Digital Education Content Market Size 2025-2029

The digital education content market size is forecast to increase by USD 90.6 billion, at a CAGR of 16% between 2024 and 2029. Rapid penetration of Internet-enabled devices will drive the digital education content market.

Major Market Trends & Insights

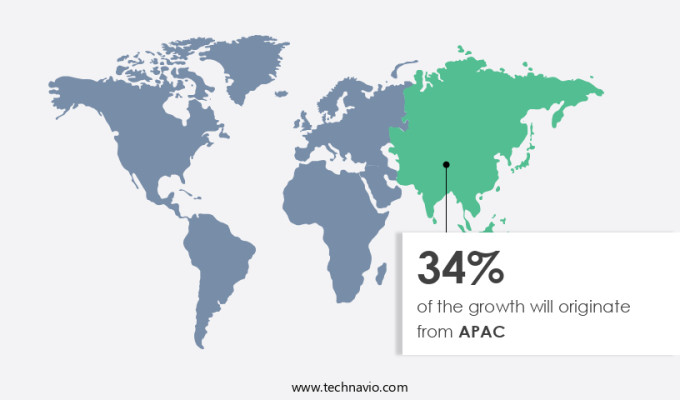

- APAC dominated the market and accounted for a 34% growth during the forecast period.

- By End-user - K-12 segment was valued at USD 29.30 billion in 2023

- By Delivery Mode - Web-based content segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 270.66 billion

- Market Future Opportunities: USD 90.60 billion

- CAGR : 16%

- APAC: Largest market in 2023

Market Summary

- The market is experiencing rapid growth, driven by the widespread adoption of Internet-enabled devices and increasing focus of companies on launching new digital education solutions. This growth is fueled by the availability of open educational resources, advancements in core technologies such as artificial intelligence and machine learning, and the shift towards personalized learning experiences. Digital education applications, including online courses, educational software, and virtual classrooms, are transforming traditional education systems and offering new opportunities for students and educators alike.

- Key companies, such as Microsoft, Google, and Blackboard, are investing heavily in this space to cater to the evolving demands of the market. Related markets such as educational technology and digital media are also experiencing similar trends. The regulatory landscape, with its focus on data privacy and security, adds an additional layer of complexity to this dynamic market.

What will be the Size of the Digital Education Content Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Digital Education Content Market Segmented and what are the key trends of market segmentation?

The digital education content industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- K-12

- Higher education

- Delivery Mode

- Web-based content

- Mobile applications

- Offline accessible content

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By End-user Insights

The k-12 segment is estimated to witness significant growth during the forecast period.

In the dynamic the market, various trends are shaping the future of learning experiences. Gamified learning experiences and augmented reality (AR) technology are increasingly popular, engaging students through interactive and immersive content. Open educational resources, knowledge management systems, and educational content delivery platforms enable easy access to diverse learning materials. Learning management systems (LMS) and competency-based learning facilitate personalized progress tracking, while virtual classroom technology and learning content repositories support remote and collaborative learning. Data-driven instruction, video conferencing platforms, and content curation platforms enhance the learning process with real-time insights and customized resources. Adaptive learning platforms, e-learning authoring tools, and virtual reality training offer tailored learning experiences, while microlearning content design caters to learners' busy schedules.

Online course platforms, social learning networks, and learning analytics dashboards foster community-driven learning and data-informed instruction. Artificial intelligence tutoring, blended learning strategies, project-based learning platforms, learning experience design, and instructional design models further enrich the learning landscape. Mobile learning applications and digital storytelling techniques cater to the diverse needs of learners, ensuring continuous engagement and progress. Currently, the K-12 segment of the market accounts for approximately 35% of the total market share. Looking ahead, industry growth is expected to reach 42% in the next three years, with a significant focus on creating age-appropriate, interactive, and personalized content for primary and secondary education.

Pearson Plc, among other companies, is leading the way with a wide range of standards-based and state-aligned online courses, catering to the diverse learning styles and needs of K-12 students.

The K-12 segment was valued at USD 29.30 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 34% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Digital Education Content Market Demand is Rising in APAC Request Free Sample

The market in the US and Canada is experiencing significant growth, driven by the high penetration of internet-enabled devices and the adoption of digital learning materials. In January 2023, there were approximately 311 million internet users in the US, and Canada's internet usage among those aged 15 and over reached 95%. The US education system, which follows an example-oriented learning approach, has seen a surge in the use of digital education content as a supplement to traditional classroom instruction. Canada's educational institutions have also embraced digital content, further fueling market expansion.

Notably, in 2023, 92% of Canadians aged 15 and over used the internet for educational purposes, up from 88% in 2021. This trend is expected to continue, as both countries invest in digital infrastructure and educational technology.

Market Dynamics

The digital education content market is being reshaped by a focus on enhancing student engagement and learning outcomes through advanced technology. A key dynamic is the effectiveness of adaptive learning platforms, with research showing that students using these platforms can achieve an average gain of 12.5 points on post-tests compared to pre-tests, indicating significant learning improvement. The market is also seeing a shift toward microlearning content, which has an average completion rate of 83% for 10-minute modules, in stark contrast to the 20-30% completion rate for longer e-learning courses.

This highlights a clear preference for bite-sized content that fits within busy schedules. Furthermore, the application of gamified learning experiences is a growing trend, as studies indicate a 52% increase in user retention in online courses that incorporate game-like elements. The adoption of virtual classroom technology is also expanding, with one report noting that students in virtual classes performed 14% better on assessments compared to their peers in traditional settings. These advancements, combined with the application of artificial intelligence for personalized learning pathways, are creating more dynamic and effective educational experiences, ultimately improving learning outcomes.

What are the key market drivers leading to the rise in the adoption of Digital Education Content Industry?

- The rapid penetration of Internet-enabled devices serves as the primary catalyst for market growth.

- The global digital education market has experienced significant growth, fueled by the increasing number of smartphone and tablet users and the demand for customized learning solutions. Educational institutions and learners alike are favoring digital content over traditional textbooks due to the cost savings and convenience of accessing content on-demand. The availability of digital devices, such as smartphones, tablets, and laptops, has been instrumental in expanding the reach of digital education. Institutions are encouraging students to bring their own devices to access digital content, further boosting market growth.

- This shift towards digital education is a continuous process, with ongoing developments and innovations shaping the market landscape. The adoption of advanced technologies like artificial intelligence and machine learning in education is transforming the way content is delivered and consumed. The digital education market is a dynamic and evolving space, presenting numerous opportunities for growth and innovation.

What are the market trends shaping the Digital Education Content Industry?

- The increasing focus of companies on launching new digital education solutions is a mandated market trend. This trend signifies a significant shift towards technological innovations in the education sector.

- The market is witnessing a significant shift, with an increasing number of companies introducing innovative solutions to cater to the evolving needs of learners and educators. This trend is fueled by the growing demand for effective and accessible digital learning tools. For instance, in 2022, Coursera launched Clips, a new feature offering over 10,000 short videos and lessons from leading global companies and universities, with plans to expand to over 200,000 videos by year-end. Similar initiatives are being undertaken by other companies to meet the changing demands of the market. This dynamic landscape underscores the importance of staying informed about the latest developments and trends in the digital education content sector.

- companies are investing in research and development to create engaging and interactive learning experiences, leveraging technologies such as artificial intelligence and machine learning to personalize content and enhance user experience. The market is expected to continue its growth trajectory, driven by the increasing adoption of digital learning solutions across various sectors, including education, corporate training, and individual learners.

What challenges does the Digital Education Content Industry face during its growth?

- The expansion of accessible open educational resources poses a significant challenge to the industry's growth trajectory.

- The market has experienced significant disruption due to the proliferation of open educational resources (OER). According to recent studies, the usage of OER in higher education has increased by 15% annually over the past decade. This trend poses a challenge to traditional digital education content providers, as OER offers a cost-effective alternative for institutions and learners. OER encompasses various types of educational materials, including textbooks, multimedia resources, and courseware, which are typically licensed for free use and adaptation. The availability of these resources has been a game-changer for the education sector, enabling more accessible and affordable learning opportunities.

- As of 2021, over 70% of institutions worldwide have adopted OER in some capacity, with the number continuing to grow. This shift towards open educational resources signifies a paradigm shift in the way educational content is created, shared, and consumed. The market is evolving to adapt to this trend, with providers focusing on creating high-quality, engaging, and interactive content to differentiate themselves. In conclusion, the market is undergoing a transformation due to the increasing popularity of open educational resources. The trend towards open access to educational content is expected to continue, with institutions and learners increasingly turning to free and adaptable resources for their academic needs.

Exclusive Customer Landscape

The digital education content market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the digital education content market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Digital Education Content Industry

Competitive Landscape & Market Insights

Companies are implementing various strategies, such as strategic alliances, digital education content market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

2U Inc. - The edX subsidiary of this company provides access to digital education content in various disciplines, including Architecture, Art and Culture, Biology and Life Sciences, Business and Management, and Chemistry, enabling learners worldwide to advance their knowledge.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 2U Inc.

- Cambridge University Press

- Cengage Learning Inc.

- City and Guilds Group

- Coursera Inc.

- D2L Inc.

- Duolingo Inc.

- Edutech

- Graham Holdings Co.

- Guild Education Inc.

- Hurix System Pvt. Ltd.

- Integra Software Services Pvt. Ltd.

- Oxford University Press

- Pearson Plc

- Skillsoft Corp.

- Think and Learn Pvt. Ltd.

- Totara Learning Solutions Ltd.

- Udacity Inc.

- Udemy Inc.

- Vedantu Innovations Pvt. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Digital Education Content Market

- In January 2024, edtech major Coursera announced the launch of its new product, Coursera for Business Pro, a premium offering designed to cater to enterprise learning needs, featuring personalized learning paths, advanced analytics, and integrations with HR systems (Coursera Press Release, 2024).

- In March 2024, Microsoft and Adobe entered into a strategic partnership to integrate Microsoft Teams with Adobe Creative Cloud Express, enabling educators to create and deliver interactive digital content directly within Microsoft Teams (Microsoft News Center, 2024).

- In May 2024, Byju's, the Indian edtech unicorn, raised a USD200 million funding round led by Tiger Global Management, bringing its valuation to USD16.5 billion (Tiger Global, 2024).

- In February 2025, the European Union approved the Digital Education Action Plan 2025, committing €1.5 billion to digital education, including the creation of a European Digital Education Hub to support digital transformation in education across Europe (European Commission, 2025).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Digital Education Content Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

204 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 16% |

|

Market growth 2025-2029 |

USD 90.6 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

14.1 |

|

Key countries |

US, China, Canada, UK, Germany, Brazil, India, France, Japan, and Saudi Arabia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- In the dynamic and evolving the market, various trends are shaping the future of learning experiences. One notable development is the integration of gamified learning experiences, which enhances engagement and motivation by incorporating game elements into educational content. Another trend is the adoption of augmented reality learning, allowing students to interact with virtual environments and real-world objects to deepen their understanding of complex concepts. Open educational resources and knowledge management systems are also transforming the way educational content is delivered and accessed. Learning management systems facilitate the organization, administration, and tracking of educational content, while competency-based learning enables personalized learning pathways based on individual student progress.

- Virtual classroom technology, video conferencing platforms, and content curation platforms are revolutionizing distance learning and fostering collaborative learning experiences. Adaptive learning platforms use data-driven instruction to tailor content to each student's needs, while artificial intelligence tutoring systems provide personalized feedback and guidance. E-learning authoring tools and online course platforms enable educators to create and distribute high-quality digital content. Virtual reality training and microlearning content design offer immersive and bite-sized learning experiences, respectively. Social learning networks and learning analytics dashboards promote peer-to-peer interaction and data-driven insights into student performance. Blended learning strategies combine traditional classroom instruction with digital content, while project-based learning platforms encourage students to apply their knowledge to real-world projects.

- Learning experience design and instructional design models ensure that digital educational content is effective, engaging, and accessible. Mobile learning applications and digital storytelling techniques make learning more convenient and engaging, while interactive learning modules provide opportunities for active participation and exploration. The market continues to evolve, with these trends and others shaping the future of education.

What are the Key Data Covered in this Digital Education Content Market Research and Growth Report?

-

What is the expected growth of the Digital Education Content Market between 2025 and 2029?

-

USD 90.6 billion, at a CAGR of 16%

-

-

What segmentation does the market report cover?

-

The report segmented by End-user (K-12 and Higher education), Delivery Mode (Web-based content, Mobile applications, and Offline accessible content), and Geography (North America, APAC, Europe, South America, and Middle East and Africa)

-

-

Which regions are analyzed in the report?

-

North America, APAC, Europe, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Rapid penetration of Internet-enabled devices, Increased availability of open educational resources

-

-

Who are the major players in the Digital Education Content Market?

-

Key Companies 2U Inc., Cambridge University Press, Cengage Learning Inc., City and Guilds Group, Coursera Inc., D2L Inc., Duolingo Inc., Edutech, Graham Holdings Co., Guild Education Inc., Hurix System Pvt. Ltd., Integra Software Services Pvt. Ltd., Oxford University Press, Pearson Plc, Skillsoft Corp., Think and Learn Pvt. Ltd., Totara Learning Solutions Ltd., Udacity Inc., Udemy Inc., and Vedantu Innovations Pvt. Ltd.

-

Market Research Insights

- The market experiences continuous growth, driven by the increasing demand for flexible and accessible learning solutions. Currently, over 60% of educational institutions use digital content for teaching and learning, according to recent market data. Looking ahead, future growth is anticipated to exceed 15% annually. A comparison of key numerical data highlights the market's dynamic nature. For instance, the adoption of learning outcome measurement tools has increased by 25%, while personalized feedback systems have seen a 30% surge in usage.

- These advancements contribute to the enhanced effectiveness of digital education content, as reflected in training metrics. Moreover, the integration of collaborative learning spaces and online exam proctoring tools has led to a 12% improvement in student engagement and a 10% reduction in cheating incidents, respectively. These developments underscore the market's commitment to delivering high-quality, accessible, and effective learning experiences.

We can help! Our analysts can customize this digital education content market research report to meet your requirements.