Corrugated Box Market Size 2024-2028

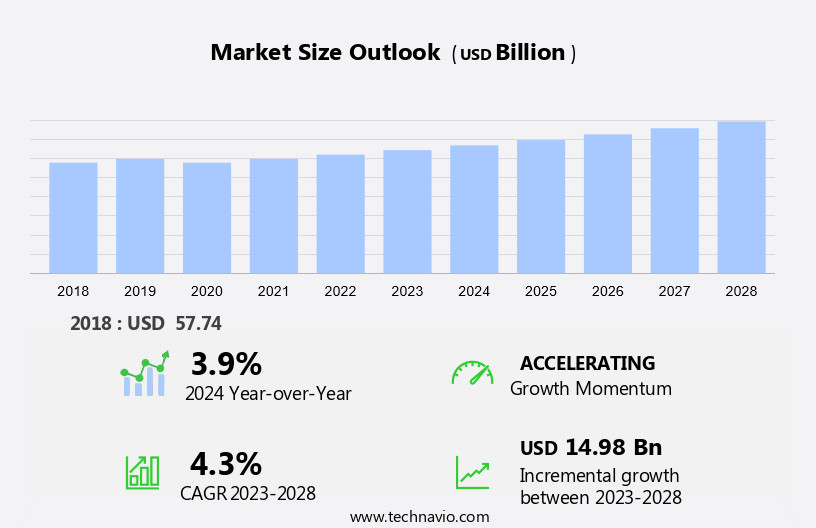

The corrugated box market size is forecast to increase by USD 14.98 billion at a CAGR of 4.3% between 2023 and 2028.

- The market is experiencing significant growth due to the Industrial Revolution and the increasing demand for efficient material management in various industries. The rise of e-commerce and the expansion of online retail have led to a rise in the usage of corrugated boxes for shipping and packaging. These boxes offer superior strength, with key attributes such as flute profile, burst strength, and edge crush strength, making them an ideal choice for secure transportation. However, the market is faced with challenges, including the fluctuating prices of raw materials like wood pulp and paper. The use of corrugated boxes also contributes to sustainability efforts, as they are recyclable and eco-friendly.

What will be the size of the Corrugated Box Market During the Forecast Period?

- The market holds significant importance In the material management sector, particularly for transportation and storage applications. This market is driven by the demand for reliable and durable packaging solutions that can effectively protect goods during transit and ensure their preservation in various storage conditions. Corrugated boxes are engineered with a fluted structure, which comprises an inner layer, middle layer, and outer layer. The inner layer is responsible for providing cushioning and protection, while the outer layer enhances durability and strength. The middle layer, featuring flutes, provides the necessary rigidity and structure to the box.

- The fluted structure of corrugated boxes offers various advantages, such as increased capacity, improved strength, and excellent cushioning properties. These boxes are available in single-wall, double-wall, and triple-wall configurations, with different flute profiles and wall configurations catering to diverse applications. The market has seen substantial growth due to the increasing demand for efficient and cost-effective packaging solutions. The Industrial Revolution brought about significant changes In the manufacturing sector, leading to the mass production of cardboard sheets and the subsequent growth of the corrugated box industry. Cardboard boxes, a key component of the market, are available in various paper weights and surface treatments.

How is this Corrugated Box Industry segmented and which is the largest segment?

The industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Food and beverage

- Non-durable products

- Others

- Geography

- APAC

- China

- India

- Japan

- Europe

- Germany

- North America

- US

- South America

- Middle East and Africa

- APAC

By End-user Insights

- The food and beverage segment is estimated to witness significant growth during the forecast period.

The market has experienced significant growth due to the increasing demand for packaging solutions In the food and beverage industry. With the rise of processed food and ready-to-eat products, the need for protective and durable packaging has become essential. Corrugated boxes, made of cardboard, offer the necessary strength and capacity to meet these requirements. Furthermore, food and beverage manufacturers have recognized the marketing potential of corrugated display boxes. These boxes provide an effective platform to showcase their products, thereby increasing sales and demand for corrugated boxes. According to industry reports, the food and beverage sector accounts for over half of the total demand for corrugated boxes In the US.

Furthermore, the material management of corrugated boxes is crucial in ensuring the strength and durability required for shipping and transporting food and beverage products. The flute profile and various strength tests, such as burst strength, edge crush strength, and flat crush strength, are essential factors in evaluating the quality of corrugated boxes. By investing in high-quality corrugated boxes, manufacturers can protect their products during transportation and enhance their brand image.

Get a glance at the market report of share of various segments Request Free Sample

The Food and beverage segment was valued at USD 26.01 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

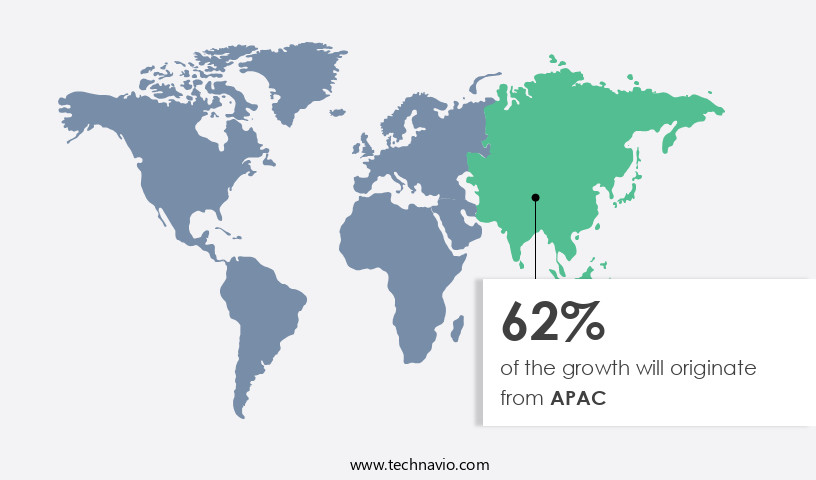

- APAC is estimated to contribute 62% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market in Asia Pacific (APAC) is driven by several factors, including the need for structural rigidity to protect fragile articles during transport. This market is particularly important for perishable products, ensuring their safe and efficient transportation. Kraft paper, a key component of corrugated boxes, is re-used and recycled, making it a versatile and eco-friendly solution for packaging. India and China are major contributors to the growth of this market in APAC. With over 42% of the world's population, this region will experience moderate growth over the forecast period. The FMCG industry in India has seen significant expansion, with urban areas driving the majority of demand for food and beverage products.

Moreover, rural areas have also seen an increase In the penetration of consumer goods due to the introduction of new products. Environmental protection is a growing concern, and the recyclable nature of corrugated boxes aligns with this trend. Re-used and re-pulped materials are becoming increasingly popular, reducing the need for raw materials and minimizing waste. As economic growth continues to outpace the world average, the demand for packaging solutions that can protect and transport goods efficiently and sustainably is expected to remain strong.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Corrugated Box Industry?

Expansion of the online retail market is the key driver of the market.

- The rise in e-commerce sales In the United States has led to a significant increase In the demand for corrugated boxes for transporting various commodities. Consumers' preference for the convenience of online shopping has resulted in a shift from traditional shopping methods. E-retailers utilize different types of corrugated boxes and containers depending on the nature of the goods being shipped.

- These boxes play a crucial role in maintaining the freshness and safety of perishable items like fruits and vegetables, as well as non-perishable items such as office supplies, stationery, industrial supplies, textiles, and electronic products. Effective packaging is essential In the competitive e-commerce market, driving the growth of the corrugated box industry. Small and local companies are expanding their customer base by offering their products online on a larger scale.

What are the market trends shaping the Corrugated Box Industry?

Corrugated boxes aid environment sustainability is the upcoming market trend.

- Corrugated boxes, a popular choice for single-use containers, boast an eco-friendly and sustainable structure. Comprised of multiple layers, these boxes feature an inner layer, middle layer, and outer layer, all adhering to a fluted structure that offers superior cushioning and durability. This design makes corrugated boxes ideal for transportation and storage purposes. The corrugated packaging industry prioritizes sustainability, utilizing recycled materials for up to 46% of its production. By adhering to industry standards and government regulations, manufacturers ensure the production process is environmentally safe. Sustainability is a top priority for clients, making eco-friendly packaging solutions like corrugated boxes increasingly desirable.

- Corrugated boxes are a preferred choice for businesses due to their durability, cushioning properties, and commitment to sustainability. The recycled materials used In their production contribute to a reduced environmental impact, making corrugated boxes a responsible and sustainable choice for packaging needs.

What challenges does the Corrugated Box Industry face during its growth?

Fluctuating prices of wood pulp and paper is a key challenge affecting the industry growth.

- The market is currently facing significant pricing challenges due to escalating input costs, particularly In the area of kraft paper, a primary raw material. Paper mills have increased the price of kraft paper by USD20-40 per ton, but buyers of corrugated boxes are unwilling to pay the higher prices. In response, the industry is considering raising the prices of corrugated boxes by 15%-18% In the northern region and 12%-16% In the Western and southern regions. Additionally, the industry is advocating for the elimination of import duties on kraft and waste paper to mitigate costs. This trend is particularly relevant for industries that rely on corrugated boxes for the transit protection of fragile items, such as e-commerce, healthcare, and medication packaging.

- Customized designs are increasingly popular for valuable goods, relocation, and movers and packers. Furthermore, temperature control is a crucial consideration for certain industries, such as healthcare and food services. The market is essential for ensuring the safe and efficient transportation of these goods, and its continued growth is vital for businesses In these sectors.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amcor Plc

- BillerudKorsnas AB

- Buckeye Corrugated Inc.

- Corrugated Supplies Co.

- DS Smith Plc

- Georgia Pacific LLC

- Industrial Development Co. sal

- International Paper Co.

- Kruger Inc.

- Mondi Plc

- Orora Ltd.

- Packaging Corp. of America

- Pregis LLC

- Rengo Co. Ltd.

- Riverside Paper Co. Inc.

- Shillington Box Co LLC

- Smurfit Kappa Group

- Southgate Packaging Ltd.

- WestRock Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is a significant segment of the packaging industry, known for its versatility and durability. These boxes are made up of multiple layers, including an inner layer, a middle layer with a fluted structure, and an outer layer. The fluted structure provides cushioning and strength, making it suitable for the transportation and storage of various goods. The Industrial Revolution brought about the widespread use of corrugated boxes in shipping containers and material management. Their capacity and strength make them ideal for transporting fragile items, perishable products, and valuable goods. The flute profile, burst strength, edge crush strength, and flat crush strength of corrugated boxes are crucial factors In their design.

Furthermore, corrugated boxes come in various wall configurations, including single-wall, double-wall, and triple-wall, with different flute profiles and standard fluting types. Custom fluting profiles are also available for specific applications. The material used in making corrugated boxes is usually made of cardboard sheets with varying paper weights and surface treatments. Corrugated boxes are recyclable and made from re-used and re-pulped paper, making them an eco-friendly option for businesses. They are used in various industries, including logistics, textiles, electronics, healthcare, and e-commerce, among others. Customized designs are available for specific industries, such as medication packaging and temperature control. The market continues to grow due to its ability to provide transit protection for fragile items and its versatility in various industries.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

148 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.3% |

|

Market Growth 2024-2028 |

USD 14.98 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.9 |

|

Key countries |

China, US, Germany, Japan, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- A thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the market growth of industry companies

We can help! Our analysts can customize this market research report to meet your requirements.