APAC Footwear Market Size 2024-2028

The APAC footwear market size is forecast to increase by USD 45.8 billion, at a CAGR of 7% between 2023 and 2028.

- The market is experiencing robust growth, primarily driven by the surging demand for athletic footwear. Consumers in the region are increasingly embracing active lifestyles, leading to a significant increase in the popularity of sports shoes. Furthermore, the market is witnessing a notable trend towards online sales channels. With the convenience of shopping from home and the vast selection offered by e-commerce platforms, more consumers are opting to purchase footwear online. However, this trend also presents challenges for market players. Rising labor costs, particularly in countries like China and Vietnam, are putting pressure on manufacturers to find ways to maintain profitability.

- Companies must carefully manage their supply chains and explore cost-saving measures to remain competitive in the market. To capitalize on the growing demand for athletic footwear and navigate the challenges of increasing labor costs, market participants should focus on innovation, operational efficiency, and strategic partnerships. By staying agile and responsive to changing consumer preferences and market dynamics, they can effectively capitalize on opportunities and maintain a strong market position.

What will be the size of the APAC Footwear Market during the forecast period?

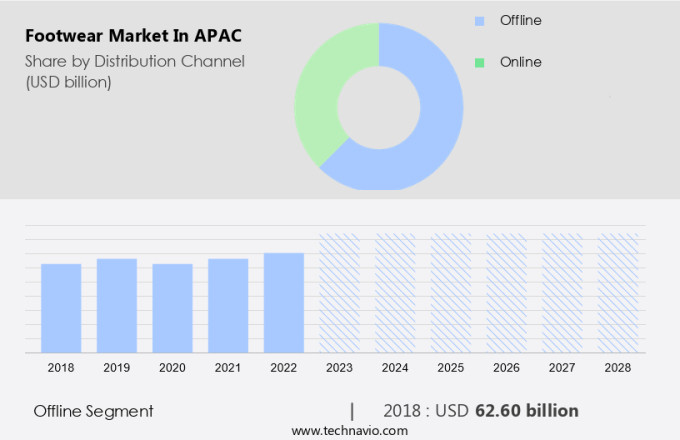

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

- The APAC footwear market is witnessing significant trends and advancements, with consumer insights playing a pivotal role in shaping the industry. Footwear longevity is a growing concern, leading to increased focus on personalized footwear solutions and performance testing. The integration of 3D printing technology in footwear production offers customization opportunities, while footwear cushioning and ergonomics analysis ensure superior comfort. Footwear retail channels continue to evolve, with online sales surging. Innovation trends include footwear incorporating recycled materials, bio-based materials, and smart technology. Footwear safety standards remain paramount, with anti-slip soles and waterproof membranes ensuring protection. Footwear brand loyalty is being tested as consumers demand more from their footwear.

- Durability testing and wearability assessments are essential to meet these expectations. Footwear technology continues to advance, with footwear manufacturers focusing on arch support, comfort features, and ventilation. Sustainable materials and footwear customization are key differentiators, with consumers increasingly conscious of their environmental impact. The footwear industry trends towards eco-friendly production methods and ethical manufacturing practices. Footwear marketing strategies are adapting to these changes, emphasizing transparency and authenticity.

How is this market segmented?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Distribution Channel

- Offline

- Online

- Geography

- APAC

- China

- India

- Japan

- South Korea

- APAC

By Distribution Channel Insights

The offline segment is estimated to witness significant growth during the forecast period.

The APAC footwear market encompasses various segments, including outdoor footwear, rubber footwear, athletic footwear, casual footwear, formal footwear, and sports footwear. The footwear industry analysis reveals a significant focus on footwear innovation, design, and sustainability. companies invest in research and development to create footwear with advanced sole technology, biomechanics, waterproofing, and breathability. Footwear marketing strategies emphasize consumer demographics, ergonomics, and fit. Retailers prioritize footwear styles, aesthetics, comfort, and performance to cater to diverse consumer preferences. Footwear brands compete based on price, value, durability, and customer satisfaction. Footwear distribution channels include offline sales through specialty stores, hypermarkets, and department stores, and online sales through e-commerce platforms.

Offline sales have been declining due to the convenience and affordability of online shopping. However, companies are expanding into local markets to increase offline sales. Footwear regulations ensure safety, quality, and ethical manufacturing practices. Footwear testing is crucial to meet these standards and maintain consumer trust. The footwear supply chain involves various stages, from raw material sourcing to production, distribution, and retail. The footwear competitive landscape includes numerous brands, each offering unique styles, materials, and features. Synthetic footwear and leather footwear cater to different consumer segments. Footwear materials, such as canvas and rubber, influence the market dynamics. In conclusion, the APAC footwear market is dynamic and competitive, with a focus on innovation, consumer preferences, and regulatory compliance. Companies and retailers adopt various strategies to cater to evolving consumer trends and preferences, ensuring footwear remains a vital part of everyday life.

The Offline segment was valued at USD 62.60 billion in 2018 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the APAC Footwear Market market drivers leading to the rise in adoption of the Industry?

- The market is propelled forward by the increasing demand for athletic footwear, making it a significant market driver.

- The Asia Pacific footwear market is experiencing significant growth, driven by the increasing preference for sports-inspired and sports-specific footwear. This trend is particularly noticeable in countries like China and India, where the demand for athletic shoes is on the rise. The surge in international sporting events in the region, such as the Asian Games, ICC Cricket World Cup, and ACC Asian Cup, has heightened consumer awareness of the benefits of sports and fitness activities. As a result, the demand for footwear designed for specific sports and activities is expected to continue growing. Moreover, the development of advanced footwear materials, sole technology, and footwear certification is fueling innovation in the market.

- Brands are focusing on sustainability and biomechanics to cater to the evolving needs of consumers. Synthetic footwear, with its durability and versatility, is gaining popularity due to its ability to meet the demands of various sports and activities. Customer satisfaction is a key priority for footwear brands, and they are investing in research and development to create footwear that offers superior comfort and performance. The competitive landscape in the market is intensifying, with brands continually striving to differentiate themselves through innovative designs and technologies. Overall, the Asia Pacific footwear market is poised for continued growth, driven by consumer preferences, technological advancements, and the increasing popularity of sports and fitness activities.

What are the APAC Footwear Market market trends shaping the Industry?

- The trend in the market is shifting towards increased online product penetration. This means that more and more products are being sold online, making it a mandatory direction for businesses to explore.

- The market is experiencing significant growth due to several factors. The region's increasing Internet penetration is a primary driver, leading to an upward trend in online footwear sales. Consumers in APAC are spending more money and making more transactions online, attracted by the convenience, time-saving aspects, and extensive product offerings of e-commerce platforms. Additionally, enhanced online security features, such as secure payments and improved customer service, are increasing consumer confidence in shopping online. Footwear consumers in APAC span various demographics, with a growing preference for footwear that offers both waterproofing and breathability for various climates and activities.

- Performance and durability are also key considerations, particularly in the sports footwear segment. Understanding these consumer behaviors and preferences is crucial for businesses looking to tap into the growing the market.

How does APAC Footwear Market market faces challenges face during its growth?

- The escalating labor costs pose a significant challenge to the industry's growth trajectory.

- The footwear industry analysis in APAC reveals that several footwear manufacturers, catering to international markets, have production facilities in countries like Indonesia, China, Bangladesh, Vietnam, and India. However, these economies have experienced rising labor costs, leading to increased manufacturing expenses and narrowing company profit margins. This trend is expected to impede the growth of the global outdoor, casual, athletic, and leather footwear markets during the forecast period. Merchants are growing increasingly concerned about the escalating labor costs in Asian factories.

- For instance, some companies have already relocated their production facilities from China and Indonesia due to substantial wage increases in these nations. Despite these challenges, footwear marketing strategies, footwear testing, footwear fit, footwear ergonomics, footwear distribution, and footwear retailers continue to play crucial roles in the industry. Companies prioritize innovation and quality to maintain their competitive edge.

Exclusive APAC Footwear Market Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Adidas AG

- Alpinestars USA Inc.

- ASICS Corp.

- Bata

- Belle International Holdings Ltd.

- Daphne International Holdings Ltd.

- Geox S.p.A

- Industria de Diseno Textil SA

- LVMH Moet Hennessy Louis Vuitton SE

- Nike Inc.

- Paragon Polymer Products Pvt. Ltd.

- PUMA SE

- PVH Corp.

- Reliance Industries Ltd.

- Sara Suole Pvt. Ltd.

- VF Corp.

- VKC Pride

- Wolverine World Wide Inc.

- Woodland Worldwide

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Footwear Market In APAC

- In March 2023, Adidas and Shiseido, a leading Japanese cosmetics company, announced a strategic partnership to co-create footwear and apparel products, combining Adidas' sports expertise with Shiseido's fashion and beauty knowledge (Adidas Press Release). This collaboration is expected to cater to the growing demand for unique, high-quality, and fashionable sports products in the APAC region.

- In July 2024, Decathlon, a French multinational sporting goods retailer, invested USD100 million in its footwear manufacturing facility in Vietnam, expanding its production capacity and strengthening its presence in the APAC market (Decathlon Press Release). This investment aims to cater to the increasing demand for affordable and high-performance footwear in the region.

- In October 2024, Xiaomi, a leading technology company, launched its latest smart shoe, 'Mi Smart Shoes 2', in India, featuring advanced health monitoring and fitness tracking capabilities (Xiaomi Press Release). This strategic entry into the footwear market signifies the growing trend of wearable technology integration in everyday footwear.

- In February 2025, the Indian government announced the 'Make in India' footwear campaign, offering incentives to domestic and foreign investors to set up footwear manufacturing units in India (Indian Ministry of Commerce and Industry). This initiative aims to make India a global footwear manufacturing hub, providing significant opportunities for both local and international players in the APAC footwear market.

Research Analyst Overview

The market is characterized by its continuous evolution and dynamic nature, with various sectors and applications driving market growth. Footwear waterproofing technology, for instance, has gained significant traction among consumers seeking protection from the elements. Simultaneously, footwear breathability and performance have become essential considerations for consumers engaged in active lifestyles, leading to the popularity of sports footwear. Footwear consumer demographics also play a crucial role in shaping market trends. Casual footwear, for example, caters to the growing demand from younger generations, while formal footwear remains a staple for professionals. E-commerce platforms have revolutionized footwear retailing and distribution, enabling consumers to access a wide range of options from the comfort of their homes.

Footwear sizing and ergonomics have emerged as critical factors influencing consumer behavior. Brands are investing in research and development to create footwear that fits comfortably and caters to individual preferences. Sole technology and footwear materials have also advanced significantly, with synthetic materials gaining popularity for their durability and sustainability. Footwear manufacturing processes have undergone significant changes, with a focus on automation and efficiency. Footwear brands are increasingly adopting digital marketing strategies to reach consumers, with advertising efforts targeting specific demographics and preferences. The footwear competitive landscape is highly dynamic, with new players entering the market regularly. Footwear regulations and safety standards continue to evolve, ensuring that consumers are protected.

The footwear market segmentation is diverse, with various categories catering to different consumer needs and preferences. In conclusion, the market is a dynamic and evolving landscape, with various sectors and applications shaping its growth. From footwear waterproofing and consumer demographics to e-commerce and manufacturing processes, the footwear industry is constantly adapting to meet the changing needs and preferences of consumers.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Footwear Market in APAC insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

120 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7% |

|

Market growth 2024-2028 |

USD 45.8 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.5 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements Get in touch