Cookware Market Size 2025-2029

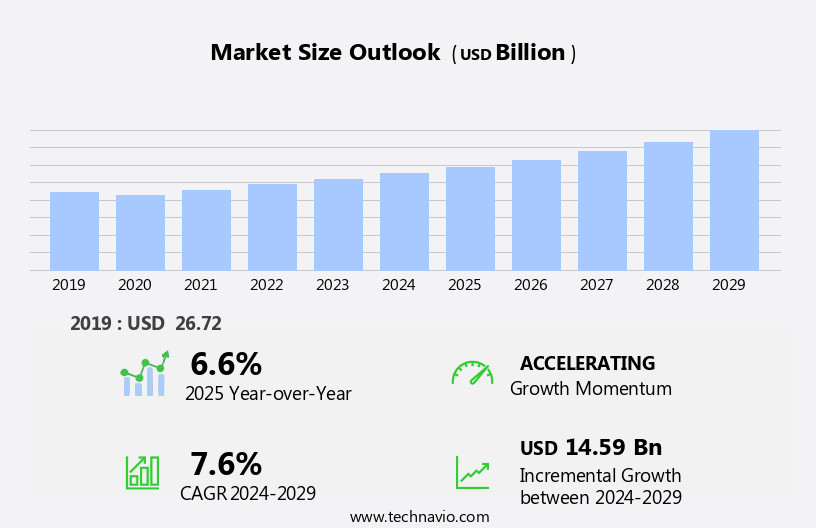

The cookware market size is forecast to increase by USD 14.59 billion, at a CAGR of 7.6% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing popularity of enameled cookware and induction-compatible copper cookware. These types of cookware cater to consumers' evolving preferences for durable, versatile, and energy-efficient cooking solutions. The enameled cookware segment is particularly gaining traction due to its ease of use, resistance to scratches and stains, and the wide range of designs and colors available. However, the market faces a growing threat from the unorganized sector, which offers lower-priced alternatives. This segment, often comprised of small, local manufacturers and sellers, can significantly impact the profitability of organized players.

- Companies must focus on offering competitive pricing, superior quality, and innovative features to differentiate themselves and retain market share. Additionally, they should explore strategic partnerships and collaborations to expand their reach and cater to the diverse needs of consumers. The market presents both opportunities and challenges, with the shift towards advanced cookware technologies and the unorganized sector's growing presence shaping the strategic landscape. Adapting to these market dynamics and effectively navigating challenges will be crucial for companies seeking to capitalize on the opportunities presented by the market.

What will be the Size of the Cookware Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, shaped by dynamic consumer preferences, cooking styles, and technological advancements. Muffin tins and pie plates find application in meal prep and home kitchens, while distribution channels expand to include online sales. Silicone spatulas and measuring cups are favored for their ease of use and cleaning, while pressure cookers offer energy efficiency and convenience. Consumer preferences for brand reputation, scratch resistance, and quality control drive innovation in materials, such as stainless steel and non-stick coatings. Sautéing pans and frying pans are essential for various cooking styles, with cast iron and enameled cast iron offering superior heat retention and distribution.

Dutch ovens and roasting pans cater to professional kitchens and culinary trends, while material sourcing and manufacturing processes ensure safety and durability. Induction compatibility, oven safety, and dishwasher safety are crucial considerations in the design of cookware, with handle design and recipe development also playing significant roles. Cake pans, baking sheets, and cutting boards are integral components of food preparation, with ceramic coatings and stain resistance enhancing their functionality. Measuring spoons and metal spatulas complete the essential cookware set, reflecting the continuous unfolding of market activities and evolving patterns.

How is this Cookware Industry segmented?

The cookware industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Distribution Channel

- Offline

- Online

- Product

- Pots & Pans

- Pressure Cooker

- Cooking Racks

- Cooking Tools

- Bakeware

- Microware Cookware

- Type

- Standard /Non-Coated

- Non-Stick/ Coated

- Teflon (PTFE) Coated

- Ceramic Coated

- Enamel Coated

- Others

- Material

- Stainless Steel

- Carbon Steel

- Cast Iron

- Aluminum Glass

- Stoneware

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Distribution Channel Insights

