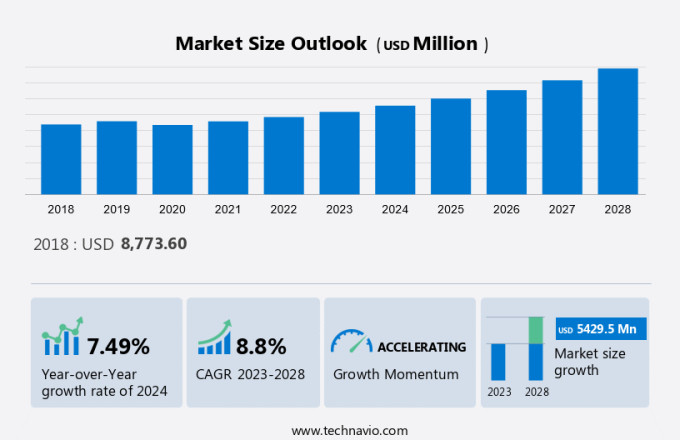

Flavored Cigar Market Size 2024-2028

The Flavored Cigar Market size is estimated to grow by USD 5.43 billion at a CAGR of 8.8% between 2023 and 2028. The flavored cigar market is experiencing significant growth, driven by the high appeal of these products among young adults. Customization and discounted prices are also key growth factors, making flavored cigars an attractive option for consumers seeking unique experiences. However, convincing veteran cigar consumers to switch to flavored cigars remains a challenge for market players. The trend toward personalized smoking experiences is expected to continue, with an increasing number of consumers looking for innovative and exotic flavors. Additionally, affordability appeals to price-conservative consumers who still desire the flavors and aromas associated with flavored cigarettes. Despite these opportunities, regulatory challenges and increasing health concerns may pose threats to market growth. Overall, the flavored cigar market is expected for continued expansion, driven by consumer preferences, innovation, and marketing strategies.

Market Overview

To get additional information about the market, Request Free Sample

Market Dynamics

The market is witnessing significant growth due to the increasing preference among young adults for unique and innovative smoking experiences. With hectic work schedules, people seek relaxation and enjoyment, making flavored cigars a popular choice. Infused flavors such as chocolate, strawberry, fruit, spices, herbs, coffee, and vanilla add to the appeal. These cigars are used for gifting purposes and as status symbols. However, high taxation policies and healthy lifestyle trends pose challenges to the market. Hand-rolled and machine-made cigars offer different experiences, with hand-rolled providing a more authentic smoking experience. Customization options allow cigar connoisseurs to mix and match flavors for social occasions. The fusion of flavors provides innovative sensory experiences, with limited edition flavors adding exclusivity. Despite bad breath being a concern, the market continues to grow, with cigar manufacturers constantly exploring new ways to enhance the smoking experience.

Key Market Driver

One of the key factors driving the market growth is the rising demand for limited-edition flavored cigars. There is an increasing launch of limited edition flavored cigars by several market players in order to cater to a broad range of customers. These limited-edition flavored cigarettes enable market players to promote new offerings and thereby enhance their existing product line. The main purpose of purchasing these cigars by consumers is for gifting.

For example, Gurkha Cigars sells limited-edition flavored cigars like GURKHA JUBILEE (which has oak, cocoa, coffee, and nutty flavors), GURKHA AVENGER G5 (with flavors of sweet spice, oak, and molasses), GURKHA THE BEAST (with flavors of tobacco, sweet spice, and earthy undertones), and GURKHA THE BEAUTY (with a flavor profile of chestnut, vanilla, and caramel). Hence, the launch of such products is positively impacting the market which in turn will drive the market growth during the forecast period.

Significant Market Trends

A key factor shaping the market growth is the growing demand for a fusion of flavors in flavored cigars. Several players in the market are increasingly developing and launching a fusion of flavors in flavored cigars to attract consumers. For example, Tatiana Classic Fusion Frenzy is an aroma-infused cigar seasoned with Madagascar vanilla, rich essences of cognac, passion fruit, and sweet natural fruit flavors.

Moreover, the prominent market player Dutch Masters launched the Gotham Cigars Dutch a flavor fusion cigarillo, which features flavor fusion combinations of berry, mint, and java. As a result, there is an increase in preference among consumers for flavored cigarettes. Hence, the launch of such products is positively impacting the market which in turn will drive the market trends during the forecast period.

Major Market Challenge

Strict anti-smoking campaigns are one of the key challenges hindering the market growth. There is an increasing number of public awareness programs and campaigns running across the world that are encouraging consumers to stop smoking. For example, the WHO recognizes 31st May as the World No Tobacco Day.

As a result, such initiatives generate awareness regarding the health risks associated with smoking thereby introducing effective policies to reduce tobacco consumption. Moreover, another significant stop-smoking campaign is Tobacco-Free Kids which encourages consumers to reduce tobacco use and its deadly toll in the US and around the world. Hence, such kinds of awareness programs are negatively impacting the market. Therefore, it is expected to hinder the market growth during the forecast period.

Market Segmentation

By Type

The machine-made segment is estimated to witness significant growth during the forecast period. This segment is mainly manufactured using scraps of homogenized tobacco and is manufactured in large amounts. There is an increasing preference for this segment among young adults as they are usually less expensive than hand-rolled cigars. Some of the prominent companies that offer machine-made flavored cigarette include brands like BACKWOODS (Imperial Tobacco Group), and Swisher International.

For a detailed summary of the market segments Request for Sample Report

The machine-made segment was the largest segment and was valued at USD 5.45 billion in 2018. One of the main factors that is fuelling the shift of young adults toward relatively cheap cigars with various flavors is the increasing prices of cigarettes. The manufacturing process is designed in such a way that it enables consistent production and faster output compared to handmade cigarettes. There is a growing popularity for machine-made flavored cigars due to their affordability. Another significant factor that fuels the growth of this segment is its convenience as these cigars are often sold in packs or boxes, making it easier for consumers to purchase and enjoy them as well as they are readily available in convenience stores, gas stations, and online retailers. Hence, such factors are expected to fuel the growth of this segment which in turn will drive the market growth during the forecast period.

Key Regions

Get a glance at the market share of various regions View PDF Sample

North America is estimated to contribute 51% to the growth of the global market during the forecast period. Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. Some of the main factors that are significantly contributing to the growth of the market in North America are the high popularity of disposable products, their increased availability in retail stores and through online channels, and rapidly growing demand from the young population base.

Moreover, there is an increasing consumption of flavored cigarettes across the US. One of the major factors for the growth of flavored cigarettes in the US is the increasing preference of young adults. The main advantage of flavored cigars is that they are affordable and do not impart bad breath. Due to the rising trend of flavored cigars, several market players are launching new flavor fusions to attract consumers. Hence, such factors are expected to drive the market growth in the region during the forecast period.

Key Market Companies Overview

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

- Key Offering- Arnold Andre GmbH and Co. KG: The company offers flavored cigars such as clubmaster, carlos andre, chazz, and Toscano.

The market growth analysis report also includes detailed analyses of the competitive landscape of the market and information about 20 market companies, including:

- C. Fuente Holdings Inc.

- DANNEMANN EL NOBLE CIGARRO GmbH

- Godfrey Phillips India Ltd.

- Imperial Brands Plc

- ITC Ltd.

- J. Cortes Cigars NV

- Japan Tobacco Inc.

- North Carolina Tobacco Manufacturing LLC

- Oettinger Davidoff AG

- Paladin Cigars

- Rocky Patel Premium Cigars LLC

- Scandinavian Tobacco Group AS

- Senenca Manufacturing Co.

- Snyman Tobacco Pty Ltd.

- Swedish Match AB

- Swisher International Inc.

- Tatiana Cigars

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Customer Landscape

The market research and growth report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market growth and forecasting report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their growth strategies.

Customer Landscape

Segment Overview

The market research report provides comprehensive data (region wise segment analysis), with forecasts and estimates in "USD Billion" for the period 2024 to 2028, as well as historical data from 2018 to 2022 for the following segments

- Type Outlook

- Machine-made

- Hand-rolled

- Flavor Outlook

- Fruit-flavored cigar

- Alcohol and non-alcohol-flavored cigar

- Others

- Geography Outlook

- North America

- The U.S.

- Canada

- Europe

- The U.K.

- Germany

- France

- Rest of Europe

- APAC

- China

- India

- South America

- Chile

- Argentina

- Brazil

- Middle East & Africa

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

- North America

Market Analyst Overview

The market is growing with innovations in taste combinations, such as menthol, cherry, and grape, appealing to younger audiences and health-conscious consumers. Premiumization drives interest in high-quality cigars and unique flavor profiles, incorporating botanical extracts and natural ingredients. Packaging designs reflect the status symbol associated with cigars, herbs, while regulatory changes and sociocultural views impact consumption trends. The market caters to both business and household consumption, blending conventional tobacco flavors with flavor profile innovation. Discounted prices and the infusion of tobacco leaves, hookah tobacco further enhance appeal in the lounge culture. Further, amidst a hectic work schedule, the female smoking population is increasingly exploring natural and organic smoking alternatives, such as Cuban cigars and Habanos, which infusing tobacco leaves with mixing flavors tailored to business consumption preferences.

|

Industry Scope |

|

|

Report Coverage |

Details |

|

Page number |

165 |

|

Base year |

2023 |

|

Historic period |

2018 - 2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.8% |

|

Market growth 2024-2028 |

USD 5.43 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.49 |

|

Regional analysis |

North America, Europe, APAC, Middle East and Africa, and South America |

|

Performing market contribution |

North America at 51% |

|

Key countries |

US, UK, Germany, Malaysia, and Belgium |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Arnold Andre GmbH and Co. KG, C. Fuente Holdings Inc., DANNEMANN EL NOBLE CIGARRO GmbH, Firmin cigars, Godfrey Phillips India Ltd., Gurkha Cigar Group, Imperial Brands Plc, ITC Ltd., J. Cortes Cigars NV, Japan Tobacco Inc., North Carolina Tobacco Manufacturing LLC, Oettinger Davidoff AG, Paladin Cigars, Rocky Patel Premium Cigars LLC, Scandinavian Tobacco Group AS, Senenca Manufacturing Co., Snyman Tobacco Pty Ltd., Swedish Match AB, Swisher International Inc., and Tatiana Cigars |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, Market growth and Forecasting, COVID 19 impact and recovery analysis and future consumer dynamics, Market condition analysis for market forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

BUY NOW Full Report and Discover more

What are the Key Data Covered in this Market Forecasting Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the growth of the market between 2023 and 2027

- Precise estimation of the market size and its contribution to the market in focus on the parent market

- Accurate predictions about upcoming trends and changes in consumer behavior

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- A thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch