Gin Market Size 2025-2029

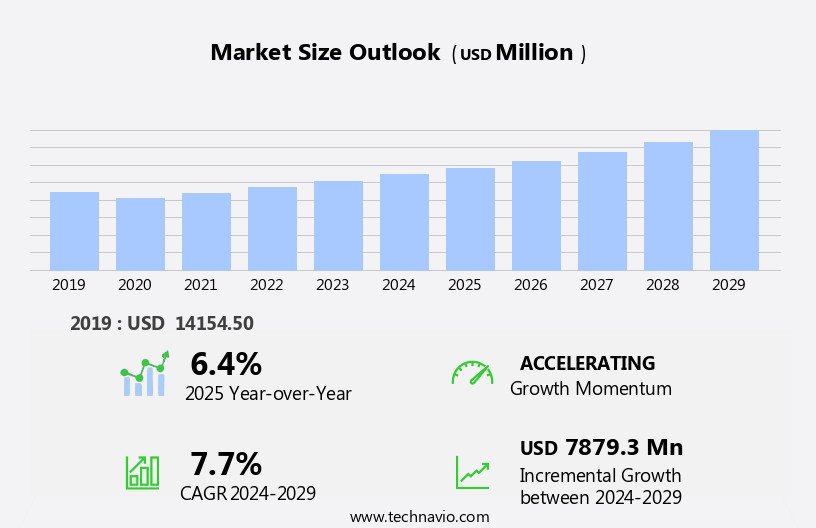

The gin market size is forecast to increase by USD 7.88 billion at a CAGR of 7.7% between 2024 and 2029.

- The market is experiencing significant growth, driven primarily by the expansion of organized retailing. With the increasing number of supermarkets and hypermarkets, consumers have easier access to a wider range of gin brands and varieties. However, this trend also presents challenges, particularly in the area of distribution. One major issue is the complexities involved in supplying gin from supermarkets and hypermarkets, which can result in logistical challenges and increased costs for producers. Another key development in the market is the rising influence of online retailing. As more consumers turn to e-commerce platforms to purchase gin, producers and retailers must adapt to meet this demand.

- This includes investing in digital marketing strategies and improving the customer experience on e-commerce sites to attract and retain customers. Despite these challenges, the market offers significant opportunities for growth, particularly for companies that can effectively navigate the complex distribution landscape and capitalize on the growing demand for this popular spirit.

What will be the Size of the Gin Market during the forecast period?

- The market continues to evolve, with dynamics unfolding across various sectors. Gin's rich heritage and vibrant community fuel the ongoing revival of this classic spirit. Super-premium gin brands dominate the landscape, offering consumers a refined experience. Gin flights and tastings provide opportunities for exploration and appreciation. Market share shifts as gin labels adapt to consumer preferences, with sustainability and unique botanical blends gaining traction. The gin & tonic remains a staple cocktail, while new creations like gin and juice emerge. Craft gin distilleries proliferate, contributing to the gin renaissance. Online sales and innovative packaging attract tech-savvy consumers, while gin connoisseurs seek out rare and limited-edition releases.

- Juniper berries, the spirit's defining ingredient, remain at the heart of gin production. Gin lifestyle and experience are increasingly important, with gin bars and tourism driving growth. Navy strength gin and other styles cater to diverse tastes, attracting collectors and enthusiasts. Gin culture thrives, with education and marketing efforts expanding its reach. Regulations and retail channels adapt to meet the demands of this dynamic market. London dry gin, plymouth gin, and other traditional styles maintain their legacy, while ultra-premium offerings push the boundaries of innovation. Gin exports and imports shape the global landscape, with festivals and events celebrating the spirit's diverse applications.

How is this Gin Industry segmented?

The gin industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Standard

- Economy

- Premium

- Super-premium

- Distribution Channel

- Offline

- Online

- Alcohol Content

- Standard ABV (37.5-40%)

- High ABV (>40%)

- Low ABV (<37.5%)

- Price

- Standard

- Premium

- Luxury

- Category Type

- London Dry Gin

- Plymouth Gin

- Genever

- Old Tom Gin

- New American Gin

- Geography

- North America

- US

- Mexico

- Europe

- France

- Germany

- UK

- Middle East and Africa

- UAE

- APAC

- Australia

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

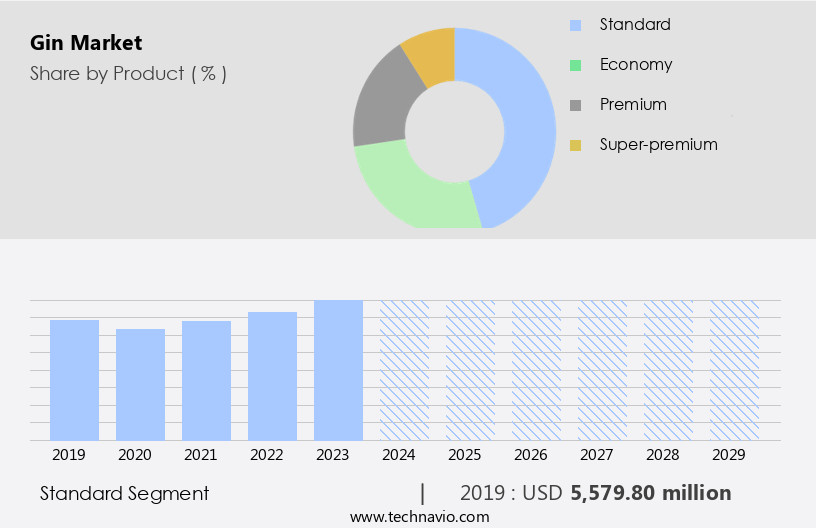

By Product Insights

The standard segment is estimated to witness significant growth during the forecast period.

Gin, a traditional spirit known for its distinctive juniper flavor, has seen a resurgence in popularity in recent years. Premium gin, with its superior quality and unique botanical profiles, has driven a significant portion of this growth. The market encompasses various segments, including gin sales, production, education, advertising, sustainability, trends, and community. Small-batch distilleries have emerged, producing craft gin with innovative flavors and limited production runs. Gin cocktails, such as the classic gin and tonic, continue to be popular, while gin flights offer consumers the opportunity to taste and compare different varieties. Super-premium gin, with its high-end packaging and exclusive branding, caters to collectors and connoisseurs.

London dry gin, a style that dominates the market, is known for its clear appearance and balanced flavor. The gin renaissance has also led to an increase in gin tourism, with visitors flocking to distilleries for tastings and educational experiences. Gin imports and exports have grown, broadening the availability of various gin styles and brands. Sustainability is a key trend, with distilleries focusing on eco-friendly production methods and packaging. Gin consumption is on the rise, with the US, Spain, and India being major markets. Gin labels highlight the botanicals used, adding to the overall gin lifestyle experience. Gin regulations ensure consistent quality and authenticity.

The market is dynamic, with new brands and innovations emerging regularly.

The Standard segment was valued at USD 5.58 billion in 2019 and showed a gradual increase during the forecast period.

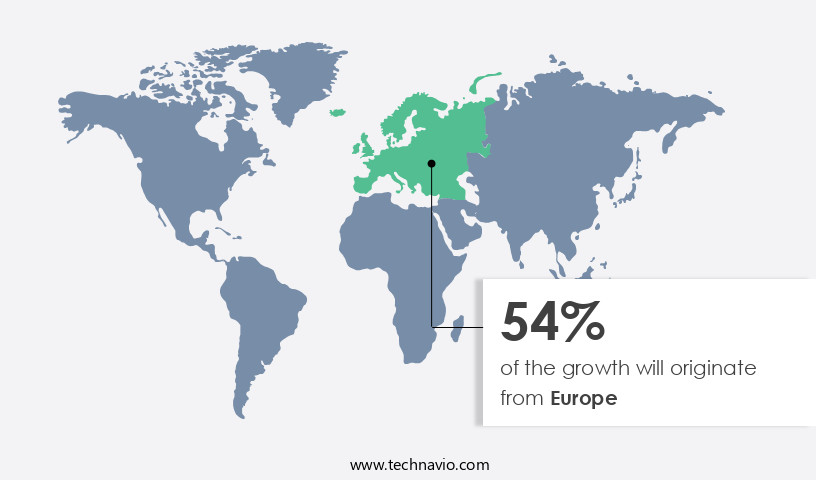

Regional Analysis

Europe is estimated to contribute 54% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market experienced significant growth in 2024, with Europe leading in sales revenue. Europe's dominance in the global alcoholic beverages market, driven by high alcohol consumption, contributes to its prominence in the gin industry. However, the region's complex regulatory landscape poses challenges for companies. For instance, Norway enforces strict alcohol policies, including licensing and sales restrictions. Premium gin and small-batch productions have been at the forefront of the gin renaissance, attracting a dedicated community of enthusiasts. The popularity of gin cocktails, such as the classic gin and tonic, has fueled the market's growth. Sustainability and innovation have become essential trends, with distilleries adopting eco-friendly practices and creating unique flavors.

Gin education and marketing efforts have played a crucial role in expanding consumer base. Gin tastings, appreciation events, and mixology classes have provided opportunities for enthusiasts to deepen their understanding of this spirit. Gin flights and online sales have also contributed to the market's expansion. The market is diverse, encompassing various styles, including London dry gin, old tom gin, navy strength gin, and plymouth gin. Brands cater to different preferences, from craft gin to super-premium offerings. The gin lifestyle and experience continue to evolve, with collectors and connoisseurs seeking unique bottles and labels. Gin exports have also seen a surge, with the United States and other countries importing significant quantities.

The spirit's rich history and cultural significance continue to inspire new generations of consumers and producers. Regulations and retail channels have adapted to accommodate the market's growth, ensuring its continued success.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Gin Industry?

- The expansion of organized retailing has significantly increased the demand for gin, serving as the primary market driver.

- The market, with its rich history dating back to the late 16th century, has witnessed significant growth and innovation. Ultra-premium gins have emerged as a popular segment, offering consumers a refined and sophisticated tasting experience. Gin distribution is primarily driven by large, organized retailers, with supermarkets being a major channel. The rise in population and the growth of supermarkets, particularly in countries like the US, Brazil, Chile, and Mexico, have contributed to the market's expansion. Gin and juice cocktails have gained popularity, leading to increased gin appreciation and mixology experiments.

- Old tom gin, with its unique sweet and spicy flavor profile, has also regained popularity. The gin industry continues to innovate, with new product launches and gin festivals fostering consumer engagement and education. Despite these positive trends, market dynamics remain dependent on the retail landscape and consumer preferences.

What are the market trends shaping the Gin Industry?

- The rising influence of online retailing represents a significant market trend in today's business landscape. E-commerce platforms are increasingly gaining popularity among consumers due to their convenience and accessibility.

- Gin sales have experienced significant growth, driven by the popularity of gin cocktails and the rise of premium gin brands. The gin spirit category has seen a renaissance, with small-batch distilleries emerging and consumers seeking unique and high-quality offerings. This trend is supported by increased gin education and advertising efforts, which have helped to expand the market. Sustainability is also becoming a key consideration in gin production, with distilleries focusing on eco-friendly practices and reducing their carbon footprint. As e-commerce continues to grow, gin companies have an opportunity to increase their profits through online sales.

- Nearly 12% of global retail trade is conducted online, and the number of transactions and average transaction value are increasing. The growing number of internet users and the buy-it-now attitude of consumers are driving the growth of e-commerce, making it an attractive channel for gin sales.

What challenges does the Gin Industry face during its growth?

- The distribution challenges associated with gin, particularly in the context of supermarkets and hypermarkets, represent a significant obstacle to the industry's growth.

- The market, steeped in heritage and boasting a vibrant community of enthusiasts, has experienced a significant revival in recent years. Super-premium gin brands have gained prominence, with gin connoisseurs and casual drinkers alike appreciating the intricacies of craft gin production. The market share continues to grow, driven by the popularity of gin flights and the enduring appeal of the gin & tonic. Manufacturers face challenges in meeting the demands of retailers, who seek competitive pricing and smaller product packaging to minimize storage costs. Innovative merchandising units, such as movable shelves, are increasingly expected to reduce replenishment costs.

- The gin labeling trend towards unique designs and storytelling adds complexity to production processes. Online sales are on the rise, necessitating adaptability in distribution channels and marketing strategies. As the market evolves, manufacturers must balance the needs of retailers and consumers while preserving the integrity of their brands. This dynamic market environment requires a keen understanding of consumer preferences and market trends to remain competitive.

Exclusive Customer Landscape

The gin market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the gin market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, gin market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Asahi Group Holdings Ltd. - The company specializes in crafting distinctive gin varieties, including Apple Orange Bitters, Grapefruit Lime, Elderflower Lime, and Mist Wood Gin. Each expression is meticulously crafted to offer unique and complex flavor profiles, elevating the gin category through innovation and originality. Our dedication to quality and authenticity sets US apart in the spirits industry, providing consumers with an unparalleled tasting experience.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Asahi Group Holdings Ltd.

- Bacardi and Co Ltd

- Berry Bros and Rudd Ltd.

- Brown Forman Corp.

- CLS REMY COINTREAU

- Davide Campari-Milano N.V.

- Diageo PLC

- Durham Distillery

- Heaven Hill Distillery Inc.

- Herno Gin AB

- Hotaling and Co LLC

- LT Group Inc.

- Manchester Gin

- Mast Jagermeister SE

- Pernod Ricard SA

- Quintessential Brands Group

- San Miguel Corp

- Suntory Holdings Ltd.

- Thai Beverage Public Co. Ltd.

- William Grant and Sons Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Gin Market

- In January 2024, Diageo, a leading spirits company, introduced a new line of flavored gins under its Tanqueray brand. This expansion aimed to cater to the growing demand for innovative and diverse gin flavors (Diageo Press Release). In March 2025, Pernod Ricard and Seedlip, the world's leading non-alcoholic spirits company, announced a strategic partnership to co-create and distribute non-alcoholic gin and tonic kits. This collaboration marked a significant shift towards low and no-alcohol beverages, responding to changing consumer preferences (Pernod Ricard Press Release). In May 2025, Beam Suntory, a global spirits company, completed the acquisition of the Australian gin brand, Four Pillars. This acquisition expanded Beam Suntory's gin portfolio and strengthened its presence in the Asia Pacific market (Beam Suntory Press Release). In October 2025, the European Union approved new regulations allowing the use of botanicals like cannabis and hemp in gin production. This regulatory change opened new opportunities for innovation and growth within the market (European Commission Press Release).

Research Analyst Overview

The market exhibits vibrant trends and dynamics, with consumer insights revealing a growing preference for sustainable production methods. Producers are increasingly focusing on aging gin in oak barrels to enhance flavor profiles and cater to discerning palates. Gin events, competitions, blogs, subscription boxes, research, books, and masterclasses foster a community of enthusiasts, driving industry growth. Copper stills, a traditional production technique, continue to be favored for their distinctive taste. Innovation in botanical blends and production techniques is shaping the future of gin.

Online retailers offer a wide range of cocktail recipes and gin tours, while tourism destinations showcase distilleries as must-visit attractions. Gin influencers and industry associations further fuel the buzz around this spirit, with awards and gift sets adding to its allure.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Gin Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

203 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.7% |

|

Market growth 2025-2029 |

USD 7879.3 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.4 |

|

Key countries |

UK, Germany, US, China, France, Brazil, Canada, Japan, India, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Gin Market Research and Growth Report?

- CAGR of the Gin industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the gin market growth of industry companies

We can help! Our analysts can customize this gin market research report to meet your requirements.