Cloud Advertising Market Size 2024-2028

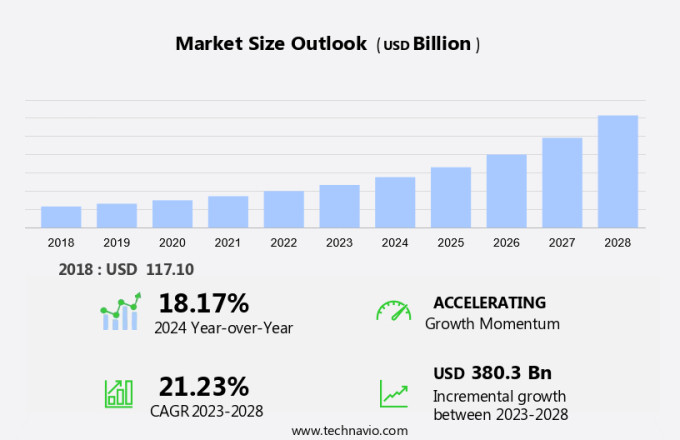

The cloud advertising market size is forecast to increase by USD 380.3 billion at a CAGR of 21.23% between 2023 and 2028. The market is experiencing significant growth due to the increasing adoption of cloud services and the shift from traditional to online advertising. Customer experience and brand loyalty are key priorities for businesses in the era of Internet commerce, leading them to explore advanced marketing strategies utilizing cloud-based advertising platforms. Data science and machine learning are integral components of these platforms, enabling personalized targeting and real-time campaign optimization. Moreover, artificial intelligence (AI) and machine learning-driven mobile SaaS and app-based solutions are gaining traction, offering agility and flexibility to marketers. However, data security concerns persist, necessitating strong security measures to protect sensitive customer information.

The market is witnessing significant growth as organizations increasingly adopt cloud-based solutions to enhance their digital advertising strategies. This shift is driven by the need for advanced consumer and customer analytics, which are crucial for effective omnichannel brand interactions. Cloud advertising services, including Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS), enable businesses to store, process, and analyze large volumes of data in real-time. This capability is essential for data-driven marketing campaigns that leverage big data from various sources, such as social media, email marketing, in-app marketing, and company websites.

Furthermore, private cloud and hybrid cloud solutions are popular choices for organizations due to their enhanced security features and flexibility. Data warehouse solutions integrated with cloud advertising platforms offer advanced data analytics capabilities, enabling businesses to gain valuable insights into consumer behavior and preferences. Artificial intelligence (AI) and machine learning (ML) technologies are integral to cloud advertising services. These technologies enable automated targeting, personalized messaging, and real-time optimization, resulting in improved campaign performance and higher ROI. The market segmentation by organization size reveals that mid-sized and large enterprises dominate the market. These organizations have larger marketing budgets and a greater need for advanced analytics capabilities to manage complex digital advertising campaigns.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Retail

- Media and entertainment

- IT and telecom

- BFSI

- Others

- Deployment

- Private

- Public

- Hybrid

- Geography

- North America

- US

- Europe

- Germany

- UK

- APAC

- China

- India

- Middle East and Africa

- South America

- North America

By End-user Insights

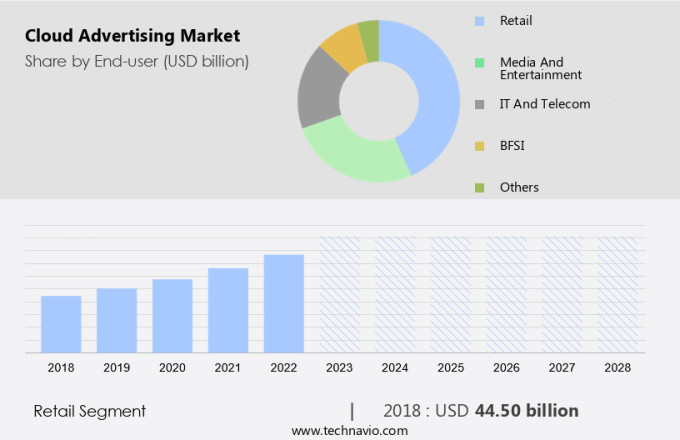

The retail segment is estimated to witness significant growth during the forecast period. In today's digital age, retail businesses are increasingly focusing on providing customer-centric experiences to stay competitive. With growing consumer spending power, the retail sector is poised for significant expansion. Traditionally, shoppers would visit physical stores to make purchases, but now they can access a vast array of goods online using mobile devices. Before making a purchase, consumers compare prices, read product reviews, and explore competitors' offerings. To attract customers to their brick-and-mortar stores, retailers employ various marketing strategies. However, managing customer data in large quantities is a challenge for these organizations. Hybrid environments, serverless architecture, and containers are becoming increasingly popular in the retail cloud market to address these data management issues.

Furthermore, cloud advertising services, such as programmatic advertising, are being adopted to reach potential customers more effectively. In the SaaS market, these solutions offer cost savings, flexibility, and scalability. However, data security concerns and strict cloud restrictions remain significant challenges. Retailers must ensure that their cloud solutions provide strong security measures to protect sensitive customer information. In conclusion, the retail industry's shift towards digital transformation has created a need for advanced cloud solutions. Hybrid environments, serverless architecture, and containers are key technologies driving growth in the retail cloud market. Cloud advertising services, such as programmatic advertising, offer retailers an effective way to reach potential customers. However, data security and cloud restrictions remain critical challenges that must be addressed to fully leverage the benefits of cloud technology.

Get a glance at the market share of various segments Request Free Sample

The retail segment was valued at USD 44.50 billion in 2018 and showed a gradual increase during the forecast period.

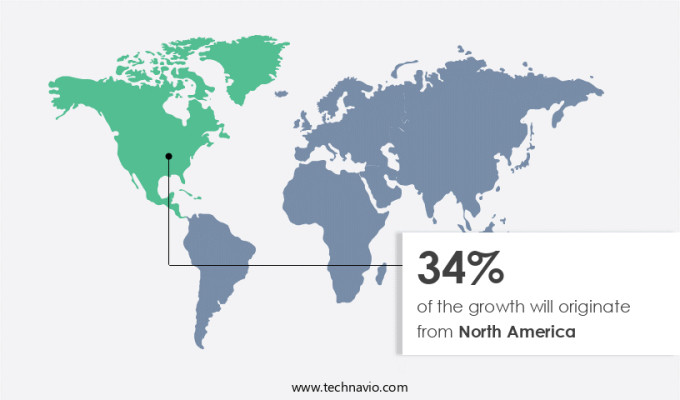

Regional Insights

North America is estimated to contribute 34% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

In North America, the digital transformation of businesses has led to a heightened focus on enhancing online presence and digital marketing capabilities. Cloud advertising, with its targeted and personalized offerings, has emerged as a preferred choice for marketers in this region. The presence of a large consumer base, including a significant number of social media and smartphone users, makes North America an attractive market for cloud advertising. Sectors such as consumer goods and retail, as well as media and entertainment, are anticipated to invest heavily in cloud marketing technologies. The demand for customized information and experiences is expected to fuel the growth of cloud advertising in North America.

Moreover, the proliferation of small and medium-sized businesses and the rising awareness of cloud-based advertising are contributing to the expansion of the regional market. To strengthen their presence, companies are employing a range of growth strategies, including product innovation, strategic partnerships, and mergers and acquisitions.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Increasing adoption of cloud services is the key driver of the market. In today's data-driven business landscape, the adoption of cloud advertising solutions is on the rise. Digital advertising is increasingly moving towards cloud-based platforms to leverage advanced consumer and data analytics. The market encompasses various applications such as authentication processes, video management, biometric information storage, and Big Data computing. The flexibility and scalability of these solutions enable organizations and governments to effectively manage their diverse requirements.

Furthermore, the proliferation of Internet of Things (IoT) devices globally has led to an exponential increase in data generation. Connected cars, homes, retail environments, utilities, and social media platforms are some of the industries harnessing IoT for enhanced data transfer. This data deluge necessitates strong data warehousing solutions and omnichannel brand interaction capabilities. The market players offer private cloud solutions to cater to the growing demand for secure and efficient data processing. By adopting cloud advertising, businesses can gain valuable customer insights and optimize their marketing strategies accordingly.

Market Trends

The shifting trend from traditional to online advertising is the upcoming trend in the market. In today's digital age, the use of cloud-based advertising platforms has become a crucial aspect of marketing strategies for businesses aiming to enhance customer experience and foster brand loyalty. With approximately 2.78 billion people engaging in internet commerce annually and 78% of internet users conducting extensive research online before making a purchase, companies need to establish a strong online presence. Cloud-based advertising solutions, such as data science and machine learning-driven platforms, offer significant advantages over traditional marketing methods. These technologies enable businesses to precisely target specific audiences and demographics, reaching potential customers who are actively seeking products or services.

Furthermore, traditional marketing approaches prioritize broad audience reach, often resulting in a less focused marketing effort. Moreover, the integration of artificial intelligence (AI) and machine learning algorithms into cloud-based advertising platforms further enhances their capabilities. These advanced technologies analyze user behavior and preferences, allowing businesses to deliver personalized and relevant content to their audiences. This level of customization significantly improves the customer experience, leading to increased brand loyalty and potential sales. Mobile SaaS and app-based solutions further expand the reach of cloud-based advertising platforms, enabling businesses to connect with customers on their preferred devices. As the trend towards online shopping continues to grow, businesses need to adapt and invest in cloud-based advertising solutions to effectively engage with their audiences and remain competitive in the marketplace.

Market Challenge

Data security concerns is a key challenge affecting the market growth. Cloud advertising has gained significant traction among organizations of all sizes, with large enterprises and smartphone users leading the charge. The increasing internet penetration and digital media consumption have made customer-centric marketing through online channels essential. However, the implementation of cloud advertising comes with security risks and privacy concerns.

Furthermore, retailers, in particular, face challenges such as unauthorized access and data leaks due to the growing number of IoT-connected devices, estimated at 50 million in the US in 2022. To mitigate these risks, retailers must invest in strong cybersecurity processes and systems. Additionally, a reliable internet connection and third-party services are necessary for cloud advertising, increasing the potential vulnerabilities. Granting system access to third parties for upgrades and implementation also poses a risk of data leaks. Therefore, organizations must prioritize cybersecurity measures when adopting cloud advertising.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Demandbase Inc. - The company offers different types of solutions for marketing, sales, and others. The key offerings of the company include cloud advertising.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Acquia Inc.

- Adobe Inc.

- Alphabet Inc.

- CM Group

- Demandbase Inc.

- Experian Plc

- Fair Isaac Corp.

- HubSpot Inc.

- Imagine Communications Corp.

- InMobi Pte. Ltd.

- International Business Machines Corp.

- Marin Software Inc.

- MediaMath Inc.

- Oracle Corp.

- Pegasystems Inc.

- Salesforce Inc.

- SAP SE

- Sitecore Holding II AS

- The Nielsen Co. US LLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is experiencing significant growth as businesses increasingly adopt digital advertising strategies. Cloud advertising enables organizations to store, manage, and analyze large amounts of consumer and customer data in real-time, facilitating data-driven marketing campaigns. Consumer analytics and data analytics are key components of cloud advertising, with big data and customer analytics playing crucial roles in understanding customer behavior and preferences. Private cloud data warehouse solutions are popular among large enterprises, providing secure and efficient storage and processing of structured and unstructured data. Omnichannel brand interactions are a priority in today's customer-centric marketing landscape, and cloud-based advertising platforms enable real-time engagement across multiple channels.

Furthermore, smartphone users and high internet penetration have fueled digital media consumption, making cloud advertising an essential component of marketing strategies. Real-time data analytics and machine learning algorithms enable personalized advertising and targeted marketing, enhancing customer experience and brand loyalty. Cloud advertising services include IaaS, PaaS, and SaaS offerings, catering to various industry sectors such as ecommerce, retail, healthcare, travel and hospitality, manufacturing, media and entertainment, IT and telecommunications, and digital transformation. Data security issues and strict cloud restrictions remain challenges, but advancements in AI, ML, and container technologies are addressing these concerns. The market trends include mobile SaaS and app-based solutions, programmatic advertising, and hybrid environments with serverless architecture.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

184 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 21.23% |

|

Market Growth 2024-2028 |

USD 380.3 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

18.17 |

|

Regional analysis |

North America, Europe, APAC, Middle East and Africa, and South America |

|

Performing market contribution |

North America at 34% |

|

Key countries |

US, China, UK, Germany, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Acquia Inc., Adobe Inc., Alphabet Inc., CM Group, Demandbase Inc., Experian Plc, Fair Isaac Corp., HubSpot Inc., Imagine Communications Corp., InMobi Pte. Ltd., International Business Machines Corp., Marin Software Inc., MediaMath Inc., Oracle Corp., Pegasystems Inc., Salesforce Inc., SAP SE, Sitecore Holding II AS, and The Nielsen Co. US LLC |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch