Casinos And Gambling Market Size 2025-2029

The casinos and gambling market size is forecast to increase by USD 165.3 billion, at a CAGR of 11.6% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing popularity of online gambling and the expanding use of social media marketing by casino operators. The shift towards digital platforms and streaming has opened new avenues for casino businesses, enabling them to reach a broader audience and offer more convenient gaming experiences. This trend is further fueled by the socio-economic impact of casinos, which contributes to local economies through job creation and revenue generation. However, the market is not without challenges. Regulatory frameworks and societal concerns regarding problem gambling continue to pose significant obstacles. The need for stricter regulations to protect consumers and mitigate potential harm is increasingly important.

- Additionally, the intensifying competition among casino operators necessitates continuous innovation and differentiation to attract and retain customers. To capitalize on opportunities and navigate challenges effectively, companies must stay informed of market trends and consumer preferences, while adhering to regulatory requirements and ethical business practices.

What will be the Size of the Casinos And Gambling Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, with dynamic market dynamics shaping various sectors. Sports betting, a significant segment, experiences ongoing shifts in consumer preferences and regulatory requirements. Operating costs, a crucial factor, are influenced by advancements in technology and increasing competition. Access control and security protocols are continually refined to ensure a safe gaming environment. Behavioral patterns of players, driven by mobile casinos and social media marketing, are reshaping customer engagement strategies. Loyalty programs and VIP schemes are increasingly leveraged to retain customers, while compliance training and responsible gambling initiatives address regulatory demands and ethical concerns. Slot machines, a staple of casino gaming, undergo continuous innovation in game mechanics and design, from interior elements to sound systems and progressive jackpots.

Casino management systems, including customer support and house edge optimization, are essential for efficient operations. Free spins and affiliate marketing are popular promotional tools, while casino games, from table games to live dealer options, cater to diverse player demographics. Marketing expenditure and marketing strategies are crucial for attracting and retaining customers. Software providers and online casinos offer various payment gateways and wagering requirements to accommodate diverse player needs. Customer service, including live chat and email support, is vital for addressing player inquiries and concerns. Fraud prevention and player tracking are essential for maintaining security and ensuring fair play. Anti-money laundering (AML) measures are implemented to comply with regulatory requirements and maintain a reputable image.Overall, the market remains an ever-evolving landscape, requiring continuous adaptation and innovation.

How is this Casinos And Gambling Industry segmented?

The casinos and gambling industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Poker

- Blackjack

- Craps

- Lottery

- Others

- Platform

- Offline

- Online

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Type Insights

The poker segment is estimated to witness significant growth during the forecast period. The market is experiencing significant growth, with various entities shaping its dynamics. Poker, a popular card game, held a substantial share in 2024 due to its increasing popularity, especially online. Online poker has attracted a massive following worldwide, contributing to a surge in the number of players. This trend is further fueled by the proliferation of online gambling platforms, offering not only poker but also other casino games. Live casino games have also emerged, adding to the demand for poker and other offerings. These games can be accessed on desktops and mobile devices, catering to diverse player preferences.

The Poker segment was valued at USD 50.80 billion in 2019 and showed a gradual increase during the forecast period. Casino design, loyalty programs, and social media marketing are essential elements in attracting and retaining customers. Compliance training, customer service, and security protocols ensure a safe and responsible gaming environment. Slot game mechanics and progressive jackpots engage players, while risk management and fraud prevention maintain financial stability. Sports betting, table games, and wagering requirements cater to diverse gambling habits. Employee training, casino management systems, and software providers ensure smooth operations. Behavioral patterns and player demographics influence marketing strategies, while affiliate marketing and free spins incentivize new sign-ups. Responsible gambling initiatives, such as VIP programs and anti-money laundering measures, promote a socially responsible market. Overall, the market is an immersive, harmonious, and continuously evolving industry.

Regional Analysis

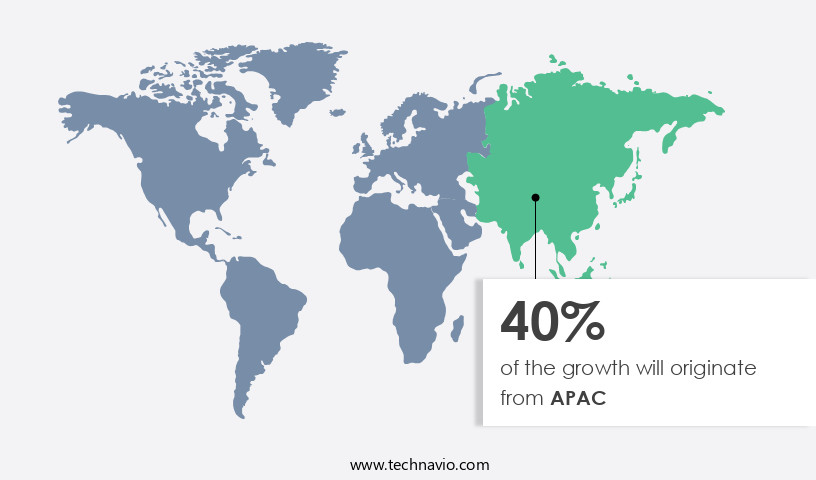

APAC is estimated to contribute 40% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is experiencing significant growth due to the increasing adoption of technology and digital platforms, as well as the relaxation of regulations surrounding various forms of gambling. Companies are expanding their reach by deploying more gaming terminals and partnering with retailers. In the US, the landscape of the market varies greatly from state to state, with each having the authority to regulate its own gambling market. Technology plays a crucial role in the market, with data analytics used to understand player behavior and preferences, and casino management systems employed to streamline operations.

