Dissolving Wood Pulp (DWP) Market Size 2025-2029

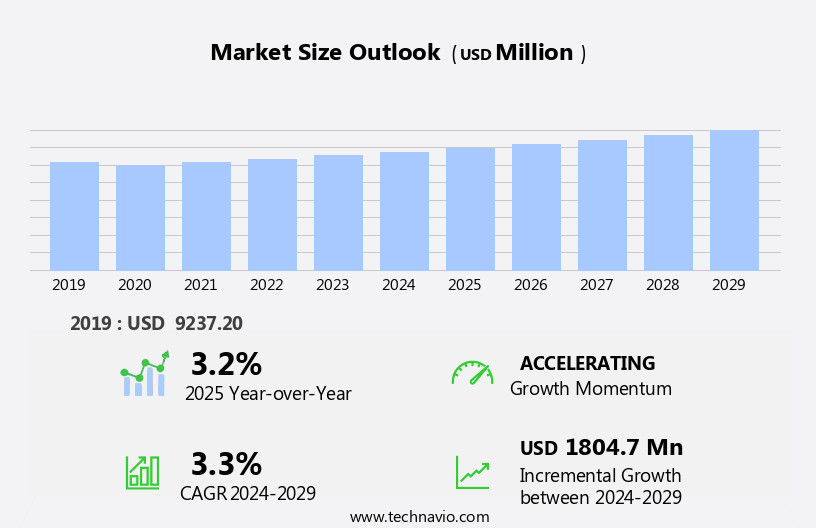

The dissolving wood pulp (DWP) market size is forecast to increase by USD 1.8 billion at a CAGR of 3.3% between 2024 and 2029.

- The market is experiencing significant growth due to the increasing demand for tissue and hygiene products. This trend is driven by the rising awareness of personal hygiene and health, particularly in developing regions. However, environmental regulations and sustainability concerns pose challenges to market expansion. Regulatory hurdles, such as stringent environmental standards and increasing focus on circular economy, necessitate the adoption of eco-friendly production methods. Moreover, inconsistencies in the supply chain, including fluctuations in raw material availability and pricing, temper growth potential. Powder coatings, such as those used for seats and kitchen cabinets, continue to gain popularity due to their design freedoms and ease of application.

- To capitalize on market opportunities and navigate these challenges effectively, companies must invest in sustainable production processes and establish robust supply chain partnerships. By doing so, they can cater to the growing demand for eco-friendly tissue and hygiene products while ensuring a consistent supply to meet customer needs.

What will be the Size of the Dissolving Wood Pulp (DWP) Market during the forecast period?

- The market is experiencing dynamic shifts, driven by advancements in bio-based chemicals and green technologies. Product innovation, such as the development of cellulose nanocrystals, is revolutionizing industries and enhancing value propositions. Process automation and digital marketing are key trends, improving customer experience and brand building. Bio-based economies prioritize supply chain traceability and transparency, necessitating robust process control systems and forest certification. Price fluctuations, influenced by market volatility and demand fluctuations, require effective risk management strategies. Green chemistry and life cycle analysis contribute to environmental management systems and carbon sequestration. Customer relationship management and social media marketing are essential for competitive advantage, while predictive maintenance and quality management systems ensure operational efficiency. The versatility of wooden products is vast, with applications ranging from home furniture such as beds, chairs, shelves, tables, and cabinets, to interior and exterior furniture, doors, and decorative elements.

- Trade barriers and regulatory compliance pose challenges, necessitating responsible sourcing and adherence to environmental management systems. In the DWP market, companies leveraging data analytics for customer engagement and predictive maintenance gain a significant edge. Sustainable forest management and green technologies foster long-term success and strengthen market positions.

How is this Dissolving Wood Pulp (DWP) Industry segmented?

The dissolving wood pulp (DWP) industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Rayon grade

- Specialty grade

- Raw Material

- Hardwood

- Softwood

- Grade Type

- Alpha-cellulose

- Beta-cellulose

- Gamma-cellulose

- Application

- Viscose Fiber

- Acetate

- Cellophane

- Others

- Geography

- North America

- US

- Canada

- Europe

- Austria

- Finland

- Germany

- Sweden

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Type Insights

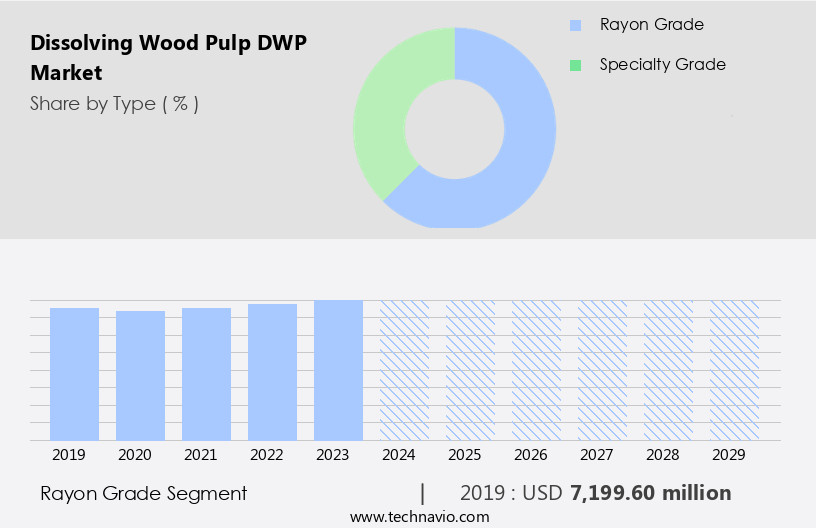

The rayon grade segment is estimated to witness significant growth during the forecast period.

The market is experiencing steady growth in 2024, driven by the increasing demand for cellulosic products in various industries, including textiles, pharmaceuticals, and cosmetics. Rayon-grade DWP holds a significant market share due to its superior quality and versatile applications. The textile industry remains the primary consumer, utilizing rayon-grade pulp to produce cellulose fibers for garments, yarns, and fabrics. Its high strength, smooth texture, and absorbency make it a preferred choice for textile manufacturers. Furthermore, the use of rayon-grade pulp is expanding into high-value applications such as pharmaceuticals and cosmetics, where purity and sustainability are crucial. Sustainable forestry practices, mechanical pulping, and soda pulping contribute to the production of DWP, ensuring energy efficiency and process control. By offering various protective coatings that cater to diverse applications and environmental requirements, this market continues to evolve and adapt to the changing needs of the industry.

The pulp industry continues to innovate with advancements in technology, including predictive analytics, machine learning, and big data, to optimize production and improve product differentiation. Renewable resources and circular economy principles are also shaping the industry, with a focus on reducing carbon footprint and increasing fiber yield. Pulp testing, research and development, and supply chain management are essential components of the market, ensuring quality assurance and customer loyalty. The paper industry is another significant consumer of DWP, utilizing it for various applications, including chemical pulping and the sulfate process. Pulp brightness, viscosity, and fiber properties are critical factors in determining pulp quality and price.

The market is dynamic, with mergers and acquisitions, joint ventures, and trade agreements shaping the competitive landscape. Overall, the DWP market is poised for continued growth, driven by evolving customer needs and technological advancements.

The Rayon grade segment was valued at USD 7.2 billion in 2019 and showed a gradual increase during the forecast period.

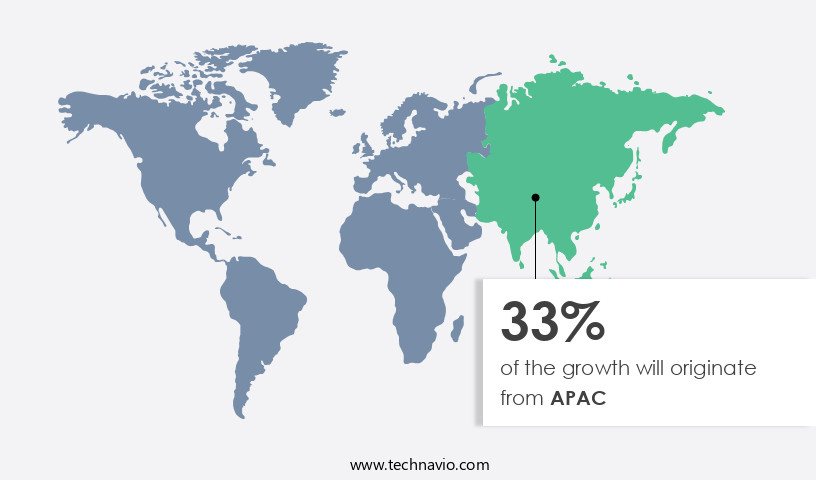

Regional Analysis

APAC is estimated to contribute 33% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In North America, the market encompasses the production, trade, and consumption of a specific type of pulp primarily used in the manufacturing of cellulosic materials like rayon. This pulp is derived from cellulose extracted chemically from wood chips or alternative sources, resulting in pure fibers. The DWP market in North America holds significant importance due to the US and Canada being the leading manufacturers and consumers of this commodity. The demand for rayon is robust in various industries, including textiles, healthcare, and automotive, fueling the growth of the DWP market. Sustainable forestry practices, such as mechanical pulping and soda pulping, are integral to the DWP industry.

Process control, energy efficiency, and predictive analytics are crucial elements in DWP production, ensuring fiber strength and pulp purity. DWP is employed in creating cellulose ethers, films, nonwoven fabrics, membranes, and derivatives, catering to diverse customer needs. Research and development, machine learning, and big data are pivotal in enhancing product differentiation and optimizing processes. The pulp industry focuses on quality assurance, ensuring pulp brightness, viscosity, and fiber properties meet customer requirements. Mergers and acquisitions, joint ventures, and supply chain management are essential strategies for market players. Renewable resources, global trade, and circular economy concepts are increasingly shaping the industry. Exterior furniture, doors, and other wooden products also benefit from these coatings, ensuring resistance to environmental influences, including water and UV rays.

The DWP market faces competition from other pulp types, such as kraft and sulfate processes, and the market dynamics are influenced by factors like pulp pricing, environmental impact, and fiber yield. Bio-based materials and trade agreements are emerging trends in the DWP industry.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Dissolving Wood Pulp (DWP) market drivers leading to the rise in the adoption of Industry?

- The significant demand for tissue and hygiene products serves as the primary market catalyst. The market experiences significant growth due to the increasing demand for hygiene products, particularly in emerging economies. DWP is a specialized type of wood pulp used in niche applications, such as textile fibers, rayon, cellulose ethers for producing cellulose films and nonwoven fabrics, and various hygiene items like wipes and diapers. The global population growth, especially in developing countries, is a primary driver for the demand in tissue and hygiene products. With the expanding middle class and rising disposable income, consumers in these regions are investing more in personal care and hygiene items. As a result, the demand for DWP to manufacture these goods is increasing substantially.

- The pulp industry focuses on sustainable forestry practices, employing mechanical pulping and soda pulping methods to ensure fiber strength and efficient pulp handling. DWP's unique properties make it an essential raw material in various industries, ensuring customer satisfaction and contributing to the market's continuous growth.

What are the Dissolving Wood Pulp (DWP) market trends shaping the Industry?

- The increasing demand for viscose fibers represents a significant market trend. This popular textile choice is gaining widespread recognition due to its versatility and sustainability. The market is experiencing significant growth due to the increasing demand for viscose fibers. These fibers, derived from DWP, are gaining popularity for their adaptability and eco-friendliness, making them a preferred choice in various industries. The textile sector, in particular, values viscose fibers for their unique qualities, such as softness, lightness, and breathability. These fibers are extensively used in the production of industrial, household, and apparel textiles. Moreover, the demand for non-woven goods is on the rise in industries like automotive, personal care, and healthcare. Viscose fibers are a key component in the manufacturing of these products due to their strength, flexibility, and ability to be easily molded.

- Advancements in technology are also driving the DWP market forward. Process control and energy efficiency are critical factors in the production of DWP, and innovations in these areas are leading to cost savings and increased productivity. Predictive analytics and machine learning are being employed to optimize production processes and improve product quality. Research and development in the areas of cellulose membranes, cellulose nitrate, and cellulose acetate are also contributing to the growth of the DWP market. Pulp testing and quality control are essential to ensure the production of high-quality DWP and its derived products. DWP market is expected to continue growing due to the increasing demand for viscose fibers and the expanding use of non-woven goods in various industries. Technological advancements and research and development efforts are also playing a significant role in driving market growth.

How does Dissolving Wood Pulp (DWP) market faces challenges face during its growth?

- The growth of the industry is significantly influenced by the complex interplay of environmental regulations and sustainability concerns. These issues pose a substantial challenge, requiring companies to balance economic expansion with the responsible stewardship of the environment. The market is characterized by various dynamics, including environmental regulations and sustainability concerns. The production and disposal of DWP have a significant environmental impact, leading to challenges such as deforestation, loss of biodiversity, and pollution of air and water. To mitigate these issues, there is a growing emphasis on the use of renewable resources and sustainable forestry practices. Supply chain management plays a crucial role in ensuring the traceability and sustainability of raw materials. Joint ventures and collaborations between industry players and research institutions are also driving innovation in DWP processing and production, leading to improvements in pulp viscosity, fiber properties, and pulp brightness.

- Quality control and assurance are essential in maintaining customer loyalty and ensuring pulp supply. Mergers and acquisitions have been common in the industry to increase production capacity and improve efficiency. Environmental regulations and the circular economy are key drivers of innovation and growth in the DWP market. Despite these challenges, the market is expected to continue growing due to the increasing demand for biodegradable and sustainable materials in various industries, including textiles, food, and pharmaceuticals.

Exclusive Customer Landscape

The dissolving wood pulp (DWP) market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the dissolving wood pulp (DWP) market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, dissolving wood pulp (DWP) market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Aditya Birla Management Corp. Pvt. Ltd. - This company distinguishes itself in the market through its integrated business model, encompassing the production of dissolving grade wood pulp, caustic soda, carbon-disulphide, power generation, and steam.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aditya Birla Management Corp. Pvt. Ltd.

- Amafhh Enterprises

- Bracell

- Fujian Qingshan Paper Industry Co Ltd.

- Fulida Group Holding Co. Ltd.

- Lenzing AG

- Nippon Paper Industries Co. Ltd.

- RAG Innovations

- Rayonier Advanced Materials

- Sappi Ltd.

- Shandong Sun Holdings Group

- Siam Cement PCL

- Yueyang Forest and Paper Co Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Dissolving Wood Pulp (DWP) Market

- In January 2024, Lenzing Group, a leading provider of specialty fibers, announced the successful start-up of its new dissolving wood pulp (DWP) production line in Heiligenkreuz, Austria. This expansion increased the company's annual DWP production capacity by 100,000 metric tons, strengthening its market position (Lenzing Group, 2024).

- In March 2025, Södra, a major forest industry group, and Mitsui Chemicals, a leading Japanese chemical manufacturer, signed a strategic collaboration agreement to jointly develop and commercialize new applications for DWP. The partnership aimed to expand the use of DWP in various industries, including textiles, food, and pharmaceuticals (Södra, 2025).

- In May 2025, Arauco, a global forest industry company, received approval from the Chilean Environmental Evaluation Commission to build a new DWP production plant in the BiobÃo region. The project represented a USD300 million investment and was expected to add 250,000 metric tons of annual DWP production capacity (Arauco, 2025).

Research Analyst Overview

The market continues to evolve, driven by the dynamic interplay of various factors. Customer needs and preferences shape the demand for DWP in diverse sectors, including hygiene products, nonwoven fabrics, and cellulose films. Process control and energy efficiency are crucial in maintaining a competitive edge, with predictive analytics and machine learning playing increasingly significant roles. Product differentiation is achieved through fiber length, pulp transportation, and the development of advanced cellulose membranes. The Kraft process, a cornerstone of the pulp industry, undergoes continuous refinement, with innovations in prehydrolysis Kraft and sulfate process. Sustainable forestry practices and the use of renewable resources align with global trends towards a circular economy. Outdoor applications encompass furniture, floors, cladding, and architectural elements exposed to harsh environmental conditions, such as temperature fluctuations, abrasion, and chemical exposure.

Mergers and acquisitions, joint ventures, and supply chain management strategies shape the competitive landscape. Fiber strength, pulp viscosity, and fiber properties are essential factors in ensuring pulp quality and customer satisfaction. The integration of artificial intelligence and big data in pulp testing and research and development enhances process optimization and the creation of cellulose derivatives. The pulp industry grapples with environmental impact, carbon footprint, and trade agreements, while quality assurance and customer loyalty remain key priorities. Pulp supply and production are subject to fluctuations, necessitating effective quality control and pulp pricing strategies. Chemical pulping and mechanical pulping methods evolve to meet the demands of the market. Sustainable packaging alternatives, such as paper-based or biodegradable packaging, are being adopted to reduce plastic usage. The paper industry, a major consumer of DWP, adapts to these changes, with bio-based materials gaining popularity. The DWP market's continuous unfolding is a testament to its dynamic nature, requiring constant adaptation and innovation.

Dive into Technavio's strong research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Dissolving Wood Pulp (DWP) Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

216 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.3% |

|

Market growth 2025-2029 |

USD 1804.7 million |

|

Market structure |

Concentrated |

|

YoY growth 2024-2025(%) |

3.2 |

|

Key countries |

US, China, Brazil, Sweden, Canada, Finland, Austria, India, Germany, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Dissolving Wood Pulp (DWP) Market Research and Growth Report?

- CAGR of the Dissolving Wood Pulp (DWP) industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the dissolving wood pulp (DWP) market growth of industry companies

We can help! Our analysts can customize this dissolving wood pulp (DWP) market research report to meet your requirements.