What is the Executive Search Services Market Size?

The executive search services market size is forecast to increase by USD 23.39 billion, at a CAGR of 10% between 2024 and 2029. The market is experiencing significant growth due to several key factors. One trend driving market expansion is the increasing prevalence of cross-border recruitment, as companies seek to find top talent in a globalized business landscape. Another growth factor is the rise in strategic collaborations among executive search firms, enabling them to expand their reach and offer more comprehensive services to clients. However, the market also faces challenges, such as data security and privacy concerns, as executive search firms handle sensitive information during the recruitment process. By closely monitoring these trends and addressing the challenges, market participants can position themselves for success in the dynamic executive search services industry.

What will be the size of the Market during the forecast period?

Request Free Executive Search Services Market Sample

Market Segmentation

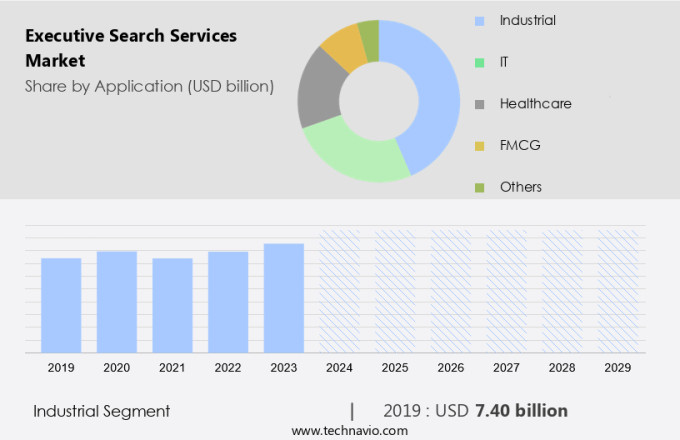

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019 - 2023 for the following segments.

- Application

- Industrial

- IT

- Healthcare

- FMCG

- Others

- End-user

- Large enterprises

- SMEs

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- Italy

- APAC

- China

- India

- Japan

- South Korea

- Middle East and Africa

- South America

- North America

Which is the largest segment driving market growth?

The industrial segment is estimated to witness significant growth during the forecast period. Executive search services play a crucial role in identifying and recruiting specialized leaders for industrial companies. With the industrial sector undergoing technological transformations, such as Industry 4.0 initiatives, there is an increasing demand for executives with expertise in automation, AI, and digital technologies. These leaders are essential for navigating the complexities of industrial operations and ensuring compliance with industry regulations.

Get a glance at the market share of various regions. Download the PDF Sample

The industrial segment was valued at USD 7.40 billion in 2019. Additionally, as many industrial companies operate on a global scale, executives with experience in managing diverse teams, understanding international markets, and addressing regulatory variations are highly sought after. Executive search firms that possess a deep understanding of both industry operations and cutting-edge technologies are well-positioned to meet this demand.

Which region is leading the market?

For more insights on the market share of various regions, Request Free Sample

North America is estimated to contribute 35% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. In North America, economic growth and industry diversification have fueled a significant demand for experienced and skilled executives. With the rapid advancement of technology, there is a particular need for leaders proficient in digital transformation, cybersecurity, and data analytics. Executive search services are essential in identifying and recruiting individuals with the necessary expertise for senior management positions. The technology, healthcare, IT, and telecom industries, in particular, require specialized knowledge and understanding of their unique requirements. Executive search firms play a crucial role in connecting organizations with qualified candidates to drive growth and success in the digital age.

How do company ranking index and market positioning come to your aid?

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

AIMS International - The company offers executive search services with efficient practice teams and seamless cross border cooperation to serve international clients and source talent.

Technavio provides the ranking index for the top 19 companies along with insights on the market positioning of:

- Amrop Partnership SC

- Cornerstone International Group

- DHR Group

- Egon Zehnder International Ltd.

- Hays Plc

- Heidrick and Struggles International Inc.

- I.I.C. Partners Ltd.

- Korn Ferry

- KPMG International Ltd.

- ManpowerGroup Inc.

- Morgan Philips Group

- N2Growth Inc.

- Nash Squared

- NGS Global LLC

- Odgers Berndtson

- Randstad NV

- Russell Reynolds Associates Inc.

- Spencer Stuart Inc.

Explore our company rankings and market positioning. Request Free Sample

How can Technavio assist you in making critical decisions?

What is the market structure and year-over-year growth of the Market?

|

Market structure |

Fragmented |

|

YoY growth 2024-2025 |

9.1 |

Market Dynamics

Executive search services have become an indispensable solution for organizations seeking to attract and retain high-ranking executives and C-suite roles. Recruitment and talent acquisition have evolved beyond traditional methods, with a growing emphasis on leadership, succession planning, and culture fit. The demand for executive search services is driven by the increasing complexity of business environments and talent shortages in various industries, including industrial, healthcare, IT, FMCG, public sectors, and private sectors. Contingency firms and retainer firms have emerged as key players in this market, offering customized solutions to meet the unique needs of each client. The recruitment process for senior-level personnel involves a meticulous approach, with a focus on identifying candidates who possess the necessary skills, experience, and cultural fit. Cloud-based recruitment software has revolutionized the industry, streamlining the process and enabling real-time collaboration between recruiters and hiring managers. Succession planning is a critical aspect of executive search services, ensuring a smooth transition of leadership and minimizing disruption to business operations.

Further, the interview process is a crucial step in the recruitment journey, allowing organizations to assess candidates' competencies, motivations, and fit within the company culture. Recruitment start-ups have disrupted the market with innovative approaches and agile business models, offering cost-effective solutions to clients. The use of recruitment software has enabled these start-ups to provide a more personalized and efficient service, leveraging data analytics and artificial intelligence to identify top talent. In conclusion, the market is dynamic and evolving, with a growing focus on talent acquisition, leadership development, and culture fit. Organizations across industries are turning to executive search firms to address their talent needs and ensure the long-term success of their businesses. Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the primary factors driving the market growth?

The rise in cross-border executive recruitment is notably driving market growth. The market is experiencing substantial growth due to the globalization of businesses and the increasing need for high-ranking executives with international experience and expertise in various industries. C-suite roles, such as those in healthcare executives, industrial automation, IT, telecom, and senior management, require specialized recruitment services to identify and attract top talent. Talent shortages in niche markets have led organizations to turn to contingency and retainer firms for talent acquisition. Digital transformation is revolutionizing the recruitment process with digital tools, AI-powered algorithms, data analysis, and candidate sourcing. Specialized firms cater to the unique needs of industries, providing leadership development, succession planning, and organizational consulting.

The complexity of industries like healthcare, industrial, IT, and telecom necessitates the involvement of boutique firms to ensure cultural fit and navigate regulatory hurdles and compliance requirements. Investment levels in recruitment software and cloud-based solutions have increased, streamlining the recruitment process, including candidate screening, matching processes, and interview processes. Recruitment start-ups are also gaining popularity, offering flexible solutions for both the public and private sectors. The employment landscape is continuously evolving, and executive search services remain essential for securing senior-level personnel and ensuring the success of organizations. Thus, such factors are driving the growth of the market during the forecast period.

What are the significant trends being witnessed in the market?

An increase in the number of strategic collaborations in the market is an emerging trend shaping the market growth. Executive search services have witnessed notable collaborations between firms and various entities, including industry associations, educational institutions, and technology providers. These partnerships augment the capabilities of executive search firms, broaden their reach, and offer innovative solutions. In the competitive executive search market, talent acquisition for high-ranking executives, C-suite roles, and senior management remains a priority. With talent shortages prevalent in industries such as healthcare, industrial automation, IT, telecom, and the public and private sectors, the demand for specialized recruitment firms is increasing. These firms employ digital tools, AI-powered algorithms, and data analysis to enhance candidate sourcing, screening, and matching processes. Boutique firms and niche market specialists cater to specific industries, offering organizational consulting, leadership development, and succession planning services.

Digital transformation is also influencing the recruitment process, with cloud-based software and recruitment start-ups streamlining the employment process. Compliance requirements, regulatory hurdles, and investment levels vary between sectors, necessitating a customized approach for each client. Collaborations between executive search firms and technology providers, for example, can lead to the development of AI-powered recruitment software, enhancing the efficiency and effectiveness of the recruitment process. The employment landscape is continually evolving, and executive search services must adapt to meet the changing needs of clients and the market. Thus, such market trends will shape the growth of the market during the forecast period.

What are the major market challenges?

Data privacy concerns associated with executive search firms is a significant challenge hindering the market growth. Executive search services play a crucial role in identifying and recruiting high-ranking executives for C-suite roles and senior management positions in various industries, including healthcare, industrial automation, IT, telecom, and the public sector. Talent acquisition in these specialized markets can be challenging due to talent shortages and the need for candidates with specific skills and expertise. Contingency firms and retainer firms offer different approaches to executive search, with the former charging a fee only if a successful placement is made, and the latter charging a retainer fee for the entire search process. Both types of firms utilize digital tools, AI-powered algorithms, data analysis, and candidate sourcing to streamline the recruitment process. Digital transformation is driving innovation in executive search services, with the use of cloud-based software, recruitment process automation, and AI-powered matching processes becoming increasingly common. Leadership development, succession planning, and organizational consulting are also key areas of focus for specialized firms in niche markets. Data privacy and security are paramount in executive search services due to the sensitive nature of the information involved.

Compliance with regulations such as GDPR and investment in strong data protection measures are essential to maintain client trust and avoid reputational damage. In the market, the demand for executive search services is driven by the need for leadership in digital transformation, talent shortages, and regulatory compliance in industries such as healthcare, industrial, IT, telecom, and the public sector. Senior-level personnel in these industries require specialized recruitment solutions to address the unique challenges of their markets. Connectivity and regulatory hurdles can impact the recruitment process in various industries, requiring executive search firms to navigate complex employment laws and compliance requirements. Despite these challenges, the market for executive search services is expected to grow as organizations continue to prioritize leadership development, succession planning, and talent acquisition. Hence, the above factors will impede the growth of the market during the forecast period.

Exclusive Customer Landscape

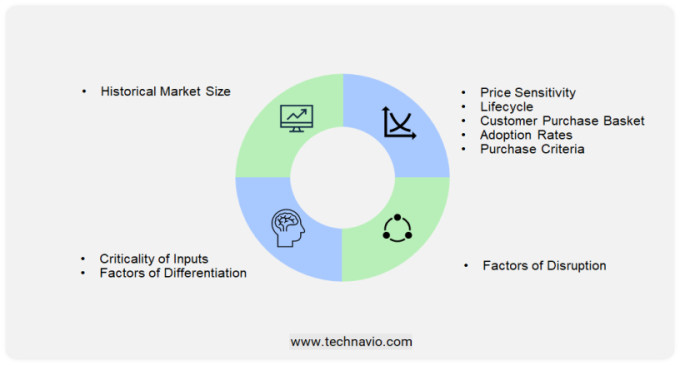

The market forecasting report includes the adoption lifecycle of the market research and growth, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Market Analyst Overview

Recruitment executive search services have emerged as an essential solution for organizations seeking to fill high-ranking positions, particularly those in the realm of C-suite roles. This market encompasses a diverse range of recruitment firms, each offering unique approaches and specialized expertise to address the intricacies of talent acquisition for senior management positions. The demand for executive search services stems from the increasing importance of leadership in driving business success. With talent shortages persisting across various industries, organizations are turning to these firms to identify and attract top talent. The recruitment process for C-suite roles often requires a deep understanding of industry trends, market dynamics, and organizational culture. Two primary categories of executive search firms exist: contingency firms and retainer firms. Contingency firms operate on a success-fee basis, only charging clients when they successfully fill a position. Retainer firms, on the other hand, are engaged on a long-term, ongoing basis, providing a more personalized and comprehensive service. Both models offer distinct advantages, with contingency firms providing cost-effectiveness and retainer firms delivering a more strategic and in-depth approach.

Digital transformation has significantly impacted the executive search industry. Digital tools, AI-powered algorithms, and data analysis have streamlined candidate sourcing, screening, and matching processes. These advancements enable firms to identify and engage top talent more efficiently, reducing the time-to-hire and ensuring a better cultural fit. Specialized firms cater to niche markets, such as healthcare executives, industrial automation, IT, telecom, and software. These firms possess deep industry expertise and a strong network, making them valuable partners for organizations seeking to fill critical roles in these sectors. Boutique firms and organizational consulting firms also play a significant role in the executive search market. Boutique firms offer a more personalized, hands-on approach, while organizational consulting firms focus on leadership development, succession planning, and talent management strategies. The executive search market is not without its challenges. Digital transformation, regulatory hurdles, and compliance requirements present significant investment levels for firms looking to stay competitive.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

212 |

|

Base year |

2024 |

|

Historic period |

2019 - 2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10% |

|

Market Growth 2025-2029 |

USD 23.39 billion |

|

Regional analysis |

North America, Europe, APAC, Middle East and Africa, and South America |

|

Performing market contribution |

North America at 35% |

|

Key countries |

US, China, Germany, Japan, UK, Canada, India, South Korea, France, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

AIMS International, Amrop Partnership SC, Cornerstone International Group, DHR Group, Egon Zehnder International Ltd., Hays Plc, Heidrick and Struggles International Inc., I.I.C. Partners Ltd., Korn Ferry, KPMG International Ltd., ManpowerGroup Inc., Morgan Philips Group, N2Growth Inc., Nash Squared, NGS Global LLC, Odgers Berndtson, Randstad NV, Russell Reynolds Associates Inc., and Spencer Stuart Inc. |

|

Market Segmentation |

Application (Industrial, IT, Healthcare, FMCG, and Others), End-user (Large enterprises and SMEs), and Geography (North America, Europe, APAC, Middle East and Africa, and South America) |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the market forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behavior

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies