Digital Broadcast And Cinematography Cameras Market Size 2025-2029

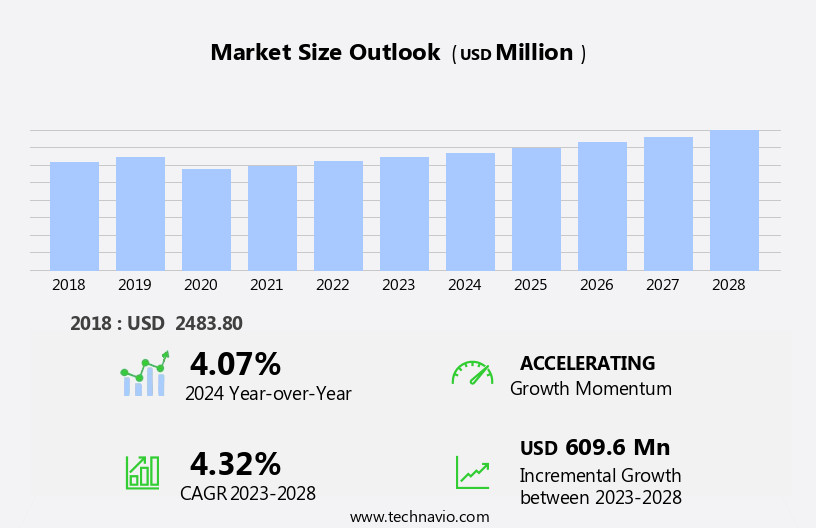

The digital broadcast and cinematography cameras market size is forecast to increase by USD 655.4 million, at a CAGR of 4.4% between 2024 and 2029.

- The increasing number of high-definition (HD) channel subscribers and the rising demand for ultra-high definition (UHD) content are major growth factors. This trend is fueled by the growing preference for superior quality visual experiences among consumers. However, the market faces challenges, particularly in emerging economies where the low density of movie screens hampers the growth potential. This issue necessitates strategic collaborations and investments in expanding the reach of UHD content in these regions. To capitalize on the market opportunities, companies must focus on innovation, improving image quality, and providing cost-effective solutions for UHD content production and distribution.

- The market is also experiencing significant growth due to the increasing demand for high-quality visual content in various industries, including travel and tourism, sports and adventure. Additionally, partnerships with content providers and broadcasters can help strengthen market position and increase market share. Companies must navigate the challenges presented by market dynamics and emerging economies to effectively capitalize on the opportunities and maintain a competitive edge.

What will be the Size of the Digital Broadcast And Cinematography Cameras Market during the forecast period?

- The market is experiencing significant advancements, driven by the integration of artificial intelligence (AI) and machine learning (ML) technologies. AI is revolutionizing video compression, enabling more efficient data transfer and storage through content delivery networks (CDNs). ML algorithms are also enhancing video editing software, enabling object recognition and scene analysis for improved workflow optimization. Interactive media is gaining traction, with virtual reality (VR) and augmented reality (AR) technologies becoming increasingly popular. Broadcast infrastructure is evolving to support these new formats, with networked video and wireless transmission solutions becoming essential. Camera control systems are becoming more sophisticated, with sensor technology and lens technology advancing to deliver superior image quality.

- Motion capture and visual effects are also benefiting from these advancements, enabling more realistic and engaging content. Post-production tools are being enhanced with AI and ML capabilities, enabling more efficient and accurate audio processing and scene analysis. Computer vision is also being integrated into digital asset management systems, improving content management and distribution. Scene analysis and sensor technology are enabling virtual production and remote monitoring, allowing for more efficient and cost-effective production workflows. Cloud storage solutions are becoming more prevalent, providing cost-effective and scalable storage options for large video files. The market is also witnessing the emergence of new applications, such as digital signage and 360-degree video, which are driving demand for more advanced camera technologies and workflows.

- Overall, the market is undergoing a period of significant innovation and growth, with AI and ML technologies playing a key role in driving new capabilities and efficiencies.

How is this Digital Broadcast and Cinematography Cameras Industry segmented?

The digital broadcast and cinematography cameras industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- ENG cameras

- Cinema cameras

- EFP cameras

- Distribution Channel

- Offline

- Online

- Application

- Broadcast

- Cinematography

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- Spain

- UK

- APAC

- China

- India

- Japan

- Rest of World (ROW)

- North America

By Product Insights

The ENG cameras segment is estimated to witness significant growth during the forecast period. The market is witnessing significant advancements, driven by the increasing demand for high-quality video production in various industries. ENG cameras, popular for their portability and ease of use, continue to dominate the broadcast television sector, particularly for live news reporting. Panasonic Corp., a leading industry player, showcased the AG-CX370 at NAB 2025, featuring 12G-SDI output, GENLOCK input, and 4-channel audio, making it suitable for mobile field production. Moreover, the shift towards tapeless HD camcorders is propelling market growth. This trend is prevalent in professional video production, commercials, independent filmmaking, and online content creation. The need for longer recording times, improved image quality, and external audio input is driving the demand for advanced cameras with features like high frame rates, dynamic range, and HDR video.

Professional cameras with interchangeable lenses, advanced image processing, and raw image capture are increasingly preferred for news gathering, documentary filmmaking, and film production. Mirrorless cameras and DSLRs with features like autofocus performance, image stabilization, and wireless connectivity cater to the needs of corporate video, sports broadcasting, and social media content creation. The market is also witnessing the integration of advanced features like color grading, remote control, live streaming, and ease of use. The latest cameras offer 4K and 8K resolutions, high pixel counts, and improved ISO sensitivity, enhancing video quality and color depth. Furthermore, the compatibility with editing software and post-production workflows ensures seamless production processes.

The ENG cameras segment was valued at USD 1.13 billion in 2019 and showed a gradual increase during the forecast period.

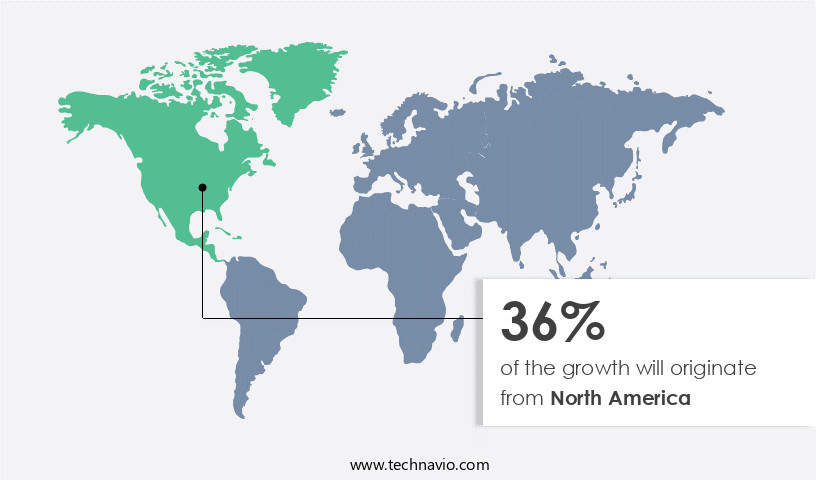

Regional Analysis

APAC is estimated to contribute 35% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is experiencing growth due to the increasing demand for high-quality movies and TV programs. Online video platforms are driving this demand, leading to market expansion. North America's large production industry, including companies like 20th Century Studios Inc. and Paramount Pictures Corp., contributes significantly to the region's market share. Image quality, recording time, external audio input, and professional video production are essential features for these cameras in professional video production, commercials, news gathering, and filmmaking. Dynamic range, time lapse, slow motion, low light performance, and high frame rate are advanced features that distinguish digital broadcast and cinematography cameras from consumer models.

Interchangeable lenses, wireless connectivity, and remote control offer flexibility for various applications. The market also caters to independent filmmakers and online content creators, requiring editing software compatibility and post-production workflows. Digital cinema cameras offer 4K and 8K resolutions, while broadcast cameras ensure high color depth, accuracy, and bit depth for broadcast television. Mirrorless and DSLR cameras cater to different user needs, with mirrorless cameras offering advanced autofocus performance and image stabilization. The market's evolution includes trends like HDR video, raw image capture, and cinematic looks.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Digital Broadcast and Cinematography Cameras market drivers leading to the rise in the adoption of Industry?

- The substantial growth in the number of subscribers opting for high-definition (HD) channels serves as the primary market driver. The market has experienced significant growth due to the increasing demand for high-definition (HD) content. With the advancement of technology, sensors in digital cameras have grown in size, enabling superior image quality and 4K resolution. HDMI output allows for seamless transmission of high-definition video to external displays. Both DSLR and mirrorless cameras offer autofocus performance and fast shutter speeds, making them ideal for capturing special effects and advanced camera functions. Consumer demand for HD cameras extends beyond photography to corporate video production and sports broadcasting.

- HD cameras offer improved image stabilization, ensuring clear and stable footage during movement. HD cameras also offer streaming capabilities, audio recording, and various lens mount options, making them versatile tools for professional applications. The preference for HD content continues to drive the adoption of advanced cameras, further fueling market growth.

What are the Digital Broadcast and Cinematography Cameras market trends shaping the Industry?

- The increasing demand for Ultra High Definition (UHD) content represents a significant market trend. UHD content refers to media with higher resolution and improved image quality compared to standard definition or high definition formats. Digital cinematography and broadcast cameras have seen significant advancements in recent years, with a focus on delivering superior video quality and enhanced features for online content creation and independent filmmaking. One such evolution is the adoption of higher resolutions, such as 4K (3840x2160 pixels) and 8K (7680x4320 pixels), which offer increased color depth and accuracy. RED, a prominent digital cinema camera manufacturer, has introduced an 8K sensor, boasting a resolution of 8192x4320 pixels and 33 million pixels, providing exceptional color information and dynamic range.

- The market is witnessing an increase in new product launches to cater to the growing demand for UHD content. Editing software compatibility and post-production workflows are also being prioritized to ensure a cinematic look for final outputs. Zoom range and video quality remain crucial factors for both broadcast and cinematography cameras, as social media content creation continues to gain traction.

How does Digital Broadcast and Cinematography Cameras market face challenges during its growth?

- In emerging economies, the low movie screen density poses a significant challenge to the growth of the film industry. This issue, characterized by a limited number of cinemas per capita, hinders the expansion of the market and the potential revenue generation for industry players. The market faces hindrances due to the low movie screen density in developing and underdeveloped economies. This issue is a significant barrier to market expansion, as the number of available movie screens per million population is substantially lower in these regions compared to developed nations. The primary reason for the low screen count is the limited cinema penetration in tier-II, tier-III, and tier-IV markets. Infrastructure constraints, communication barriers, and low disposable income are additional factors that can impede the growth of the movie industry in these areas. Professionals in event videography and news gathering require high-quality cameras for capturing images and recording extended periods.

- Image quality, recording time, external audio input, dynamic range, time lapse, slow motion, low light performance, pixel count, and SDI output are essential features for professional video production. These features enable the creation of deep visual content for broadcast television and other applications. Digital broadcast and cinematography cameras with interchangeable lenses offer flexibility and versatility to meet the diverse needs of professional videographers. Battery life is another crucial factor, ensuring uninterrupted recording during extended shoots. The market's growth may also be influenced by advancements in technology, such as improved low light performance and enhanced pixel count.

- Despite these opportunities, the market's expansion is hindered by the challenges in developing and underdeveloped economies.

Exclusive Customer Landscape

The digital broadcast and cinematography cameras market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the digital broadcast and cinematography cameras market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, digital broadcast and cinematography cameras market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Aaton Digital - This company specializes in advanced digital broadcast and cinematography cameras. Our offerings include in-camera time recording technology, adhering to Super16 film industry standards, and integrated video-assist functionality.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aaton Digital

- AbelCine

- ARRI AG

- Blackmagic Design Pty. Ltd.

- Canon Inc.

- FUJIFILM Holdings Corp.

- GoPro Inc.

- Grass Valley Canada

- Hitachi Ltd.

- JVCKENWOOD Corp.

- Kinefinity Inc.

- Nikon Corp.

- Panasonic Holdings Corp.

- Panavision Inc.

- RED Digital Cinema LLC

- Silicon Imaging Inc.

- Sony Group Corp.

- SZ DJI Technology Co. Ltd.

- Teledyne Technologies Inc.

- Vision Research Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Digital Broadcast And Cinematography Cameras Market

- In March 2023, Canon, a leading player in digital broadcast and cinematography cameras, launched its new EOS C70 Cinema Camera, marking a significant advancement in compact and versatile cinema production solutions (Canon Europe Press Release). This compact camera offers 4K RAW recording and Dual Gain Output (DGO) sensor technology, catering to the growing demand for high-quality, portable filmmaking equipment.

- In August 2024, Sony and Panasonic, two major players in the market, announced a strategic partnership to develop and manufacture advanced image sensors together (Sony Press Release). This collaboration is expected to strengthen both companies' positions in the market by combining their expertise and resources, leading to the creation of more innovative and competitive products.

- In December 2024, Blackmagic Design, an Australian technology company, raised over USD100 million in a funding round to accelerate its research and development efforts in digital broadcast and cinematography cameras (Bloomberg). This substantial investment will enable the company to expand its product line and enhance its technology, aiming to capture a larger share of the growing market.

- In February 2025, ARRI, a German film technology company, introduced its new ALEXA Mini LF Plus, a large-format digital film camera with improved ergonomics and workflow efficiency (ARRI Press Release). This technological advancement addresses the increasing demand for compact, high-performance cameras in the digital broadcast and cinematography market, offering filmmakers a more efficient and cost-effective solution for large-format filmmaking.

Research Analyst Overview

The market continues to evolve, driven by advancements in technology and expanding applications across various sectors. Image quality remains a key focus, with high pixel counts, bit depth, and color accuracy delivering cinematic looks for professional video production. The ability to capture still images and record for extended periods, external audio input, and SDI output are essential features for broadcast television and commercial production. Dynamic range, time lapse, slow motion, and low light performance are crucial for news gathering and documentary filmmaking, while HDR video and image processing enhance the viewing experience. The market caters to diverse needs, from entry-level cameras for independent filmmaking and online content creation to advanced cameras for film and corporate video production.

The Digital Broadcast and Cinematography Cameras Market is evolving rapidly with advancements in sensor size technology, enhancing still image capture quality. The demand for broadcast cameras is driven by high-resolution video production needs, while mirrorless cameras are gaining popularity for their compact design and superior performance. Traditional DSLR cameras remain relevant for photographers seeking versatility. Professionals prefer professional cameras with advanced features, while entry-level users opt for consumer cameras that balance quality and affordability.

Recording format, post-production workflows, and ease of use are critical factors, with wireless connectivity, remote control, and live streaming capabilities becoming increasingly important. Digital cinema cameras offer 8k resolution and raw image capture, catering to the highest standards in the industry. The market's continuous dynamism is reflected in the evolving patterns of video quality, color grading, and editing software compatibility. The ongoing unfolding of market activities is evident in the emergence of mirrorless cameras, high frame rates, and ISO sensitivity, as well as the integration of advanced autofocus performance, special effects, and shutter speed. The market's versatility extends to various industries, including sports broadcasting and social media content creation, further fueling its growth and innovation.

Dive into Technavio's strong research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Digital Broadcast And Cinematography Cameras Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

215 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.4% |

|

Market growth 2025-2029 |

USD 655.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.2 |

|

Key countries |

US, Canada, China, Japan, Germany, UK, India, France, Italy, and Spain |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Digital Broadcast And Cinematography Cameras Market Research and Growth Report?

- CAGR of the Digital Broadcast And Cinematography Cameras industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the digital broadcast and cinematography cameras market growth of industry companies

We can help! Our analysts can customize this digital broadcast and cinematography cameras market research report to meet your requirements.