Deodorants Market Size 2025-2029

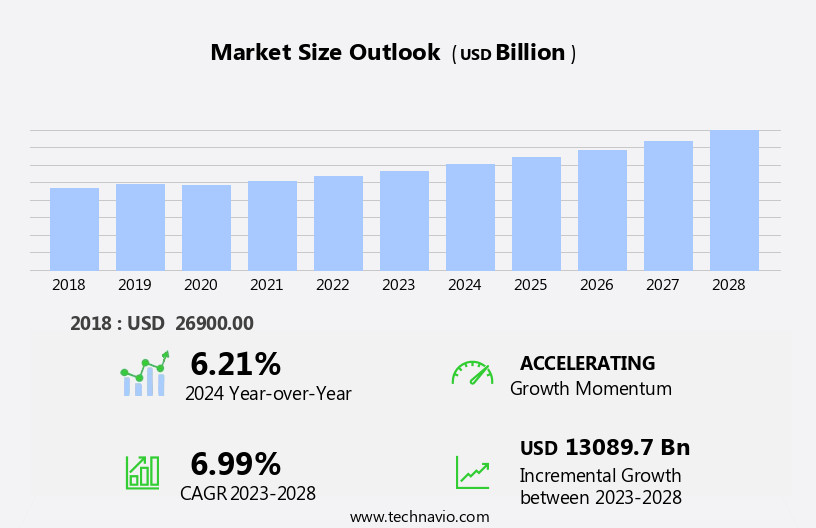

The deodorants market size is forecast to increase by USD 14.05 billion at a CAGR of 7.1% between 2024 and 2029.

- The market is driven by the improving living standards and increasing consumer awareness towards personal hygiene. As disposable income rises and populations become more urbanized, the demand for deodorants as a daily essential continues to grow. Innovative promotional activities by market players further fuel this trend, as companies invest in creative marketing strategies to attract and retain customers. However, the market faces significant challenges. Marketing campaigns focusing on health and wellness have further fueled demand.

- Companies must invest in robust counterfeit prevention measures to protect their brands and maintain consumer trust. Additionally, regulatory compliance remains a challenge, as governments around the world implement stricter regulations on deodorant ingredients and manufacturing processes. Adhering to these regulations can add costs and complexity to the supply chain, requiring companies to be agile and adaptable in their operations. Novel fragrances, such as rose extract, vanilla, waterlily, and argan oil, are also driving innovation in the market.

What will be the Size of the Deodorants Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The deodorant market is characterized by dynamic trends and evolving consumer preferences. Product development continues to be a key focus, with companies investing in innovative formulations and packaging designs to meet consumer demands. Distribution costs remain a significant factor, as wholesale distribution and online sales gain popularity. Travel-size deodorants and deodorant refills are popular choices for cost-conscious consumers, driving growth in this segment. To capitalize on market opportunities and navigate these challenges effectively, companies must focus on product innovation, supply chain efficiency, and strong brand management.

Private label deodorants and loyalty programs are effective retail strategies, as are POS displays and influencer marketing. Marketing costs, including PPC advertising, email marketing, and content marketing, are essential for brand awareness and market penetration. Sales volume is impacted by retail promotions and subscription services, as consumers seek convenience and value. Ingredient costs and packaging costs remain critical factors in the production process. The availability of counterfeit products poses a threat to both consumer safety and brand reputation. These counterfeits, often sold at lower prices, can lead to consumer dissatisfaction and erode trust in the market.

How is this Deodorants Industry segmented?

The deodorants industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Men

- Women

- Product

- Deodorant sprays

- Roll-on deodorants

- Sticks and solid deodorants

- Others

- Source

- Alcohol-based

- Aluminum-free

- Natural or organic

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

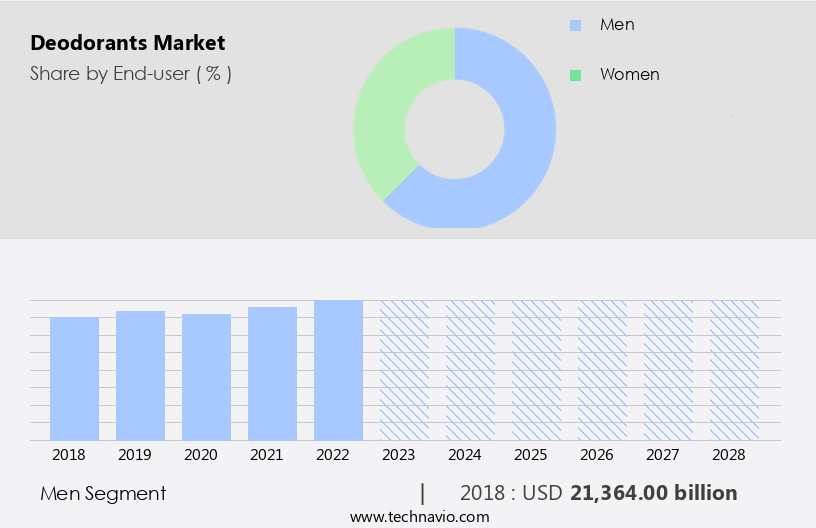

By End-user Insights

The Men segment is estimated to witness significant growth during the forecast period. In the dynamic deodorant market, cream and essential oil variants continue to gain popularity among consumers, driven by their natural and gentle formulations. Brand loyalty remains a significant factor, with consumers preferring trusted brands that cater to their specific needs. Charcoal deodorants and those offering 48-hour protection are in high demand due to their effectiveness. Distribution channels continue to expand, with online sales growing rapidly. Shelf life and consumer preferences shape manufacturing processes, while teen deodorants and baking soda alternatives cater to niche markets. Ingredient sourcing and sustainability initiatives are crucial, as parabens-free and alcohol-free deodorants gain traction. Women's, men's, and sensitive skin deodorants each hold distinct market shares.

Sales forecasts predict steady growth, with clinical-strength and antibacterial deodorants catering to specific consumer needs. Product innovation and product lifecycle management remain essential, with fragrance-free, roll-on, long-lasting, and 24-hour protection deodorants leading the way. Competitive landscape analysis, safety testing, and pricing strategies shape the market, with active, botanical, solid, aerosol, natural, organic, probiotic, and spray deodorants catering to diverse consumer preferences. The deodorant market is expected to experience robust growth in the coming years, driven by improving living standards, innovative marketing strategies, and the rising demand for natural and organic products with deodorant and antiperspirant ingredients.

The Men segment was valued at USD 22.35 billion in 2019 and showed a gradual increase during the forecast period.

The Deodorants Market is experiencing dynamic growth, driven by evolving consumer preferences and lifestyle choices. There's a rising demand for cream deodorants, favored for their gentle formulation and easy application method. Distinct segments like men's deodorants and women's deodorants are expanding with tailored fragrances and functionality. A significant trend is the popularity of longlasting deodorants, catering to active lifestyles that demand all-day freshness. Meanwhile, alcoholbased deodorants remain a staple for their quick-drying and antibacterial properties. Novel fragrances, such as those inspired by wild roses, vanilla, waterlily, and argan oil, are gaining popularity.

The Deodorants Market is evolving as brands explore both traditional retail sales and innovative direct-to-consumer (DTC) sales strategies. Shifting consumer perception is shaped by authentic customer reviews and interactive social media marketing, which fuel brand visibility and loyalty. Precision-targeted pay-per-click (PPC) advertising and broader online advertising campaigns are boosting digital presence. In-store tactics like point-of-sale (POS) displays and engaging sampling programs continue to influence impulse purchases. Behind the scenes, advanced data analytics and real-time market intelligence empower brands to track trends, personalize offerings, and stay competitive.

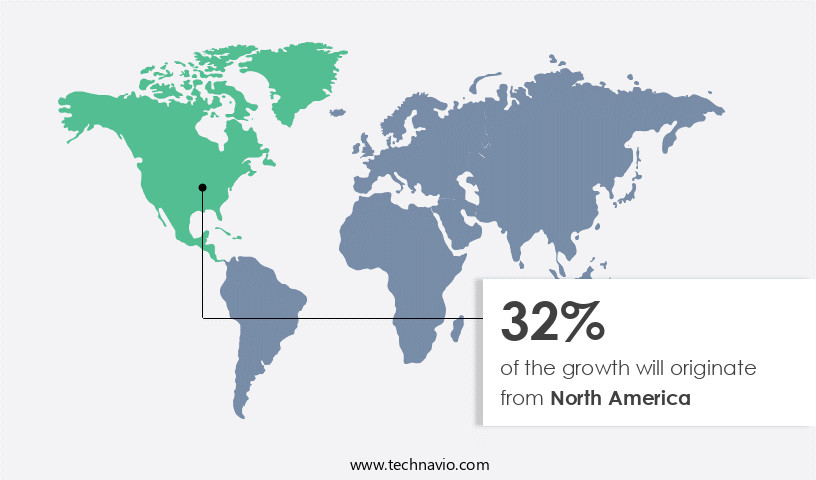

Regional Analysis

APAC is estimated to contribute 33% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In the North American market, the deodorants sector experiences significant growth due to various factors. The region's dominance is primarily driven by the Millennial, Generation X, and Baby Boomer populations' increased spending on grooming products to maintain a fashionable image. Furthermore, the expanding working population and rising disposable income contribute to market expansion. Consumer preferences lean towards organic deodorants, reflecting the region's health-conscious culture. For instance, Blended Strategy Group, a marketing firm based in Los Angeles, introduced an organic deodorant brand in both the US and Canada in November 2024. Brand loyalty is crucial in the market, with consumers showing preference for long-lasting, 24-hour protection deodorants.

Charcoal deodorants and alcohol-free options have gained popularity due to their effectiveness and appeal to health-conscious consumers. Manufacturing processes are continually evolving, with an emphasis on sustainability initiatives and parabens-free ingredients. The competitive landscape is diverse, featuring cream, roll-on, solid, and aerosol deodorants. Essential oil deodorants and baking soda deodorants cater to niche markets, while clinical-strength deodorants address specific consumer needs. Sales forecasts indicate continued growth, with sales expected to reach new heights. Product innovation is a key driver in the market, with brands introducing new scents, application methods, and formulations. Fragrance-free deodorants and sensitive skin options cater to a growing consumer base.

Safety testing and environmental impact are crucial considerations for both manufacturers and consumers. Active deodorants, botanical deodorants, and probiotic deodorants are gaining traction due to their natural appeal and perceived health benefits. Pricing strategies vary, with premium options targeting high-end consumers and budget-friendly options catering to cost-conscious shoppers. Distribution channels have evolved, with online platforms becoming increasingly popular for purchasing deodorants. Shelf life, customer satisfaction, and product lifecycle management are essential factors for manufacturers to ensure success in this dynamic market.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Deodorants market drivers leading to the rise in the adoption of Industry?

- The essential factor fueling market growth is the continuous enhancement of living standards. The global deodorant market is experiencing significant growth, driven by the increasing demand from millennials who prioritize personal grooming and exotic fragrances. With improving living standards and expanding middle-income demographics, consumer spending continues to rise, particularly in the fragrance industry. Millennials, aged roughly 28 to 43, are highly brand-conscious and value quality, often willing to pay more for deodorants that align with their identity and preferences. Two key trends in the market include the increasing demand for alcohol-free and parabens-free deodorants due to growing environmental concerns and health awareness. Additionally, there is a rising preference for scent profiles that cater to unique and youthful fragrances.

- Deodorant sticks remain the most popular format, but alcohol-free deodorants are gaining popularity due to their milder application and reduced environmental impact. Moreover, there is a growing demand for aluminum-free and clinical-strength deodorants, catering to consumers seeking effective and natural alternatives. Sales forecasts indicate continued growth in the market, with the industry expected to reach significant revenue by 2024. Overall, the deodorant market is a dynamic and evolving industry, driven by changing consumer preferences and a focus on quality and sustainability. Young people, both male and female, are prioritizing hygiene and freshness, leading to a significant increase in sales of deodorants and antiperspirants as well as natural and organic personal care products.

What are the Deodorants market trends shaping the Industry?

- The use of innovative promotional activities is becoming a mandatory trend in the upcoming market. Professionals in marketing are increasingly focusing on creative and knowledgeable approaches to engage consumers and differentiate their brands. Deodorants are a staple in the personal care market, with consumers prioritizing long-lasting protection, product innovation, and fragrance-free options. Skin irritation is a concern for some users, leading to the popularity of botanical and active deodorants. Product lifecycle management is crucial for companies to maintain competitiveness, with roll-on and 24-hour protection deodorants being popular choices.

- Safety testing is essential in ensuring the quality and safety of deodorants. The competitive landscape analysis reveals a focus on innovation, with companies introducing new fragrances and advanced formulations to cater to diverse consumer preferences. Pricing strategies, such as product bundling, play a significant role in attracting price-sensitive consumers. Combining a deodorant with a matching perfume or bundling men and women deodorants together can enhance perceived value and encourage brand loyalty.

How does Deodorants market face challenges during its growth?

- The proliferation of counterfeit products poses a significant challenge to the industry, hindering its growth and undermining consumer trust. The deodorant market is experiencing significant growth due to the increasing consumer preference for personal hygiene and odor control. Two primary categories of deodorants, solid and aerosol, cater to various consumer needs. Sustainability initiatives, such as antibacterial properties in deodorants, have gained traction, leading to the development of natural, organic, probiotic, and sensitive skin options. However, the market faces challenges, primarily from counterfeit products. The use of natural ingredients, such as argan oil and essential oils, adds to the appeal of these offerings.

- E-commerce platforms and live-shopping channels have made it easier for counterfeiters to reach consumers, especially in regions with limited regulatory oversight. Sophisticated packaging and branding techniques make it challenging for buyers to distinguish between authentic and fake goods, necessitating heightened vigilance and awareness. Antibacterial deodorants, solid deodorants, and aerosol deodorants cater to diverse consumer preferences. The market dynamics remain influenced by factors such as consumer trends, product innovation, and regulatory requirements. In 2024, the proliferation of these counterfeits poses a serious threat to consumer safety and brand integrity. Counterfeit deodorants, often manufactured using substandard or hazardous materials, can lead to health issues.

Exclusive Customer Landscape

The deodorants market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the deodorants market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, deodorants market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Chic Cosmetic Industries 1989 Ltd. - The company specializes in deodorants and offers its range of products under the brand name Lavilin.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Chic Cosmetic Industries 1989 Ltd.

- Colgate Palmolive Co.

- Firmenich SA

- Giorgio Armani SpA

- Henkel AG and Co. KGaA

- Hermes International SA

- ITC Ltd.

- LOreal SA

- LVMH Moet Hennessy Louis Vuitton SE

- MacAndrews and Forbes Inc.

- maxingvest AG

- Pharmaceutical Specialties Inc.

- PVH Corp.

- S.C. Johnson and Son Inc.

- The Estee Lauder Co. Inc.

- The Procter and Gamble Co.

- Unilever PLC

- Vanesa Care Pvt. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Deodorants Market

- In January 2024, Unilever, a leading consumer goods company, launched a new line of natural deodorants under its Schmidt's brand, catering to the growing demand for clean label personal care products (Unilever Press Release, 2024).

- In March 2024, Procter & Gamble (P&G) and L'Oréal, two major players in the deodorant market, announced a strategic partnership to co-create and co-manufacture deodorants using recycled plastic, reducing their environmental footprint (P&G and L'Oréal Press Release, 2024).

- In April 2025, Edgewell Personal Care, a leading deodorant manufacturer, completed the acquisition of Teva Pharmaceutical Industries' personal care business, expanding its reach in the European market and strengthening its product portfolio (Edgewell Personal Care Press Release, 2025).

- In May 2025, the European Commission approved the use of certain natural ingredients in deodorants, paving the way for more eco-friendly and consumer-friendly products (European Commission Press Release, 2025).

Research Analyst Overview

The deodorant market continues to evolve, with dynamic market trends shaping its growth and application across various sectors. Product innovation remains a key driver, as manufacturers introduce new offerings to cater to diverse consumer preferences. Skin irritation concerns have led to the development of fragrance-free, parabens-free, and aluminum-free deodorants. Roll-on, long-lasting, and 24-hour protection deodorants are gaining popularity for their effectiveness. Product lifecycle management is crucial in this industry, with manufacturers constantly updating their offerings to meet changing consumer demands. The competitive landscape is characterized by intense competition, with players focusing on safety testing, pricing strategies, and sustainability initiatives to gain a competitive edge.

Active deodorants, botanical deodorants, and probiotic deodorants are emerging categories, reflecting the ongoing quest for effective, natural, and eco-friendly solutions. Consumer preferences for specific application methods, such as roll-on, stick, spray, or solid, continue to influence market dynamics. The distribution channels are expanding, with online sales gaining traction. The market's evolution is not limited to traditional deodorants; new categories, such as alcohol-free, essential oil, and charcoal deodorants, are disrupting the status quo. Manufacturing processes, ingredient sourcing, and scent profiles are critical aspects of the deodorant market, with companies investing in research and development to create innovative, high-quality products.

The market's environmental impact is a growing concern, with manufacturers focusing on reducing waste and using eco-friendly packaging. The deodorant market's continuous dynamism offers significant growth opportunities, particularly in niche categories such as teen, sensitive skin, and clinical-strength deodorants. The market's future is shaped by ongoing product innovation, evolving consumer preferences, and competitive landscape analysis.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Deodorants Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

215 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.1% |

|

Market growth 2025-2029 |

USD 14.05 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.5 |

|

Key countries |

US, Germany, UK, Canada, India, China, France, Japan, Italy, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Deodorants Market Research and Growth Report?

- CAGR of the Deodorants industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the deodorants market growth of industry companies

We can help! Our analysts can customize this deodorants market research report to meet your requirements.