the health benefits of goat milk, such as its high potassium, vitamin A, and calcium content, contribute to its popularity. These nutrients play a crucial role in bone health and immunity. As consumers adopt unhealthy lifestyles, the need for nutrient-rich dairy alternatives is becoming increasingly important. Consequently, the market is expected to expand further during the forecast period. In conclusion, the market is poised for growth due to the rising demand for lactose-free and allergy-friendly dairy alternatives. Companies are focusing on improving production methods and supply chains to cater to this growing market. Goat milk's health benefits, including its high potassium, vitamin A, and calcium content, make it an attractive option for consumers seeking nutrient-rich dairy alternatives.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Goat Milk Market?

Rising demand for lactose-free and lower lactose products is the key driver of the market.

- Goat milk is gaining popularity in the US dairy industry due to its benefits for individuals with digestion problems, such as lactose intolerance and allergies. Goat dairy products, including liquid goat milk, cheese, butter, ice cream, yogurt, and Chevre, offer critical nutrients like potassium, Vitamin A, calcium, and protein, which contribute to bone health and immunity. The dairy industry's production activities have been responding to this demand by increasing production capacities and expanding their offerings to include lactose-free and low-lactose goat milk and goat milk-based infant formulae and baby foods. Lactose intolerance, a condition that affects the ability to digest lactose, is prevalent among certain populations.

- Symptoms include bloating, cramps, diarrhea, and nausea. With an increasing number of individuals experiencing these symptoms, the demand for dairy alternatives or products with reduced lactose content is on the rise. Goat milk, which naturally contains lower lactose than cow milk, is a viable option. Goat milk's benefits extend beyond lactose intolerance. It is also suitable for individuals with gluten-free diets and those seeking alternative sources of essential nutrients. Goat milk-based soaps, creams, lotions, and flavored milk are also gaining traction in the market. Grocery stores, supermarkets, hypermarkets, specialty stores, convenience stores, and online retailers stock a wide range of goat milk and goat dairy products.

What are the market trends shaping the Goat Milk Market?

Increasing demand for flavored goat milk is the upcoming trend in the market.

- Goat milk has gained popularity in the US market due to its benefits for individuals with lactose intolerance, digestion problems, and allergies. Goat dairy products are rich in critical nutrients like potassium, Vitamin A, calcium, and proteins, contributing to bone health and immunity. The dairy industry's production activities have increased to meet the growing demand for goat milk and its derivatives, such as powdered milk, infant formulae, and baby foods. Goat milk's nutritional profile makes it an attractive alternative for those following unhealthy lifestyles seeking healthier options. Goat milk is naturally gluten-free and contains A2 casein and beta-casein, which are easier to digest than the A1 protein found in cow's milk.

- Consumers can find goat milk and its related foodstuffs in various retail outlets, including grocery stores, hypermarkets, specialty stores, convenience stores, and online retailers. Brands like Hochdorf, Bimbosan, and Delamere Dairy offer a range of goat milk products, including liquid milk, cheese, butter, ice cream, yogurt, and chevre. The liquid milk segment dominates the market, with cheese being a close second. Goat milk's versatility extends beyond dairy products, with applications in soaps, creams, lotions, and infant formulae. Goat milk's production capacities have increased to cater to the growing infant population's demand for goat milk-based products. Raw material prices and goat feed costs have also risen due to the increased demand for goat milk.

What challenges does Goat Milk Market face during the growth?

Stringent government regulations in goat milk production is a key challenge affecting the market growth.

- The market in the US is driven by the growing demand for dairy products that cater to specific dietary needs, such as lactose intolerance and allergies. Goat dairy products, including liquid goat milk, cheese, butter, ice cream, yogurt, and infant formulae, offer critical nutrients like calcium, potassium, vitamin A, and immunity-boosting proteins. These nutrients are essential for bone health, making goat milk an attractive alternative for consumers seeking healthier options. However, the production of goat milk and goat dairy products involves several challenges. Strict government regulations can hinder market growth by imposing entry barriers, raising production costs, and restricting market access.

- The market for goat milk is expanding, with major players like Hochdorf, Bimbosan, Delamere Dairy, and Courtyard Farms producing a range of goat milk products, including flavored milk, powdered milk, and infant formula. While regulatory requirements and production challenges can impact market growth, the demand for goat milk and goat dairy products continues to increase, offering opportunities for producers and processors to meet consumer needs and expand their offerings.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Bubs Australia Limited

- Dairy Goat Co-operative N.Z. Limited

- Delamere Dairy Ltd.

- Emmi Group

- Gujarat Cooperative Milk Marketing Federation Ltd.

- Hay Dairies Pte Ltd

- Ice House Farm

- Karnataka Milk Federation

- Meredith Dairy Pty Ltd.

- Meyenberg Goat Milk Products

- Mother Dairy Fruit and Vegetable Pvt. Ltd.

- Oak Knoll Dairy

- Redwood Hill Farm and Creamery Inc.

- Saputo Inc.

- St. Helens Farm Ltd.

- St. John Creamery

- Summerhill Goat Dairy

- Unica Global BV

- Xian Baiyue Goat Milk Group Co. Ltd

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is witnessing significant growth due to the increasing health consciousness among consumers and the rising prevalence of lactose intolerance, digestion problems, and allergies. Goat dairy products, including liquid milk, cheese, butter, ice cream, yogurt, and infant formulae, are gaining popularity due to their unique nutritional properties. Goat milk, in particular, is rich in critical nutrients such as potassium, vitamin A, calcium, and bone health-promoting minerals like copper and iron. These nutrients make goat milk an ideal choice for individuals with lactose intolerance or those seeking to maintain a healthy lifestyle. The dairy industry's production activities are influenced by several factors, including the demand for dairy and raw material prices. Goat feed prices have been on the rise due to increased demand, leading to higher production costs for goat milk and dairy products. Infant population growth and the increasing trend of goat milk usage in infant formulae and baby foods are significant market drivers.

Moreover, goat milk is also used in various non-dairy applications, such as soaps, creams, lotions, and flavored milk. These products cater to consumers with specific dietary requirements, such as gluten-free or lactose-intolerant individuals. The market's growth is influenced by several market dynamics, including consumer preferences, production capacities, and competition from other dairy products. The market's growth is expected to be driven by factors such as changing consumer preferences, increasing health consciousness, and the rising prevalence of lactose intolerance and digestion problems. In conclusion, the goat dairy products market is experiencing significant growth due to the increasing demand for lactose-free and nutrient-rich dairy alternatives. Goat milk, in particular, is gaining popularity due to its unique nutritional properties and the growing awareness of its health benefits. The market's future outlook is promising, with increasing demand from various end-users and the growing trend of goat milk usage in various applications.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

156 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.05% |

|

Market growth 2024-2028 |

USD 3.14 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.02 |

|

Key countries |

US, China, India, France, and Spain |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch