Commercial Vehicle Steering System Market Size 2025-2029

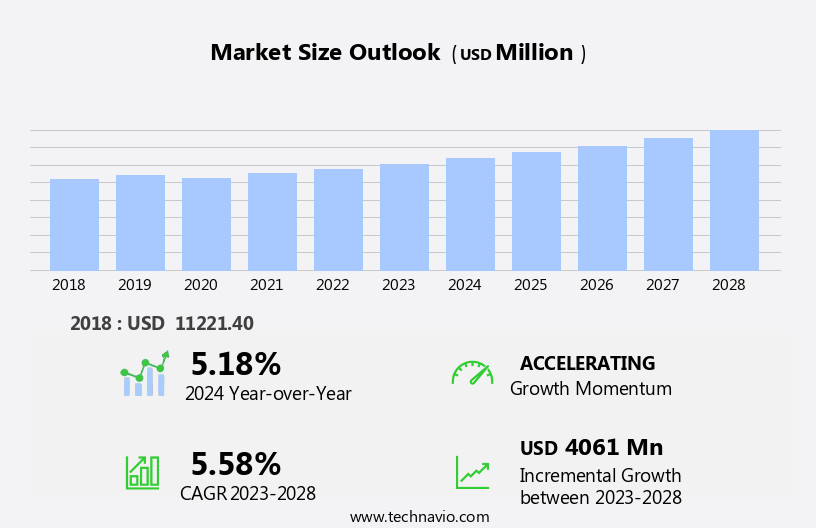

The commercial vehicle steering system market size is forecast to increase by USD 4.43 billion at a CAGR of 5.8% between 2024 and 2029.

- The market is driven by the electrification of automotive components for enhanced steering control and accuracy. This trend is fueled by the increasing demand for advanced safety features and improved fuel efficiency in commercial vehicles. Moreover, continuous advances in steering technology, such as electric power steering systems and active steering systems, are gaining popularity due to their ability to provide better maneuverability and reduced driver effort. However, the market faces significant challenges, including increasing cost pressure on Original Equipment Manufacturers (OEMs) due to the rising cost of raw materials and labor.

- To capitalize on the market opportunities, companies must focus on developing innovative and cost-effective steering solutions while adhering to regulatory requirements. Effective operational planning and strategic partnerships can help OEMs navigate these challenges and maintain a competitive edge in the market. Lightweight steering systems, such as those using hydraulic pumps, are also in focus for fuel-efficient cars and commercial vehicles to reduce emissions. Additionally, stringent regulations regarding emissions and safety standards add to the financial burden for OEMs, necessitating the need for cost-effective and efficient steering systems.

What will be the Size of the Commercial Vehicle Steering System Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market is witnessing significant advancements, driven by the integration of advanced technologies such as human-machine interfaces, active and electro-mechanical steering, over-the-air updates, parking assist, and automated emergency braking. Electro-hydraulic steering systems are gaining traction due to their fuel efficiency and ease of integration with electronic systems. Failure modes and component lifespan are critical concerns for fleet operators, leading to a growing demand for remote diagnostics and aftermarket parts. Sensors, including lateral acceleration, yaw rate, and road friction, are essential for enhancing safety and improving driving dynamics. Additionally, steering systems are evolving to support advanced features like all-wheel steering, servo-assisted steering, driver fatigue detection, and autonomous driving.

Noise and vibration reduction, night vision, head-up displays, and driver displays are also becoming increasingly important for enhancing driver comfort and safety. Data analytics and vibration analysis are key trends in the market, enabling predictive maintenance and optimizing component performance. Blind spot detection and adaptive front-lighting systems are further enhancing safety and reducing accidents. Overall, the market is experiencing dynamic growth, driven by technological innovations and the evolving needs of the transportation industry. This trend is particularly prominent in the commercial vehicle sector, where improved fuel efficiency and reduced emissions are key priorities.

How is this Commercial Vehicle Steering System Industry segmented?

The commercial vehicle steering system industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Light commercial vehicle

- Medium and heavy commercial vehicle

- Type

- Electronic power steering

- Electro-hydraulic power steering

- Hydraulic power steering

- Propulsion

- Diesel vehicle

- Gasoline vehicle

- Electric vehicle

- Hybrid vehicle

- End-user

- OEM

- Aftermarket

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- APAC

- Australia

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Application Insights

The Light commercial vehicle segment is estimated to witness significant growth during the forecast period. Commercial Vehicle Steering Systems Market: Trends and Developments the market encompasses various components, including Electronic Stability Program (ESP) systems, angle sensors, vehicle dynamics control, stability control, steering wheel controls, commercial vehicles, ball joints, power steering, haptic feedback, driver assistance systems, multi-function steering wheels, steering column adjustment, traction control, off-highway vehicles, steering columns, steering shafts, steering gears, tilt steering, steering dampers, steering pinions, collision avoidance, wheel alignment, infotainment system integration, control arms, ABS systems, light-duty vehicles, and steering linkages in heavy-duty vehicles. The market's ongoing evolution is reflected in the integration of advanced features, such as hydraulic systems, throttle control, and ground clearance, which enhance performance and safety.

The market for Commercial Vehicle Steering Systems is experiencing significant growth due to the increasing demand for advanced driver assistance systems (ADAS) and safety features in commercial vehicles. These systems include lane departure warnings, collision avoidance, and driver monitoring systems. Moreover, the integration of steering systems with infotainment systems and advanced software algorithms is driving the market's expansion. Light commercial vehicles (LCVs), which have a gross vehicle weight (GVW) of less than 3.5 tons, are gaining popularity in the US and China due to the growth of small businesses and the increasing demand for time-critical and high-value goods delivery.

Pick-up trucks, a significant segment of LCVs, play a crucial role in the final delivery of these goods and support services. Power steering systems, such as hydraulic and electric power steering, are essential components of commercial vehicles, making them easier to maneuver, especially in heavy-duty applications. The adoption of electronic power steering systems is increasing due to their energy efficiency and ability to integrate with advanced driver assistance systems. Manufacturing processes and safety standards continue to evolve, with a focus on reducing weight and improving fuel efficiency. The use of advanced materials, such as lightweight metals and composites, and the integration of steering systems with suspension systems are contributing to the development of more efficient and effective commercial vehicles.

The adoption of light commercial vehicles, particularly in the US and China, is driving the market's expansion, with power steering systems playing a crucial role in making these vehicles easier to maneuver. The evolution of manufacturing processes and safety standards, as well as the increasing complexity of the supply chain, are also contributing to the market's growth.

The Light commercial vehicle segment was valued at USD 8.84 billion in 2019 and showed a gradual increase during the forecast period.

Off-highway vehicles, including agricultural machinery and construction equipment, require robust steering systems to navigate challenging terrains and operate heavy loads. Hydraulic power steering systems are commonly used in these applications due to their ability to provide the necessary torque and power. The supply chain management of commercial vehicle steering systems is becoming increasingly complex, with a focus on reducing lead times and improving quality. The use of advanced software algorithms and real-time data analytics is enabling manufacturers to optimize their production processes and improve their overall efficiency. The Commercial Vehicle Steering Systems Market is experiencing significant growth due to the increasing demand for advanced driver assistance systems, safety features, and fuel efficiency.

The Commercial Vehicle Steering System Market is advancing toward intelligent mobility and precision handling. Technologies like fourwheel steering enhance maneuverability, especially in tight urban conditions. Advanced sensor integration, such as steering angle sensor, yaw rate sensor, lateral acceleration sensor, and road friction sensor is enabling real-time data processing for optimal vehicle control. The rise of interactive cockpit experiences is fueled by innovations like headup display and driver display, offering vital driving insights without distraction. At the core of this evolution lies the human machine interface (HMI), seamlessly connecting drivers with vehicle systems for enhanced safety, responsiveness, and user experience.

Regional Analysis

North America is estimated to contribute 43% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is witnessing significant growth, with North America leading the way in 2024. The US dominates this market in the region, driven by the increasing demand for commercial vehicles, particularly SUVs and light-duty trucks such as pick-ups and crossovers. These vehicles incorporate advanced steering systems, including electronic power steering, adaptive cruise control, and lane keeping assist, to enhance safety and improve the driver experience. Manufacturing processes for commercial vehicle steering systems adhere to stringent safety standards, ensuring the integration of safety features like anti-lock braking systems (ABS), traction control, and stability control.

Off-highway vehicles, including agricultural machinery and construction equipment, also utilize steering systems with advanced features like power steering, steering columns, and steering shafts for optimal maneuverability. The supply chain management of these systems involves the integration of software algorithms, control arms, and steering linkages, ensuring efficient production and delivery. Passenger vehicles, too, are adopting advanced steering systems, with electric power steering and steering gear becoming increasingly popular. Telescopic steering, tilt steering, and steering wheel controls further enhance the driving experience. The integration of infotainment systems and steering wheel-mounted controls adds to the convenience and functionality of these vehicles.

In the market, key entities include power steering, ball joints, steering columns, steering racks, and steering linkages. These components work in harmony, ensuring precise vehicle handling and optimal driver control. The market is also witnessing the emergence of innovative technologies like hydraulic power steering, steering damper, and steering pinion, contributing to the market's growth and evolution. The aftermarket demand for ATV steering systems and related components, including Electric Power Steering (EPS), remains robust due to the growing consumer preference for performance tuning and safety standards in utility vehicles.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Commercial Vehicle Steering System market drivers leading to the rise in the adoption of Industry?

- The electrification of automotive steering components is a primary market driver, enabling precise and accurate control. The automotive industry has witnessed significant advancements in steering systems over the last few decades, driven by regulatory requirements and the need for enhanced safety and efficiency. Traditional hydraulic power steering systems have given way to electronic power steering (EPS) and torque sensor-assisted systems, offering improved fuel efficiency and precise steering. Moreover, the integration of advanced technologies like adaptive cruise control and suspension systems has become essential for both commercial and passenger vehicles.

- The shift towards electric power steering (EPS) is further accelerating, as it offers numerous benefits, including reduced fuel consumption and lower emissions. As the industry continues to evolve, supply chain management and integration of multiple systems will be key focus areas for OEMs and Tier-1 suppliers. The future of steering systems lies in the development of sophisticated, electronically controlled systems that ensure safety, efficiency, and environmental sustainability. Agricultural machinery and construction equipment also rely on robust steering racks and suspension systems for optimal performance. The increasing demand for lightweight and durable materials, such as aluminum and high-strength steel, is driving up the cost of production.

What are the Commercial Vehicle Steering System market trends shaping the Industry?

- The ongoing evolution of automotive steering technology represents a significant market trend. This advancement encompasses the development of more responsive, fuel-efficient, and technologically sophisticated steering systems. The automotive steering system market has experienced significant advancements, driven by the increasing focus on reducing vehicle emissions and enhancing safety features. Manufacturers are investing heavily in research and development to create more efficient engines and comply with emission norms. One notable trend is the integration of safety technologies, such as collision avoidance systems and wheel alignment sensors, with steering systems.

- In heavy-duty vehicles, the focus is on enhancing durability and precision through the use of advanced steering pinions and ABS systems. The steering system market is expected to continue evolving, with the integration of more advanced safety and connectivity features becoming increasingly common. Additionally, tilt steering and steering damper technologies have gained popularity for their ability to improve handling and stability. Furthermore, the integration of infotainment systems and control arms with steering linkages has become a norm in light-duty vehicles.

How does Commercial Vehicle Steering System market face challenges during its growth?

- The escalating cost pressures confronted by Original Equipment Manufacturers (OEMs) represent a significant challenge to the industry's growth trajectory. The market presents both challenges and opportunities for component manufacturers and suppliers. Strict quality requirements and cost pressure from OEMs and tier-1 suppliers necessitate innovative growth strategies. In the realm of Electric Power Steering (EPS) systems for commercial vehicles, maintaining costs while delivering high-quality components is crucial. Simultaneously, rack and pinion steering systems, along with automotive steering columns, are witnessing increased popularity, particularly for compact and mid-size vehicles, owing to their capacity to enhance control and responsiveness.

- To remain competitive, players must optimize production processes and costs while ensuring the highest level of quality. These components must pass stringent quality control tests and meet the demands of vehicle dynamics control systems, stability control, steering wheel controls, traction control, and driver assistance systems. Moreover, the integration of advanced features like angle sensors, haptic feedback, multi-function steering wheels, and steering column adjustment adds complexity to the manufacturing process.

Exclusive Customer Landscape

The commercial vehicle steering system market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the commercial vehicle steering system market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, commercial vehicle steering system market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ATS Automation Tooling Systems Inc. - The company specializes in advanced commercial vehicle steering systems, including hydraulic power steering and electronic power steering technologies, enhancing vehicle maneuverability and fuel efficiency for diverse industries.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ATS Automation Tooling Systems Inc.

- China Automotive Systems Inc.

- Global Steering Systems LLC

- Hitachi Ltd.

- HL Mando Co. Ltd.

- JTEKT Corp.

- Knorr Bremse AG

- Mahindra and Mahindra Ltd.

- Mitsubishi Electric Corp.

- Nexteer Automotive Corp.

- NSK Ltd.

- OGNIBENE POWER SPA

- Pailton Engineering Ltd.

- R. H. Sheppard Co. Inc.

- Robert Bosch GmbH

- ST System Truck Spa

- thyssenkrupp AG

- Unique Metal Products Inc.

- ZF Friedrichshafen AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Commercial Vehicle Steering System Market

- In January 2024, ZF Friedrichshafen AG, a leading global technology company, announced the launch of its new electric power steering system, 'Eco Line,' for commercial vehicles. This system reduces fuel consumption by up to 3% and CO2 emissions by up to 2.5 g/km (ZF press release).

- In March 2024, Daimler Trucks and Mercedes-Benz Trucks signed a strategic partnership with Magna International, a global automotive supplier, to develop and produce advanced driver assistance systems (ADAS) and automated driving technologies for commercial vehicles (Daimler Trucks press release).

- In April 2025, Nexteer Automotive, a global automotive steering system manufacturer, completed the acquisition of the steering business of the French automotive supplier, Valeo. This acquisition strengthened Nexteer's position in the European market and expanded its product portfolio (Nexteer Automotive press release).

- In May 2025, the European Union introduced new regulations for commercial vehicles, mandating the installation of advanced safety features, including advanced emergency braking systems and lane departure warning systems. These regulations are expected to drive the demand for advanced steering systems in the European commercial vehicle market (European Commission press release).

Research Analyst Overview

The market continues to evolve, driven by advancements in technology and the diverse requirements of various sectors. Steering systems, including tilt steering, steering damper, steering pinion, and steering linkage, form the core of commercial vehicles, enabling efficient maneuverability and control. Ball joints, power steering, and control arms ensure stability and precision in light-duty vehicles, while heavy-duty vehicles rely on robust components such as tie rods, anti-roll bars, and traction control systems. Steering wheel innovations, like multi-function steering wheels and haptic feedback, enhance driver experience and safety. Collision avoidance, lane keeping assist, and emergency braking systems are increasingly integrated into commercial vehicles, contributing to improved safety standards.

Manufacturing processes and software algorithms optimize steering system performance, ensuring compliance with safety regulations. Infotainment system integration and driver monitoring systems further enhance the commercial vehicle driving experience. Off-highway vehicles, including agricultural machinery and construction equipment, require specialized steering systems, such as hydraulic power steering and suspension systems, to navigate challenging terrains. The market remains dynamic, with ongoing developments in driver assistance systems, electronic power steering, and adaptive cruise control. Supply chain management and the integration of various steering system components continue to shape market trends.

The Commercial Vehicle Steering System Market is rapidly evolving with safety, precision, and driver comfort at its core. Essential components like the steering shaft, steering rack, tie rod, and ball joint are being enhanced for better durability and performance. Integration with the suspension system ensures smoother handling. Advanced sensorsâtorque sensor, angle sensor, and speed sensorâare improving responsiveness and real-time control. Safety features like the ABS system, ESP system, and antiroll bar are now standard in many commercial vehicles. Innovations like the multifunction steering wheel and driver monitoring system support driver well-being and operational efficiency, shaping a smarter and safer future for long-haul and urban commercial transport.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Commercial Vehicle Steering System Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

240 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.8% |

|

Market growth 2025-2029 |

USD 4.43 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.4 |

|

Key countries |

US, Japan, Canada, China, India, South Korea, Mexico, Germany, UK, and Australia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Commercial Vehicle Steering System Market Research and Growth Report?

- CAGR of the Commercial Vehicle Steering System industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the commercial vehicle steering system market growth of industry companies

We can help! Our analysts can customize this commercial vehicle steering system market research report to meet your requirements.