Cable Laying Vessel Market Size 2025-2029

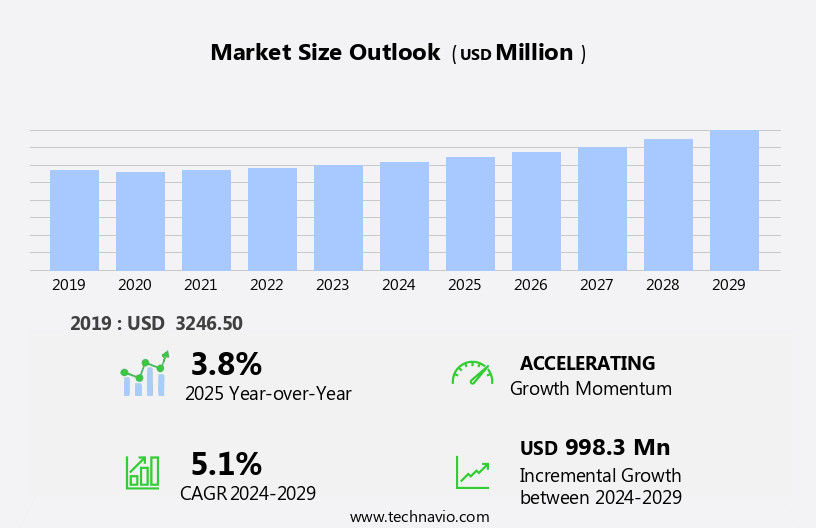

The cable laying vessel market size is forecast to increase by USD 998.3 million, at a CAGR of 5.1% between 2024 and 2029.

- The market is experiencing significant growth, driven by the expansion of offshore wind capacity. This trend is fueled by increasing global focus on renewable energy sources and the need for reliable power transmission solutions. Another key driver is the growing use of hybrid cable laying vessels, which combine the capabilities of construction and installation vessels, enhancing operational efficiency and reducing project timelines. However, the market faces challenges, including the impact of weather and environmental conditions on cable laying operations. Severe weather events and harsh marine environments can cause delays and increase costs. Additionally, the need for specialized vessels and crew, as well as the high capital investment required for these vessels, can pose challenges for market entrants.

- Companies seeking to capitalize on market opportunities should focus on innovation, such as developing advanced cable laying technologies and optimizing operational processes, while also addressing the challenges through risk management strategies and collaboration with industry partners.

What will be the Size of the Cable Laying Vessel Market during the forecast period?

The market is characterized by continuous evolution and dynamism, driven by advancements in technology and the expanding applications across various sectors. Navigation systems and vessel optimization are essential components of cable laying operations, ensuring economic feasibility and adherence to industry standards. Positioning systems and data acquisition play a crucial role in hydrographic survey and machine learning applications, enabling accurate cable laying and minimizing environmental impact. Subsea cable laying involves intricate marine construction projects, requiring consideration of cable length, weight, and strength, as well as laying depth and tension. Vessel capacity, including crane capacity, winch capacity, and deck space, is essential for efficient installation services.

Project planning, engineering services, and project management are integral to cost optimization and risk management. Data analysis, seabed survey, and subsea pipeline construction are critical components of cable laying operations, facilitated by advanced navigation software, safety regulations, and dynamic positioning systems. Fleet management, supply chain optimization, and remote monitoring enable efficient cable laying and maintenance services. Offshore wind farms and renewable energy projects are driving growth in the market, with increasing demand for telecommunications infrastructure and fiber optic cable installation services. Autonomous underwater vehicles and cable burial techniques are also gaining popularity, enhancing safety and reducing fuel consumption.

The market's ongoing evolution is reflected in the integration of advanced technologies such as machine learning and artificial intelligence, enabling real-time data analysis and remote monitoring. Cable laying vessels are becoming more versatile, with the ability to adapt to various project requirements and optimize laying speed and distance. In conclusion, the market is a dynamic and evolving industry, driven by advancements in technology and expanding applications across various sectors. Navigation systems, vessel optimization, crane capacity, laying depth, winch capacity, project management, data analytics, seabed survey, subsea pipeline, offshore construction, data analysis, remotely operated vehicles, deck space, and other key components are seamlessly integrated into cable laying operations, ensuring efficient and cost-effective projects.

How is this Cable Laying Vessel Industry segmented?

The cable laying vessel industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Power cable

- Communication cable

- End-user

- Oil and gas

- Telecommunication

- Offshore wind farms

- Others

- Geography

- North America

- US

- Canada

- Europe

- Belgium

- Denmark

- France

- Germany

- The Netherlands

- UK

- APAC

- China

- Japan

- Rest of World (ROW)

- North America

By Type Insights

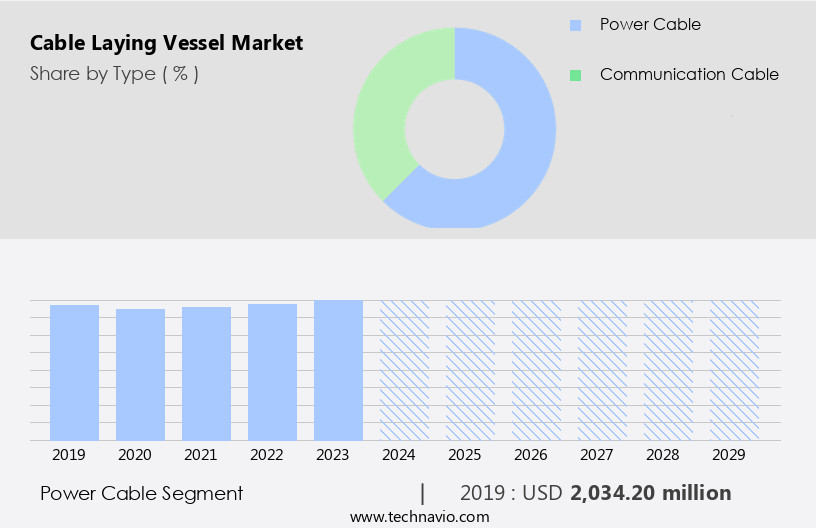

The power cable segment is estimated to witness significant growth during the forecast period.

The offshore power cable market is a significant component of the global energy infrastructure, focusing on subsea cables used in offshore wind farms, oil and gas platforms, and interconnection projects. Renewable energy sources, particularly offshore wind, are driving the demand for these cables, which facilitate efficient and reliable power transmission from offshore installations to onshore grids. Advancements in technology have influenced the market, with machine learning and artificial intelligence playing crucial roles in optimizing cable laying operations. Positioning systems, hydrographic surveys, and data acquisition are integral to ensuring accurate cable placement and minimizing environmental impact. Safety regulations, risk management, and vessel optimization are essential considerations in marine construction projects, which require large vessel capacities and sophisticated dynamic positioning systems.

Cable length, diameter, and laying speed are critical factors in project planning and cost optimization. Industry standards ensure consistent quality and safety, while engineering services and maintenance offer ongoing support. Fiber optic cables, subsea pipelines, and telecommunications infrastructure are additional applications for power cables. Innovations such as autonomous underwater vehicles, remote monitoring, and data analytics contribute to increased efficiency and cost savings. Offshore wind farms, renewable energy projects, and offshore construction sites continue to expand, fueling the need for advanced cable laying vessels and installation services. Fleet management, supply chain optimization, and project management are essential aspects of this dynamic market.

The market's evolving trends include the integration of renewable energy sources, increasing focus on cost optimization, and the development of advanced vessel designs. Navigation software, crane capacity, and winch capacity are essential features for cable laying vessels, ensuring safe and efficient operations. The future of the power cable market lies in its ability to adapt to the ever-changing offshore energy landscape while maintaining the highest standards of safety, reliability, and environmental sustainability.

The Power cable segment was valued at USD 2034.20 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

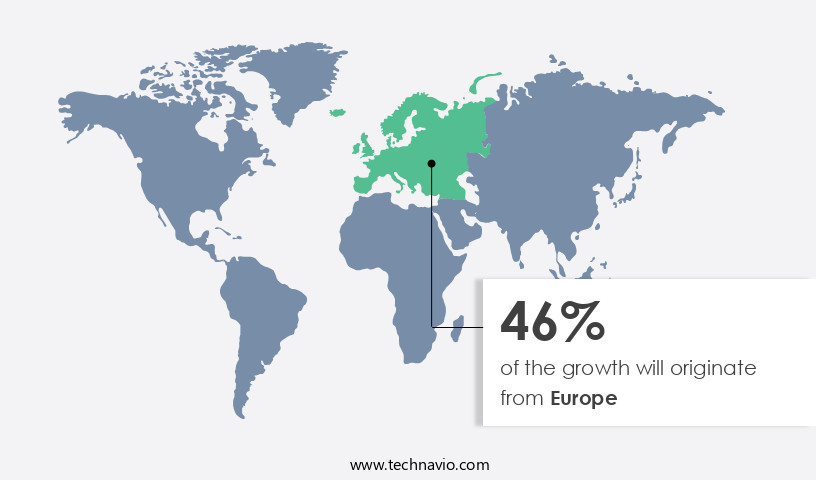

Europe is estimated to contribute 46% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

Europe is a significant market for cable laying vessels, fueled by the increasing demand for offshore wind farms and telecommunications infrastructure. Renewable energy and digital connectivity are key priorities in Europe, leading to substantial investments in subsea cable projects. In October 2024, Seaway7, a Subsea 7 Group subsidiary, secured a contract worth between USD150 million and USD300 million from Orsted for transporting and installing 192 66kV inter-array cables for the Hornsea 3 offshore wind project in the North Sea. This project entails approximately 500 kilometers of cables, with offshore activities set to begin in 2026. Seaway7's CEO, Stuart Fitzgerald, highlighted that this contract, marking their seventh collaboration with Orsted, underscores their robust partnership and Seaway7's leading role in the UK offshore wind sector.

Marine construction projects involve intricate planning, adherence to industry standards, and stringent safety regulations. Cable laying operations require precise positioning systems, data acquisition, and hydrographic surveys to ensure economic feasibility and minimize environmental impact. Machine learning and artificial intelligence are increasingly employed to optimize vessel design, maintenance services, and fleet management, enhancing efficiency and cost optimization. Cable strength, laying speed, and dynamic positioning systems are crucial factors in the success of these projects. Offshore wind farms and telecommunications infrastructure projects necessitate extensive engineering services, project planning, and project management. Remote monitoring, data analytics, and navigation software are essential tools for effective cable installation services.

The supply chain, from cable manufacturing to vessel optimization, plays a vital role in the success of these projects. Renewable energy projects, such as offshore wind farms, contribute to the reduction of greenhouse gas emissions and the transition to a sustainable future.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Cable Laying Vessel Industry?

- The expansion of offshore wind capacity is a primary market driver, as this renewable energy source continues to gain significant traction and investment due to its potential to generate large-scale, clean power.

- The global offshore wind market is experiencing significant growth, with installations projected to triple by 2028, reaching approximately 65 GW by 2033. Renewable energy sources, particularly offshore wind, are becoming increasingly important, with offshore wind's share of new installations expected to rise from 9% in 2023 to at least 25% by 2033. Over 400 GW of new offshore wind capacity is anticipated between 2024 and 2033, with two-thirds of this growth expected in the latter half of the period. Asia is expected to lead this market, fueled by robust growth in China and emerging Asian markets.

- Cable laying vessels play a crucial role in this sector, enabling the installation and maintenance of the underwater cables required for transmitting power from offshore wind farms to the grid. Key considerations for cable laying vessels include engineering services for project planning, cable diameter, laying distance, cable tension, remote monitoring, and maintenance services. Autonomous underwater vehicles and telecommunications infrastructure are also essential for optimizing cost and vessel design. Fuel consumption is a critical factor in vessel operation and cost optimization. With the expanding role of offshore wind in the renewable energy sector, the demand for cable laying vessels is set to increase substantially.

What are the market trends shaping the Cable Laying Vessel Industry?

- The increasing adoption of hybrid cable laying vessels represents a significant market trend in the maritime industry. This shift towards more environmentally friendly and efficient vessels is a notable development in cable laying technology.

- The market is experiencing a notable trend towards the utilization of hybrid cable laying vessels. This trend is fueled by the industry's commitment to improving operational efficiency and lessening environmental impact. Hybrid vessels, which integrate traditional fuel engines with advanced battery systems, provide a sustainable solution for cable laying tasks, particularly in the offshore wind sector. For instance, on October 19, 2022, Van Oord nv unveiled its latest hybrid cable laying vessel, Calypso, at VARD's Tulcea shipyard in Romania. This 130-meter DP2 vessel boasts a substantial battery pack, shore supply connection, and an energy management system designed to minimize CO2, NOx, and SOx emissions.

- Navigation systems and vessel optimization are crucial aspects of cable laying operations. Hybrid vessels, with their advanced technology, offer enhanced navigation capabilities and improved vessel performance. Crane capacity, laying depth, and winch capacity are essential factors that determine a vessel's efficiency in cable installation. Project management and data analytics play a significant role in optimizing cable laying operations and ensuring project success. Seabed surveys are an integral part of the cable laying process, and remotely operated vehicles (ROVs) are commonly used for this purpose. ROVs enable thorough inspections of the seabed, ensuring the optimal location for cable installation.

- Subsea pipeline construction and offshore construction projects require extensive planning and coordination, making data analysis a vital tool for project success. Cable laying vessels require ample deck space for storing and handling cable reels. The integration of hybrid technology in these vessels not only enhances operational efficiency but also reduces the environmental footprint, making it a preferred choice for the industry.

What challenges does the Cable Laying Vessel Industry face during its growth?

- The growth of the industry is significantly influenced by the impact of weather and environmental conditions, posing a substantial challenge that requires careful consideration and adaptation strategies.

- The market faces significant challenges due to weather and environmental conditions, which can impact project timelines, operational efficiency, and safety. A study published in Earth-Science Reviews on February 21, 2023, emphasizes the vulnerability of global internet connectivity to climate change. Researchers from the UK National Oceanography Centre and the University of Central Florida found that extreme weather events, such as intensifying tropical cyclones and rising sea levels, are increasingly damaging subsea fiber-optic cables, which are essential for global data flow. Cable laying operations are intricate processes, requiring precise execution in often remote and challenging offshore environments. Adverse weather conditions, including heavy storms, high winds, and strong currents, can delay projects, increase costs, and even cause damage to equipment and cables.

- Economic feasibility is a critical factor in the market, with positioning systems, data acquisition, hydrographic survey, machine learning, and artificial intelligence playing significant roles in enhancing operational efficiency and reducing costs. Industry standards and environmental impact assessments are also crucial considerations in the market, with a focus on minimizing disruptions to marine ecosystems and ensuring a favorable return on investment. Cable length is another essential factor, with longer cables requiring more advanced technology and greater operational expertise.

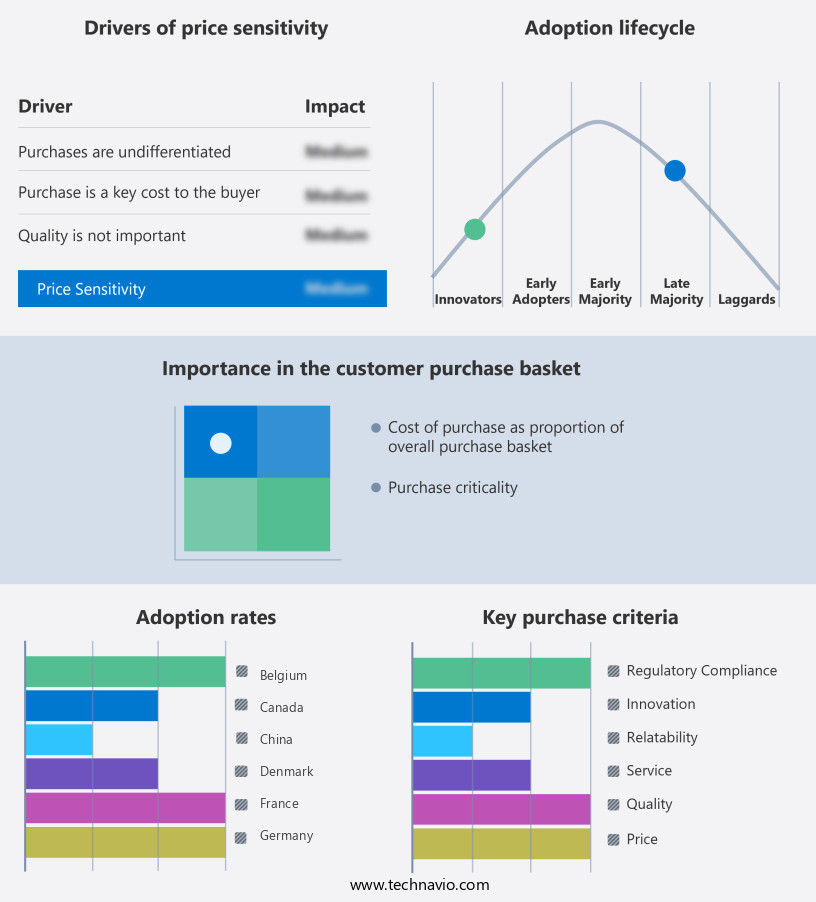

Exclusive Customer Landscape

The cable laying vessel market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the cable laying vessel market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, cable laying vessel market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Boskalis - The company specializes in providing advanced cable laying vessel solutions, including the Boka Ocean, Ndurance, Bokabarge 82, Giant 7, Ndeavor, and BOKA Constructor. These vessels are engineered to optimize cable deployment, ensuring minimal downtime and maximum efficiency. With a focus on innovation and technological advancements, the company's offerings elevate subsea cable infrastructure projects, enhancing connectivity and reliability. The vessels' robust designs enable them to navigate challenging environments, making them a preferred choice for global clients. By prioritizing quality and safety, the company's cable laying services enable clients to meet their project objectives in a timely and cost-effective manner.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Boskalis

- Fincantieri Spa

- Jan De Nul

- Kongsberg Gruppen ASA

- PaxOcean

- Royal IHC

- Ulstein Group ASA

- Van Oord nv

- Vouvray Acquisition Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Cable Laying Vessel Market

- In February 2023, Boskalis, a leading global maritime services provider, announced the successful launch of its newbuild cable laying vessel, the "Willem Adelaar" (Boskalis press release, 2023). This state-of-the-art vessel, equipped with advanced technologies, significantly enhances Boskalis' capacity to deliver subsea cable installation projects, expanding its market presence.

- In June 2024, Heerema Marine Contractors and Van Oord, two major players in the market, entered into a strategic partnership to jointly pursue offshore wind projects (Heerema Marine Contractors press release, 2024). This collaboration aims to combine their expertise and resources, enabling them to offer comprehensive services to clients and strengthening their positions in the rapidly growing offshore wind sector.

- In March 2025, Allseas, a Swiss engineering company, secured a contract worth â¬1.5 billion to install the Nord Link interconnector between Denmark and Norway (Allseas press release, 2025). This significant project further solidifies Allseas' position as a leading player in the market, demonstrating its capability to handle large-scale projects and its commitment to contributing to the expansion of Europe's interconnected power grid.

- In May 2025, Saab Seaeye, a leading provider of underwater technology systems, introduced its new cable laying system, "CableLay 1000," featuring advanced autonomous capabilities (Saab Seaeye press release, 2025). This technological breakthrough is expected to increase efficiency and reduce costs for cable laying projects, positioning Saab Seaeye as a pioneer in the market and setting new industry standards.

Research Analyst Overview

- The market encompasses various aspects, including marine insurance, cable testing, project financing, and marine environmental assessment. Marine mammal observation is crucial for minimizing potential disruptions to wildlife during deep water and shallow water cable laying. Underwater welding and cable termination are essential for vessel performance and operational efficiency. Environmental regulations mandate stringent safety procedures, including emissions reduction and environmental monitoring. Acoustic imaging and seabed mapping are integral to quality assurance and seabed classification. Cable splicing and cable repair are vital for maintaining high voltage cable systems. Investment opportunities abound in this sector, with a focus on fuel efficiency optimization, navigation software, and marine logistics.

- Training and certification for offshore personnel are essential for adhering to safety procedures. Risk assessment and cable tension control are crucial for ensuring operational efficiency and vessel safety. Subsea survey equipment and cable handling systems are indispensable for accurate route planning and cable payout. Project financing requires rigorous risk assessment and adherence to environmental regulations. Cable monitoring and vessel performance monitoring are essential for maintaining optimal cable protection systems and ensuring the longevity of these vital infrastructure projects.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Cable Laying Vessel Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

191 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.1% |

|

Market growth 2025-2029 |

USD 998.3 million |

|

Market structure |

Concentrated |

|

YoY growth 2024-2025(%) |

3.8 |

|

Key countries |

UK, US, Germany, China, Denmark, The Netherlands, France, Japan, Belgium, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Cable Laying Vessel Market Research and Growth Report?

- CAGR of the Cable Laying Vessel industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the cable laying vessel market growth of industry companies

We can help! Our analysts can customize this cable laying vessel market research report to meet your requirements.