Flexographic Printing Machine Market Size 2024-2028

The flexographic printing machine market size is forecast to increase by USD 591.49 million at a CAGR of 6.33% between 2023 and 2028.

- The market is experiencing significant growth, driven by high demand volumes from the packaging industry. This sector's expansion is fueled by the increasing preference for flexo-digital hybrid label printing solutions. This technology plays a significant role in the e-commerce and online shopping sectors, where efficient and cost-effective packaging solutions are essential.

- Cutting-edge technologies combine the advantages of flexographic and digital printing, delivering high-quality images with faster turnaround times. However, the market faces challenges, particularly the volatility of raw material prices for flexographic printing machines. Despite this obstacle, the market holds strong growth potential, driven by the packaging industry's sustained demand for flexographic printing and continuous advancements in hybrid printing solutions.

What will be the Flexographic Printing Machine Market Size During the Forecast Period?

- The market encompasses the production and sale of machinery used for creating self-adhesive labels, flexible packaging, and various other packaging materials such as bags, cartons, and labels. This technology employs print media like plastic bags, foil wrappings, and medical supplies, utilizing substrates in the food packaging sector. The machinery incorporates relief plates made of rubber or photo-polymer, operated by four rollers including an ink roller, meter roller, plate cylinder, and impression cylinder.

- In addition, an Anilox roller distributes ink evenly across the plate surface. The Flexographic printing process produces raised-relief image plates, resulting in high-quality prints. Skilled operators ensure the optimal functioning of these machines, ensuring the production of high-quality packaging materials.

How is this market segmented and which is the largest segment?

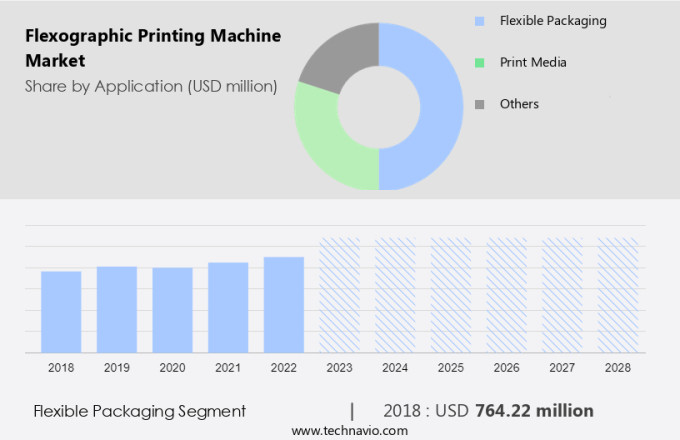

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Flexible packaging

- Print media

- Others

- Product

- Wide web

- Medium web

- Narrow web

- Geography

- Europe

- Germany

- France

- North America

- US

- APAC

- China

- Japan

- South America

- Middle East and Africa

- Europe

By Application Insights

- The flexible packaging segment is estimated to witness significant growth during the forecast period.

The market experiences significant growth in the packaging industry, primarily due to the increasing demand for flexible packaging in various sectors. Beverages and personal care items are major consumers of this type of packaging, as it offers superior barrier properties against moisture, oxygen, and light. Flexible packaging's ability to protect content from external factors is a key factor driving its popularity. Manufacturers and retailers benefit from its lightweight nature, which reduces transportation costs. Packaging printing companies leverage advanced flexographic printing technologies to produce high-quality, customized designs on these flexible packages, further enhancing their appeal.

Get a glance at the market report of share of various segments Request Free Sample

The flexible packaging segment was valued at USD 764.22 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

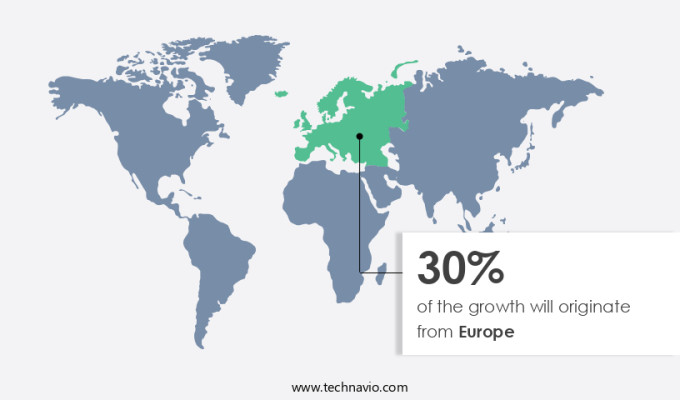

- Europe is estimated to contribute 30% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market in Europe, particularly Western Europe, has attained maturity due to the widespread use of smartphones and digital devices for e-reading. This region's shift from print to eBooks is evident in the increasing adoption of electronic devices for reading in countries like Germany and France. In the educational sector, the European Union (EU) has made significant strides in digitalizing education through initiatives like the Digital Agenda, which is one of the seven pillars of the Europe 2020 Strategy. Regarding the flexographic printing industry, this technology employs various components such as ink rollers, meter rollers, plate cylinders, and impression cylinders.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Flexographic Printing Machine Market?

High demand volumes from packaging industry is the key driver of the market.

- In the realm of packaging, the demand for flexible packaging solutions has escalated, driven by the burgeoning consumer goods industry and technological innovations like AptarGroup's VersaPouch closure. This closure boasts a flip-cap, a built-in pull ring, and an anti-spill SimpliSqueeze valve. The expansion of the global packaging industry has catalyzed the growth of the market. The food and beverage sector, as the largest end-user, plays a pivotal role in market expansion due to the escalating demand for packaged foods, beverages, and frozen items. Flexographic printing machines are indispensable in flexible packaging plants, enabling the production of print labels on various packaging materials.

- In addition, quick-drying inks ensure efficient printing processes, while skilled operators manage the printing of individualized text, QR codes, and serialized labels. Flexible packaging materials, such as recyclable high-barrier laminates, are essential for various industries, including wine, corrugated cardboard, and the logistics industry. The printing process for these materials is carried out using flexographic printers, which offer shorter print runs and on-demand printing capabilities.

What are the market trends shaping the Flexographic Printing Machine Market?

Increasing demand for flexo-digital hybrid label printing solutions is the upcoming trend in the market.

- In the realm of packaging solutions, flexographic printing holds a significant position, particularly in the production of labels and flexible packaging. This printing process is renowned for its compatibility with various materials, including recyclable high-barrier laminates, and its ability to print on a wide range of substrates such as corrugated cardboard and laminators. Flexographic printing is a preferred choice for industries like logistics, pharmaceuticals, and wine, where quick-drying inks and the ability to print individualized text, QR codes, and serialized labels are essential. In the age of online shopping, this printing method ensures shipping-friendly designs and enhances unboxing experiences.

- In addition, flexographic printers offer shorter print runs and on-demand printing, making them an attractive option for price-sensitive brands dealing with various SKUs, seasonal promotions, or limited edition products. Flexographic printing also caters to industrial-scale applications, such as those in the production of grains, cement, and industrial goods. The use of flexographic printing technology in labeling and packaging design allows for the integration of branding elements, ensuring a cohesive and professional appearance for printed products.

What challenges does Flexographic Printing Machine Market face during the growth?

Fluctuation in raw material prices for flexographic printing machines is a key challenge affecting the market growth.

- In the realm of flexible packaging and labeling, the demand for quick-drying inks in the flexographic printing process continues to surge. This printing method is extensively utilized in various industries, including the logistics sector for print labels on corrugated cardboard, the wine industry for printed bottles, and the labeling of recyclable high-barrier laminates in the packaging material market. Skilled operators manage the printing process, ensuring variable data printing for individualized text, QR codes, and serialized labels. Flexographic printing machines are indispensable in creating packaging designs for a multitude of materials, from paper and plastics to industrial-scale applications such as large-scale packaging materials for grains, cement, and other industrial goods.

- In addition, the printing process allows for shorter print runs and on-demand printing, catering to price-sensitive brands. Bobst, a leading manufacturer of equipment for packaging materials, plays a significant role in the production of these printing machines. The technology enables the creation of shipping-friendly designs, enhancing unboxing experiences and contributing to the overall branding elements of the packaged products.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Barry Wehmiller Group Inc.

- BFM Srl

- Bobst Group SA

- Comexi Group Industries SAU

- Edale Ltd.

- Heidelberger Druckmaschinen AG

- Koenig and Bauer AG

- LohiaGroup

- Mark Andy Inc.

- MPS Systems BV

- Nilpeter

- OMET Srl

- OMSO SpA

- ORIENT SOGYO Co. Ltd.

- Rotatek

- Star Flex International

- Taiyang Machinery Co. Ltd.

- Uteco Converting SpA

- Windmoller and Holscher KG

- Wolverine Flexographic LLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Flexographic printing machines have gained significant traction in the printing industry due to their versatility and ability to print on various substrates. The market for these machines is driven by the increasing demand for flexible packaging and labels. The printing technology offers several advantages such as high print quality, fast production speeds, and cost-effectiveness. Flexible packaging and labels are widely used in various end-use industries including food and beverage, pharmaceuticals, and cosmetics. The growing consumer preference for convenient and portable packaging solutions is fueling the demand for these printing machines. Moreover, the ongoing trend towards sustainable packaging is also expected to boost the market growth.

Furthermore, the market for flexographic printing machines is segmented based on machine type, application, and end-use industry. The market is highly competitive with key players focusing on product innovation and expansion of their product portfolio to cater to the evolving market demands. The future outlook for the market is promising with several trends such as the increasing adoption of digital technologies and the growing demand for eco-friendly printing solutions. These trends are expected to provide new opportunities for market players and drive the growth of the flexographic printing machines market.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

168 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.33% |

|

Market growth 2024-2028 |

USD 591.49 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.15 |

|

Key countries |

US, China, Japan, Germany, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch