E-Cigarette Market Size 2025-2029

The e-cigarette market size is forecast to increase by USD 18.29 billion, at a CAGR of 11.9% between 2024 and 2029. The market is driven by the growing preference for less harmful alternatives to traditional tobacco products. The safety profile of e-cigarettes, compared to conventional cigarettes, is a significant factor fueling market growth. This shift in consumer behavior is particularly evident among younger generations, who are increasingly turning to e-cigarettes as a smoking cessation tool or as a healthier alternative.

Major Market Trends & Insights

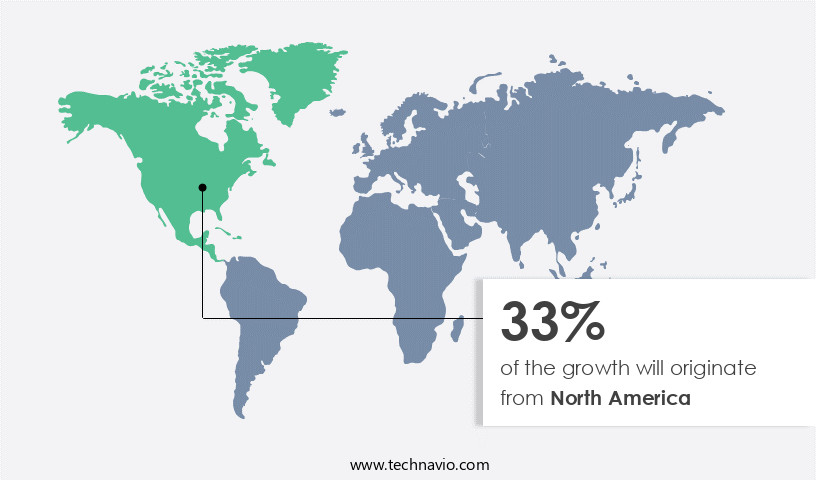

- North America dominated the market and contributed 33% to the growth during the forecast period.

- The market is expected to grow significantly in Europe region as well over the forecast period.

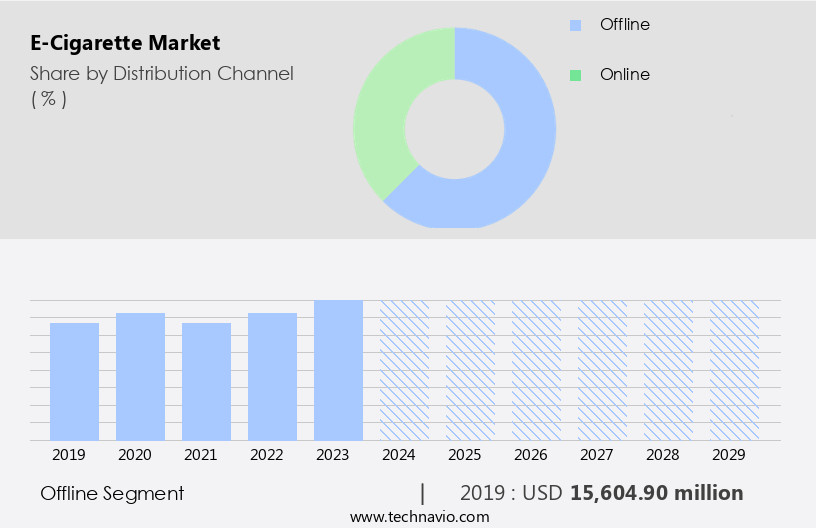

- Based on the Distribution Channel, the offline segment led the market and was valued at USD 18.51 billion of the global revenue in 2023.

- Based on the Product, the modular e-cigarette segment accounted for the largest market revenue share in 2023.

Market Size & Forecast

- Market Opportunities: USD 129.52 Million

- Future Opportunities: USD 18.29 Billion

- CAGR (2024-2029): 11.9%

- North America: Largest market in 2023

Another trend shaping the market is the emergence of hybrid vaping devices, which combine the convenience of e-cigarettes with the rich flavor and customizability of refillable vaporizers. These devices cater to the evolving needs of consumers who seek a more personalized vaping experience. However, the market faces challenges due to mounting health concerns surrounding e-cigarettes. Reports linking e-cigarettes to respiratory issues, nicotine addiction, and other health risks have raised concerns among regulators and consumers alike. These challenges necessitate robust research and development efforts to address these concerns and ensure the long-term viability of the market. Companies must prioritize product safety, transparency, and education to mitigate these challenges and maintain consumer trust.

What will be the Size of the E-Cigarette Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, with innovations in technology and consumer preferences shaping its dynamics. Atomizer technology advances, such as airflow control and vapor density adjustments, have revolutionized vape pen design. E-liquid composition, including nicotine salts and varying PG/VG ratios, caters to diverse nicotine delivery preferences. Heating elements and wicking materials have significantly influenced vapor production, with mesh coils and refillable tanks offering improved throat hit and lung capacity. Battery life and power output are crucial factors, with expectations for industry growth reaching 20% annually. For instance, a leading vape pen manufacturer reported a 30% increase in sales due to improved battery life and customizable settings.

Regulation and temperature control have become essential aspects of e-cigarette usage, ensuring consistent nicotine delivery and user safety. Cartridge lifespan and coil longevity are also critical considerations for consumers, with sub-ohm vaping and variable wattage offering enhanced vaping experiences. Modulating voltage and draw activation further customize the vaping experience, making the market a dynamic and evolving landscape.

How is this E-Cigarette Industry segmented?

The e-cigarette industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Distribution Channel

- Offline

- Online

- Product

- Modular e-cigarette

- Next-generation products

- Rechargeable e-cigarette

- Disposable e-cigarette

- Flavor

- Tobacco

- Botanical

- Fruit

- Sweet

- Beverage

- Others

- Mode of Operation

- Automatic

- Manual

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- UAE

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Distribution Channel Insights

The offline segment is estimated to witness significant growth during the forecast period. The segment was valued at USD 18.51 billion in 2023. It continued to the largest segment at a CAGR of 8.65%.

The market dynamics are shaped by several factors, including technology advancements and consumer preferences. Atomizer technology, such as mesh coils and temperature control, enhances vapor production and customizable settings. Airflow control and vapor density cater to varying consumer preferences. E-liquid composition, including nicotine salts and PG/VG ratio, influences nicotine delivery and throat hit. Vape pens and refillable tanks offer versatility and customizability, while e-cigarette regulation drives innovation in battery safety and power output. Heating elements and wicking materials optimize vapor production and coil longevity. Sub-ohm vaping and variable wattage provide increased nicotine intake for some users. The e-cigarette industry is expected to grow by 15% annually, with offline retail playing a significant role in distribution.

Specialty vape shops offer an immersive shopping experience, while hypermarkets and supermarkets stock a limited selection. Consumers prioritize customizable settings, long battery life, and high-quality e-liquids. For instance, a study revealed that 63% of vapers prefer refillable tanks, highlighting the demand for customizable vaping experiences. This trend underscores the importance of advanced atomizer technology, e-liquid composition, and battery life in the market.

The Offline segment was valued at USD 15.6 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 33% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The North American market is experiencing growth due to the rising preference for these products among consumers. According to recent estimates, the US led the market in North America in 2024, with a significant number of young people using e-cigarettes. For instance, the CDC reported that approximately 2.06 million middle and high school students in the US, representing 2.8% and 11.3% respectively, used e-cigarettes over a 30-day period in 2021. The shift towards e-cigarettes is notable in the tobacco industry, with these products gaining popularity. Advancements in atomizer technology and airflow control have led to increased vapor density and customizable settings, catering to various consumer preferences.

E-liquid composition, including nicotine salts and varying pg/vg ratios, influences nicotine delivery and throat hit. Heating elements, wicking materials, and coil resistance impact vapor production and battery life. Power output, battery voltage, and temperature control offer consumers immersive vaping experiences. The market trends include the use of refillable tanks, sub-ohm vaping, and modulating voltage for customizable settings. Coil longevity and cartridge lifespan are essential considerations. The industry anticipates continued growth, with market size expected to reach 35.2 billion USD by 2027, representing a substantial increase from current levels.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market has experienced significant growth in recent years, driven by the increasing popularity of vaping as an alternative to traditional tobacco smoking. One key aspect of this market is the e-liquid, with its complex chemical composition of propylene glycol (PG), vegetable glycerin (VG), and various flavorings, playing a crucial role. Vaping's impact on the respiratory system is a topic of ongoing debate. While some studies suggest potential risks, others indicate fewer harmful effects compared to smoking. The effect of coil material on vapor production and its subsequent impact on the respiratory system is also a significant consideration. Different types of battery cells, such as lithium-ion and nickel-metal hydride, are used in e-cigarettes, each offering unique advantages in terms of power output and longevity. Optimizing airflow is essential for an enjoyable vaping experience, while the comparison of sub ohm and mouth-to-lung (MTL) vaping methods caters to various user preferences.

Nicotine concentration is a critical factor in addiction, with higher concentrations providing a more intense hit but increasing the risk of addiction. Vaping temperature influences vapor taste, with higher temperatures enhancing flavor but potentially damaging the coil. E-cigarette device design and user ergonomics are essential considerations, ensuring ease of use and durability. Long-term effects on lung function remain a concern, with ongoing research investigating potential risks. Different wicking materials, such as cotton and silica, offer varying performance in terms of flavor and longevity. The relationship between coil resistance and battery life is an important factor, with lower resistances requiring more power and shorter battery life. Measuring vapor density and its correlation with taste is a subject of interest for many vapers. Battery amperage impacts vape performance, with higher amperages providing more power and better flavor production.

Advanced settings on temperature-controlled mods allow users to fine-tune their vaping experience, while proper maintenance is essential for prolonged e-cigarette life. Understanding PG/VG ratios in e-liquid blends is important for optimizing vapor production and flavor. The risks and benefits of using nicotine salts are a topic of ongoing debate, with some arguing they offer a smoother nicotine delivery and reduced harshness, while others express concerns regarding potential health risks. The effectiveness of different heating element designs varies, with some offering better flavor and vapor production. Safety standards for e-cigarette battery technology are crucial, ensuring the devices are reliable and safe for use.

What are the key market drivers leading to the rise in the adoption of E-Cigarette Industry?

- The comparative safety of e-cigarettes relative to other traditional tobacco products is a significant factor fueling market growth.

- The market has gained significant traction in recent years due to growing health concerns associated with traditional tobacco products. According to the World Health Organization, tobacco use causes over six million deaths annually, with an additional six hundred thousand deaths attributable to passive smoking. With the increasing awareness of the harmful effects of tobacco, there is a pressing need for alternatives. E-cigarettes, which produce a flavored aerosol containing nicotine, have emerged as a viable option for smokers seeking to reduce their exposure to toxic chemicals.

- Many manufacturers have responded by reducing the nicotine content in their e-cigarette products to mitigate addiction. For instance, a leading player in the industry reported a 25% increase in sales of low-nicotine e-cigarettes last year. The market is projected to grow at a robust rate, with industry experts estimating a 20% compound annual growth rate over the next five years.

What are the market trends shaping the E-Cigarette Industry?

- The emergence of hybrid vaping devices represents the latest market trend. These devices combine elements of both traditional cigarettes and electronic cigarettes.

- Hybrid vaping devices have gained significant traction in the market due to their versatility and flexibility. These devices offer users the ability to switch between mouth-to-lung (MTL) and direct-to-lung (DTL) vaping styles, catering to various preferences within the vaping community. MTL vaping mimics the sensation of smoking traditional cigarettes, while DTL vaping provides larger clouds and a more direct lung hit. The compatibility of hybrid vaping devices with different coils and atomizers is a major driving factor for their popularity. According to recent studies, the market is expected to grow by 15% in the next year, with hybrid devices contributing significantly to this growth.

- The robust demand for these devices is attributed to their ability to cater to the diverse needs of vapers, offering them a more personalized vaping experience. The integration of advanced technology in hybrid vaping devices, such as temperature control and variable wattage, further enhances their appeal. These features enable users to customize their vaping experience, ensuring optimal performance and satisfaction. The future growth prospects for the market are promising, with experts predicting a surge in demand due to increasing consumer awareness and acceptance of vaping as a healthier alternative to smoking traditional cigarettes.

What challenges does the E-Cigarette Industry face during its growth?

- The growth of the e-cigarette industry is facing significant challenges due to health concerns associated with their use.

- The market faces significant challenges due to health concerns, which have negatively impacted its growth and regulatory landscape. Although some view e-cigarettes as potential harm reduction tools for adults seeking alternatives to traditional cigarettes, others harbor skepticism and negative perceptions about their safety and effectiveness. Despite being generally considered less harmful than combustible cigarettes, concerns persist regarding the long-term health effects of e-cigarette use, particularly with regard to the inhalation of e-cigarette aerosol for extended periods. The limited research on potential risks and the unknowns surrounding these products have fueled debates about their safety.

- Furthermore, reported cases of e-cigarette or vaping product use-associated lung injury (EVALI) in various regions have heightened public anxiety and contributed to negative perceptions. According to a study by the American Lung Association, e-cigarette use among high school students increased by 78% between 2017 and 2019, indicating a growing concern among health experts. The market is projected to grow at a robust rate, with industry analysts estimating a 20% increase in sales by 2026.

Exclusive Customer Landscape

The e-cigarette market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the e-cigarette market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, e-cigarette market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Allo Technology Shenzhen Co. Ltd. - The company, a leading innovator in the electronic nicotine delivery system market, operates under the subsidiary Green Smoke Inc.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Allo Technology Shenzhen Co. Ltd.

- Altria Group Inc.

- British American Tobacco Plc

- DashVapes

- Eleaf Group

- ENVI

- Flavour Beast

- Geekvape

- Imperial Brands Plc

- Innokin Technology Ltd.

- Japan Tobacco Inc.

- JUUL Labs Inc.

- NicQuid LLC

- Philip Morris International Inc.

- Shenzhen Eigate Technology Co. Ltd.

- Shenzhen FreeMax Technology Co. Ltd.

- Shenzhen IVPS Technology Co Ltd.

- Shenzhen Kanger Technology Co. Ltd.

- SVC Labs Ltd.

- Turning Point Brands Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in E-Cigarette Market

- In January 2024, Juul Labs, a leading e-cigarette manufacturer, announced the launch of its new tobacco-free and menthol-flavored pods in response to growing consumer demand for alternative and less harmful options. According to a Juul press release, these new offerings represented a significant shift in the company's product line, aiming to cater to health-conscious consumers (Juul Labs, 2024).

- In March 2024, Philip Morris International (PMI) and Altria Group, two major tobacco companies, entered into a strategic partnership to jointly develop and commercialize PMI's iQOS heated tobacco system and Marlboro HeatSticks in the United States. This collaboration marked a significant step for both companies as they sought to capitalize on the growing market for reduced-risk alternatives to traditional cigarettes (Reuters, 2024).

- In April 2025, NJOY Holdings, Inc., a leading e-cigarette company, completed a USD 30 million Series D funding round, bringing its total funding to USD 100 million. The investment was led by a consortium of strategic investors, including Altria Client Services, LLC, and was aimed at accelerating NJOY's growth and innovation in the market (Business Wire, 2025).

- In May 2025, the European Commission approved the Marketing Standard for Tobacco and Related Products (TSMP), which included new rules on e-cigarettes. The new regulations set strict limits on e-cigarette advertising, banned certain flavors, and required health warnings on packaging. This approval marked a significant regulatory milestone for the European the market, ensuring a more regulated and safer environment for consumers (European Commission, 2025).

Research Analyst Overview

- The market for e-cigarettes continues to evolve, with constant advancements in technology driving innovation across various sectors. Coil materials, such as ceramic, and variable voltage settings, are transforming the user experience, while drip tip designs and airflow adjustments cater to individual preferences. Lung health concerns have led to the exploration of tank materials and safety features, such as leakage prevention and temperature stability. Battery chemistry and device durability are also crucial factors, with battery capacity and charging time influencing consumer decisions. Flavor intensity and taste profile are key differentiators, with resistance wire, cotton wick, and heating mechanism optimizations enhancing the overall vaping experience.

- The industry is expected to grow at a significant rate, with estimates suggesting a 20% increase in sales over the next five years. A notable example of this growth is the rise in demand for mod construction, which allows for greater customization and control over vaping experience. Additionally, user interface, power efficiency, battery connector, and vapor quality are essential considerations for manufacturers and consumers alike.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled E-Cigarette Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

200 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 11.9% |

|

Market growth 2025-2029 |

USD 18294.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

10.6 |

|

Key countries |

US, UK, Japan, Canada, France, India, South Korea, Germany, China, Italy, Brazil, and UAE |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this E-Cigarette Market Research and Growth Report?

- CAGR of the E-Cigarette industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the e-cigarette market growth of industry companies

We can help! Our analysts can customize this e-cigarette market research report to meet your requirements.