Caffeine-Based Drinks Market Size 2025-2029

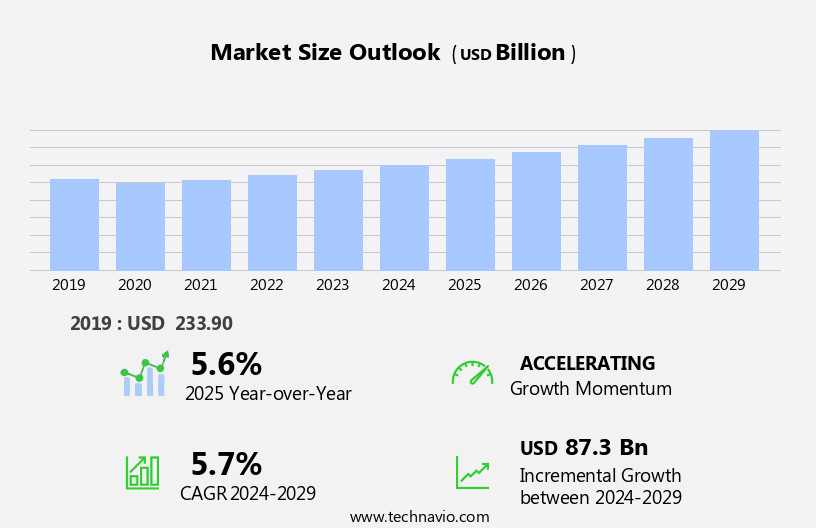

The caffeine-based drinks market size is forecast to increase by USD 87.3 billion, at a CAGR of 5.7% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing urbanization and changing lifestyle trends. The rising number of urban populations and the subsequent shift towards convenience and on-the-go consumption habits have fueled the demand for caffeine-based beverages. Moreover, the beverage industry's marketing and promotional activities have intensified, leading to increased consumer awareness and preference for these products. However, the market faces challenges from stringent regulations, particularly concerning caffeine content and health concerns. Governments worldwide are imposing stricter regulations on caffeine levels in beverages, necessitating reformulation and innovation to meet these requirements.

- Companies must navigate these regulations while maintaining product quality and consumer satisfaction. Adhering to these regulations and addressing health concerns will be crucial for market players to capitalize on the opportunities presented by the evolving consumer landscape and remain competitive in the dynamic the market.

What will be the Size of the Caffeine-Based Drinks Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, with innovations and trends shaping consumer preferences and market dynamics. Cold brew coffee, a method that involves steeping coffee grounds in cold water for an extended period, has gained popularity due to its smooth taste and lower acidity. Coffee creamers, available in various forms, cater to those seeking to add flavor and creaminess to their beverages. Brewing methods, such as espresso machines and French press, offer distinct taste profiles, while roasting techniques influence the coffee's taste and caffeine content. Robusta beans, known for their higher caffeine content, are used in some coffee products.

Online retailers and coffee capsules provide convenience, while coffee certification schemes ensure ethical sourcing and fair trade practices. Brewing temperature, coffee certification, and water quality are essential factors in coffee extraction, which impacts the final taste and quality of the beverage. Coffee additives, such as syrups and concentrates, cater to diverse tastes and preferences. Sustainability is a growing concern, with compostable packaging, coffee waste management, and recycling programs gaining importance. Market activities unfold continuously, with ongoing research and development in coffee bean sourcing, roasting techniques, and brewing methods. Coffee consumption patterns and cultural significance continue to evolve, with coffee competitions, coffee shops, and coffee culture playing a significant role in shaping the market landscape.

How is this Caffeine-Based Drinks Industry segmented?

The caffeine-based drinks industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Carbonated drinks

- Energy drinks

- RTD coffee

- Others

- Distribution Channel

- Supermarkets/hypermarkets

- Departmental stores

- Online retail stores

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Product Insights

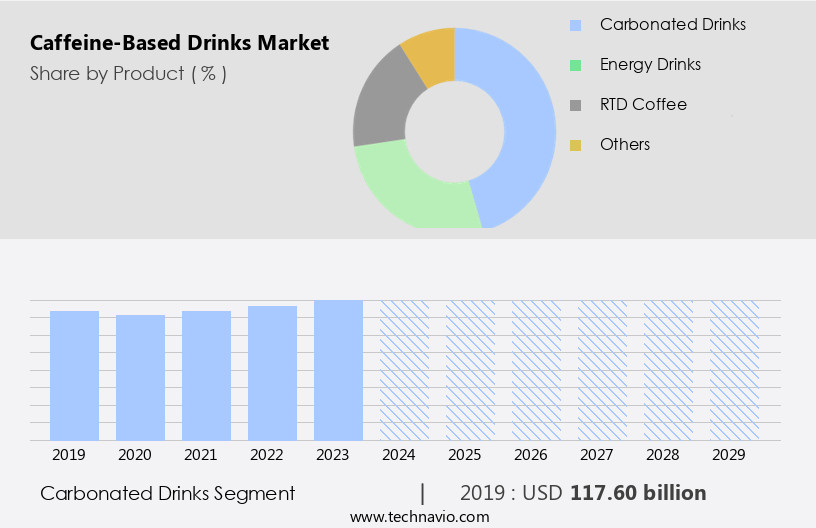

The carbonated drinks segment is estimated to witness significant growth during the forecast period.

The beverage industry continues to evolve, with a notable shift towards caffeine-based drinks. Coffee, in particular, has gained significant traction due to its various forms and health benefits. Shelf life and food safety are crucial considerations in the industry, ensuring the quality of ground coffee, milk frother, coffee syrup, and coffee concentrate. Organic coffee, sourced from fair trade and sustainable farms, is increasingly popular among consumers. Coffee tourism and specialty coffee competitions have fueled interest in coffee's taste profile, roasting techniques, and extraction methods. Brewing methods, such as French press, pour over, and espresso machines, cater to diverse preferences. Coffee certification programs ensure ethical sourcing and quality control.

Ready-to-drink coffee, iced coffee, and cold brew coffee have gained popularity due to their convenience. Health-conscious consumers opt for low-calorie, low-sugar options, while others prefer coffee creamer and sugar substitutes. Coffee capsules, coffee pods, and instant coffee cater to the single-serve market. Water quality is essential for brewing, with many consumers preferring filtered or bottled water. Coffee waste management and recycling programs are becoming increasingly important, reflecting the industry's commitment to sustainability. Caffeine content remains a consideration, with some consumers seeking decaffeinated options due to caffeine addiction concerns. Brewing temperature and grind size also impact the taste and extraction of coffee.

Robusta beans, Arabica beans, and blends offer unique taste profiles. Online retailers and convenience stores stock a wide range of coffee products, catering to diverse consumer preferences. Espresso machines, coffee grinders, and milk frothers are essential equipment for coffee enthusiasts. The market trends reflect a growing appreciation for the art and culture of coffee, with barista skills and coffee shops playing a pivotal role in the industry's growth. Coffee consumption continues to rise, with artificial sweeteners and flavored coffee catering to various tastes. Drip coffee makers remain a staple in many households, while the popularity of coffee competitions and specialty coffee further fuels innovation in the industry.

The Carbonated drinks segment was valued at USD 117.60 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 33% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The APAC market for caffeine-based drinks is experiencing significant growth due to the region's strong economic development and increasing disposable income. This attractive market is home to numerous untapped opportunities, making it a prime destination for global and regional players. Companies such as Nestle S.A, Dr. Pepper Snapple Group, and Pepsi Bottling Group Inc are among those capitalizing on this trend. Consumers in APAC are increasingly shifting towards coffees, leading to a surge in demand for various caffeine-based drinks. To expand their reach, companies are leveraging e-commerce platforms, primarily through third-party online retailers like Amazon. Shelf life, caffeine content, and food safety are crucial factors in the market.

Ground coffee, milk frother, organic coffee, and coffee syrup are popular choices among consumers. Ready-to-drink coffee, iced coffee, and cold brew coffee are gaining popularity due to their convenience. Coffee certification, fair trade coffee, and sustainable coffee practices are essential considerations for consumers. Roasting techniques, coffee extraction, and brewing methods, including espresso machines, French press, and pour over, influence the taste profile. Coffee waste management and recycling programs are becoming increasingly important as consumers demand more eco-friendly packaging solutions. Coffee capsules, coffee pods, and coffee extract are popular choices for single-serve coffee drinkers. Health benefits, such as increased energy and focus, are driving consumer demand for caffeine-based drinks.

However, concerns regarding caffeine addiction and the use of artificial sweeteners and sugar substitutes are influencing consumer preferences towards healthier options. Coffee competitions, coffee shops, and coffee culture continue to thrive, with barista skills and coffee bean sourcing playing a significant role in shaping the market dynamics. Coffee blends, whole bean coffee, and coffee grinders cater to the diverse preferences of coffee enthusiasts. Water quality is essential for coffee production and brewing, and companies are investing in advanced technologies to ensure consistent quality. Coffee certification, fair trade coffee, and sustainable coffee practices are essential considerations for consumers.

In conclusion, the market in APAC is expected to witness significant growth due to the increasing number of consumers shifting towards coffees. Companies are expanding their reach by increasing their e-commerce activities and offering a wide range of products to cater to diverse consumer preferences. The market is dynamic, with various factors, including health benefits, sustainability, and taste profile, influencing consumer choices.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Caffeine-Based Drinks Industry?

- The primary factors fueling market growth are the escalating urbanization trends and evolving consumer lifestyles.

- Caffeine-based drinks, including ready-to-drink (RTD) options, have gained significant popularity due to urbanization and changing lifestyles. Consumers, particularly those with hectic work schedules, seek convenient beverages that provide an instant energy boost. Caffeine, a primary ingredient in these drinks, enhances the effects of neurotransmitters like serotonin, dopamine, and acetylcholine. Dopamine blocks adenosine receptors in the basal forebrain, leading to increased concentration. Additionally, caffeine increases the release of catecholamines, which can make the heartbeat faster, send more blood to muscles, and force the liver to release sugar into the bloodstream for energy. Food safety and water quality are crucial factors in the production and consumption of caffeine-based drinks.

- Proper coffee storage, including keeping ground coffee away from light and moisture, and ensuring the use of clean water, are essential for maintaining the shelf life and preserving the taste and quality of these beverages. Compostable packaging and eco-friendly alternatives, such as reusable milk frothers, are becoming increasingly important for environmentally-conscious consumers. Organic coffee and coffee syrups are also popular choices for those seeking healthier options. Coffee tourism, which involves visiting coffee plantations and learning about the production process, is another trend that appeals to consumers interested in the origins and sustainability of their coffee. Caffeine-based drinks offer numerous health benefits, including increased alertness, focus, and energy.

- However, excessive consumption can lead to negative side effects, such as insomnia, jitters, and increased heart rate. It is essential to maintain a balanced intake and consult a healthcare professional if you have any concerns about your caffeine consumption.

What are the market trends shaping the Caffeine-Based Drinks Industry?

- Marketing and promotional activities are seeing a significant increase as a current market trend. It is essential for businesses to enhance their efforts in this area to remain competitive.

- The market is witnessing significant growth due to various trends. One of the notable trends is the increasing use of marketing and promotional campaigns by players. Companies like Red Bull and Monster Beverage Corporation are associating their brands with sports events and teams through sponsorships. This strategy helps in influencing consumer preferences as people tend to adopt products used by their favorite sportspersons, teams, and celebrities. Another trend is the focus on the millennial population, who are the major consumers of energy drinks. Brewing methods, such as cold brew coffee and French press, are gaining popularity due to their unique taste profiles.

- Coffee certification, fair trade coffee, and sustainable roasting techniques are also influencing consumer choices. Coffee additives like coffee creamer and coffee capsules are also contributing to the market growth. Brewing temperature plays a crucial role in coffee extraction, and advanced technologies like espresso machines ensure optimal brewing conditions. Companies are investing in research and development to innovate and introduce new products with enhanced taste and functionality. The market for caffeine-based drinks is expected to continue its growth trajectory due to these trends and consumer preferences.

What challenges does the Caffeine-Based Drinks Industry face during its growth?

- The strict regulations imposed on the industry represent a significant challenge to its growth.

- The market faces regulatory challenges due to stringent guidelines on the sale, advertisement, and marketing of these products. In Australia and New Zealand, the Food Standards Agency sets limits on the total caffeine content in cola-type drinks and requires labeling on energy drinks for sensitive groups. The European Union's Food Information Regulation mandates specific labeling for high-caffeine foods and beverages. These regulations ensure consumer safety and awareness but add complexity to the market. Coffee-based drinks, such as coffee pods, coffee extract, instant coffee, whole bean coffee, and specialty coffee, continue to be popular choices. Consumers prioritize convenience, quality control, and sustainability in their coffee sourcing.

- Grind size, coffee bean origin, and coffee blends are essential factors influencing consumer preferences. Convenience stores and pour-over methods cater to the growing demand for immersive and harmonious coffee experiences. Despite concerns over caffeine addiction, coffee competitions celebrate the artistry and craftsmanship of coffee production. Coffee pods and instant coffee offer convenience, while whole bean coffee and grinders cater to those seeking a more authentic coffee experience. Regardless of the format, the market remains dynamic and diverse, with consumers continually seeking new and innovative coffee offerings.

Exclusive Customer Landscape

The caffeine-based drinks market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the caffeine-based drinks market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, caffeine-based drinks market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Amway Corp. - This company specializes in producing caffeine beverages, prioritizing health and wellness. Their offerings are fortified with vitamins and natural ingredients, appealing to health-conscious consumers. The drinks cater to the growing market demand for functional beverages that promote overall well-being.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amway Corp.

- AriZona Beverages USA LLC

- Arla Foods amba

- Asahi Group Holdings Ltd.

- AVT Natural Products Ltd.

- Bawls Acquisition LLC

- Clear Cut Phocus LLC

- Double D Beverage Co.

- Enerzal

- Herbalife International of America Inc.

- HighBrewCoffee

- Keurig Dr Pepper Inc.

- La Colombe Torrefaction Inc.

- Monster Energy Co.

- Nestle SA

- PepsiCo Inc.

- Red Bull GmbH

- Starbucks Corp.

- Suntory Beverage and Food Ltd.

- The Coca Cola Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Caffeine-Based Drinks Market

- In January 2024, Starbucks Corporation announced the launch of its new nitro-infused cold brew coffee with caffeine content up to 205 mg per 12 oz serving, marking a strategic expansion of its caffeine-based beverage offerings (Starbucks Press Release). In March 2024, Nestlé and Dunkin Brands entered into a strategic partnership, with Nestlé acquiring a 21.5% stake in Dunkin Brands for approximately USD1.1 billion, aiming to accelerate growth in the coffee and baked goods market (Bloomberg). In April 2025, The Coca-Cola Company received regulatory approval from the U.S. Food and Drug Administration (FDA) for its new caffeine-infused beverage, Coca-Cola Energy, containing 80 mg of caffeine per 12 oz serving (Coca-Cola Press Release). In May 2025, PepsiCo entered the European the market with the acquisition of a majority stake in British energy drink brand, Rockstar Energy Drink, for USD3.95 billion, expanding its global reach and market share (Reuters).

Research Analyst Overview

- In the dynamic caffeine-based beverage market, pricing strategies play a crucial role in shaping consumer preferences. Ethical sourcing of ingredients, such as tea blends and single origin coffee, is increasingly important for brands seeking to differentiate themselves. Sustainability initiatives, including sustainable agriculture and packaging innovations, are gaining traction, resonating with health-conscious and socially responsible consumers. Nutritional value and risk management are key considerations in the development of functional beverages, including energy drinks, coffee desserts, and coffee cocktails. Product development in the realm of dietary supplements and herbal infusions is also driving growth. Effective supply chain management, inventory management, and sales forecasting are essential for navigating the complex distribution channels.

- Brand positioning and sensory evaluation are critical components of marketing strategies, as consumers seek unique and authentic flavors. Regulatory compliance is a constant challenge, requiring robust regulatory frameworks and rigorous sensory testing. Coffee-infused products, from coffee ice cream to coffee liqueurs, continue to innovate and expand the market. Consumer preferences for health and wellness, social responsibility, and diverse flavors are shaping the future of the caffeine-based beverage industry.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Caffeine-Based Drinks Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

209 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.7% |

|

Market growth 2025-2029 |

USD 87.3 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.6 |

|

Key countries |

US, China, Canada, Germany, Japan, India, UK, South Korea, Saudi Arabia, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Caffeine-Based Drinks Market Research and Growth Report?

- CAGR of the Caffeine-Based Drinks industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the caffeine-based drinks market growth of industry companies

We can help! Our analysts can customize this caffeine-based drinks market research report to meet your requirements.