Europe Craft Beer Market Size 2025-2029

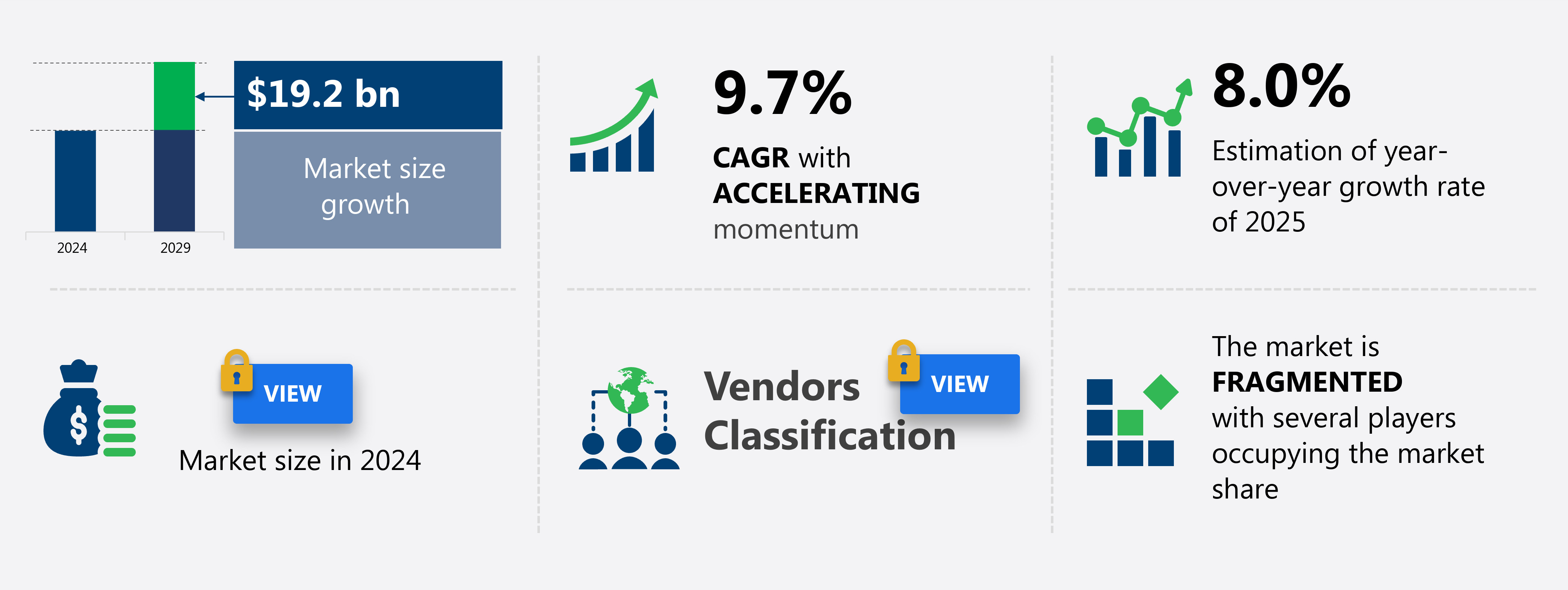

The craft beer market size in Europe is forecast to increase by USD 19.2 billion at a CAGR of 9.7% between 2024 and 2029.

-

The European craft beer market is experiencing significant growth, driven by the increasing number of microbreweries and craft breweries emerging across the region. This trend is fueled by consumers' growing preference for unique, locally produced beer varieties. Moreover, the market is witnessing an uptick in partnerships, agreements, and mergers and acquisitions, as larger players seek to expand their reach and market share. Convenience stores and retail shops have also entered the market, offering a more accessible distribution channel for consumers.

-

However, stringent regulations and heavy taxation for alcoholic beverages pose challenges to market growth. Despite these hurdles, the market's dynamic nature and consumer demand for authentic, artisanal beer continue to drive innovation and expansion opportunities. Companies that can navigate these complexities and adapt to evolving consumer preferences stand to gain a competitive edge in the European craft beer landscape.

What will be the Size of the Market During the Forecast Period?

The European craft beer market continues to evolve, with consumer preferences shifting towards flavorful options and innovative brews. Urbanization and the rise of millennials and Gen Z have led to an increase in the number of brewpubs, and craft production facilities, and a rising demand for microbrewery equipment. Bottom fermenting and top fermented yeast are used in the production of both craft ale and lager, catering to diverse tastes. The alcoholic beverage sector sees growth in low alcohol beers and no alcohol options, appealing to health-conscious Gen Z consumers.

Independent breweries employ advanced beer brewing technologies to create unique, organic flavors, such as CBD-infused beers. Off trade retail shops report increased sales, while on trade establishments adapt to meet consumer demands. The craft beer industry's dynamic landscape reflects the market's ongoing evolution, with large beer companies also investing in craft beer and low alcohol beverages to stay competitive. However, the rise of off-trade channels has also led to concerns regarding counterfeit products, necessitating increased vigilance and quality control measures.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Distribution Channel

- Off-trade

- On-trade

- Product

- IPA-based craft beer

- Seasonal-based craft beer

- Pale ale-based craft beer

- Amber ale-based craft beer

- Others

- Geography

- Europe

- Germany

- Poland

- Russia

- UK

- Europe

By Distribution Channel Insights

The Off-trade segment is estimated to witness significant growth during the forecast period. In Europe's thriving craft beer market, off-trade channels have emerged as a popular distribution method for consumers seeking varied tastes and innovative flavors. Moreover, social networking through social media platforms is playing a crucial role in promoting craft beer consumption through local events and innovative marketing strategies. Supermarkets and hypermarkets, such as Tesco Plc and Carrefour SA, are major players in this sector, offering a wide selection of craft beers at competitive prices. The off-trade distribution model allows consumers to explore different craft beer brands at their convenience, without the added costs associated with on-trade channels. Moreover, health-conscious consumers are increasingly turning to craft beer, which is often produced using superior brewing technologies and premium ingredients.

Social media platforms have played a significant role in promoting these beverages, enabling craft breweries to reach younger generations, including Gen Z. Craft beer consumption continues to grow, with trends leaning towards flavorful options, including CBD infused beers and low alcohol beers. The craft beer industry is characterized by independent breweries producing premium products using diverse distillation techniques, such as bottom and top fermenting. Despite the hectic lifestyles of modern consumers, there is a strong emphasis on beer quality and alcohol tolerance. Additionally, the legalization of cannabis in several regions is influencing the beer market, with some consumers turning to cannabis-infused beers as an alternative to traditional options.

Get a glance at the market report of share of various segments Request Free Sample

Market Dynamics

Our Europe Craft Beer Market researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Europe Craft Beer Market?

-

Growing number of microbreweries and craft breweries is the key driver of the market. Europe's alcohol beverage market has experienced a notable increase in craft beer consumption due to the rising preference for flavorful options among consumers. The continent's beer scene has seen a rise in microbreweries and craft breweries, driven by the demand for high-quality beer and unique varieties. Consumers in countries like Germany and the UK, known for their traditional beer styles, are now seeking out IPAs and other craft ales. This trend is not limited to these countries, as beer enthusiasts across Europe continue to explore new and exciting beer options.

-

Local events, such as beer festivals and tastings, provide opportunities for consumers to discover and sample these new brews. Additionally, some breweries are offering CBD-infused beers, adding another layer of innovation to the market. Overall, the European craft beer market is dynamic, with brewers continually striving to meet the evolving preferences of consumers. Off-trade channels, including retail shops, convenience stores, and e-commerce platforms, dominate distribution.

What are the market trends shaping the Europe Craft Beer Market?

-

Increasing number of partnerships, agreements, and mergers and acquisitions activities is the upcoming trend in the market. The European craft beer market is experiencing significant growth, driven in part by an increasing number of mergers and acquisitions. These deals enable larger companies to expand their market shares, gain access to new products and technologies, and enhance their supply chain efficiency. The popularity of craft beer has led major players to acquire smaller, specialized breweries, bolstering their product offerings.

-

Furthermore, strategic partnerships with regional macro breweries and distributors facilitate market entry into new regions and the introduction of innovative beverages. This dynamic market environment underscores the importance of staying informed and agile for businesses looking to capitalize on the growing demand for premium, top-fermented alcoholic beverages, including low alcohol and organic flavors, as well as no alcohol options. Moreover, alternatives to alcoholic drinks, including non-alcoholic and low-alcohol beers, cater to health-conscious consumers and changing demographics.

What challenges does Europe Craft Beer Market face during the growth?

-

Stringent regulations and heavy taxation for alcoholic beverages is a key challenge affecting the market growth. The European craft beer market is subject to stringent regulations and taxation policies, which companies must adhere to for marketing and consumption. Compliance with these rules is essential to ensure consumer safety and health. Regulatory bodies closely scrutinize ingredients and packaging labels before allowing craft beer to be sold in shops. These regulations aim to prevent the sale of contaminated or defectively packaged alcoholic beverages.

-

The craft beer industry in Europe is characterized by bottom fermenting techniques and a growing preference among young drinkers for healthier beverage options. Despite the hectic lifestyles of modern consumers, there is a significant demand for craft production and craft lager. companies must navigate the intricacies of various sectoral laws, regulations, and taxation policies to remain competitive in this market.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast , partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Anheuser Busch InBev SA NV - This Brazilian beverage corporation specializes in the production and distribution of popular craft beer brands, including Aguila, Brahma, and Cass.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Anheuser Busch InBev SA NV

- Asahi Group Holdings Ltd.

- Brasserie De La Senne

- BrewDog Plc

- Buxton Brewery Co. Ltd.

- Carlsberg Breweries AS

- Cloudwater Brew Co.

- Diageo PLC

- Duvel Moortgat NV

- German Kraft Brewery Ltd

- Heineken NV

- Lervig AS

- Magic Rock Brewing Co. Ltd.

- Mikkeller APS

- Stone Brewing Co. LLC

- Swinkels Family Brewers

- The Boston Beer Co. Inc.

- Thornbridge Brewery

- VAN PUR S.A.

- Wild Beer Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Craft Beer Market In Europe

- In January 2024, Heineken, a leading international brewer, announced the acquisition of a 49% stake in the popular Czech craft brewery, Radegast, marking a strategic move to expand its craft beer portfolio (Heineken Press Release, 2024).

- In March 2024, Carlsberg Group and Danish microbrewery, Mikkeller, unveiled their partnership, launching a new craft beer brand called "Carlsberg Mikkeller," aiming to cater to the growing demand for craft beers in Europe (Carlsberg Press Release, 2024).

- In May 2024, the European Union (EU) approved new regulations allowing craft breweries to produce up to 50,000 hectoliters per year without needing to install costly pollution control equipment, significantly reducing the regulatory burden for small breweries (EU Commission Press Release, 2024).

- In February 2025, AB InBev, the world's largest brewer, revealed plans to invest ⬠100 million in its European craft beer business, Bohemia Interbrew, to expand its production capacity and distribution network (AB InBev Press Release, 2025).

Research Analyst Overview

The European craft beer market continues to evolve, driven by consumer preferences for innovative flavors and superior beer quality. Brewing technologies advance, leading to the production of varied tastes and styles, from craft ale to light lager and flavorful options. Social media plays a significant role in promoting these alcoholic craft beverages, reaching a wide audience and fostering a sense of community among health-conscious consumers. Local events and festivals showcase the best of the craft beer industry, providing opportunities for direct engagement with independent breweries and their premium products. The market's dynamics are influenced by various sectors, including on-trade channels and off-trade retail shops.

Counterfeit products pose a challenge, as consumers seek authenticity and transparency. Younger generations, such as Gen Z, are driving the demand for low alcohol beers and organic flavors, reflecting changing consumer preferences and hectic lifestyles. CBD infused beers and distillation techniques, like bottom fermenting and top fermented yeast, add to the market's complexity, catering to diverse alcohol tolerance levels and consumer preferences. The craft beer industry remains dynamic, with continuous innovation and adaptation to meet the evolving needs of its consumers.

The European craft beer market is evolving as health conscious consumers increasingly seek no alcohol beers that align with their lifestyles. These options offer health benefits like fewer calories and safer choices during social gatherings, without compromising flavor. As alcohol consumption trends shift, breweries are innovating to meet demand for popular drinks with authenticity and wellness in mind. Sales through off trade channels, including supermarkets and specialty stores, are rising rapidly.

Dive into Technavio's strong research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Craft Beer Market in Europe insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

181 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.7% |

|

Market growth 2025-2029 |

USD 19.2 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

8.0 |

|

Key countries |

Germany, UK, Poland, Russia, and Rest of Europe |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Europe

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch