Commercial HVAC Market Size 2025-2029

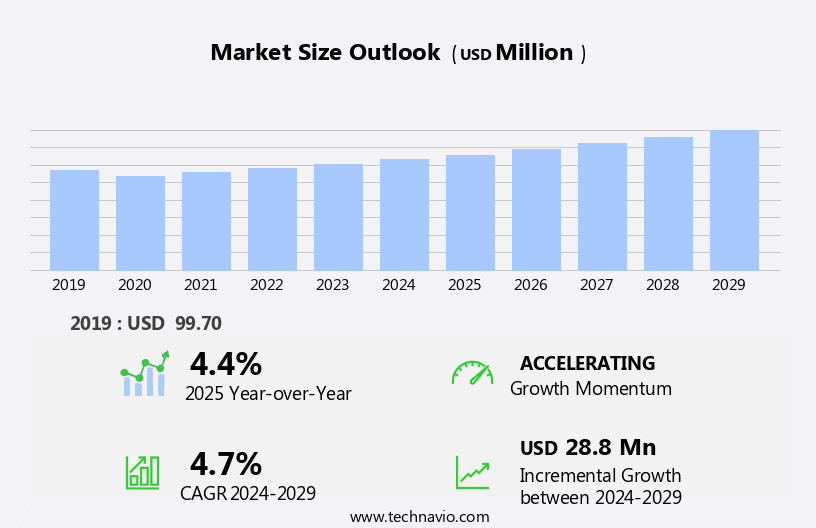

The commercial HVAC market size is forecast to increase by USD 28.8 million, at a CAGR of 4.7% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing number of data centers and the emergence of smart and connected HVAC systems. The proliferation of data centers necessitates advanced cooling solutions to maintain optimal operating temperatures, leading to increased demand for Commercial HVAC systems. Furthermore, the integration of IoT technologies in HVAC systems enables remote monitoring, predictive maintenance, and energy efficiency, making them an attractive investment for businesses. However, the market faces formidable competition, with numerous players vying for market share. This intense competition necessitates continuous innovation and differentiation to gain a competitive edge.

- Additionally, the integration of new technologies into HVAC systems can pose challenges, such as high implementation costs and the need for specialized expertise. Building management systems and IoT integration facilitate data analytics and remote monitoring, allowing for real-time performance optimization. Companies seeking to capitalize on market opportunities must focus on delivering cost-effective, energy-efficient, and technologically advanced solutions while navigating these challenges effectively. By staying abreast of market trends and addressing customer needs, businesses can position themselves for long-term success in the market.

What will be the Size of the Commercial HVAC Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by the need for carbon footprint reduction, improved air filtration, and enhanced indoor air quality. HVAC systems, including air handlers, packaged units, and rooftop units, are being integrated with advanced technologies such as variable speed drives, flow sensors, and demand response programs. These innovations enable energy efficiency, optimized performance, and demand response capabilities. New construction projects and building renovations are embracing sustainable design, adhering to codes and standards, and implementing green building practices. HVAC systems are being modeled and simulated to ensure optimal energy usage and carbon footprint reduction.

Air conditioning systems are being augmented with air filtration and indoor air quality solutions, such as air purifiers, UV air treatment, and humidity sensors. Water systems are being optimized for energy efficiency and carbon footprint reduction through the use of heat pumps and cooling towers. Variable refrigerant flow and VAV systems are gaining popularity for their energy efficiency and ability to adapt to changing environmental conditions. Smart controls and building automation systems are being employed to enhance overall system performance and reduce energy consumption. Carbon dioxide monitoring and temperature sensors are becoming essential components of HVAC systems, ensuring optimal indoor air quality and maintaining a healthy environment for building occupants.

HVAC software and cloud-based platforms are facilitating the integration of these advanced technologies, enabling building owners and operators to make data-driven decisions and maximize their return on investment.

How is this Commercial HVAC Industry segmented?

The commercial HVAC industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Equipment

- Services

- Type

- Heat pump

- Furnaces

- Boilers

- Unitary heaters

- Technology

- Conventional HVAC systems

- Smart HVAC systems

- Variant

- Retrofit and replacement

- New installation

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- Middle East and Africa

- UAE

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

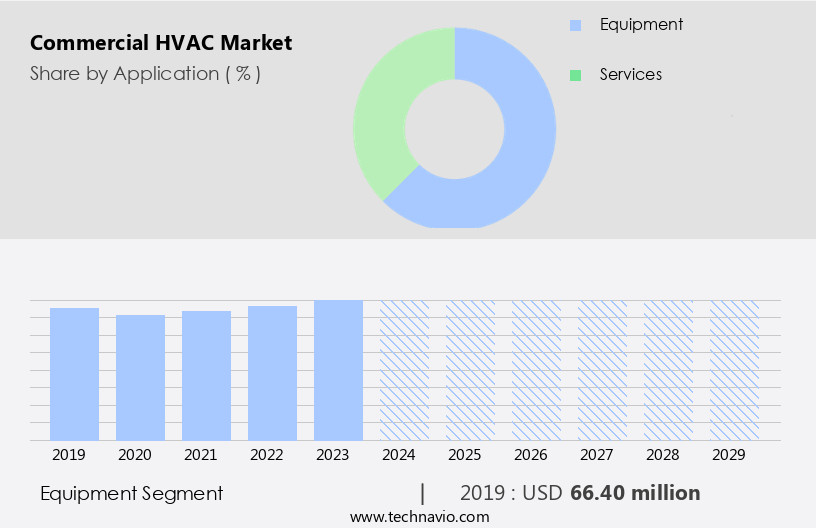

By Application Insights

The Equipment segment is estimated to witness significant growth during the forecast period. HVAC equipment, which includes heating, ventilation, and air conditioning systems, is experiencing significant demand due to the construction boom in the Middle East and Asian economies. In Europe and North America, where harsh winters necessitate heating, underfloor heating (UFH) systems are increasingly popular due to their energy savings and minimal space requirement. Split systems, a type of air conditioning equipment, are also gaining traction due to their energy efficiency and flexibility. Cloud-based platforms and building management systems are revolutionizing HVAC operations through remote monitoring, data analytics, and performance optimization.

Energy management systems, including variable speed drives and smart controls, are essential for reducing energy consumption and carbon footprint. Air filtration and indoor air quality systems, such as air purifiers and UV air treatment, are crucial for maintaining healthy indoor environments. Codes and standards, including LEED certification, are driving the market towards sustainable design and energy efficiency. HVAC software and building automation systems are facilitating the integration of IoT and demand response programs for enhanced energy efficiency. Additionally, innovative technologies like VAV systems, modeling and simulation, and variable refrigerant flow are transforming the HVAC landscape. Water systems, cooling towers, and fan coil units are other essential components of HVAC systems, ensuring optimal temperature and humidity control.

The focus on energy efficiency and sustainability is expected to continue driving the growth of the HVAC market.

The Equipment segment was valued at USD 66.40 million in 2019 and showed a gradual increase during the forecast period.

The Commercial HVAC Market is becoming more intelligent and sustainable with innovations across chiller plant and central plant systems. Solutions like air purification, UV lamps, and refrigerant recovery enhance indoor air quality and environmental safety. Advanced leak detection and HVAC controls improve operational reliability. Strategic energy audits, precise load calculations, and occupancy sensing optimize building efficiency. Adherence to building codes compliance is ensured by expert commissioning agents and skilled HVAC technicians. Routine preventative maintenance is key to system longevity. Technologies like digital twins and AI-driven optimization redefine performance. Flexible HVAC equipment financing, performance contracting, and renewable energy integration empower sustainability goals. Solutions such as district cooling, district heating, waste heat recovery, fluid coolers, and cloud-based monitoring platforms are leading the market transformation.

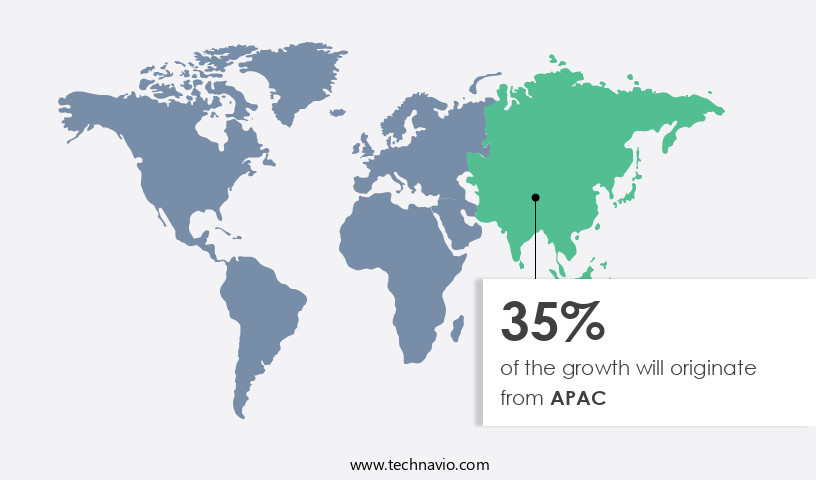

Regional Analysis

APAC is estimated to contribute 35% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in APAC is experiencing significant growth, with this region being the highest contributor to the global market. The rise in infrastructure spending on commercial projects is driving the demand for advanced HVAC systems in APAC. The positive economic climate in emerging economies like India, China, Vietnam, and the Philippines is boosting investments in the commercial real estate sector, which in turn is fueling the demand for energy-efficient HVAC solutions. China, Japan, and India are the leading contributors to the market in APAC. The increasing number of smart city projects in Asia is further augmenting the demand for commercial buildings, leading to a higher adoption rate of HVAC systems.

Sustainable design, energy management, and performance optimization are key trends in the market, with an emphasis on energy efficiency, indoor air quality, and carbon footprint reduction. HVAC equipment, including rooftop units, split systems, and packaged units, is being integrated with IoT technology, building automation, and smart controls for enhanced energy savings and operational efficiency. Additionally, the adoption of cloud-based platforms, modeling and simulation, and data analytics is enabling better performance optimization and remote monitoring of HVAC systems. Variable speed drives, air filtration, and humidity sensors are also gaining popularity in the market for their energy-saving capabilities and contribution to improved indoor air quality.

The market in APAC is expected to continue its growth trajectory, driven by the increasing demand for sustainable and energy-efficient solutions in the commercial sector.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Commercial HVAC Industry?

- The increasing number of data centers serves as the primary catalyst for market growth. The market is experiencing significant growth due to the increasing demand for energy efficiency and green building practices in both residential and commercial buildings. Building automation systems, including smart controls, IoT integration, and humidity sensors, are becoming increasingly popular for optimizing energy usage and improving indoor air quality. Variable refrigerant flow (VRF) systems, which offer energy savings and zoned temperature control, are also gaining traction. Cooling towers and fan coil units are essential components of commercial HVAC systems, ensuring efficient cooling and heating. Building codes continue to evolve, mandating higher energy efficiency standards, which further drives market growth.

- Builders of modern commercial buildings are prioritizing sustainable practices, leading to the adoption of energy-efficient HVAC systems and renewable energy sources. Demand response programs, which incentivize building owners to reduce energy usage during peak demand periods, are also contributing to market expansion. Moreover, the integration of advanced technologies, such as IoT and building automation, enables real-time monitoring and analysis of energy usage, leading to increased energy savings and operational efficiency. The focus on sustainability and reducing carbon footprints is also fueling market growth, as green building practices become more prevalent. Overall, the market is expected to continue its upward trajectory, driven by the need for energy efficiency, advanced technologies, and regulatory requirements.

What are the market trends shaping the Commercial HVAC Industry?

- The emergence of smart and connected HVAC systems represents a significant market trend. Intelligent heating, ventilation, and air conditioning (HVAC) technologies are becoming increasingly popular due to their energy efficiency, convenience, and advanced features. The market is witnessing significant growth due to the increasing focus on reducing carbon footprint and enhancing indoor air quality. Advanced technologies such as air filtration systems, flow sensors, and HVAC software are gaining popularity. These technologies enable real-time monitoring and analysis of HVAC system performance, leading to energy savings and improved air quality. Packaged units and air handlers are being upgraded with smart features, allowing for demand response and integration with building management systems.

- These thermostats can learn user preferences and adjust temperatures accordingly, leading to significant energy savings and improved comfort. Moreover, the use of carbon filters and UV germicidal irradiation systems in HVAC systems is on the rise. These technologies help in removing harmful pollutants and maintaining optimal indoor air quality. The market is experiencing dynamic growth, driven by the need for energy efficiency, improved indoor air quality, and advanced technologies. The focus on reducing carbon footprint and optimizing energy usage is leading to the adoption of smart and connected HVAC systems, which offer significant benefits in terms of cost savings, comfort, and health. This not only optimizes energy usage but also ensures better temperature control and comfort. Smart thermostats are becoming increasingly common, providing users with the ability to remotely manage their HVAC systems.

What challenges does the Commercial HVAC Industry face during its growth?

- In the industry, intense market competition poses a significant challenge to growth. The market is characterized by intense competition due to the presence of numerous international and regional players. Established companies with strong brand value and extensive geographical reach coexist with emerging local players, particularly in Asia Pacific (APAC), who offer competitive pricing. The region's low manufacturing costs for raw materials and labor enable these companies to undercut international prices. Furthermore, APAC's well-established distribution channels contribute to the affordability of HVAC systems in the region. Market competition is primarily driven by the non-restrictive nature of regulations on HVAC systems in APAC.

