Consulting Services Segment Market Size 2024-2028

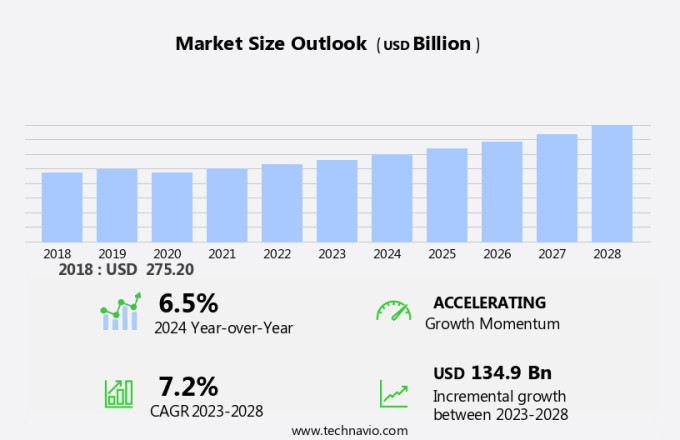

The consulting services segment market size is forecast to increase by USD 134.9 billion at a CAGR of 7.2% between 2023 and 2028. In the consulting services market, there are several key trends shaping industry growth. First, there is a growing demand for decarbonization consulting as organizations adopt net zero strategies to reduce their carbon footprint. This trend is particularly prevalent in industries such as human resources, IT and telecommunications, technology advisory, life sciences, and financial services. Additionally, Cybersecurity issues continue to pose significant challenges for professional services firms, necessitating a focus on security solutions. Another trend is the increasing importance of technology advisory services, as businesses seek expert guidance on implementing advanced technologies to drive growth and efficiency. Overall, these trends underscore the need for consulting firms to stay abreast of emerging industry trends and offer innovative solutions to meet evolving client needs.

What will be the Size of the Market During the Forecast Period?

Technology-driven consulting services play a pivotal role in helping organizations navigate digital transformations and optimize operational performance. This article explores the significance of technology-driven consulting in various industries, including IT and telecommunications, financial services, energy, life sciences, and more. A Game Changer in Business Technology-driven consulting refers to the practice of leveraging external expertise to help businesses make informed decisions regarding technology investments and implementations. This type of consulting encompasses various domains, such as data analytics, artificial intelligence (AI), machine learning, automation, augmented and virtual reality, and cloud-based platforms. Data-Driven Insights for Strategic Planning Data analytics is a crucial aspect of technology-driven consulting. By analyzing large datasets, businesses can gain valuable insights into customer behavior, market trends, and operational efficiency. These insights, in turn, inform strategic planning and help organizations stay competitive. Enhancing Operational Capabilities Artificial intelligence and machine learning are transforming industries by automating repetitive tasks and enabling predictive analytics. Technology-driven consulting firms help businesses integrate these technologies into their operations, streamlining processes and improving overall performance. Protecting Digital Assets As businesses increasingly rely on digital platforms, cybersecurity becomes a top priority.

Technology-driven consulting services can help organizations assess their cybersecurity risks and implement vital security measures to protect sensitive data and maintain regulatory compliance. Human Resources and Legal Compliance Technology-driven consulting also plays a crucial role in human resources management and legal compliance. Firms specializing in technology advisory can help organizations navigate labor laws, ensuring they remain compliant while optimizing their workforce and implementing technology solutions. Industry-Specific Expertise Technology-driven consulting services cater to various industries, including banking, healthcare, and energy. In the banking sector, consulting firms help financial institutions implement digital solutions, optimize operations, and maintain regulatory compliance. In healthcare, technology consulting enables organizations to improve patient care, streamline processes, and enhance data security. Energy consulting focuses on optimizing energy production and distribution, reducing costs, and improving operational efficiency. In conclusion, technology-driven consulting services are essential for businesses seeking to make informed strategic decisions and optimize operational performance. By leveraging external expertise in domains such as data analytics, AI, machine learning, automation, cybersecurity, and human resources management, organizations can stay competitive and adapt to the ever-evolving business landscape.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Management consulting

- IT Consulting

- Financial Consulting

- Marketing Consulting

- Others

- Consumer

- Large enterprises

- Small and medium enterprises

- Geography

- North America

- US

- Europe

- Germany

- UK

- France

- Spain

- APAC

- China

- India

- Japan

- South Korea

- Middle East and Africa

- South America

- Brazil

- North America

By Type Insights

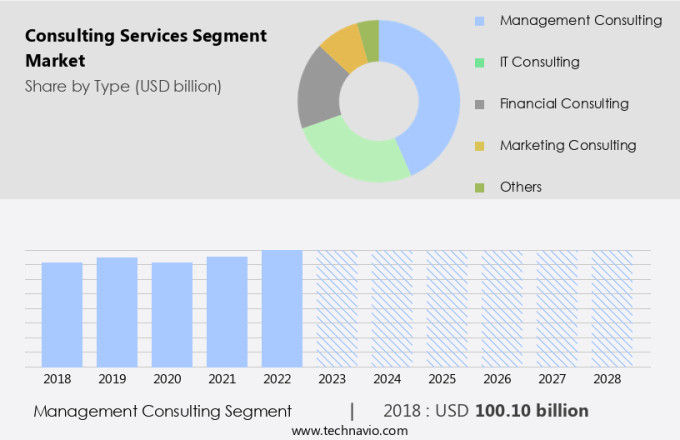

The management consulting segment is estimated to witness significant growth during the forecast period. The consulting services market's management segment is a significant and indispensable part, catering to the strategic and operational requirements of businesses in diverse industries. This segment is recognized for its role in enhancing organizational efficiency by diagnosing and addressing existing business issues and proposing solutions for improvement. Management consulting encompasses various services such as strategy consulting, technology consulting, and operations consulting. Strategy consulting is a pivotal sub-segment that assists organizations in setting long-term objectives and devising effective strategies to attain them. Consulting firms in this area offer valuable insights on market penetration strategies, competitive landscape analysis, and business model innovation. Management consulting services play a crucial role in optimizing business performance and ensuring sustainable growth.

Get a glance at the market share of various segments Request Free Sample

The Management consulting segment accounted for USD 100.10 billion in 2018 and showed a gradual increase during the forecast period.

Regional Insights

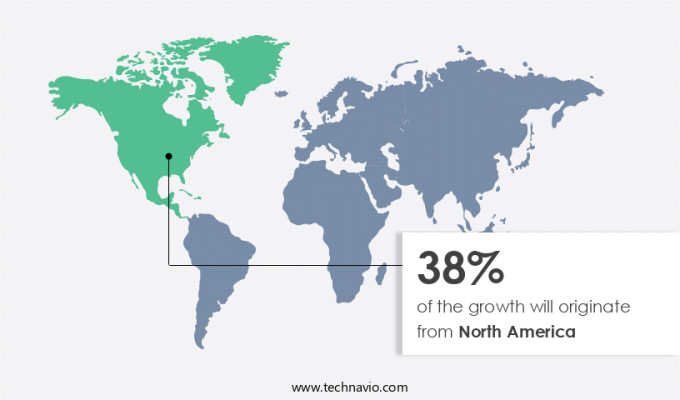

North America is estimated to contribute 38% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The North American consulting services market is a thriving industry, catering to the unique requirements of businesses in various sectors. This market is distinguished by its concentration on delivering expert knowledge in specialized fields, including architecture and engineering, environmental consulting, and strategic business consulting. The region's consulting services sector is witnessing significant growth due to the increasing emphasis on sustainable development and technological innovation. Environmental consulting is a significant segment within the North American consulting services industry. This segment offers expert guidance and solutions for environmental management, sustainability, and regulatory compliance. The recent selection of Stantec by Canada Nickel Company (CNC) in March 2024 to provide environmental consulting services for the Crawford Nickel Project underscores the importance of environmental consulting in the mining industry.

As businesses in North America continue to navigate complex challenges, the demand for consulting services that offer strategic decision-making and external expertise is on the rise. The integration of technology-driven consulting, data analytics, and artificial intelligence is further enhancing the value proposition of consulting services. This trend is expected to continue, as companies seek to optimize their operations and remain competitive in a rapidly evolving business landscape.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

The launch of new services by companies is the key driver of the market. The consulting services market in the United States is witnessing substantial growth due to the introduction of innovative solutions by companies, aimed at meeting evolving client demands and technological advancements. One such development is the integration of Artificial Intelligence (AI) and machine learning (ML) in consulting services. In September 2023, IBM unveiled new offerings to help clients optimize their use of Oracle's cloud applications and technology. This expansion includes the implementation of generative AI, which allows for an open, orchestrated approach, addressing the increasing demand for advanced AI solutions. Similarly, in October 2022, Dell Technologies debuted new generative AI (GenAI) consulting services, alongside the launch of AI laptops and mobile workstations.

These advancements in consulting services are revolutionizing business operations and driving value creation. Cloud-based platforms and Cybersecurity are also key areas of focus for consulting services. Companies are seeking expert guidance to ensure their transition to cloud environments is seamless and secure. With the increasing use of virtual reality(VR) and Augmented Reality (AR) in various industries, consulting services are providing valuable insights to clients looking to implement these technologies. As businesses continue to prioritize digital transformation, the demand for consulting services that leverage AI, ML, automation, and other emerging technologies will only continue to grow. In conclusion, the consulting services market in the US is experiencing significant growth due to the integration of advanced technologies such as AI, ML, and cloud-based platforms. companies are expanding their offerings to meet evolving client demands, and consulting services are playing a crucial role in driving digital transformation and value creation for businesses.

Market Trends

Increased focus of consulting firms on sustainability is the upcoming trend in the market. The consulting services industry is experiencing a notable transition towards sustainability, as businesses increasingly prioritize eco-friendly practices. This trend is reflected in the strategic initiatives of leading consulting firms, which are expanding their sustainability offerings to meet client demands. This collaboration enhances CBRE Romania's ability to provide comprehensive ESG and sustainability consulting services. Similarly, global professional services firm EY has bolstered its sustainability consulting capabilities through the acquisition of Denkstatt, an Austria-based firm, in April 2024.

The human resources, IT and telecommunications, technology advisory, life sciences, and financial services sectors are increasingly seeking the expertise of consulting firms to help them decarbonize their operations and develop net zero strategies. These industries recognize the importance of sustainability in maintaining a competitive edge and meeting stakeholder expectations. As a result, the demand for decarbonization consulting services is expected to grow significantly in the coming years. In conclusion, the consulting services market is undergoing a significant transformation as businesses prioritize sustainability and decarbonization. Leading consulting firms are responding to this trend by expanding their sustainability offerings and capabilities, providing valuable support to clients in various industries as they navigate the complexities of implementing net zero strategies.

Market Challenge

Cybersecurity issues in professional services is a key challenge affecting the market growth. The consulting services industry in the United States is experiencing a significant shift towards digital transformation, with an increasing emphasis on remote working and the adoption of advanced technologies. This transition brings new opportunities for consulting firms but also introduces unique cybersecurity challenges. With the rise of digital platforms and cloud-based solutions, sensitive information is increasingly at risk of cyberattacks. Consulting firms, along with accounting, legal, and other professional services, are prime targets for cybercriminals due to the valuable data they handle. Intellectual property, legal documents, and client personally identifiable information (PII) are just a few examples of the data that could be compromised in a cybersecurity breach.

By investing in advanced cybersecurity solutions and implementing best practices, firms can mitigate risks and build trust with their clients. This not only helps to protect sensitive information but also enhances the overall value proposition of consulting services. In conclusion, the consulting services industry in the US is undergoing a digital transformation, and with it comes new cybersecurity challenges. Firms must prioritize cybersecurity to protect their clients' data, their reputation, and their business operations. By investing in advanced solutions and implementing best practices, consulting firms can mitigate risks and build trust with their clients in this increasingly digital and interconnected business world.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Accenture PLC - The company provides strategy, technology, and operations consulting to drive business transformation.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Bain and Co. Inc.

- Boston Consulting Group Inc.

- Capgemini Services SAS

- CGI Inc.

- Cognizant Technology Solutions Corp.

- Deloitte Touche Tohmatsu Ltd.

- Ernst and Young Global Ltd.

- FTI Consulting Inc.

- Gartner Inc.

- HCL Technologies Ltd.

- Infosys Ltd.

- International Business Machines Corp.

- KPMG International Ltd.

- McKinsey and Co.

- NTT DATA Corp.

- PricewaterhouseCoopers LLP

- Roland Berger Holding GmbH and Co. KGaA

- Tata Consultancy Services Ltd.

- Wipro Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Consulting services play a pivotal role in helping businesses navigate complex strategic decision-making processes. External expertise is sought after to drive digital transformations, leveraging technology-driven consulting services such as data analytics, artificial intelligence (AI), machine learning, automation, and cloud-based platforms. Consulting firms provide valuable insights in various industries, including life sciences, financial services, energy, and technology, among others. Consulting services encompass various domains, including cybersecurity, remote working, operations consulting, supply chain management, process management, and resilient supply chains. Climate control and net zero strategy are increasingly becoming essential areas of focus for businesses, leading to a wave in decarbonization consulting.

Further, human resources, IT and telecommunications, and technology advisory are critical consulting services that help businesses optimize their operations and improve operational performance. Independent consultants and boutique businesses cater to specific client needs, offering customized solutions to meet evolving business requirements. Technology investment is a significant driver for consulting services, with cloud computing, ESG activities, and AI, ML, and automation playing essential roles in enhancing operational efficiency and strategic planning. Consulting firms help businesses stay competitive by providing expert advice on banking, healthcare, technology development, and more.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

222 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.2% |

|

Market growth 2024-2028 |

USD 134.9 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.5 |

|

Regional analysis |

North America, Europe, APAC, Middle East and Africa, and South America |

|

Performing market contribution |

North America at 38% |

|

Key countries |

US, China, Japan, Germany, UK, France, South Korea, Spain, India, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Accenture PLC, Bain and Co. Inc., Boston Consulting Group Inc., Capgemini Services SAS, CGI Inc., Cognizant Technology Solutions Corp., Deloitte Touche Tohmatsu Ltd., Ernst and Young Global Ltd., FTI Consulting Inc., Gartner Inc., HCL Technologies Ltd., Infosys Ltd., International Business Machines Corp., KPMG International Ltd., McKinsey and Co., NTT DATA Corp., PricewaterhouseCoopers LLP, Roland Berger Holding GmbH and Co. KGaA, Tata Consultancy Services Ltd., and Wipro Ltd. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch