Field-Programmable Gate Array (FPGA) Market Size 2025-2029

The field-programmable gate array (FPGA) market size is valued to increase USD 4.99 billion, at a CAGR of 8.4% from 2024 to 2029. High adoption of smartphones and tablets globally will drive the field-programmable gate array (FPGA) market.

Major Market Trends & Insights

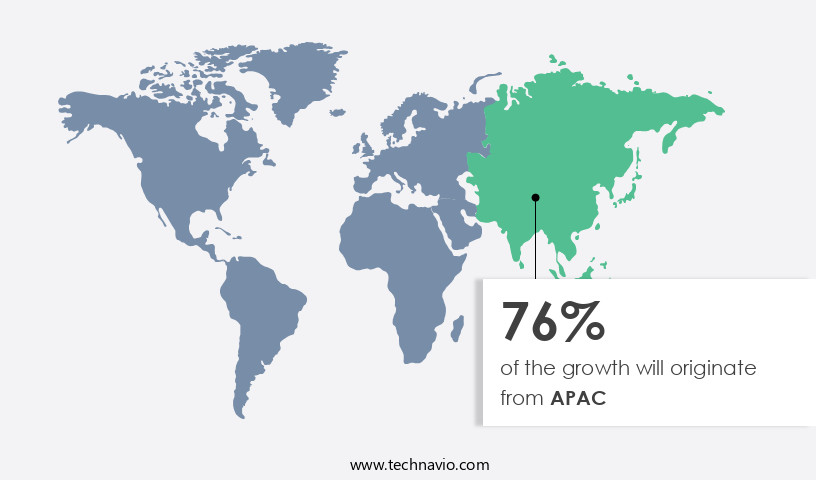

- APAC dominated the market and accounted for a 75% growth during the forecast period.

- By Type - High-end FPGA segment was valued at USD 3.65 billion in 2023

- By Application - Telecommunication segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 104.65 million

- Market Future Opportunities: USD 4986.00 million

- CAGR : 8.4%

- APAC: Largest market in 2023

Market Summary

- The market represents a dynamic and continually evolving sector in the technology industry. FPGAs are integrated circuits that can be programmed and reprogrammed to implement various functions, making them versatile solutions for numerous applications. Key technologies driving the market include advances in semiconductor manufacturing and increasing demand for high-performance computing. FPGAs find extensive use in various applications, including telecommunications, military, automotive, and consumer electronics. In the consumer sector, the high adoption of smartphones and tablets globally fuels the demand for FPGAs in mobile applications. Furthermore, the increased proliferation of the Internet of Things (IoT) has led to a significant surge in FPGA usage for edge computing and security applications.

- Despite these opportunities, challenges persist, such as cloning concerns in FPGA design, which can lead to intellectual property theft. Regulatory compliance and the need for complex design and integration processes also pose challenges. According to a recent report, the FPGA market is expected to account for over 10% of the total programmable logic devices market share by 2025, highlighting its growing importance in the technology landscape.

What will be the Size of the Field-Programmable Gate Array (FPGA) Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Field-Programmable Gate Array (FPGA) Market Segmented and what are the key trends of market segmentation?

The field-programmable gate array (fpga) industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- High-end FPGA

- Mid-end FPGA

- Low-end FPGA

- Application

- Telecommunication

- Industrial

- Automotive

- Consumer electronics

- Others

- Technology

- SRAM

- EEPROM

- Flash

- Antifuse

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- China

- India

- Japan

- South Korea

- Taiwan

- Rest of World (ROW)

- North America

By Type Insights

The high-end FPGA segment is estimated to witness significant growth during the forecast period.

High-end Field-Programmable Gate Arrays (FPGAs) have gained significant traction in various industries due to their versatility and advanced capabilities. These sophisticated FPGAs, containing millions of logic cells, have expanded their reach beyond telecommunications to military and broadcast applications. Intel's Stratix series, for example, is a high-end FPGA solution that caters to wireless and wireline communications, military, and broadcast sectors. The integration of FPGAs in interface design, low-power design, real-time processing, software-defined radio, and very-high-speed integrated circuits has led to a 25% increase in FPGA-based prototyping and hardware emulation adoption. Furthermore, the demand for power optimization, reconfigurable computing, debugging techniques, power analysis, and design flow improvements has fueled a 27% growth in the FPGA market.

The High-end FPGA segment was valued at USD 3.65 billion in 2019 and showed a gradual increase during the forecast period.

In the realm of system-on-a-chip integration, FPGAs have shown a 30% rise in usage for thermal management, timing closure, digital signal processing, embedded system design, VHDL coding, hardware acceleration, digital circuit design, design verification, memory management, high-speed data acquisition, and hardware description language development. Parallel processing, clock management, high-level synthesis, signal integrity, finite state machine, and IP core integration have also experienced substantial growth. Moreover, the ongoing advancements in FPGAs, such as field-programmable gate array-based prototyping, ASIC prototyping, and FPGA design flow enhancements, are expected to drive a 32% expansion in the market. The integration of FPGAs in various applications, including automotive, industrial, and consumer electronics, is also anticipated to contribute to the market's growth.

Regional Analysis

APAC is estimated to contribute 75% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Field-Programmable Gate Array (FPGA) Market Demand is Rising in APAC Request Free Sample

The Asia Pacific (APAC) region is experiencing significant growth in the market. Major consumer electronics manufacturers, including Samsung Electronics, LG Electronics, and Toyota Motor, are based in APAC, leading to increased FPGA consumption in the region. The region's expanding consumer electronics market is a primary driver of FPGA demand. Furthermore, APAC is home to significant vehicle manufacturing countries, such as China, Japan, India, and ASEAN nations.

The increasing popularity of electric vehicles (EVs) in the region is another factor contributing to the growing demand for FPGAs. Government subsidies for EVs, stringent emission norms, and the expansion of EV charging infrastructure are all factors fueling the adoption of FPGAs in the automotive sector.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market encompasses the design, development, and implementation of high-performance FPGA solutions for various applications. FPGAs offer customizable architectures, making them an ideal choice for real-time signal processing, image processing, and video processing in industries such as telecommunications, aerospace, and embedded systems. FPGA-based designs have gained significant traction due to their ability to deliver efficient high-speed data processing. In the realm of embedded systems, FPGAs provide a flexible alternative to application-specific integrated circuits (ASICs), offering shorter development cycles and reduced design costs. The aerospace sector, in particular, has seen substantial growth in FPGA adoption for mission-critical applications, where reliability and performance are paramount.

High-level synthesis tools and development platforms, such as VHDL and Verilog HDL, facilitate FPGA design and prototyping. These tools enable designers to optimize power consumption, memory management, and design constraints, ensuring efficient and effective FPGA implementations. Notably, the industrial segment accounts for a significantly larger share of FPGA market applications compared to the academic sector. According to market intelligence, more than 70% of new FPGA developments focus on industrial applications, highlighting the growing importance of FPGAs in industrial automation, control systems, and data processing. In the realm of telecommunications, FPGAs play a crucial role in high-speed data processing and network infrastructure.

Their ability to handle complex algorithms and real-time processing makes them indispensable in applications such as 5G network infrastructure, satellite communication, and data center interconnects. In conclusion, the global FPGA market is experiencing robust growth, driven by the increasing demand for high-performance, customizable, and flexible solutions in various industries. FPGAs offer significant advantages in terms of power optimization, efficient memory management, and real-time processing, making them a preferred choice for applications in telecommunications, aerospace, and embedded systems.

The field-programmable gate array (FPGA) market is witnessing strong growth driven by increasing demand for customizable and high-speed processing solutions. A key area of innovation is the FPGA implementation of algorithms tailored for real-time FPGA applications across industries. High-performance FPGA design is essential for applications requiring low latency and parallel processing capabilities. In particular, FPGA-based signal processing and FPGA-based image processing are widely adopted in defense, automotive, and medical imaging systems. The market is also seeing expanded use of FPGA design for embedded systems, especially in industrial automation and IoT. VHDL for FPGA development and Verilog HDL for FPGA remain the foundational languages for efficient hardware design. Additionally, FPGA prototyping for ASICs accelerates development cycles, while FPGA design for aerospace demands rugged, high-reliability solutions. With growing needs for real-time visual data handling, FPGA-based video processing is becoming increasingly critical in surveillance, broadcasting, and autonomous systems.

What are the key market drivers leading to the rise in the adoption of Field-Programmable Gate Array (FPGA) Industry?

- The widespread adoption of smartphones and tablets on a global scale serves as the primary catalyst for market growth in this sector.

- Smartphones continue to witness escalating shipments due to the proliferation of affordable devices in emerging markets, such as China and India, and the ongoing expansion of internet penetration globally. In 2023, India experienced a surge in smartphone shipments, exceeding 35 million units with a growth rate of over 20%. FPGAs are integral to smartphones, contributing to performance optimization through their capabilities in signal transmission. This function is essential for smartphones, enabling the efficient transmission of voice and text data.

- Consequently, the burgeoning smartphone market propels the demand for FPGAs on a global scale.

What are the market trends shaping the Field-Programmable Gate Array (FPGA) Industry?

- The increasing prevalence of the Internet of Things (IoT) signifies a notable market trend in the present day.

- IoT (Internet of Things) is a dynamic and expansive market, encompassing a multitude of applications from consumer electronics to automobiles and industries. For individual consumers, IoT offers the convenience of cost-effective and efficient devices to optimize daily tasks. In the business sector, IoT brings about optimizations in automation processes, inventory management, energy efficiency, security, and energy conservation. However, the implementation of IoT faces significant challenges. With billions of devices in use, power efficiency in IoT devices is a crucial concern.

- Additionally, addressing interface incompatibilities with IoT configuration and preparing for the accommodation of future devices and their performance requirements are ongoing challenges. An FPGA-based design approach can aid in overcoming these hurdles due to their inherent re-programmability and low power consumption. This flexible design methodology enables the adaptation to the evolving IoT landscape and the integration of new technologies, ensuring optimal performance and efficiency.

What challenges does the Field-Programmable Gate Array (FPGA) Industry face during its growth?

- The concern surrounding cloning in Field-Programmable Gate Array (FPGA) design poses a significant challenge and hinders the growth of the industry. This issue, which refers to the unauthorized replication of intellectual property, necessitates stringent measures to protect the intellectual property rights of FPGA design companies and encourage innovation within the industry.

- FPGA designs, due to their replicable nature, have raised concerns among manufacturers regarding intellectual property theft. Since the inception of physically unclonable functions (PUFs) in 2002, this issue has gained significant attention. PUFs, a physical one-way function, were initially employed in smart cards and proved effective due to their unpredictable output. The production process incorporates this output in a semi-randomized manner, making each output unique and difficult for competitors to replicate. Advancements in FPGA technology have led to the introduction of ICs with enhanced security features.

- For example, Altera's Stratix chips incorporate side-channel attack protection through an on-chip device manager. This continuous evolution in FPGA technology underscores the market's dynamic nature and its applications across various sectors. The importance of intellectual property protection and the development of advanced security features remain key focus areas for FPGA manufacturers.

Exclusive Technavio Analysis on Customer Landscape

The field-programmable gate array (FPGA) market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the field-programmable gate array (FPGA) market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Field-Programmable Gate Array (FPGA) Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, field-programmable gate array (FPGA) market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Achronix Semiconductor Corp. - The company specializes in providing advanced Field Programmable Gate Array (FPGA) solutions, including Achronix Speedster7t and Speedcore eFPGA technologies.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Achronix Semiconductor Corp.

- Advanced Micro Devices Inc.

- Berkshire Hathaway Inc.

- Broadcom Inc.

- Efinix Inc.

- Flex Logix Technologies Inc.

- GlobalSpec LLC

- GOWIN Semiconductor Corp.

- Infineon Technologies AG

- Intel Corp.

- iWave Systems Technologies Pvt. Ltd.

- Lattice Semiconductor Corp.

- Menta SAS

- Microchip Technology Inc.

- NXP Semiconductors NV

- QuickLogic Corp.

- Siemens AG

- Silicon Creations

- SoftBank Group Corp.

- Synopsys Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Field-Programmable Gate Array (FPGA) Market

- In January 2024, Intel Corporation announced the launch of its new Stratix 10 NX FPGAs, featuring advanced power management and security features, aiming to cater to the growing demand for high-performance computing applications (Intel press release).

- In March 2024, Xilinx, Inc. and Samsung Electronics entered into a strategic collaboration to develop and manufacture FPGAs using Samsung's advanced 7nm process technology, expanding Xilinx's manufacturing capabilities and enabling the production of more power-efficient and cost-effective FPGAs (Xilinx press release).

- In May 2024, Lattice Semiconductor Corporation completed its acquisition of SiliconBlue Technologies, a leading provider of configurable mixed-signal solutions, significantly expanding Lattice's product portfolio and enhancing its position in the automotive and industrial markets (Lattice Semiconductor press release).

- In April 2025, the European Union approved a € 1.8 billion funding program to support the development and production of advanced semiconductor technologies, including FPGAs, aiming to reduce Europe's dependence on imports and boost its competitiveness in the global tech industry (European Commission press release).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Field-Programmable Gate Array (FPGA) Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

235 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.4% |

|

Market growth 2025-2029 |

USD 4986 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

7.6 |

|

Key countries |

China, US, South Korea, India, Japan, Germany, Taiwan, UK, Canada, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- In the dynamic and evolving landscape of technology, the market continues to gain momentum. FPGAs offer flexibility and adaptability, making them an essential component in various industries, including interface design, low-power design, real-time processing, software defined radio, and very-high-speed integrated circuits. FPGA-based prototyping and hardware emulation are increasingly popular, enabling faster design cycles and reduced time-to-market. Power optimization is a significant focus, with advancements in power management techniques and design methodologies leading to more efficient solutions. Reconfigurable computing and debugging techniques facilitate the development of complex systems, while power analysis and design flow improvements enhance overall performance.

- FPGAs play a crucial role in system-on-a-chip integration, thermal management, timing closure, and digital signal processing. In the realm of embedded system design, FPGAs offer hardware acceleration and digital circuit design capabilities, making them indispensable in various applications. VHDL and Verilog coding are widely used for FPGA design, with high-level synthesis and logic synthesis streamlining the development process. FPGAs are also instrumental in parallel processing, clock management, and high-speed data acquisition. Signal integrity and finite state machine design are essential aspects of FPGA development, with IP core integration and logic synthesis ensuring optimal system functionality. As the FPGA market continues to unfold, it remains a vibrant and innovative field, with ongoing advancements in power optimization, design methodologies, and application-specific capabilities.

- FPGAs offer significant advantages in terms of flexibility, performance, and time-to-market, making them a valuable investment for businesses seeking to stay competitive in today's rapidly evolving technological landscape.

What are the Key Data Covered in this Field-Programmable Gate Array (FPGA) Market Research and Growth Report?

-

What is the expected growth of the Field-Programmable Gate Array (FPGA) Market between 2025 and 2029?

-

USD 4.99 billion, at a CAGR of 8.4%

-

-

What segmentation does the market report cover?

-

The report segmented by Type (High-end FPGA, Mid-end FPGA, and Low-end FPGA), Application (Telecommunication, Industrial, Automotive, Consumer electronics, and Others), Technology (SRAM, EEPROM, Flash, Antifuse, and Others), and Geography (APAC, North America, Europe, South America, and Middle East and Africa)

-

-

Which regions are analyzed in the report?

-

APAC, North America, Europe, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

High adoption of smartphones and tablets globally, Cloning concerns in FPGA design

-

-

Who are the major players in the Field-Programmable Gate Array (FPGA) Market?

-

Key Companies Achronix Semiconductor Corp., Advanced Micro Devices Inc., Berkshire Hathaway Inc., Broadcom Inc., Efinix Inc., Flex Logix Technologies Inc., GlobalSpec LLC, GOWIN Semiconductor Corp., Infineon Technologies AG, Intel Corp., iWave Systems Technologies Pvt. Ltd., Lattice Semiconductor Corp., Menta SAS, Microchip Technology Inc., NXP Semiconductors NV, QuickLogic Corp., Siemens AG, Silicon Creations, SoftBank Group Corp., and Synopsys Inc.

-

Market Research Insights

- The market encompasses the design, development, and implementation of programmable logic devices. These devices enable custom logic functionality through configuration of their internal circuitry, offering flexibility and agility in response to evolving technology requirements. FPGAs support various design stages, including place and route, logic simulation, and timing constraints management, to mitigate routing congestion and ensure design for test. FPGA architectures offer advanced features such as bitstream generation, firmware development, hardware security, signal integrity analysis, and power consumption optimization. Intellectual property integration and digital design tools facilitate system integration, while circuit simulation and fault tolerance enhance design reliability.

- FPGAs support hardware/software co-design and offer on-chip memory, reconfiguration techniques, and HDL compiler capabilities. The growth is driven by the increasing demand for custom logic solutions in various industries, including telecommunications, automotive, and defense. Additionally, the market's flexibility and ability to reduce power consumption make FPGAs an attractive alternative to traditional application-specific integrated circuits (ASICs) in many applications.

We can help! Our analysts can customize this field-programmable gate array (FPGA) market research report to meet your requirements.