Conveyor Belt Market Size 2025-2029

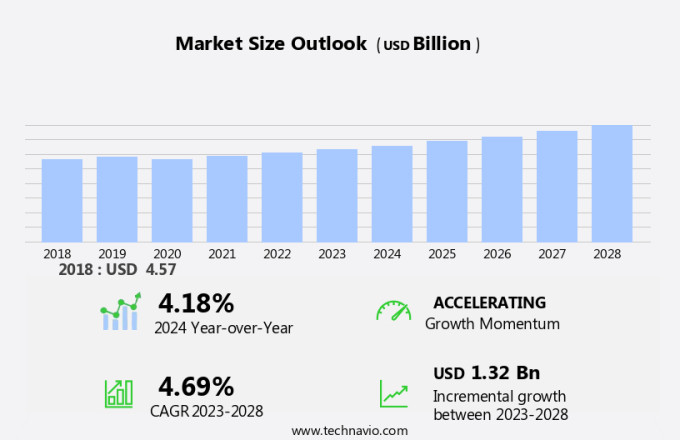

The conveyor belt market size is forecast to increase by USD 1.54 billion, at a CAGR of 4.6% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing demand for automation in material handling across various industries. This trend is particularly prominent in sectors such as manufacturing, logistics, and food processing, where conveyor belts are essential for streamlining production processes and enhancing operational efficiency. Moreover, the integration of Internet of Things (IoT) technology into conveyor belt systems is gaining momentum, enabling real-time monitoring, predictive maintenance, and improved productivity. However, the market faces challenges, including the rising number of injuries and accidents associated with conveyor belts.

- These incidents can lead to downtime, increased costs, and reputational damage. Addressing these safety concerns through technological advancements and stricter regulations will be crucial for market participants to capitalize on the opportunities presented by the evolving market. Companies that successfully navigate these challenges and innovate in response to market trends will be well-positioned to gain a competitive edge. The market is witnessing significant growth, driven by the increasing demand for automated material handling equipment in various industries.

What will be the Size of the Conveyor Belt Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by the ever-growing demand for efficient material handling solutions across various sectors. Idlers and pulleys play a crucial role in maintaining drive system efficiency, while conveyor frame design and material spillage prevention are key considerations for optimizing material handling efficiency. Conveyor belt materials have seen significant advancements, with new offerings providing improved load capacity limits and resistance to wear and tear. Preventive maintenance, including belt tracking system adjustments and maintenance scheduling, is essential for ensuring system reliability and minimizing operational downtime. Power consumption reduction through automation integration, belt cleaning systems, and belt slippage mitigation techniques is a major focus for conveyor system designers.

Roller alignment precision, remote monitoring systems, and throughput maximization techniques are other critical areas of innovation. Industry growth in the market is expected to reach double-digit percentages in the coming years, driven by the increasing demand for automation and safety regulations compliance. Moreover, conveyor belts are not limited to traditional industries but have found applications in novel areas such as e-commerce distribution centers, waste management facilities, and even power plants. Belt splicing techniques, component lifespan, dust control measures, load distribution analysis, vibration analysis, conveyor safety systems, and belt lubrication are other essential aspects of conveyor system design. Ensuring structural integrity, belt speed optimization, and safety regulations compliance are crucial for maintaining a competitive edge in the market.

How is this Conveyor Belt Industry segmented?

The conveyor belt industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Retail

- Food and beverage

- Automotive

- Others

- Type

- Unit handling

- Bulk handling

- Product Type

- Light-weight

- Medium-weight

- Heavy-weight

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

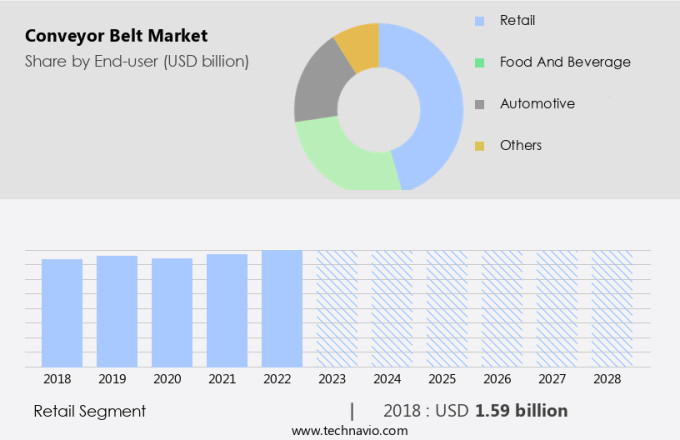

By End-user Insights

The Retail segment is estimated to witness significant growth during the forecast period. Conveyor belts, a vital component in retail operations, are essential for streamlining processes in checkout counters and distribution centers. Idlers and pulleys facilitate smooth belt movement, while conveyor frame design ensures structural integrity. Material spillage prevention and belt tracking systems minimize product loss during transportation. Drive system efficiency and power consumption reduction enhance operational efficiency, with automation integration further increasing productivity. Material handling efficiency is maximized through belt slippage mitigation and roller alignment precision. Remote monitoring systems enable predictive maintenance scheduling, extending component lifespan and reducing downtime. Throughput maximization techniques and noise reduction methods improve overall performance. System integration services play a crucial role in optimizing conveyor control systems and motor control systems, ensuring seamless communication between components.

Pulleys of optimal diameter ensure efficient belt speed and power transfer. Safety regulations compliance is crucial, with conveyor safety systems and emergency stop mechanisms ensuring a secure work environment. Capacity optimization and belt splicing techniques maintain consistent performance, while load distribution analysis and vibration analysis prevent potential issues. Dust control measures maintain a clean and hygienic environment, contributing to a more productive workforce. According to recent industry reports, the market is projected to grow by over 5% annually, driven by increasing automation in various industries and the need for efficient material handling solutions. Industry growth is expected to reach double digits, with industrial automation solutions, product inspection systems, and precise sorting technologies leading the charge.

The Retail segment was valued at USD 1.86 billion in 2019 and showed a gradual increase during the forecast period.

The Conveyor Belt Market is advancing through innovations focused on performance and safety. Efficient conveyor belt tension and advanced tension control mechanism are critical for minimizing slippage and wear. Emphasis on maintenance optimization and wear monitoring system helps reduce downtime and extend lifespan. Safety interlock systems ensure secure operation, while dust suppression techniques improve environmental compliance. Accurate material flow rate monitoring enhances productivity. Improved power transmission solutions support heavy-duty applications. Integrated solutions offer seamless system integration and enable remote monitoring system capabilities for predictive maintenance and operational control. The market is characterized by continuous innovation and the integration of advanced technologies to improve production line efficiency, conveyor system reliability, and waste management systems.

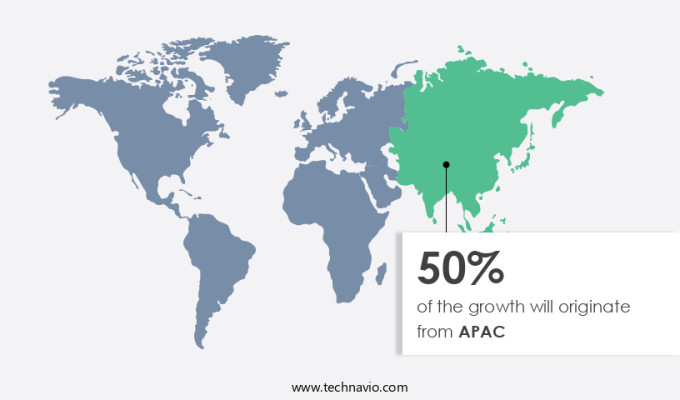

Regional Analysis

APAC is estimated to contribute 47% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In Asia Pacific (APAC), the market is witnessing significant growth due to the region's industrialization and urbanization. Conveyor belts are essential for material handling and transportation in various sectors, including manufacturing, construction, mining, and logistics. Infrastructure development projects, such as the construction of roads, ports, and airports, require conveyor belts for efficient material transportation. Moreover, APAC's rich natural resources, including minerals, coal, and ores, necessitate conveyor belts for bulk material handling in mining and quarrying operations. For instance, India's mining sector recorded a 13.1% increase in mineral production in 2023, driving the demand for conveyor belts in mines, quarries, and processing plants. Vibration analysis, predictive analytics, and big data are transforming fault diagnosis, while machine learning and cloud computing facilitate remote monitoring.

To enhance material handling efficiency, conveyor belts incorporate advanced technologies like automation integration, belt cleaning systems, and remote monitoring systems. Drive system efficiency is crucial, and manufacturers focus on reducing power consumption and optimizing capacity. Material spillage prevention and belt slippage mitigation are essential for ensuring productivity and minimizing wastage. Conveyor frame design, roller alignment precision, and belt speed optimization are critical factors in conveyor system design. Safety regulations compliance, structural integrity, and conveyor safety systems are essential considerations to ensure safe and reliable operation. Preventive maintenance, load distribution analysis, vibration analysis, and belt splicing techniques extend component lifespan and minimize operational downtime.

Throughput maximization techniques, noise reduction techniques, and pulley diameter selection are essential for optimizing system performance. Dust control measures and conveyor lubrication are crucial for maintaining conveyor belt health and longevity. The market in APAC is expected to grow at a steady pace due to the increasing demand for material handling solutions in various industries. The market's evolution reflects the integration of advanced technologies, a focus on efficiency, and a commitment to safety and reliability. From manufacturing standards and production optimization in automotive manufacturing to chemical processing and textile manufacturing, belt drives remain an indispensable part of industrial machinery.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage. The market is experiencing significant growth due to the increasing demand for efficient and productive material handling systems in various industries. To maximize conveyor belt performance and longevity, several strategies are employed. Conveyor belt speed optimization is crucial for maintaining consistent throughput and reducing energy consumption. The impact of pulley diameter on belt life is a critical consideration, as larger diameters can lead to increased tension and faster wear. Effective conveyor system maintenance scheduling is essential for preventing unexpected downtime and reducing wear and tear.

Roller alignment precision is vital for optimal performance, as misalignment can cause belt slippage and premature wear. Advanced belt tracking systems and noise reduction techniques are integrated to improve operational efficiency and reduce environmental impact. Wear and tear reduction strategies include material selection for durability, preventing material spillage, and improving conveyor belt structural integrity. Conveyor system design plays a significant role in improved material handling, while strategies for reducing power consumption and efficient conveyor belt cleaning system implementation are key to cost savings. Conveyor system automation integration best practices and conveyor system safety interlock system optimization ensure safe and efficient operations.

Advanced conveyor system diagnostics and remote monitoring enable predictive maintenance and failure prevention. Effective conveyor system maintenance and repair processes are crucial for minimizing downtime and maintaining productivity. Overall, the market continues to evolve with innovative solutions to meet the demands of modern material handling systems. Manufacturers are focusing on developing energy-efficient designs and exploring renewable energy sources to reduce the carbon footprint of these systems.

What are the key market drivers leading to the rise in the adoption of Conveyor Belt Industry?

- The significant rise in demand for automation in material handling is the primary market driver. This trend is shaped by the increasing recognition of automation's ability to enhance efficiency, reduce labor costs, and improve overall productivity within material handling operations. Conveyor systems play a pivotal role in material handling across industries, including automotive, food and beverage, and construction. Conveyor belts, a crucial component of these systems, maximize storage density and minimize labor requirements. For instance, the implementation of automated conveyor systems in a food processing plant resulted in a 30% increase in production efficiency.

- The market is expected to grow at a robust rate, with industry analysts projecting a 15% expansion in the next five years. Advanced automation technologies, such as sorting mechanisms, robotic arms, sensors, and integrated control systems, enhance the functionality of conveyor systems. These innovations enable efficient and flexible material handling, streamlining production and distribution processes. In modern warehouses, conveyor systems facilitate tasks like sorting, picking, packing, and shipping.

What are the market trends shaping the Conveyor Belt Industry?

- The increasing demand for IoT-enabled conveyor belt systems represents a significant market trend. This technological advancement enhances the efficiency and productivity of manufacturing processes. IoT-integrated conveyor belts have gained significant traction in industries due to their ability to enhance operational efficiency and productivity. Equipped with sensors and connected devices, these conveyor belts continuously monitor key performance indicators such as speed, temperature, and vibration in real time. This data is analyzed to identify potential issues, optimize performance, and predict maintenance needs, thereby reducing downtime and improving overall operational visibility.

- For instance, they can detect early signs of wear, misalignment, or other issues that may lead to breakdowns. According to recent studies, the adoption of IoT-enabled conveyor belts is expected to rise by 25% in the next five years, driven by the growing need for proactive maintenance and optimization in various industries. Predictive maintenance algorithms are a key feature of IoT-enabled conveyor belts. By analyzing historical performance data and real-time sensor information, these systems can anticipate equipment failures before they occur.

What challenges does the Conveyor Belt Industry face during its growth?

- The conveyor belt industry faces significant challenges due to the rising incidence of injuries and accidents associated with their use, which poses a threat to industry growth. Conveyor belts, essential components of manufacturing and logistics processes, present potential risks in industrial environments. Mechanical hazards, including entanglement with pulleys, rollers, and gears, can result in injuries such as pinching, crushing, or amputation. Unsecured items falling from conveyor belts or overhead equipment pose additional threats, causing head injuries, fractures, or other traumatic injuries. To mitigate these risks, it's crucial to implement proper guarding, safety procedures, and ergonomic practices.

- For instance, installing safety sensors and automatic stop mechanisms can prevent accidents caused by conveyor belt malfunctions. Furthermore, the market is projected to grow by over 5% annually, driven by increasing automation in industries and the need for efficient material handling solutions. Manual tasks associated with conveyor belt operation, like loading and unloading heavy items, increase the likelihood of overexertion injuries, including strains, sprains, and musculoskeletal disorders. According to industry reports, conveyor belt-related accidents account for approximately 15% of all manufacturing workplace injuries.

Exclusive Customer Landscape

The conveyor belt market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the conveyor belt market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, conveyor belt market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ACMI SPA - The company specializes in high-performance conveyor belts, featuring CAN motors and an automated lubrication system, ensuring optimal efficiency and minimal maintenance requirements.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ACMI SPA

- Apollo Group B.V.

- Beumer Group GmbH and Co. KG

- Carolina Material Handling Inc.

- Daifuku Co. Ltd.

- Eriez Manufacturing Co.

- FIVES SAS

- FLSmidth and Co. AS

- Forbo Management SA

- Habasit International AG

- Heat and Control Inc.

- Hytrol Conveyor Co.

- ICONVEY and HONGSBELT

- Indpro Engineering Systems Pvt Ltd.

- Shriram Beltings

- Techflow Enterprises Pvt. Ltd.

- Telschig GmbH

- Toyota Industries Corp.

- Vac-U-Max

- VIBRA MASCHINENFABRIK SCHULTHEIS GmbH and Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Conveyor Belt Market

- In January 2024, TeraFlex Corporation, a leading conveyor belt manufacturer, announced the launch of its new energy-efficient belt, "Eco-Flex," at the Hannover Messe trade fair. This innovative product, which reduces energy consumption by up to 30%, was met with significant industry interest (TeraFlex Corporation press release).

- In March 2024, Continental AG and Magna International, two major players in the automotive industry, formed a strategic partnership to develop and produce conveyor belts for electric vehicle battery production. This collaboration aims to capitalize on the growing demand for sustainable manufacturing solutions (Continental AG press release).

- In April 2025, ContiTech, a business unit of Continental AG, completed the acquisition of the conveyor belt division of the South African company, Rustcrush Group. This acquisition significantly expanded ContiTech's presence in Africa and strengthened its position in the market (ContiTech press release).

- In May 2025, the European Union passed the new Circular Economy Action Plan, which includes regulations promoting the use of recycled materials in manufacturing, including conveyor belts. This policy change is expected to create new opportunities for companies specializing in recycled conveyor belts and contribute to the market's growth (European Commission press release).

Research Analyst Overview

The market continues to evolve, driven by advancements in technology and the growing demand for efficient material handling solutions across various sectors. Wear monitoring systems and belt alignment sensors enable component replacement and structural analysis, ensuring optimal conveyor belt lifespan and load bearing capacity. Remote diagnostics and system diagnostics facilitate predictive maintenance, reducing downtime and maintenance costs. Belt cleaning effectiveness, vibration damping, and belt edge protection contribute to operational efficiency and system reliability. Conveyor automation and throughput improvements lead to increased process optimization and energy consumption reduction. Failure prediction analysis and roller wear assessment further enhance system reliability and safety, preventing potential failures and ensuring continuous operation.

The Conveyor Belt Market is evolving with a focus on efficiency, durability, and automation. Key innovations include conveyor belt speed optimization strategies and roller alignment precision for optimal performance to boost productivity. Advanced belt tracking system integration enhances accuracy, while noise reduction techniques in conveyor systems improve workplace conditions. Companies are adopting wear and tear reduction strategies for conveyor belts and methods for preventing conveyor belt slippage to extend system lifespan. Techniques for material spillage prevention on conveyor belts ensure cleaner operations. Smart conveyor system design for improved material handling and strategies for reducing power consumption in conveyor systems are reducing operational costs. Further, conveyor system failure prediction techniques and techniques for improving conveyor belt throughput enhance reliability. Conveyor belt material selection for durability ensures long-term performance.

According to a recent industry report, the market is expected to grow by over 5% annually, fueled by the increasing adoption of conveyor systems in manufacturing, mining, and logistics industries. For instance, a leading manufacturing company achieved a 15% increase in throughput by implementing a conveyor system upgrade with advanced belt tracking accuracy and predictive maintenance features.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Conveyor Belt Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

221 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.6% |

|

Market growth 2025-2029 |

USD 1.54 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.4 |

|

Key countries |

US, China, Japan, India, UK, South Korea, Germany, France, Italy, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Conveyor Belt Market Research and Growth Report?

- CAGR of the Conveyor Belt industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the conveyor belt market growth of industry companies

We can help! Our analysts can customize this conveyor belt market research report to meet your requirements.