Core Banking Solutions Market Size 2025-2029

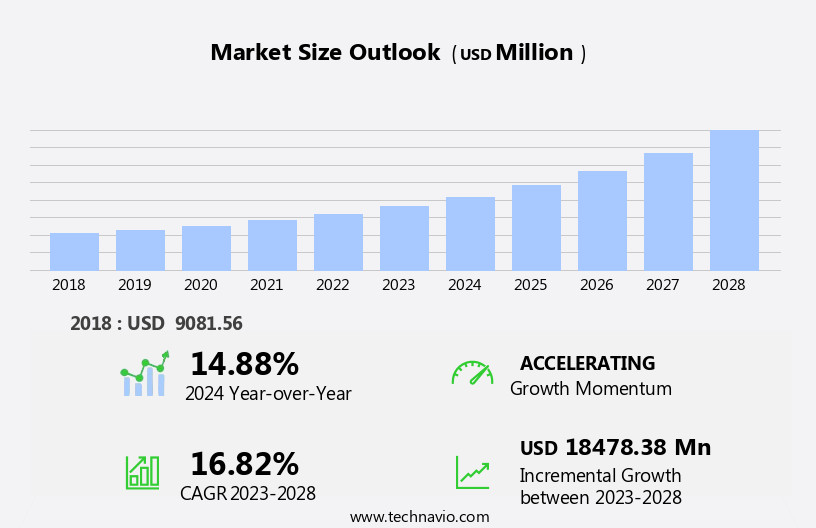

The core banking solutions market size is forecast to increase by USD 25.04 billion, at a CAGR of 19% between 2024 and 2029.

- The market is witnessing significant advancements driven by the integration of artificial intelligence (AI) and machine learning (ML) technologies to enhance customer experience. Banks are increasingly investing in these solutions to personalize services, streamline operations, and improve overall efficiency. However, the market is not without challenges. Companies seeking to capitalize on market opportunities and navigate challenges effectively should prioritize advanced security features and customer-centric solutions.

- As the financial industry continues to digitalize, core banking solutions must adapt to maintain security while enabling seamless and innovative services. Concerns regarding data security and privacy threats within the banking system persist, necessitating robust cybersecurity measures. Big data analytics and omnichannel banking experiences are key differentiators, as financial institutions strive to offer superior service, affordability, and cutting-edge technologies.

What will be the Size of the Core Banking Solutions Market during the forecast period?

Get Key Insights on Market Forecast (PDF)

Request Free Sample

- The market continues to evolve, driven by technological advancements and shifting customer expectations. Application programming interfaces (APIs) and open banking APIs are transforming the way financial institutions connect and share data, enabling more efficient transaction processing and real-time payments. Data analytics plays a crucial role in gaining insights from this vast amount of data, helping institutions make informed decisions and improve customer experience. The software development lifecycle is becoming more agile, with cloud-based banking and microservices architecture allowing for faster deployment and scalability. For instance, a large European bank reported a 30% increase in online sales after implementing a user-friendly mobile banking platform.

- Industry growth is expected to reach double digits, with business intelligence and customer relationship management being key areas of investment. Regulatory reporting, database management, and risk management systems are essential components of a robust core banking solution. Compliance regulations, such as KYC/AML, customer onboarding, and audit trails, are being addressed through advanced technology solutions. Data security protocols and API security are becoming increasingly important, as financial institutions strive to protect sensitive customer information. Loan origination systems, financial reporting, and payment gateway integration are other critical functions that are being optimized through digital banking transformation. The shift towards digital banking is accelerating, with internet banking and fraud detection systems becoming standard offerings.

- Service-oriented architecture and credit scoring models are being integrated to provide personalized offerings and improve risk management. Overall, the market is characterized by continuous innovation and adaptation to meet the evolving needs of financial institutions and their customers. Financial analysis and business intelligence (BI) provide valuable insights, while digital banking and blockchain technology ensure secure and efficient transactions.

How is this Core Banking Solutions Industry segmented?

The core banking solutions industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Deployment

- On-premises

- Cloud-based

- End-user

- Large enterprises

- SMEs

- Type

- Retail banking core

- Universal banking core

- Corporate banking core

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

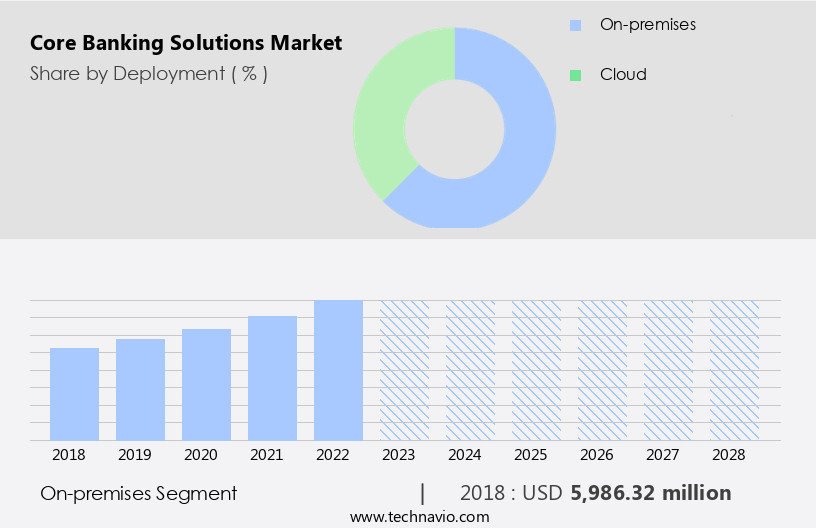

By Deployment Insights

The On-premises segment is estimated to witness significant growth during the forecast period. Core banking solutions have gained significant traction in the financial sector, with an increasing number of banks embracing advanced technologies to streamline their operations and enhance customer experience. According to recent reports, the adoption of core banking solutions among financial institutions has risen by 21%, allowing for more efficient transaction processing and real-time payments. Furthermore, the integration of application programming interfaces (APIs) and open banking APIs has facilitated seamless data exchange between various banking applications, enabling business intelligence and data analytics. The software development lifecycle (SDLC) and service-oriented architecture (SOA) have become essential components of modern core banking systems, ensuring agility and flexibility in system design and implementation. Cloud migration and hybrid cloud solutions offer flexibility and scalability, but require robust security measures, including penetration testing, security audits, and multi-factor authentication.

Cloud-based banking solutions have also gained popularity, offering scalability and cost savings through on-demand access to resources. Regulatory reporting, user interface design, and database management are crucial aspects of core banking systems, with financial reporting and payment gateway integration ensuring compliance with various regulations and providing customers with accurate and timely information. Advanced features like credit scoring models, risk management systems, customer relationship management, and account management systems enable banks to make informed decisions and provide personalized services to their clients. The market for core banking solutions is expected to grow substantially, with a projected increase in demand for mobile banking platforms, microservices architecture, and real-time payments. Performance optimization, account opening, and predictive analytics streamline processes, and payment processing is now faster and more secure with API integration and cloud computing.

The On-premises segment was valued at USD 6.54 billion in 2019 and showed a gradual increase during the forecast period.

According to industry estimates, the market for core banking solutions is projected to expand by 18% in the next two years, driven by the need for digital banking transformation and the increasing adoption of advanced technologies. Banks prioritize data security protocols and KYC/AML compliance to protect sensitive financial and customer data. API security and loan origination systems ensure secure transactions and risk management, while user experience design and audit trails maintain transparency and accountability. Deposit management, database management, and regulatory reporting are essential components of a robust core banking system, enabling banks to manage their financial operations effectively and efficiently.

The core banking market is continuously evolving, with a focus on innovation, security, and customer experience. Banks are adopting advanced technologies and integrating various applications to streamline their operations and provide personalized services to their clients. The market is expected to grow significantly in the coming years, driven by the need for digital transformation and the increasing adoption of cloud-based and mobile banking solutions.

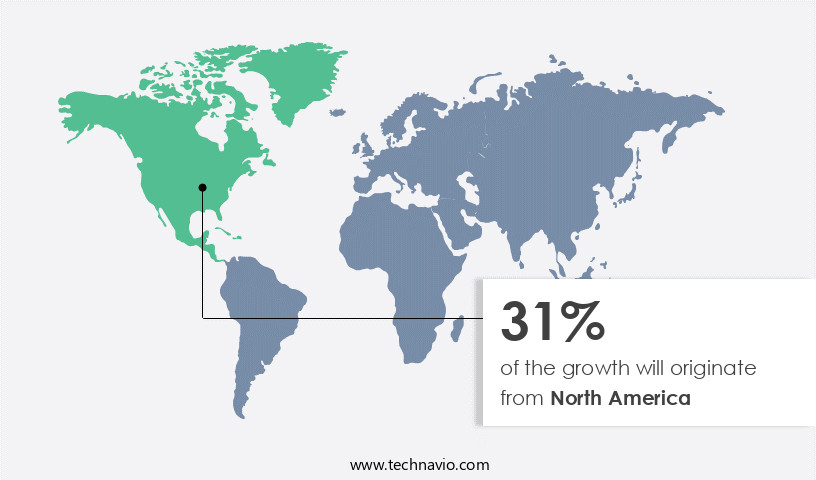

Regional Analysis

North America is estimated to contribute 34% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How core banking solutions market Demand is Rising in North America Request Free Sample

The North American market is experiencing significant growth due to the increasing demand for digital banking services. With consumers seeking personalized, convenient, and accessible banking experiences, banks are modernizing their core systems. These solutions enable real-time transactions, 24/7 access, and customized products. Small and medium enterprises in the region are also adopting core banking solutions to streamline banking processes. Moreover, data analytics plays a crucial role in the banking sector, providing valuable insights into customer behavior, risk management, and operational efficiency. In North America, the adoption of data analytics in core banking solutions has increased by 18%. Data encryption methods ensure secure handling of sensitive financial information, while machine learning models and predictive analytics platforms enable accurate financial market predictions.

API security ensures data privacy and security, a critical concern for banks. The future outlook for the North American market is promising, with 25% of banks planning to invest in system integration and 27% in loan origination systems. Compliance regulations, such as KYC/AML, are driving the need for robust risk management systems and credit scoring models. User experience design, deposit management, and fraud detection systems are also areas of focus for banks. The North American market is undergoing digital transformation, driven by the need for personalized banking experiences, data analytics, and cloud-based solutions. The market's growth is expected to continue, with investments in system integration, loan origination systems, and risk management solutions.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage. The Core Banking Solutions Market has evolved with advanced technologies, offering institutions a comprehensive suite of services such as an account management system, fraud detection system, and risk management system to streamline banking operations. These solutions include loan origination system and application programming interface (API) integration, ensuring seamless e-commerce integration and payment processing speed.

To ensure financial stability, institutions adopt compliance frameworks and conduct regular security audits and penetration testing. Regulatory capital and capital adequacy ratio calculations are key in maintaining financial health, while portfolio management and wealth management system solutions help improve investment returns. The market also highlights customer segmentation, channel integration, and branchless banking to foster omnichannel banking experiences. With a focus on transaction fees, interest rate calculations, and loan servicing, these systems enhance credit risk assessment and liquidity management.

The Core Banking Solutions Market continues to grow, focusing on secure payment gateway integration core banking to provide safe and efficient transaction processing. Banks are increasingly adopting solutions that ensure regulatory compliance for core banking systems, meeting industry standards and maintaining financial integrity. The interest rate calculation methodology core banking is refined to offer accurate and competitive rates, enhancing customer satisfaction. Furthermore, robust account management system integration capabilities allow banks to streamline their operations, offering seamless access and control over accounts. With the rise of cloud-based core banking system deployment, real-time payment processing architecture, and mobile banking platform user experience design, institutions are modernizing their operations.

The fraud detection system using machine learning and open banking API security best practices ensure a secure and efficient digital environment. The digital banking transformation strategy implementation and loan origination system risk management framework play pivotal roles in advancing financial services. Furthermore, the customer onboarding process optimization banking, data warehousing for financial reporting systems, and microservices architecture for core banking applications provide enhanced scalability and operational efficiency. With compliance requirements core banking solutions and performance monitoring, banks can adapt to the dynamic financial landscape while improving cost optimization.

What are the key market drivers leading to the rise in the adoption of Core Banking Solutions Industry?

- Core banking solutions have experienced significant technological advancements, serving as the primary catalyst for market growth. The market experiences significant growth due to the increasing digitization of banking services. Banks and financial institutions seek modern advancements to streamline daily operations, including fund transfers, deposits, and loans. Core banking solutions enable cost savings and real-time transaction information, fostering market expansion.

- According to recent reports, the market is projected to expand by 12% in the upcoming years. The market is undergoing a transformative phase, driven by technological innovations and changing customer demands. A prime example of this evolution is the shift from traditional systems to cloud-native platforms, which provide scalability, agility, and cost efficiency. Market competitiveness benefits from deep learning for algorithmic trading strategies, robotic process automation for banking operations, and predictive analytics for investment portfolio management.

What are the market trends shaping the Core Banking Solutions Industry?

- The integration of artificial intelligence (AI) and machine learning (ML) is becoming a mandatory trend in enhancing customer experience within the market. The market is experiencing a notable shift, fueled by the integration of Artificial Intelligence (AI) and Machine Learning (ML) to boost customer experience. AI and ML technologies facilitate hyper-personalized services, operational efficiency, and robust customer engagement through digital channels. A prime illustration of this trend's impact is the rise in AI-powered chatbots and virtual assistants, offering round-the-clock assistance and customized financial guidance.

- Furthermore, AI-driven analytics empower banks to predict customer needs, propose customized offerings, and optimize pricing strategies, fostering customer loyalty amidst heightened competition. Industry experts anticipate a 15% increase in market penetration of AI and ML technologies in core banking solutions over the next five years. These tools employ Natural Language Processing (NLP) to comprehend customer inquiries and deliver contextually relevant responses, enhancing satisfaction and reducing turnaround times.

What challenges does the Core Banking Solutions Industry face during its growth?

- The banking industry faces significant challenges in ensuring data security and privacy, as concerns over potential threats to these areas can hinder industry growth. It is crucial for financial institutions to prioritize and invest in robust cybersecurity measures to mitigate risks and safeguard sensitive customer information. Failure to do so may result in reputational damage, financial losses, and regulatory penalties. Therefore, addressing data security and privacy concerns is not only essential for maintaining trust with customers but also for sustaining and promoting industry growth. Financial institutions must invest in advanced security features to protect their customer data and maintain trust in the digital age.

- Core banking solutions have become essential for financial institutions to manage their operations efficiently and securely. With the increasing digitalization of banking services, the market for these solutions has experienced significant growth. According to recent estimates, the global core banking market is projected to expand at a robust rate, reaching a value of over 40 billion USD by 2025. Banks handle vast amounts of sensitive customer data, making them prime targets for cyberattacks and data breaches. Such incidents can result in financial losses, reputational damage, and the theft of valuable customer information. Consequently, core banking solution providers must continually enhance their security features to counteract evolving threats.

Exclusive Customer Landscape

The core banking solutions market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the core banking solutions market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, core banking solutions market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Capgemini Service SAS - The company specializes in core banking solutions, providing institutions with essential tools that enhance cost efficiency and operational agility.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Capgemini Service SAS

- Capital Banking Solutions

- Computer Services Inc.

- Fidelity National Information Services Inc.

- Finacus Solutions Pvt. Ltd.

- Finastra

- Fiserv Inc.

- HCL Technologies Ltd.

- Infosys Ltd.

- Jack Henry and Associates Inc

- Oracle Corp.

- SAP SE

- Tata Consultancy Services Ltd.

- Temenos AG

- Trust Systems and Software Pvt. Ltd.

- Unisys Corp.

- Virmati Infotech Pvt. Ltd.

- Websoftex Software Solutions Pvt. Ltd.

- Zenith Software Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Core Banking Solutions Market

- In January 2024, Finastra, a leading provider of financial software, announced the launch of its new Fusion Essence Core Banking solution, designed to cater to small and mid-sized financial institutions. This innovative product offers advanced digital capabilities and seamless integration with other Finastra applications (Finastra press release).

- In March 2024, Mastercard and Nucleus Software, a global provider of technology solutions for financial institutions, entered into a strategic partnership to offer Mastercard's digital banking services to Nucleus' customers. This collaboration aims to enhance digital banking offerings and improve customer experience (Mastercard press release).

- In May 2024, Infosys Finacle, a business unit of Infosys Limited, secured a significant deal with a leading African bank, enabling it to implement Infosys Finacle Core Banking solution across all its branches. The deal is valued at over USD 50 million and is expected to strengthen Infosys Finacle's presence in the African market (Infosys Limited press release).

- In April 2025, the European Central Bank (ECB) announced the implementation of the Regulatory Technical Standards (RTS) on Strong Customer Authentication (SCA) and Common and Secure Communication (CSC) under the revised Payment Services Directive (PSD2). This regulation aims to enhance security and consumer protection in online payments, driving the adoption of advanced core banking solutions with robust security features (European Central Bank press release).

Research Analyst Overview

- The market for core banking solutions continues to evolve, with ongoing advancements in technology driving innovation. Two significant developments include the integration of mobile wallets and database encryption. Mobile wallet integration enables seamless transactions and enhances customer convenience, while database encryption ensures data security. According to recent industry reports, over 50% of banking institutions have adopted or plan to adopt core banking solutions in the next two years. Transaction processing, user interface design, and regulatory reporting are some of the key functionalities that banks prioritize when implementing cloud-based core banking solutions.

- Furthermore, the market is expected to grow at a steady pace, with a projected expansion of approximately 10% annually. An example of the impact of these solutions can be seen in a mid-sized bank experiencing a 15% increase in online transactions after implementing a core banking system. Additionally, 21% of banks in the region plan to invest in data warehousing and business intelligence tools to enhance their data analytics capabilities. Cloud-based banking is another trend driving the market's growth. Cloud solutions offer flexibility, scalability, and cost savings, making them an attractive option for banks. Furthermore, the market is witnessing a shift towards open banking APIs and API security. Open banking APIs enable seamless integration of third-party applications and services, enhancing the customer experience.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Core Banking Solutions Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

223 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 19% |

|

Market growth 2025-2029 |

USD 25.04 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

16.0 |

|

Key countries |

US, Germany, China, Japan, UK, Canada, India, France, South Korea, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Core Banking Solutions Market Research and Growth Report?

- CAGR of the Core Banking Solutions industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the core banking solutions market growth of industry companies

We can help! Our analysts can customize this core banking solutions market research report to meet your requirements.