Functional Coffee Market Size 2025-2029

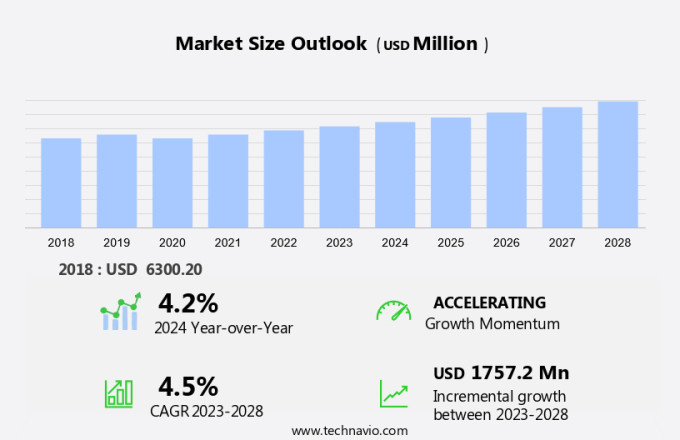

The functional coffee market size is forecast to increase by USD 1.89 billion at a CAGR of 4.6% between 2024 and 2029.

- The market is experiencing significant growth, driven primarily by the increasing consumption of coffee. This trend is particularly noticeable among the millennial demographic, who are increasingly seeking functional beverages that offer health benefits in addition to their caffeine fix. However, this market is not without challenges. This has led to the popularity of coffee infused with Medium Chain Triglyceride (MCT) oil, which is known to aid in weight loss and healthy hydration. Fluctuating prices of coffee beans pose a significant threat, as producers and retailers must navigate the volatility to maintain profitability. Moreover, the growing demand for organic and sustainably produced coffee beans adds complexity to the supply chain, requiring companies to prioritize ethical sourcing and transparency to meet consumer expectations.

- To capitalize on this dynamic market, companies must focus on innovation, sustainability, and transparency, while effectively managing the risks associated with price volatility and ethical sourcing. By doing so, they can differentiate themselves and meet the evolving needs of health-conscious and socially responsible consumers. Additionally, the rising popularity of coffee and non-alchoholic beverages among millennials, who are more health-conscious and prefer functional beverages, is contributing to market expansion.

What will be the Size of the Functional Coffee Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

In the dynamic coffee market, various sectors continue to evolve. Coffee events, such as competitions and festivals, foster a sense of community among enthusiasts, showcasing the art and science of coffee production. Coffee blogs and magazines disseminate knowledge on coffee certification, production techniques, and trends. Merchandise, including filters, mugs, and accessories, cater to consumers' growing appreciation for the beverage. Import and export play significant roles in the global coffee trade, with countries adhering to certification standards to ensure quality and sustainability. Furthermore, fluctuating prices of coffee beans, which can impact the market, are being closely monitored by industry players. Wholesale and retail businesses thrive on coffee blends, single origin offerings, and ready-to-drink products. Barista training and education equip professionals with the skills to create intricate latte art and brew the perfect cup.

Coffee waste management and oil extraction are emerging areas of focus, addressing sustainability concerns and creating new revenue streams. Decaf coffee and flavored options cater to diverse tastes, while nitrogen-infused coffee and brewing equipment innovations captivate the market. Subscription services offer convenience and personalized experiences, ensuring a consistent coffee supply. Coffee competitions, such as the World Barista Championship, showcase the artistry and skill of coffee professionals. Coffee books and blogs provide invaluable insights into the world of coffee, from bean processing to brewing techniques. The market's diversity is reflected in its offerings, from flavored coffee to coffee-themed gifts and merchandise.

How is this Functional Coffee Industry segmented?

The functional coffee industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Whole bean coffee

- Ground coffee

- RTD coffee

- Resource Type

- Caffeine

- Adaptogens and nootropics

- L-theanine

- Distribution Channel

- Offline

- Online

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

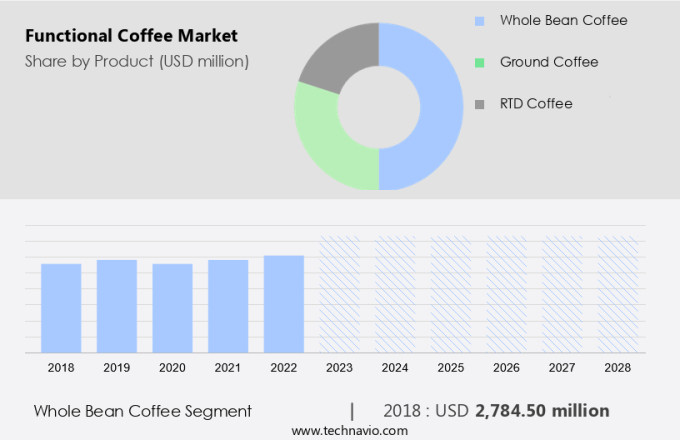

By Product Insights

The whole bean coffee segment is estimated to witness significant growth during the forecast period. Whole bean coffee, a preferred choice for coffee connoisseurs, consists of roasted coffee beans that remain unground. The preservation of their natural state ensures a longer shelf life and maintains the beans' rich aromatic qualities. Unlike pre-ground coffee, whole beans are less susceptible to oxidation and degradation, retaining their subtle flavor notes and antioxidants. Home brewing methods, such as espresso machines and moka pots, require ground beans. However, grinding whole beans just before brewing enhances the aroma and taste experience. Coffee beans, primarily Arabica and Robusta, undergo various roast profiles to create diverse flavor profiles. Sensory evaluation, including taste testing and aroma analysis, is crucial in ensuring the quality of these beans.

Bean sourcing, ethical and fair trade practices, and regulatory compliance are essential aspects of the coffee industry. Product innovation, such as smart coffee machines and coffee pods, has transformed the way coffee is brewed and consumed at home and in offices. Cold brew coffee, pour over, French press, and drip coffee makers cater to various consumer preferences. Coffee shops and office coffee services offer a range of brewing methods and additives like creamers, syrups, and coffee extracts to cater to diverse tastes. Coffee culture, driven by consumer insights and marketing campaigns, has led to an increased focus on sustainability, ethical sourcing, and food safety.

Quality control and supply chain management are essential to maintain the consistency and freshness of coffee products. Competitor analysis and pricing strategies are crucial in this dynamic market. Regulatory compliance, ethical sourcing, and consumer preferences will continue to influence the market dynamics and trends. Thermoses and cups are essential for enjoying coffee on-the-go, while coffee brewing equipment caters to the growing number of home baristas. The coffee industry continues to evolve, offering endless opportunities for innovation and growth. This segment of the coffee industry is characterized by the inclusion of functional ingredients, such as turmeric, ginger, cardamom, cinnamon, and MCT oil, to provide additional health benefits.

The Whole bean coffee segment was valued at USD 5.87 billion in 2019 and showed a gradual increase during the forecast period.

The Functional Coffee Market is brewing up innovation with products like nitrogen infused coffee and readytodrink coffee, tailored for health-conscious, on-the-go consumers. Demand for single origin coffee is rising, offering traceability and nuanced flavors. Coffee beans offer numerous health benefits, including antioxidants and unique flavor profiles. Growth in coffee accessories, coffee storage, and premium coffee mugs and coffee thermoses reflects the lifestyle appeal of specialty brews. From coffee oil extraction and coffee bean processing to cutting-edge coffee production techniques, brands are refining quality. Expanding coffee export and coffee import channels support global reach, while coffee wholesale and coffee retail drive market access. With rising interest in coffee subscription services, coffee education, and creative realms like coffee art, coffee latte art, coffee photography, and coffee magazines, the market thrives on personalization and experienceâfrom coffee gifts to engaging coffee festivals.

Regional Analysis

Europe is estimated to contribute 42% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The European the market is experiencing growth due to the increasing preference for health-conscious food choices. Europe, which consumes approximately 3.244 million tons of coffee, making it the largest coffee market globally, offers significant opportunities for coffee exporters. Germany, France, and Italy are major consumers of functional coffee in the region. To cater to this trend, companies are expanding their product offerings, focusing on functional coffee that aligns with health-conscious consumers. Arabica beans, known for their lower acidity levels, are popular choices for functional coffee. Roast profiles, grinding techniques, and brewing methods are carefully considered to preserve aroma compounds and enhance flavor profiles.

Sensory evaluation plays a crucial role in ensuring quality control and consumer satisfaction. Competitor analysis is essential to stay ahead of the curve in this dynamic market. Product innovation, such as cold brew coffee and coffee concentrates, caters to diverse consumer preferences. Ethical sourcing and fair trade practices are becoming increasingly important in the market, with consumers showing brand loyalty towards companies that prioritize sustainability and ethical business practices. Regulatory compliance, food safety, and taste testing are critical aspects of the supply chain management process. Coffee shops, office coffee service, and vending machines are key distribution channels.

Coffee additives, such as coffee creamers and syrups, and alternative brewing methods, such as French press and pour over coffee, cater to various consumer preferences. Data analytics and marketing campaigns help companies understand consumer insights and tailor their offerings accordingly. Coffee roasting, single-serve coffee, and whole bean coffee continue to be popular choices. Coffee packaging and pricing strategies are essential to maintain competitiveness in the market. Moreover, functional coffee may contain nootropic L-Theanine, an amino acid that promotes focus and relaxation.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Functional Coffee market drivers leading to the rise in the adoption of Industry?

- The significant rise in coffee consumption serves as the primary growth catalyst for the market. The market is experiencing significant growth due to increasing global consumption and the popularity of coffee as the second-most preferred beverage in developed countries, following soft drinks. Coffee production is primarily concentrated in 45 countries, with Brazil, Vietnam, Indonesia, and Colombia being the leading producers. In the US and other developed markets, coffee is a favored beverage, and the convenience of coffee pods and single-serve options has further boosted its appeal. Blockchain technology is revolutionizing the online industry by ensuring transparency and traceability in the production and distribution of healthy foods, including functional coffee.

- Brewing methods, including cold brew and traditional hot brewing, continue to evolve. Grinding techniques are also a focus, with companies exploring new ways to optimize flavor profiles and enhance the overall coffee experience. Competitor analysis plays a crucial role in product development and market positioning. Overall, the market is poised for continued growth, driven by consumer preferences, product innovation, and a commitment to regulatory compliance and quality control. To cater to this growing demand, market participants are innovating by introducing new roast profiles, flavors, and product lines. Cold brew coffee and whole bean options have gained traction, while regulatory compliance and quality control remain essential for maintaining consumer trust.

What are the Functional Coffee market trends shaping the Industry?

- The rising preference for coffee among millennials represents a significant market trend. This demographic group's increasing affinity for coffee is a noteworthy development in the industry. The market is experiencing significant growth due to shifting consumer preferences and increasing disposable income. Millennials, in particular, are driving demand for high-quality and specialized coffee products. Their penchant for premium brands and experimentation with new flavors and types has led manufacturers to introduce coffee additives, such as coffee with added sensory science, fair trade coffee, and coffee packaging with ethical sourcing. Moreover, the coffee shop culture has gained immense popularity among this demographic, contributing to the market's expansion.

- Pricing strategies have become crucial in attracting and retaining customers, with ground coffee and office coffee service being popular distribution channels. Robusta beans are increasingly being used in functional coffee due to their unique taste profile and health benefits. The market's growth is expected to continue as consumers seek healthier and more innovative coffee options. Ethical sourcing and fair trade coffee are becoming essential considerations for consumers, making it crucial for manufacturers to prioritize these practices in their supply chain management. Consumers enjoy socializing in coffee shops, making it an ideal setting for product experimentation and brand loyalty. In response, coffee roasters and manufacturers are focusing on understanding consumer preferences and implementing supply chain management strategies to cater to this market trend.

How does Functional Coffee market face challenges during its growth?

- The industry faces significant growth challenges due to the volatile pricing of coffee beans. The market faces challenges due to the volatility of coffee bean prices. Factors contributing to this instability include supply and demand imbalances, decreasing production, inclement weather conditions, and escalating labor costs. These rising raw material costs not only increase the final product price but also squeeze manufacturers' profit margins, making it difficult for them to maintain profitability. Competition among companies further intensifies the pressure. With the growing health consciousness and the increasing popularity of functional foods and beverages, the market is poised for significant growth.

- Consumer insights continue to shape the market, with preferences for pour over coffee, coffee creamers, and various taste testing methods. Marketing campaigns, food safety, data analytics, coffee syrups, vending machines, and coffee extracts are also key market dynamics. Manufacturers must balance cost savings with product quality and consumer demand to succeed in this dynamic market. In response, coffee producers are investigating cost-effective alternatives, such as lower-grade coffee beans and instant coffee powder, to remain competitive.

Exclusive Customer Landscape

The functional coffee market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the functional coffee market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, functional coffee market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Baristas Coffee Co. Inc. - This company specializes in premium functional coffee, featuring Baristas Ground White Coffee crafted exclusively from 100% Arabica beans.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Baristas Coffee Co. Inc.

- Berner Food and Beverage

- Bulletproof 360 Inc.

- Cothas Coffee Co.

- Farmer Bros Co.

- FM Cosmetics UK Ltd.

- Function Coffee Labs

- Heine Brothers Coffee

- Ingenuity Beverages LLC

- Kitu Life Inc.

- Nathan Coffee Mart

- Nestle SA

- Peak State

- Peets Coffee Inc.

- Royal Cup Inc.

- Sklew Biotech Ltd.

- Starbucks Corp.

- Strauss Group Ltd.

- Tata Sons Pvt. Ltd.

- Vardhman Foods and Beverages

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Functional Coffee Market

- In January 2024, Starbucks Corporation, the world's largest coffeehouse chain, announced the launch of its new line of functional coffee beverages infused with vitamins and minerals, targeting health-conscious consumers. The company's press release stated that these beverages would be available at all Starbucks stores in the United States and Canada (Starbucks Corporation, 2024).

- In March 2024, Nestlé, the global food and beverage giant, acquired a 68% stake in Blue Bottle Coffee, a specialty coffee roaster known for its functional coffee offerings. The deal valued Blue Bottle Coffee at USD 500 million, according to Bloomberg (Bloomberg, 2024).

- In April 2025, Dunkin' Brands, the parent company of Dunkin' Donuts and Baskin-Robbins, entered into a partnership with Functional Beverage Brands, a leading functional coffee manufacturer. The collaboration aimed to develop and launch a line of functional coffee beverages at Dunkin' Donuts and Baskin-Robbins locations in the United States (Dunkin' Brands, 2025).

- In May 2025, the U.S. Food and Drug Administration (FDA) approved the use of certain functional ingredients, such as L-theanine and MCTs, in coffee beverages. This approval opened the door for coffee companies to expand their functional coffee product lines and cater to the growing demand for healthier, functional beverage options (FDA, 2025).

Research Analyst Overview

The market continues to evolve, with dynamic market activities unfolding across various sectors. Distribution channels expand as coffee additives, such as creamers and syrups, find their way into both retail and foodservice applications. Innovative flavors and personalized nutrition are also driving demand for functional coffee. Adaptogens and nootropics, natural substances known for their health benefits, are increasingly being added to functional coffee blends. Health and wellness are top priorities for consumers, leading to the popularity of vegetable eating habits and health tracking technology. Sensory science plays a pivotal role in understanding consumer preferences for different roast profiles, aroma compounds, and flavor profiles. Robusta beans, known for their higher caffeine content, gain traction in the market. Coffee shops and office coffee service providers innovate with smart machines and pour-over methods, catering to the growing demand for specialty coffee. Ground coffee and whole bean sales fluctuate, influenced by consumer trends and brewing methods.

Fair trade coffee and ethical sourcing remain crucial factors in brand loyalty and regulatory compliance. Pricing strategies and coffee packaging evolve to address supply chain management and food safety concerns. Consumer insights and data analytics drive product innovation, from cold brew coffee and coffee concentrates to coffee extracts and instant coffee. Competitor analysis and taste testing shape the market landscape, with regulatory bodies ensuring quality control and regulatory compliance. Robusta beans, coffee shops, ground coffee, office coffee service, consumer preferences, coffee culture, fair trade coffee, pricing strategies, coffee packaging, and ethical sourcing all intertwine, creating a complex and ever-changing market landscape.

The market's continuous dynamism underscores the importance of staying informed and adaptive.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Functional Coffee Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

204 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.6% |

|

Market growth 2025-2029 |

USD 1.89 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.4 |

|

Key countries |

US, UK, China, Canada, Germany, Brazil, Japan, France, Italy, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Functional Coffee Market Research and Growth Report?

- CAGR of the Functional Coffee industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, APAC, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the functional coffee market growth of industry companies

We can help! Our analysts can customize this functional coffee market research report to meet your requirements.