US EPS Market Size 2024-2028

The US EPS market size is forecast to increase by USD 587.88 million, at a CAGR of 4.46% between 2023 and 2028.

- The market is witnessing significant growth due to several key factors. The increasing trend towards e-commerce sales and the subsequent rise in demand for efficient and lightweight packaging solutions are driving the market. Moreover, the growing preference for sustainable and eco-friendly packaging options, such as bioplastics, is also fueling market growth. These trends are expected to continue, as consumers increasingly demand convenient, sustainable, and cost-effective packaging solutions. Additionally, advancements in technology are enabling the production of thinner, more flexible, and more energy-efficient EPS materials, further boosting market growth. Overall, the market is poised for strong expansion In the coming years, driven by these key market trends and growth factors.

What will be the size of the US EPS Market during the forecast period?

- The market exhibits strong growth due to its widespread application in various industries. EPS, also known as polystyrene, is a versatile polymer known for its insulation properties, chemical inertness, and closed-cell structure. These characteristics make it an ideal choice for construction elements, including insulated panel systems, facades, walls, and packaging applications in the construction, food service industry, consumer goods sector, and retail sector. Feedstock styrene costs and crude oil prices significantly impact the EPS market. The fast-food industry utilizes EPS for food packaging due to its excellent shock absorption and moisture resistance.

- In the construction sector, EPS is used for insulation due to its thermal properties, which help reduce energy consumption. However, environmental concerns surrounding the disposal of EPS waste in landfills have led to an increased focus on post-commercial EPS recycling. The phase-out of Chlorofluorocarbons (CFCs) as insulation agents has further boosted the demand for EPS as a viable alternative. The market is expected to continue its growth trajectory, driven by its superior insulation properties and increasing demand from various industries.

How is this market segmented and which is the largest segment?

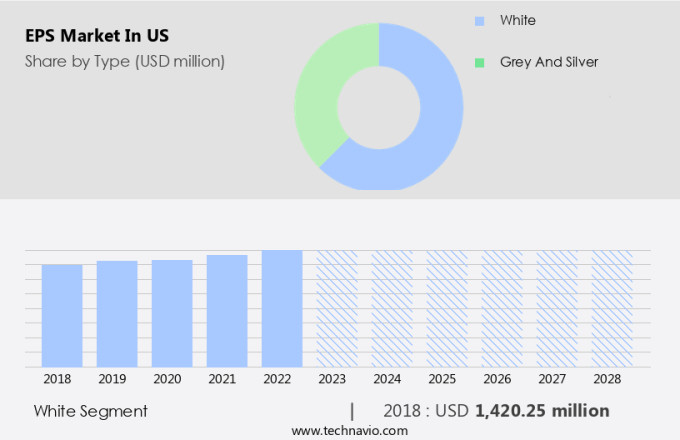

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- White

- Grey and silver

- Application

- Building and construction

- Packaging

- Others

- Distribution Channel

- Offline

- Online

- Geography

- US

By Type Insights

- The white segment is estimated to witness significant growth during the forecast period.

EPS, or expanded polystyrene, is a white foam plastic material derived from polystyrene beads. Its primary applications include packaging, insulation, and various other industries. Notably, EPS is used In the construction sector due to its closed-cell structure, which allows it to absorb water without promoting mold or decay when used as a core material. Its shock-absorbing properties make it ideal for transporting fragile items such as electronics, pharmaceuticals, and chemicals. In the food and beverage industry, EPS offers thermal insulation and moisture resistance, making it suitable for packaging perishable items like seafood, fruit, and vegetables. Additionally, EPS is widely used In the consumer goods, retail, and sports & leisure sectors for various packaging applications.

Get a glance at the market share of various segments Request Free Sample

The white segment was valued at USD 1.42 billion in 2018 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of US EPS Market?

Growing e-commerce sales and increasing EPS sales is the key driver of the market.

- The market has witnessed notable growth due to its extensive applications in various sectors. In the Building & Construction sector, EPS is utilized as an energy-efficient insulation material in insulated panel systems for facades, walls, roofs, and floors. Its closed-cell structure offers excellent insulation properties, chemical inertness, and moisture resistance, making it a preferred choice for construction elements. In the industrial packaging sector, EPS is used for its shock-absorbing properties to protect sensitive items such as medical equipment, electronic components, toys, horticultural products, and foam coolers. Its lightweight nature makes it an ideal choice for flotation material in marinas, pontoons, and as lightweight fill for void filling in concrete floor slabs.

- In the Food Packaging sector, EPS is widely used due to its excellent insulation properties, maintaining the shelf life of perishable items like fruits, vegetables, seafood, and packaged food. Its physical properties, including toughness and rigidity, make it suitable for various packaging applications, such as fruit trays, clamshell containers, and drink cups. EPS is also recyclable, making it an eco-friendly alternative to traditional packaging materials like paper and Styrofoam cups. The growing e-commerce sector in the US, driven by the increasing penetration of the Internet and smartphones, has led to a rise in demand for EPS in packaging applications.

- The convenience of online shopping has resulted in consumers spending less time in physical stores, making the first interaction with brands the packaging that is delivered to their doors. With the increasing focus on energy efficiency and sustainability, the demand for EPS as an insulation material and eco-friendly packaging alternative is expected to continue growing. EPS is also used in various industries such as automotive parts, foot pads, headrests & seats, storage compartments, bumper systems, and as white EPS and grey EPS for different physical properties. Its versatility and excellent insulation properties make it a valuable resource in various sectors, contributing significantly to the US economy.

What are the market trends shaping the US EPS Market?

Growing demand for lightweight containers and packaging is the upcoming trend In the market.

- The market is witnessing significant growth due to the increasing demand for lightweight containers and packaging solutions in various industries, including food and beverage, healthcare, and electronic appliances. EPS, also known as polystyrene, is widely used for its insulation properties, chemical inertness, and closed-cell structure, making it an ideal choice for insulated panel systems, construction elements such as facades, walls, roofs, floors, and flotation material for marinas, pontoons, and lightweight fill. EPS is also used in industries like horticulture for packaging fruits, vegetables, and other perishable goods due to its excellent moisture resistance and shock-absorbing properties.

- In the industrial packaging sector, EPS is used for packaging density, recyclability, and moulding into various shapes like fruit trays, clamshell containers, and drink cups. Moreover, EPS is used in various sectors, such as medical equipment, electronic components, toys, and automotive parts, for its shock-absorbing properties. The food packaging sector and building & construction sector are significant consumers of EPS due to its energy-efficient properties and ability to improve indoor environmental quality. The demand for EPS In the US is driven by factors such as increasing demand for energy-efficient building materials, growing consumer awareness towards sustainability, and the need for lightweight and cost-effective packaging solutions.

- Additionally, the use of EPS in underfloor heating systems, concrete floor slabs, and void filling in commercial buildings is increasing due to its excellent insulation properties and low weight. EPS is also used in various applications such as white EPS and grey EPS, which have different physical properties like toughness, rigidity, and high density. The use of additives like graphite enhances the properties of EPS, making it suitable for non-residential construction projects, hospitals, commercial buildings, colleges, and other industrial applications. The EPS market In the US is expected to continue growing due to the increasing demand for sustainable and cost-effective packaging solutions, growing awareness towards energy efficiency, and the need for lightweight and durable construction materials.

What challenges does the US EPS Market face during the growth?

The popularity of bioplastic packaging is a key challenge affecting the market growth.

- The market has witnessed significant growth due to the unique physical properties of EPS, including its insulation properties, chemical inertness, and closed-cell structure. These features make EPS an ideal choice for various applications In the construction industry, particularly in insulated panel systems for facades, walls, roofs, and floors. EPS is also used as flotation material in marinas, pontoons, and as lightweight fill in various industries. In the packaging sector, EPS is widely used for its shock-absorbing properties in packaging applications for industries such as food service, consumer goods, retail, and online shopping. EPS is commonly used for packaging food products like fruits, vegetables, and seafood, as well as for medical equipment, electronic components, toys, and horticultural products.

- The demand for EPS In the packaging industry is driven by its excellent moisture resistance, thermal insulation, and recyclability. Moreover, EPS is used in various industrial applications, including as a void filling material, underfloor heating systems, and in concrete floor slabs. EPS is also used in automotive parts, such as foot pads, headrests & seats, storage compartments, and bumper systems. The versatility of EPS has led to its use in various industries, including the building & construction sector, where it is used as energy-efficient building materials. The US EPS market is influenced by various factors, including the cost of feedstock styrene, crude oil prices, and the availability of alternative materials.

- The market is also impacted by regulatory initiatives aimed at reducing plastic waste and promoting the use of eco-friendly materials. The growing demand for energy-efficient and sustainable building materials, as well as the increasing popularity of insulated panel systems, is expected to drive the growth of the US EPS market In the coming years. EPS is available in various forms, including extruded and moulded, and is used in various applications, including food packaging, industrial packaging, and construction materials. EPS is available in different densities, including white EPS and grey EPS, which have different physical properties and applications. Overall, the US EPS market is expected to continue its growth trajectory, driven by its unique properties and the increasing demand for sustainable and energy-efficient materials.

Exclusive US EPS Market Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alfa Corporativo S.A. de C.V.

- Alpek SAB de CV

- Atlas Roofing Corp.

- BEWI ASA

- Dart Container Corp.

- Epsilyte LLC

- Foam Products Corp.

- Foamcraft USA LLC

- Integreon

- Kaneka Corp.

- Koch Industries Inc.

- LG Chem Ltd.

- Michigan Foam Products LLC

- RAG Stiftung

- RAPAC

- Saudi Arabian Oil Co.

- Styrotech Inc.

- Synthos SA

- TotalEnergies SE

- BASF SE

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Expanded polystyrene (EPS), a type of plastic foam, has gained significant traction in various industries due to its unique physical properties and versatility. This insulating material is known for its closed-cell structure, which provides excellent insulation properties, chemical inertness, and moisture resistance. These features make EPS an ideal choice for numerous applications, including construction elements, insulated panel systems, and industrial packaging. The construction sector has embraced EPS as a valuable resource for enhancing energy efficiency in buildings. EPS is commonly used in facades, walls, roofs, and floors, providing excellent insulation and reducing energy consumption. Its closed-cell structure effectively prevents the transfer of heat, making it an essential component in underfloor heating systems and concrete floor slabs.

Moreover, its low weight makes it an excellent choice for void filling in non-residential construction projects, such as hospitals, commercial buildings, colleges, and other large structures. In the industrial packaging sector, EPS has proven its worth in various applications. Its shock-absorbing properties make it an ideal material for protecting sensitive goods during transportation, such as medical equipment, electronic components, toys, and horticultural products. EPS is also used In the production of foam coolers, ensuring the optimal preservation of temperature-sensitive items like food and beverages. EPS has also found a niche In the building & construction sector, particularly In the food packaging sector.

Further, its excellent insulation properties make it an essential component In the production of food service containers, drink cups, clamshell containers, and other packaging applications. EPS's ability to maintaIn the shelf life of perishable items, such as fruits, vegetables, seafood, and packaged food, is a significant advantage In the fast-food industry and retail sector, particularly In the context of online shopping. The strong economy has led to increased demand for EPS in various industries. In the commercial real estate sector, EPS is used In the construction of energy-efficient buildings, contributing to improved indoor environmental quality and reduced energy consumption. In the housing markets, EPS is used as an affordable insulation material, ensuring that homes remain warm during the winter and cool during the summer.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

149 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.46% |

|

Market Growth 2024-2028 |

USD 587.88 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.32 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across US

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements Get in touch