Cloud Kitchen Market Size 2025-2029

The cloud kitchen market size is forecast to increase by USD 97.15 billion, at a CAGR of 20.5% between 2024 and 2029.

- The market is experiencing significant growth, driven by the advantages it offers over traditional restaurants. One of the key factors fueling this trend is the increasing demand for home-cooked food, which cloud kitchens cater to effectively by focusing solely on delivery. Another significant driver is the new packaging solutions designed specifically for food delivery, ensuring that meals arrive at customers' doors in optimal condition. However, the market also faces challenges. Regulations and permits for setting up and operating cloud kitchens vary widely, posing operational complexities. Additionally, ensuring consistent food quality across multiple delivery orders can be a challenge due to the lack of direct interaction with customers.

- To navigate these obstacles, companies must stay informed of local regulations and invest in robust quality control systems. By capitalizing on the market's growth potential and addressing these challenges effectively, players in the cloud kitchen industry can successfully cater to the increasing demand for convenient, high-quality meal options.

What will be the Size of the Cloud Kitchen Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

Cloud kitchens, an innovative business model in the food industry, continue to evolve and adapt to market dynamics. These kitchens, designed for preparing meals for delivery and takeout orders, integrate various components to ensure operational efficiency and customer satisfaction. Food costing is a critical aspect, requiring constant monitoring to maintain profitability. Packaging solutions, sustainable and hygienic, protect food during transportation and enhance the brand image. Data analytics and online ordering systems facilitate sales forecasting and inventory management, while POS systems streamline order fulfillment. Kitchen equipment leasing and kitchen design are essential for operational efficiency, with shared commercial kitchens offering cost savings.

Marketing strategies, including social media marketing and food delivery platforms, expand customer reach. Insurance coverage, a necessary component, mitigates risks. Food preparation adheres to health inspections and food safety regulations, while brand loyalty is fostered through customer service and brand development. Delivery optimization, including driver management and delivery packaging, ensures timely and quality delivery. Food waste reduction is a continuous focus, achieved through ingredient sourcing and supply chain management. Staffing solutions, from kitchen staff training to permitting and licensing, ensure a skilled workforce. Menu optimization, pricing strategies, and review management maintain customer satisfaction and brand reputation. Technology integration, including AI-powered order prediction and kitchen automation, enhances operational efficiency and customer experience.

Hygiene standards, energy efficiency, and risk management are ongoing concerns, addressed through continuous improvement and innovation.

How is this Cloud Kitchen Industry segmented?

The cloud kitchen industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Franchised

- Standalone

- Product

- Independent cloud kitchen

- Commissary/shared kitchen

- Kitchen pods

- End-user

- B2B

- B2C

- Food delivery platforms

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Type Insights

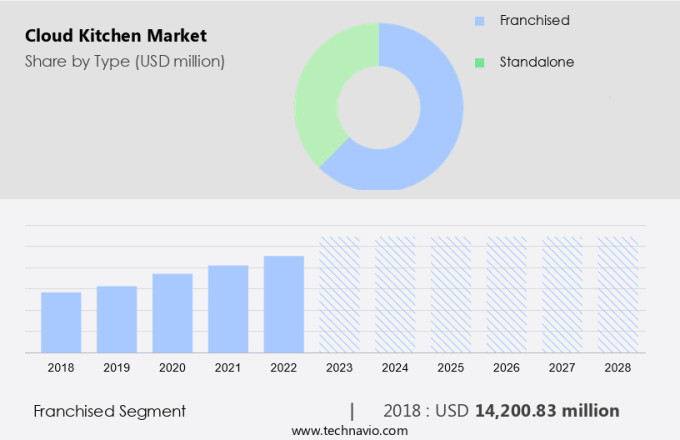

The franchised segment is estimated to witness significant growth during the forecast period.

Cloud kitchens, commercial facilities designed for food production solely for delivery, have gained traction due to the increasing popularity of online food ordering. These kitchens accommodate various food brands under one roof, expanding their reach without the necessity of investing in costly real estate and traditional dining arrangements. Franchise agreements between major restaurant operators and cloud kitchens enable the sale of food products from multiple brands. The cloud kitchen model offers operational efficiency through shared commercial kitchen spaces and inventory management systems. Kitchen staff training, customer service, and menu engineering are crucial for maintaining brand loyalty and positive customer feedback.

Food safety regulations, health inspections, and insurance coverage ensure the quality and safety of the food products. Local sourcing and sustainable packaging align with consumer preferences for eco-friendly practices. Sales forecasting and AI-powered order prediction optimize delivery and reduce food waste. The integration of restaurant management software, permitting and licensing, and technology solutions streamline operations and enhance brand reputation. Virtual and delivery-only kitchens, risk management, and menu optimization are key trends in the evolving the market.

The Franchised segment was valued at USD 28.26 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

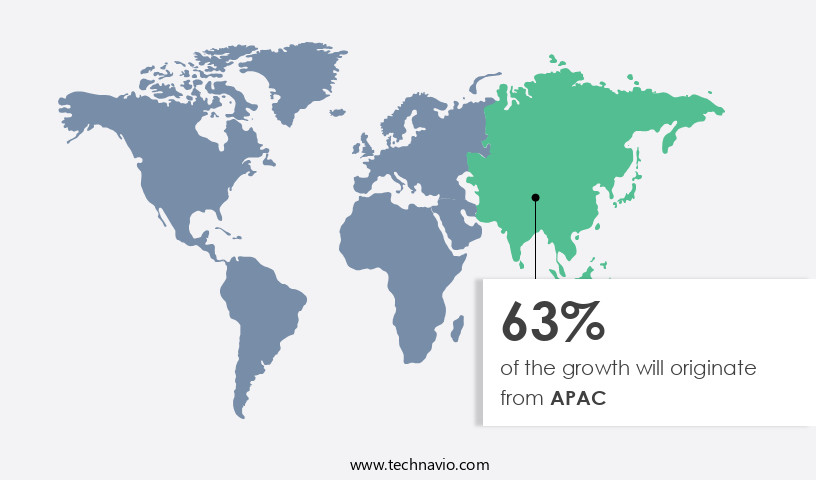

APAC is estimated to contribute 63% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In the dynamic food industry, cloud kitchens are gaining significant traction, particularly in the Asia Pacific (APAC) region. The rise of busy lifestyles and urbanization has led to an increasing preference for convenience and speed, driving the demand for ready-to-eat meals. Traditional cuisines such as Indian, Thai, Japanese, and Chinese, as well as regional fast food, continue to be popular in APAC. However, the popularity of fast food is surging, leading to a growing demand for cloud kitchens. These centralized kitchens enable restaurants to prepare and deliver meals directly to customers, optimizing operational efficiency and reducing food waste.

Kitchen design plays a crucial role in cloud kitchens, with a focus on space utilization and food preparation technology. Inventory management is essential to ensure fresh ingredients and minimize spoilage. Food safety regulations are stringently enforced to maintain hygiene standards. Local sourcing and supply chain management are vital for maintaining quality and reducing delivery times. Franchise models and brand loyalty are essential for scaling up operations. Social media marketing and food delivery platforms are effective marketing strategies to reach a wider audience and increase customer acquisition. Sales forecasting and profitability analysis are critical for making informed business decisions.

Real estate acquisition and lease negotiations are essential for securing commercial kitchen space. Brand development and reputation are crucial for customer retention and repeat business. Customer feedback and review management are essential for continuous improvement and menu optimization. Menu engineering and food costing are critical for maintaining profitability. Packaging solutions and sustainable practices are essential for reducing waste and minimizing environmental impact. Risk management, kitchen automation, and delivery optimization are essential for ensuring operational efficiency and effective order fulfillment. Insurance coverage and driver management are crucial for mitigating risks and ensuring reliable delivery. Food quality control and customer service are essential for maintaining customer satisfaction and loyalty.

In conclusion, the market is witnessing significant growth in APAC due to changing consumer preferences and lifestyles. The market's evolution is driven by various factors, including kitchen design, inventory management, food safety regulations, franchise models, local sourcing, and marketing strategies. Profitability analysis, brand development, and operational efficiency are essential for success in this competitive market.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

In the dynamic and evolving food industry, the market has emerged as a game-changer. This innovative business model allows restaurants to prepare and deliver meals directly to customers without the need for a traditional brick-and-mortar location. Cloud kitchens, also known as ghost or dark kitchens, leverage technology to streamline operations and optimize delivery. They offer cost savings through reduced overhead, increased efficiency, and the ability to cater to multiple virtual brands under one roof. The market is fueled by the growing demand for convenience, affordability, and personalized food experiences. It also benefits from advancements in food delivery apps, contactless ordering, and the rise of third-party delivery services. This market trend continues to disrupt the traditional restaurant landscape, offering opportunities for entrepreneurs, investors, and food industry professionals.

What are the key market drivers leading to the rise in the adoption of Cloud Kitchen Industry?

- The primary factor fueling market growth is the advantages that cloud kitchens hold over traditional restaurants, including lower operational costs, increased efficiency, and the ability to cater to the growing demand for food delivery services.

- Cloud kitchens, also known as delivery-only kitchens or ghost kitchens, are gaining popularity in the food industry due to the growing demand for convenient and contactless food solutions. These kitchens are designed specifically for preparing meals for online food delivery services, lacking a traditional dining area. The business model offers several advantages, making it an attractive option for entrepreneurs. One significant advantage is the reduced operating costs. Opening a cloud kitchen incurs lower expenses than starting a traditional restaurant, with monthly rent ranging from USD2,000 to USD4,000, depending on the market. By eliminating the need for a dining area and focusing solely on food preparation, businesses can save on rent, utilities, and labor costs associated with front-of-house operations.

- Another advantage is the increased efficiency in customer acquisition and delivery optimization. Social media marketing and partnerships with food delivery platforms are effective marketing strategies for reaching a target audience. Insurance coverage, staffing solutions, and supply chain management are essential aspects that can be streamlined through shared commercial kitchens. Food waste reduction is also a priority, with recipe development and ingredient sourcing playing crucial roles in minimizing waste and maintaining profitability. Lease negotiations and shared kitchen spaces enable businesses to focus on their core competencies while reducing overhead costs. Overall, cloud kitchens offer a profitable business model for entrepreneurs looking to capitalize on the growing demand for food delivery services.

What are the market trends shaping the Cloud Kitchen Industry?

- The emerging market trend involves the adoption of new packaging for food delivery services. This innovation aims to enhance the consumer experience and ensure the safe transportation of foods.

- In the market, packaging plays a crucial role in enhancing brand value. Innovative packaging solutions, such as biodegradable and compostable options, are gaining traction due to their sustainability. Corrugated packaging, specifically, has been successful in generating interest with its thermal properties, which keep food hot during delivery, and its protected fluting material that maintains food freshness and prevents spills. Recyclable corrugated layered board trays are increasingly popular for items like fish sticks and French fries. Restaurant management software is essential for managing permitting and licensing, cooking technology, food cost control, energy efficiency, technology integration, online reputation, hygiene standards, and risk management in cloud kitchens.

- Menu engineering and brand development are also critical aspects of cloud kitchen operations, emphasizing the importance of a delivery network and efficient brand reputation management.

What challenges does the Cloud Kitchen Industry face during its growth?

- The rising demand for home-cooked meals poses a significant challenge to the growth of the food industry.

- Cloud kitchens, also known as virtual or ghost kitchens, have emerged as a viable business model in the food industry, catering to the growing demand for convenient, affordable, and healthier food options. These kitchens operate solely for delivery and takeout, eliminating the need for dine-in facilities, which reduces overhead costs. Key components of cloud kitchens include advanced food costing systems, packaging solutions to maintain food quality during transit, data analytics for customer segmentation and menu optimization, online ordering systems and POS systems for seamless transactions, and kitchen equipment leasing for flexible investments. Additionally, waste management strategies, driver management systems, and food quality control measures ensure efficient operations.

- Online advertising and review management platforms help attract and retain customers, while pricing strategies and menu optimization cater to diverse preferences. Customer feedback is essential for continuous improvement and growth. With the increasing importance of data-driven decision-making, cloud kitchens can leverage data analytics to gain insights into consumer behavior and trends, enabling expansion strategies and targeted marketing efforts. The delivery packaging plays a crucial role in maintaining food quality and presentation, enhancing the overall customer experience. Proper planning and execution of these aspects can lead to a successful cloud kitchen business.

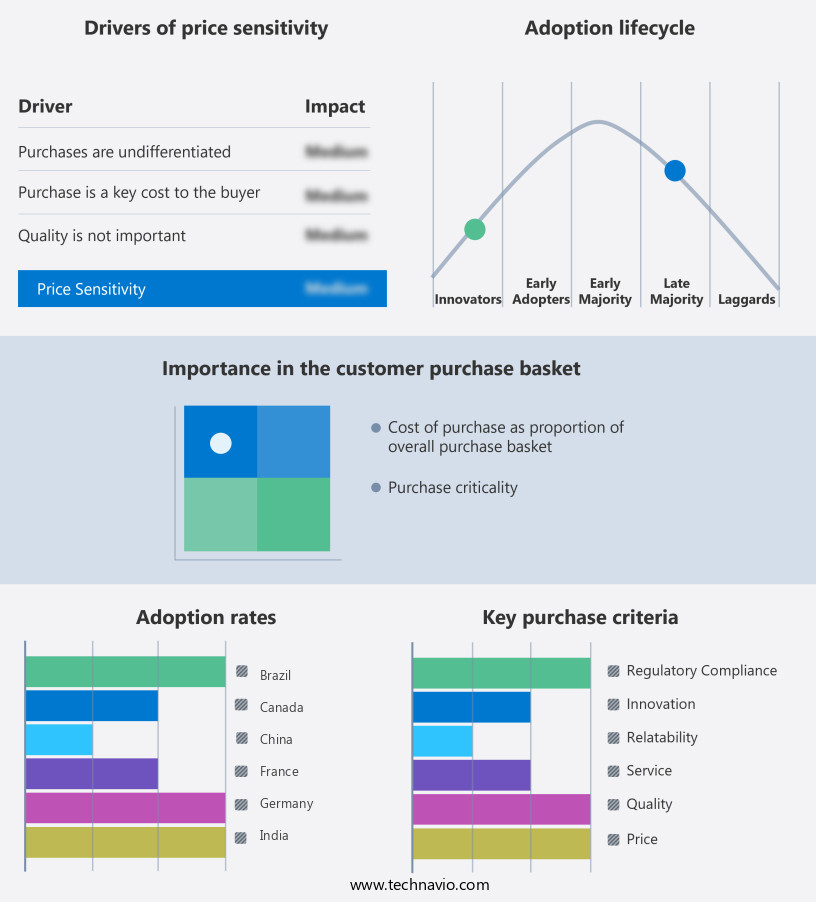

Exclusive Customer Landscape

The cloud kitchen market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the cloud kitchen market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, cloud kitchen market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

All Day Technologies Inc. - Through strategic partnerships with esteemed restaurants such as Paulie Gees, China Live, and Jerk 48, the company provides cloud kitchen services, enabling culinary innovations and streamlined operations.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- All Day Technologies Inc.

- CloudKitchens

- DoorDash Inc.

- Dropkaffe Food and Beverages Pvt. Ltd.

- Farm To Fork Sdn. Bhd.

- Food Haven Technologies Inc.

- Franklin Junction

- Ghost Kitchen Orlando

- Kitchen United

- Kitopi

- Kouzina Food Tech Pvt Ltd.

- Nextbite Brands LLC

- PAR Technology Corp

- Rebel Foods Pvt. Ltd.

- Salted

- Starbucks Corp.

- The Kroger Co.

- Toast Inc.

- Uber Technologies Inc.

- Wingstop Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Cloud Kitchen Market

- In January 2024, Grubhub, a leading online and mobile food ordering company, announced the launch of its CloudKitchens business unit, aiming to build and operate kitchen facilities dedicated to third-party delivery and pick-up orders (Grubhub Press Release, 2024). These kitchens, designed exclusively for delivery and pick-up, would help reduce food preparation and delivery times for consumers.

- In March 2024, Uber Eats, a prominent food delivery platform, announced a strategic partnership with Reef Technology, a company specializing in transforming underutilized urban spaces into kitchen and retail centers (Uber Eats Press Release, 2024). This collaboration aimed to create a network of cloud kitchens, allowing Uber Eats to expand its restaurant offerings and improve delivery times for customers.

- In May 2024, DoorDash, another major food delivery platform, raised USD1.35 billion in a Series G funding round, bringing its valuation to over USD 16 billion (DoorDash SEC Filing, 2024). The funds would be used to invest in technology, expand its delivery network, and develop cloud kitchens to increase efficiency and reduce delivery times.

- In February 2025, Amazon announced the acquisition of Bite Squad, a food delivery and cloud kitchen company, for approximately USD 115 million (Amazon Press Release, 2025). This acquisition would strengthen Amazon's position in the food delivery market and provide the company with a network of cloud kitchens to enhance its Prime Now and AmazonFresh services.

Research Analyst Overview

- In the dynamic food industry, cloud kitchens have emerged as a profitable business model, offering commercial kitchen rental solutions to food tech brands and restaurant franchises. This market trend is driven by the need for a competitive advantage in the digital transformation of food service management. Franchise development and restaurant consulting firms are increasingly turning to cloud kitchens as a means to optimize their business intelligence and profit margins. Shared kitchen spaces and dark kitchens, facilitated by cloud computing, enable efficient kitchen operations and reduce overhead costs. Food tech companies, seeking to expand their reach and customer lifetime value, are leveraging technology adoption and digital transformation to penetrate new markets.

- Business intelligence tools and data-driven decision making are essential for growth strategies, requiring extensive due diligence and financial modeling for investment analysis and risk assessment. Profitability and return on investment are key considerations for businesses in this market. Kitchen operations and restaurant technology are crucial components of a successful business strategy, with big data playing a significant role in market penetration and financial projections. As the market for cloud kitchens continues to evolve, understanding the competitive landscape and differentiation strategies will be essential for success. Cash flow analysis and technology adoption are critical factors in the financial modeling and strategic planning process.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Cloud Kitchen Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

216 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 20.5% |

|

Market growth 2025-2029 |

USD 97.15 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

16.6 |

|

Key countries |

China, US, Japan, India, South Korea, Canada, UK, Germany, France, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Cloud Kitchen Market Research and Growth Report?

- CAGR of the Cloud Kitchen industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the cloud kitchen market growth of industry companies

We can help! Our analysts can customize this cloud kitchen market research report to meet your requirements.