- Companies are investing in research and development to introduce innovative HVAC solutions that cater to these trends while maintaining energy efficiency and cost-effectiveness. The market is highly competitive, with established players and local competitors offering various solutions to meet the evolving demands of commercial buildings. The market's competitiveness is driven by factors such as pricing, technological innovation, and regulatory environments. As the market continues to grow, companies must stay informed about the latest trends and technologies to remain competitive. Sustainable design, energy management, and advanced technologies such as LEED certification, split systems, cloud-based platforms, variable speed drives, rooftop units, water systems, air purifiers, and UV air treatment are key trends in the market.

Exclusive Customer Landscape

The commercial HVAC market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the commercial HVAC market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, commercial HVAC market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Arkema - The company specializes in providing commercial HVAC solutions and offers advanced refrigerant technologies, with a primary focus on Forane gases.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Arkema

- Carrier Global Corp.

- Daikin Industries Ltd.

- Danfoss AS

- Emerson Electric Co.

- Fujitsu Ltd.

- Gree Electric Appliances Inc. of Zhuhai

- Haier Smart Home Co. Ltd.

- Honeywell International Inc.

- Johnson Controls International Plc

- Lennox International Inc.

- LG Corp.

- MIDEA Group Co. Ltd.

- Mitsubishi Electric Corp.

- Nortek

- Panasonic Holdings Corp.

- Rheem Manufacturing Co.

- Robert Bosch GmbH

- Samsung Electronics Co. Ltd.

- Trane Technologies plc

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Commercial HVAC Market

- In February 2023, Carrier Global Corporation, a leading HVAC manufacturer, announced the launch of its new AquaEdge 19DV centrifugal chiller, featuring a digital intelligence platform that optimizes energy efficiency and reduces carbon emissions by up to 20% (Carrier, 2023).

- In April 2024, Johnson Controls and Google entered into a strategic partnership to integrate Google's Building IoT platform with Johnson Controls' Metasys building management system, enabling real-time data analysis and predictive maintenance for commercial HVAC systems (Johnson Controls, 2024).

- In June 2024, LG Electronics acquired Webgains, a digital marketing agency specializing in the HVAC sector, to expand its market reach and enhance its digital marketing capabilities (LG Electronics, 2024).

Research Analyst Overview

The market is experiencing significant shifts, driven by advancements in technology and evolving regulations. Indoor comfort remains a top priority for facility managers and building owners, leading to increased adoption of Air Handling Units (AHUs) equipped with remote diagnostics capabilities. Geothermal energy and solar thermal systems are gaining traction as sustainable alternatives to traditional HVAC systems, reducing building's carbon footprint and energy consumption. EPA regulations and Energy Star certifications continue to shape the market, pushing manufacturers to improve thermal comfort and refrigerant management. Mechanical engineers and HVAC contractors are integrating building automation systems to optimize ventilation rates, air velocity, and air pressure for optimal building performance monitoring. Ozone depletion concerns have led to the phase-out of certain refrigerants, necessitating refrigerant charge management. OSHA standards ensure occupant health and safety, while maintenance technicians implement measures to minimize global warming potential.

The Commercial HVAC Market is advancing through innovation in air conditioners and ventilation systems, offering higher efficiency and indoor comfort. Enhanced compressor technology, heat exchangers, and improved SEER rating, EER rating, and IPLV rating are driving energy performance. These refrigerants are optimized for cooling applications and find extensive use in various sectors, including automotive, food processing, commercial refrigeration, industrial refrigeration, chillers, and supermarkets. Modern HVAC design incorporates absorption chillers, watercooled chillers, and aircooled chillers for versatile applications. Features like heat recovery, optimized ventilation rate, and minimal pressure drop improve system efficiency. Reduced noise levels and smart control valves ensure quieter and more precise operation. BMS integration and cloud connectivity streamline monitoring and automation. Long-term value is maximized with service contracts, efficient parts distribution, targeted training programs, and thorough lifecycle cost analysis, making commercial HVAC a cornerstone of sustainable infrastructure.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Commercial HVAC Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

241 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.7% |

|

Market growth 2025-2029 |

USD 28.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.4 |

|

Key countries |

China, US, Germany, Japan, France, Brazil, India, Canada, UK, and UAE |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Commercial HVAC Market Research and Growth Report?

- CAGR of the Commercial HVAC industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the commercial HVAC market growth of industry companies

We can help! Our analysts can customize this commercial HVAC market research report to meet your requirements.