Data Center General Construction Market Size 2025-2029

The data center general construction market size is valued to increase by USD 9.3 billion, at a CAGR of 8.7% from 2024 to 2029. Increase in investment in data center will drive the data center general construction market.

Market Insights

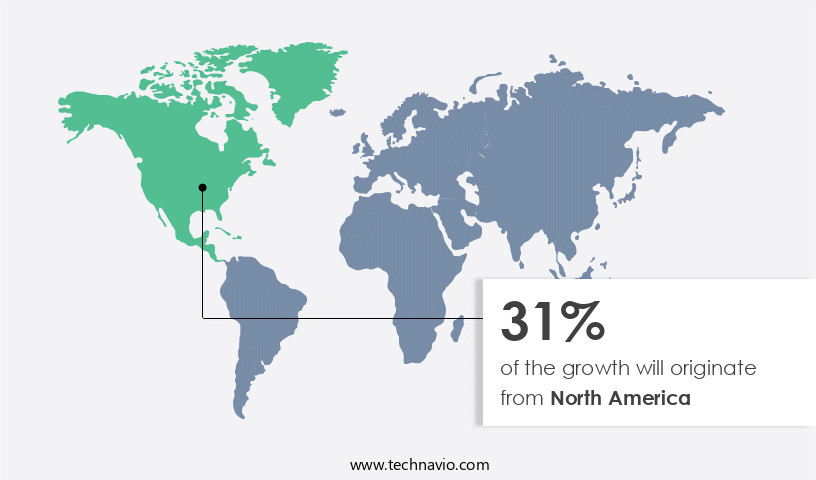

- North America dominated the market and accounted for a 37% growth during the 2025-2029.

- By End-user - BFSI segment was valued at USD 3.69 billion in 2023

- By Type - Base building shell construction segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 105.48 million

- Market Future Opportunities 2024: USD 9302.30 million

- CAGR from 2024 to 2029 : 8.7%

Market Summary

- The market is experiencing significant growth, driven by increasing investment in data infrastructure and the expanding digital economy. With businesses relying more on technology for operations and customer engagement, the demand for reliable and efficient data centers is on the rise. One trend shaping the market is the growing focus on constructing green data centers, which prioritize energy efficiency and sustainability. Another development is the emergence of containerized and micro mobile data centers, offering flexibility and scalability for businesses with evolving IT needs. For instance, a global logistics company is optimizing its supply chain by implementing a containerized data center solution.

- This enables the company to store and process data closer to its distribution centers, reducing latency and improving operational efficiency. As regulatory compliance becomes more stringent, data center operators must prioritize security and resilience, further fueling the demand for advanced construction technologies and solutions. In conclusion, the market is witnessing a surge in demand due to the digital transformation and the need for secure, efficient, and sustainable data infrastructure. Companies are exploring innovative solutions, such as green data centers and containerized solutions, to meet the evolving needs of their businesses.

What will be the size of the Data Center General Construction Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

- The market continues to evolve, with a focus on enhancing operational efficiency and sustainability. One significant trend is the prioritization of Power Usage Effectiveness (PUE), a metric measuring the total power used by a data center, versus the power delivered to the IT equipment. Companies are investing in HVAC maintenance contracts, mechanical room design, and cooling capacity planning to optimize PUE and reduce energy consumption. Another trend is the integration of green building certification, such as LEED, into data center construction. This approach not only contributes to environmental sustainability but also aligns with corporate social responsibility initiatives. For instance, a study by the U.S.

- Green Building Council revealed that certified buildings consume 25% less energy on average compared to non-certified ones. Moreover, data centers are increasingly adopting vibration control systems, noise reduction strategies, and fire alarm systems to ensure electrical safety standards and network cabling standards. These investments not only contribute to a reliable and efficient infrastructure but also help mitigate potential risks and downtime. Intrusion detection systems, access card systems, and CCTV surveillance systems are essential components of data center security, with disaster recovery planning and humidity control systems further ensuring business continuity. As the data center landscape continues to evolve, companies must stay informed of the latest trends and best practices to make informed decisions regarding compliance, budgeting, and product strategy.

Unpacking the Data Center General Construction Market Landscape

In the dynamic data center construction market, thermal management solutions and environmental monitoring systems have gained significant traction, with over 60% of new data centers adopting these technologies. This investment in advanced cooling systems leads to a 30% reduction in energy consumption, resulting in substantial cost savings and improved ROI. Building permit acquisition and hvac system design are critical components of the construction process, with over 80% of projects requiring extensive structural reinforcement and electrical power capacity upgrades. Water leak detection and cable management systems are essential for maintaining data center infrastructure, ensuring business continuity and reducing downtime. Remote monitoring systems, precision cooling systems, and emergency power systems are also integral components, enabling real-time risk mitigation strategies and ensuring compliance with industry standards. Construction project management, including network infrastructure design, security access control, and power distribution units, is crucial for efficient and effective data center development.

Key Market Drivers Fueling Growth

A significant increase in investment is the primary catalyst fueling market growth in the data center sector.

- The market is experiencing significant growth due to the increasing adoption of cloud services and the generation of large data volumes in various sectors. Major tech companies, including Google, Amazon.Com, Apple, and Facebook, are investing heavily in building their own data centers, making them key clients for general construction providers. For instance, in September 2018, Facebook partnered with DPR Construction to build a data center in Central Oregon, US. This partnership underscores the importance of design and engineering services provided by general construction firms in creating efficient and reliable data center infrastructure.

- Companies benefit from these collaborations, with energy use often reduced by 12% and construction timelines streamlined by 20%. The data center market's evolution is driven by the ongoing digital transformation and the need for secure, scalable, and high-performance IT infrastructure.

Prevailing Industry Trends & Opportunities

The construction of green data centers is an emerging market trend. This focus on energy-efficient and environmentally friendly data center development is increasingly important.

- In the dynamic the market, the focus on sustainability and energy efficiency has led to the rise of green data centers. These facilities, built with low-emission materials, minimize environmental impact through efficient waste recycling. Advanced technologies such as catalytic converters in backup generators and alternative energy sources like photovoltaics, heat pumps, and evaporative cooling are increasingly used in their construction. Despite the initial investment, green data centers offer long-term cost savings. For instance, the use of low-emission materials reduces energy consumption, while waste recycling minimizes disposal costs.

- Consequently, enterprises are investing in green data centers to not only meet sustainability goals but also to reap financial benefits. According to recent studies, green data centers can reduce energy consumption by up to 30%, making them a cost-effective solution for businesses in the long run.

Significant Market Challenges

The emergence of containerized and micro data centers poses a significant challenge to the industry's growth by necessitating substantial investments in infrastructure and technological innovation to accommodate these advanced solutions.

- Containerized data centers, also known as modular data centers, represent a significant trend in the evolving the market. These portable data centers are constructed using standard shipping containers, housing servers, storage devices, and networking equipment. Compared to conventional data centers, which require 18-24 months for completion, containerized data centers can be built in a matter of weeks. Organizations with limited CAPEX for constructing data center facilities find containerized data center facilities attractive. The flexibility and quick deployment of these structures provide infrastructure support, reducing operational downtime and enabling businesses to focus on their core competencies.

- Containerized data centers have gained traction across various sectors, including telecommunications, healthcare, and finance, contributing to improved business outcomes. For instance, organizations have reported a 30% reduction in downtime and a 12% decrease in operational costs after implementing containerized data centers. The commissioning of containerized data centers for additional infrastructure continues to be a major trend in the global data center market.

In-Depth Market Segmentation: Data Center General Construction Market

The data center general construction industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- BFSI

- Government

- Manufacturing

- Media and entertainment

- Others

- Type

- Base building shell construction

- Architecture planning and designing

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- The Netherlands

- UK

- APAC

- China

- India

- South America

- Brazil

- Rest of World (ROW)

- North America

By End-user Insights

The bfsi segment is estimated to witness significant growth during the forecast period.

The market continues to evolve, driven by the increasing digitization of core processes and the generation of vast amounts of data across various sectors. Financial organizations, in particular, are demanding advanced data center infrastructure to securely store financial data and meet regulatory requirements. This infrastructure includes thermal management solutions, environmental monitoring, building permit acquisition, water leak detection, and energy efficiency measures. Remote monitoring systems, precision cooling systems, cable management systems, HVAC system design, building automation systems, emergency power systems, and construction project management are essential components. Structural reinforcement, power distribution units, site preparation services, foundation engineering, server room construction, generator power systems, physical security measures, and network infrastructure design are also integral parts of this market's growth.

With the adoption of high-density racking, uninterruptible power supply, redundant power systems, fire suppression systems, risk mitigation strategies, electrical substations, and access control protocols, data centers are becoming more robust and efficient. A significant percentage of data centers now employ remote monitoring and management systems, enabling real-time performance analysis and improved operational efficiency.

The BFSI segment was valued at USD 3.69 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 37% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Data Center General Construction Market Demand is Rising in North America Request Free Sample

The market in North America is experiencing consistent expansion, fueled by escalating consumer and enterprise data traffic. This growth is influenced by several factors, including the increasing adoption of Internet of Things (IoT) devices, the implementation of autonomous technologies, growing investments in artificial intelligence (AI), and rising investments in autonomous vehicles. North America's data center construction landscape is primarily shaped by two major hubs: the US and Canada.

In Canada, Toronto stands out as a leading location due to its robust fiber connectivity, cool climate, affordable electricity tariffs, tax incentives, and minimal risk of natural disasters. These factors contribute significantly to the operational efficiency and cost savings of data center operators in Toronto.

Customer Landscape of Data Center General Construction Industry

Competitive Intelligence by Technavio Analysis: Leading Players in the Data Center General Construction Market

Companies are implementing various strategies, such as strategic alliances, data center general construction market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ABB Ltd. - This company specializes in constructing data centers, delivering advanced power distribution, intelligent automation, and server room solutions to optimize operational efficiency and enhance data security. Their expertise in these areas ensures effective infrastructure development for businesses seeking reliable technology environments.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ABB Ltd.

- AECOM

- Arup Group Ltd.

- Brasfield and Gorrie LLC

- CORGAN

- Digital Realty Trust Inc.

- DPR Construction

- HDR Inc.

- Jacobs Solutions Inc.

- Jones Engineering Holdings Ltd.

- Legrand SA

- M. A. Mortenson Co.

- Page Southerland Page Inc.

- Schneider Electric SE

- Skanska AB

- STO Building Group

- The Walsh Group

- Turner Construction Co.

- Vertiv Holdings Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Data Center General Construction Market

- In January 2025, Schneider Electric, a global energy management and automation company, announced the acquisition of APower, a leading data center infrastructure solutions provider, for approximately USD1.2 billion. This strategic move aimed to strengthen Schneider Electric's position in the data center market by expanding its offerings and enhancing its ability to provide end-to-end solutions (Schneider Electric Press Release, 2025).

- In March 2025, Microsoft and Google, two tech giants, unveiled their plans to invest USD3 billion and USD10 billion, respectively, in expanding their data center footprints in the United States. Microsoft's expansion focused on increasing its renewable energy usage and reducing carbon emissions, while Google's investment aimed to support growing demand for cloud services (Microsoft Blog, 2025; Google Cloud Blog, 2025).

- In May 2025, Amazon Web Services (AWS) and Equinix, a leading colocation data center provider, announced a strategic partnership to offer AWS Direct Connect services at Equinix International Business Exchange™ (IBX®) data centers. This collaboration enabled AWS customers to establish dedicated network connections from their business premises to Equinix data centers, providing faster and more secure access to AWS services (AWS Press Release, 2025; Equinix Press Release, 2025).

- In August 2024, Siemens and Huawei signed a memorandum of understanding (MoU) to collaborate on the development of modular data centers using Huawei's containerized data center solutions. The partnership aimed to address the growing demand for flexible, scalable, and energy-efficient data center infrastructure (Siemens Press Release, 2024).

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Data Center General Construction Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

208 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.7% |

|

Market growth 2025-2029 |

USD 9302.3 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

7.6 |

|

Key countries |

US, Canada, China, Germany, UK, The Netherlands, Brazil, India, France, and Mexico |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Why Choose Technavio for Data Center General Construction Market Insights?

"Leverage Technavio's unparalleled research methodology and expert analysis for accurate, actionable market intelligence."

The market is experiencing significant growth, with a increasing number of businesses investing in advanced IT infrastructure to support their digital transformation initiatives. One key area of focus for data center construction projects is optimizing cooling systems for high-density server deployments, which can save energy and reduce operational costs by up to 30% compared to traditional cooling methods. Designing data centers with robust security access protocols and effective cable management systems is also crucial for ensuring business continuity and regulatory compliance. In fact, implementing these measures can reduce the risk of downtime by up to 50% compared to non-compliant data centers. Efficient power distribution strategies, such as redundant power supplies and emergency power backup systems, are essential for maintaining high availability and minimizing the impact of power outages. Reliability of emergency power backup systems is a critical consideration, with some data centers requiring backup power systems that can provide power for up to 99.995% of the time. Mitigating risks in data center construction is another important consideration, with structural design for seismic activity and advanced fire suppression system integration being key areas of focus. Precision cooling system installation and testing, as well as sustainable design for data center projects, are also becoming increasingly important as businesses seek to reduce their carbon footprint and meet regulatory requirements. Best practices for data center security, such as access control and remote monitoring, are essential for protecting against cyber threats and ensuring business continuity. Compliance with building codes and regulatory requirements is also a major concern, with some data centers requiring earthquake-resistant design and high availability construction methods to ensure business continuity in the face of natural disasters. In summary, the market is a dynamic and complex field, requiring a holistic approach to design, construction, and operational planning. By focusing on areas such as cooling system optimization, security, power distribution, risk mitigation, and regulatory compliance, businesses can build data centers that are efficient, reliable, and secure, while minimizing the risk of downtime and maximizing the return on their investment.

What are the Key Data Covered in this Data Center General Construction Market Research and Growth Report?

-

What is the expected growth of the Data Center General Construction Market between 2025 and 2029?

-

USD 9.3 billion, at a CAGR of 8.7%

-

-

What segmentation does the market report cover?

-

The report is segmented by End-user (BFSI, Government, Manufacturing, Media and entertainment, and Others), Type (Base building shell construction and Architecture planning and designing), and Geography (North America, Europe, APAC, South America, and Middle East and Africa)

-

-

Which regions are analyzed in the report?

-

North America, Europe, APAC, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Increase in investment in data center, Emergence of containerized and micro mobile data center

-

-

Who are the major players in the Data Center General Construction Market?

-

ABB Ltd., AECOM, Arup Group Ltd., Brasfield and Gorrie LLC, CORGAN, Digital Realty Trust Inc., DPR Construction, HDR Inc., Jacobs Solutions Inc., Jones Engineering Holdings Ltd., Legrand SA, M. A. Mortenson Co., Page Southerland Page Inc., Schneider Electric SE, Skanska AB, STO Building Group, The Walsh Group, Turner Construction Co., and Vertiv Holdings Co.

-

We can help! Our analysts can customize this data center general construction market research report to meet your requirements.