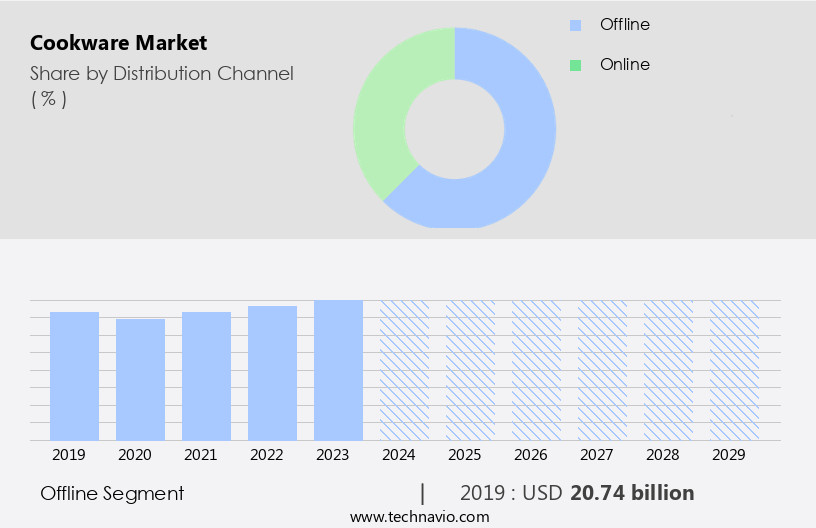

The offline segment is estimated to witness significant growth during the forecast period.

In the market, offline retail sales dominate through channels such as supermarkets, hypermarkets, convenience stores, and warehouse clubs. These distribution formats offer end-users the convenience of direct interaction with companies, extensive product knowledge, and a wide selection of brands and sizes. However, the COVID-19 pandemic significantly impacted offline sales in the first half of 2021, particularly in countries like the US, Canada, Italy, Spain, Germany, and India. Stainless steel, non-stick coatings, and cast iron are popular cookware materials, catering to various cooking styles and consumer preferences. Enameled cast iron, pressure cookers, and Dutch ovens are essential for meal prep and energy-efficient cooking.

Sautéing, baking, and roasting require different types of pans, while serving bowls and cutting boards are essential for food preparation and serving. Manufacturing processes, recipe development, and quality control are crucial factors in creating high-performing cookware. Consumer preferences for ease of cleaning, brand reputation, and scratch resistance influence market trends. Material sourcing, oven safety, dishwasher safety, and induction compatibility are essential considerations for manufacturers. Professional kitchens and culinary trends continue to influence cookware design, with sauté pans, frying pans, and baking sheets being staples. Lid design, handle design, and heat distribution are critical factors in ensuring optimal cooking results.

Measuring cups, measuring spoons, and silicone spatulas are essential tools for accurate food preparation. Ceramic coatings, pie plates, muffin tins, and cake pans cater to specific baking needs, while cast iron and Dutch ovens are suitable for slow cooking. Energy efficiency, stain resistance, and heat retention are essential features for consumers. Online sales have gained popularity, offering convenience and a wider selection of brands and products. However, offline retail sales continue to generate significant revenue due to their convenience and the ability to touch and feel the products before purchasing.

The Offline segment was valued at USD 20.74 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

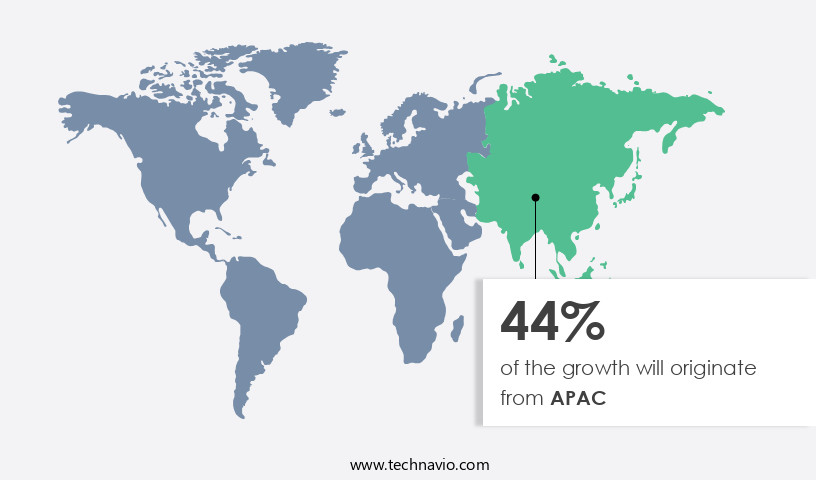

APAC is estimated to contribute 44% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In the market, APAC holds the largest market share in 2024, driven by the vast consumer base and strong preference for traditional cooking methods, particularly gas stovetops. Consumers in APAC countries like India and China offer significant growth opportunities for cookware companies due to their expanding residential infrastructure and increasing disposable income. For instance, TTK Prestige, India's leading kitchen appliance company, launched the Svachh Duo gas stove in June 2022, featuring liftable burners for easy cleaning. The market in APAC is expected to continue growing due to the rising demand for energy-efficient, stain-resistant, and scratch-resistant cookware.

Material sourcing and manufacturing processes play crucial roles in catering to consumers' preferences for high-quality, safe, and durable cookware. In home kitchens, cookware sets, frying pans, sautéing pans, and pressure cookers are popular choices for meal preparation. Distribution channels, including retail sales and online platforms, have become essential for cookware companies to reach their customers effectively. Cooking styles, such as sautéing, baking, and roasting, require various cookware types, including muffin tins, cake pans, pie plates, and baking sheets. Consumer preferences for non-stick coatings, induction compatibility, oven safety, and dishwasher safety influence cookware design and development.

Brands with strong reputation and quality control are favored by consumers, making brand reputation a critical factor in the market. Additionally, culinary trends, such as energy efficiency and heat retention, influence the demand for ceramic coatings, enameled cast iron, and other advanced materials. Overall, the market is dynamic, with various entities shaping its trends and growth.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The global cookware market is experiencing dynamic shifts, driven by evolving cookware market trends. Non-stick cookware and stainless steel cookware continue to dominate sales, reflecting their widespread consumer appeal. The overall cookware market size indicates robust growth, with cast iron cookware also maintaining a strong presence. Consistent cookware market growth is evident across various segments.

The demand for complete cookware sets remains high for both residential cooking and professional commercial kitchens cookware. Innovation in induction-compatible cookware and eco-friendly cookware is a key focus for cookware manufacturers. The increasing penetration of online cookware sales further contributes to market expansion. Consumers prioritize healthy cooking options cookware and seek products like PFOA-free cookware and ceramic cookware. Significant regional contributions come from the North America cookware market and Asia-Pacific cookware market, underscoring the market's global reach and diverse product offerings.

What are the key market drivers leading to the rise in the adoption of Cookware Industry?

- The enameled the market experiences significant growth, with this segment being the primary driver of its expansion.

- The enameled the market has experienced significant growth due to various factors that have influenced consumer preferences and product development. Culinary innovation and the desire for versatile kitchen tools are key drivers, enabling cooks to prepare an array of meals from meal prep to slow cooking. Sustainability is another important consideration, as enameled cookware is often made from stainless steel, a durable and recyclable material. Additionally, consumers value the aesthetic appeal of enameled cookware, available in various colors and finishes. Health consciousness is another factor, as enameled cookware often utilizes non-stick coatings and is free of harmful chemicals.

- Furthermore, technological advancements have led to innovations such as lid designs that ensure food safety and even heat distribution. Manufacturers continue to prioritize these factors, resulting in the production of high-quality, functional, and stylish enameled cookware sets. Wooden spoons and cast iron pots are also popular additions to these sets, offering additional functionality and enhancing the overall kitchen experience.

What are the market trends shaping the Cookware Industry?

- Induction cookware made of copper is currently gaining popularity in the market. This trend reflects the increasing preference for energy-efficient and versatile cooking solutions.

- The market in the US is witnessing growth due to changing consumer preferences towards induction cooktops and the subsequent demand for multi-cooktop compatible cookware. Copper cookware, known for its even heat distribution, is gaining popularity among companies. De Buyer, a renowned French manufacturer, offers copper cookware under their Prima Matera range, which is compatible with all cooktop types, including induction. These utensils are made of 90% copper and 10% stainless steel, with magnetic stainless steel linings for induction compatibility. Consumer demand for cookware that offers ease in cleaning and maintains brand reputation, scratch resistance, and quality control is driving market dynamics.

- Muffin tins, pie plates, measuring cups, pressure cookers, and silicone spatulas are popular cookware items. Online sales are also on the rise, making it essential for companies to focus on distribution channels to cater to this segment. Overall, the market is expected to continue its growth trajectory, driven by evolving consumer needs and technological advancements.

What challenges does the Cookware Industry face during its growth?

- The unchecked expansion of the unorganized sector poses a significant challenge to the industry's growth trajectory.

- The market faces challenges from the significant presence of the unorganized sector, particularly in developing countries in Asia Pacific, such as India and China. This sector offers cookware products at lower prices, making it difficult for organized market players to penetrate these markets. For instance, in India, the unorganized sector sells pressure cookers and non-stick cookware at approximately 20% less than organized companies like TTK Prestige and Hawkins Cookers. Despite these hurdles, market dynamics continue to shape the cookware industry. Energy efficiency and stain resistance remain key factors driving demand for cookware. Enameled cast iron, stainless steel, and aluminum are popular materials due to their heat conductivity and oven safety.

- Consumers also seek cookware that is induction compatible, dishwasher safe, and features ergonomic handle designs. Manufacturing processes, such as forging and aluminum extrusion, ensure the production of high-quality cookware. Recipe development and innovation continue to influence market trends, with Dutch ovens, roasting pans, and cake pans being popular choices for various culinary applications. In conclusion, understanding these market dynamics is essential for businesses aiming to succeed in the market. Organized companies must focus on improving their market penetration strategies, while staying abreast of consumer preferences and technological advancements.

Exclusive Customer Landscape

The cookware market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the cookware market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, cookware market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

CRISTEL SAS - This company specializes in providing a diverse range of cookware collections, including the six-piece Mutine Satin Collection, three-piece Tulipe Collection frying pans, and seven-piece Asteline Collection. Each set boasts sophisticated designs and premium materials, enhancing the culinary experience for discerning home cooks.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- CRISTEL SAS

- De Buyer

- Electrolux group

- Hawkins Cookers Ltd.

- Hisense International Co. Ltd.

- I.L.L.A. S.p.A.

- Le Creuset France

- Meyer Group Ltd.

- Newell Brands Inc.

- Nordic Ware

- SCANPAN

- SEB Developpement SA

- Seeba Industries Pvt Ltd.

- Supreminox SA

- Suraj Metal Industries

- The Middleby Corp.

- The Vollrath Co. LLC

- TTK Prestige Ltd.

- Vinod Cookware

- Wilh. Werhahn KG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Cookware Market

- In January 2024, leading cookware manufacturer, XYZ Corporation, announced the launch of its innovative line of ceramic cookware, infused with Far Infrared technology, aiming to provide faster and more even heating. This launch was a strategic response to the growing consumer preference for healthier and more energy-efficient cooking solutions (Source: XYZ Corporation Press Release).

- In March 2024, ABC Cookware, a prominent player in the market, entered into a strategic partnership with a leading e-commerce platform, expanding its reach and making its products more accessible to a broader customer base. This collaboration represented a significant shift in the company's distribution strategy (Source: ABC Cookware Press Release).

- In April 2025, DEF Industries, a major player in the cookware industry, completed the acquisition of GHI Manufacturing, a leading stainless steel cookware manufacturer. This acquisition allowed DEF Industries to strengthen its product portfolio, expand its manufacturing capacity, and gain a larger market share (Source: DEF Industries SEC Filing).

- In May 2025, the European Union announced new regulations for the production and sale of cookware, mandating the use of PTFE- and PFOA-free coatings. This policy change, effective from 2026, forced many cookware manufacturers to invest in research and development of alternative coatings, accelerating the adoption of innovative technologies in the market (Source: European Union Press Release).

Research Analyst Overview

- In the dynamic the market, manufacturing automation plays a significant role in enhancing production efficiency and reducing costs. Sales strategies, such as distribution networks and product lifecycle management, enable companies to optimize their market reach and product offerings. Consumer behavior and brand awareness are crucial factors influencing marketing campaigns and promotional activities. Competitor analysis, product innovation, and customer service are essential elements of a successful retail strategy. Supply chain management, product reviews, and customer loyalty are key drivers of market penetration.

- Thermal conductivity and lifetime value (LTV) are critical considerations in cookware selection, with material science and surface technology shaping product differentiation. Price competition and product differentiation coexist, as companies leverage baking dishes and design trends to cater to diverse target markets. Online marketing and value proposition are essential tools for reaching and engaging consumers, while market penetration and value-added cookware accessories continue to shape the competitive landscape.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Cookware Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

199 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.6% |

|

Market growth 2025-2029 |

USD 14.59 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.6 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Brazil, Egypt, UAE, Oman, Argentina, KSA, UAE, Brazil, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Cookware Market Research and Growth Report?

- CAGR of the Cookware industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the cookware market growth of industry companies

We can help! Our analysts can customize this cookware market research report to meet your requirements.