Slot machines, a significant contributor to casino revenue, are being enhanced with innovative slot game mechanics and interactive features. Social media marketing is also a key strategy for attracting and retaining customers, while loyalty programs offer incentives for repeat business. Security protocols and compliance training are essential to ensure a safe and responsible gambling environment. Customer service is another critical area of focus, with telephone and live chat support, email support, and player tracking used to address customer queries and concerns. Risk management and fraud prevention are also important considerations, with anti-money laundering measures in place to maintain the integrity of the market.

Sports betting is a growing segment of the market, with mobile casinos and online casinos offering convenience and accessibility. Marketing expenditure is a significant investment for casinos, with affiliate marketing and free spins used to attract new customers. VIP programs and table games cater to high rollers, while progressive jackpots provide the potential for large wins. Player demographics are diverse, with different age groups and income levels represented. Employee training is essential to ensure a positive customer experience, with training in customer service, security protocols, and slot machine operation. Table games, wagering requirements, digital payment gateway, and payout percentages are all factors that influence the player experience.

The market in North America is dynamic and evolving, with technology, regulation, and customer experience being key drivers of growth. Companies are leveraging data analytics, loyalty programs, and marketing strategies to attract and retain customers, while ensuring a secure and responsible gambling environment. The market is diverse, with various segments catering to different player preferences and demographics.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Nestled in the vibrant heart of entertainment and leisure, the market thrives on providing thrilling experiences for millions worldwide. This market encompasses a diverse range of offerings, from land-based casinos with their opulent interiors and electrifying atmosphere to online gambling platforms, offering convenience and accessibility. Gamblers engage in a variety of games, including poker, roulette, blackjack, baccarat, and slot machines, fueled by the lure of potential winnings. Sophisticated technology powers both physical and digital casinos, ensuring fairness and security. Advanced Random Number Generators (RNGs) guarantee random outcomes, while encryption technology protects sensitive data. Moreover, the market embraces the latest trends, such as Virtual Reality (VR) and Cryptocurrencies, enhancing the overall gaming experience. Social aspects are integral to casinos and gambling, with communities forming around shared interests and strategies. Gamblers can join loyalty programs, attend tournaments, and interact with dealers and fellow players, creating a unique and engaging atmosphere. Additionally, the market caters to diverse demographics, offering customized promotions and games to attract a broad audience. Regulations and responsible gambling initiatives play a crucial role in maintaining the integrity and sustainability of the market. Governments and industry bodies implement measures to ensure fair practices, protect consumers, and prevent underage gambling and addiction. By combining excitement, innovation, and responsible gaming, the market continues to captivate and entertain.

What are the key market drivers leading to the rise in the adoption of Casinos And Gambling Industry?

- The surge in popularity of online gambling serves as the primary catalyst for market growth.

- The casino and gambling market is experiencing significant growth due to the increasing popularity of online gambling. With over half the world's population now online, gambling companies are capitalizing on this trend by offering casino games through digital platforms. These platforms provide easy access to various types of games, such as traditional slot machines and poker, as well as new offerings from casino operators. To remain competitive, casino operators are utilizing data analytics to gain insights into customer behavior and preferences. Casino design is also a key focus, with a emphasis on creating immersive and harmonious environments through sound systems and customer service.

- Loyalty programs and compliance training are essential components of customer engagement and regulatory adherence, respectively. Security protocols and risk management are critical for ensuring a safe and fair gaming experience. Social media marketing is also being used to reach new audiences and build brand awareness. Slot game mechanics continue to evolve, with innovative features and themes attracting players. Customer support is another important aspect, with prompt and effective resolution of queries and issues ensuring customer satisfaction. The casino and gambling market is undergoing significant changes, driven by technological advancements and shifting consumer preferences.

- Casino operators must stay abreast of these trends and adapt to provide engaging and secure gaming experiences.

What are the market trends shaping the Casinos And Gambling Industry?

- The growing prevalence of social media marketing represents a significant market trend in the casino industry. Casino operators are increasingly leveraging social media platforms to engage with customers and promote their offerings.

- The markets continue to evolve, with operators leveraging various strategies to attract and retain customers. The rise of sports betting and mobile casinos has significantly impacted the industry. According to recent research, the global gambling market size is expected to reach substantial growth in the coming years. Operating costs, including access control and interior design, remain a key focus for casino management. Behavioral patterns of gamblers are also under scrutiny, with telephone support and house edge optimization becoming essential. Casino management systems are being enhanced with features like free spins and affiliate marketing to boost customer engagement.

- However, the potential for gambling addiction is a concern, necessitating responsible gaming initiatives. Overall, the market dynamics revolve around innovation, customer experience, and regulatory compliance.

What challenges does the Casinos And Gambling Industry face during its growth?

- The socio-economic impact on communities, including potential negative consequences such as increased crime rates and problem gambling, represents a significant challenge that must be addressed in order to ensure sustainable growth for the casino industry.

- The casino and gambling market encompasses various aspects, including responsible gambling initiatives, VIP programs, game development, marketing expenditure, security systems, and progressive jackpots. The industry's marketing strategies have evolved, with a focus on online casinos and software providers catering to diverse player demographics. Employee training and table games are essential components of casino operations, ensuring a harmonious gaming environment. Despite the potential risks associated with gambling, such as financial and mental health implications, the market continues to grow. The allure of winning large sums of money through games of chance inspires millions worldwide. However, it's crucial to prioritize responsible gambling practices to mitigate potential harm.

- Casino operators invest heavily in marketing efforts to attract and retain customers, utilizing various strategies to stand out in a competitive landscape. Security systems are a top priority to ensure fair play and prevent fraudulent activities. Game development continues to advance, offering immersive experiences and innovative features to keep players engaged. The casino and gambling market presents both opportunities and challenges. By focusing on responsible gambling, investing in technology, and prioritizing customer experience, operators can create a thriving business while minimizing potential negative impacts.

Exclusive Customer Landscape

The casinos and gambling market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the casinos and gambling market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, casinos and gambling market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Aristocrat Leisure Ltd. - This company specializes in providing a diverse range of casino entertainment, featuring slot machines and digital gaming experiences. Popular titles include Buffalo, Lightning Link, Dragon Link, and Dollar Storm.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aristocrat Leisure Ltd.

- Boyd Gaming Corp.

- Caesars Entertainment Inc.

- Cher Ae Heights Casino

- CT Gaming

- DraftKings Inc.

- Flutter Entertainment Plc

- Galaxy Gaming Inc.

- Gambling.Com Group Ltd.

- Konami Group Corp.

- Luxury Casino

- Marina Bay Sands Casino

- MGM Resorts International

- Motion JVco Ltd.

- NOVOMATIC AG

- SJM Holdings Ltd.

- Sky City Auckland Casino

- Table Trac Inc.

- Wynn Resorts Holdings LLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Casinos And Gambling Market

- In January 2024, MGM Resorts International and BetMGM, its interactive business unit, announced the launch of their sports betting and iGaming platform in Ontario, Canada, marking their entry into the Canadian market (MGM Resorts International Press Release, 2024). In March 2024, DraftKings and JPMorgan Chase & Co. Announced a strategic partnership to launch a co-branded credit card, providing DraftKings customers with rewards and cashback on their sports betting and daily fantasy sports transactions (DraftKings Press Release, 2024).

- In April 2025, Caesars Entertainment and Eldorado Resorts completed their merger, creating the largest casino and entertainment company in the US, with a combined market value of approximately USD17 billion (Caesars Entertainment Press Release, 2025). In May 2025, the Malta Gaming Authority granted a license to Flutter Entertainment, allowing it to offer its Betfair and Paddy Power Betfair brands in the European Union's digital single market, expanding its reach to over 300 million potential customers (Flutter Entertainment Press Release, 2025).

Research Analyst Overview

- In the dynamic the market, various trends and technologies shape the industry's landscape. Event planning and UI design enhance user experiences, while problem gambling prevention initiatives prioritize responsible gaming. Customer acquisition relies on intellectual property licensing, tournament management, and influencer marketing. Blockchain technology and financial reporting ensure secure transactions and predictive modeling for personalized gaming experiences. Staff management and promotions management are crucial for casino operations, with UX and UI optimizing player engagement. Live dealer games and game testing ensure quality assurance, while network security and legal frameworks protect against potential risks. Compliance procedures and internal controls maintain brand loyalty and awareness.

- Game optimization and player protection are essential for long-term success, with cryptocurrency casinos and digital marketing expanding reach. Brand loyalty and customer retention are fostered through personalized gaming experiences and content marketing efforts. Server infrastructure and legal frameworks continue to evolve, shaping the future of this ever-changing market.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Casinos And Gambling Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

201 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 11.6% |

|

Market growth 2025-2029 |

USD 165.3 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

10.1 |

|

Key countries |

US, China, UK, Germany, Japan, India, Canada, South Korea, France, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Casinos And Gambling Market Research and Growth Report?

- CAGR of the Casinos And Gambling industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the casinos and gambling market growth of industry companies

We can help! Our analysts can customize this casinos and gambling market research report to meet your requirements.