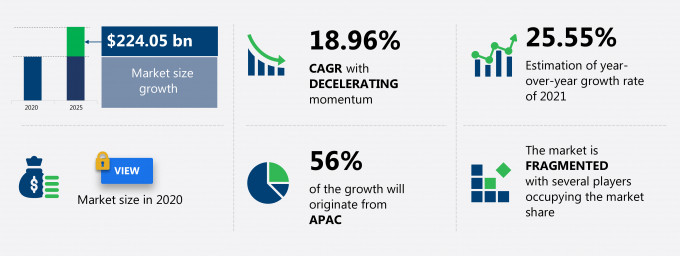

The cab services market share is expected to increase by USD 224.05 billion from 2020 to 2025, and the market’s growth momentum will decelerate at a CAGR of 18.96%. This cab services market research report provides valuable insights on the post COVID-19 impact on the market, which will help companies evaluate their business approaches. The cab services market report also offers information on several market vendors, including ANI Technologies Private Ltd., Beijing Xiaoju Technology Co. Ltd., BiTaksi Mobil Teknoloji AS, BMW Group, Daimler AG, Grab Holdings Inc., GT Gettaxi (UK) Ltd., Lyft Inc., Maxi Mobility Spain SL, and Uber Technologies Inc. among others. Furthermore, this report extensively covers cab services market segmentation by type (e-hailing, car rentals, radio cabs, and others) and geography (APAC, North America, Europe, MEA, and South America).

What will the Cab Services Market Size be During the Forecast Period?

Download the Free Report Sample to Unlock the Cab Services Market Size for the Forecast Period and Other Important Statistics

Cab Services Market: Key Drivers, Trends, and Challenges

Based on our research output, there has been a negative impact on the market growth during and post COVID-19 era. The growing use of cashless transactions in e-hailing and integration with digital wallets is notably driving the cab services market growth, although factors such as the threat from regional cab service providers may impede the market growth. Our research analysts have studied the historical data and deduced the key market drivers and the COVID-19 pandemic impact on the cab services industry. The holistic analysis of the drivers will help in deducing end goals and refining marketing strategies to gain a competitive edge.

Key Cab Services Market Driver

The growing use of cashless transactions in e-hailing and integration with digital wallets is notably driving the cab services market growth. The cash-based payment system for cab riders has been replaced by an in-app payment system, which uses digital wallets. A surge in the smartphone application user base has significantly changed the payment system of cab aggregators. Money is preloaded in digital wallets by cab riders, and the service charge is automatically deducted at the destination point without using a two-way authentication process. E-hailing apps, such as Uber and Ola, provide digital payment facilities to their customers by partnering with third-party service providers, such as PayPal, Apple Pay, PayTM, and PayU.

Key Cab Services Market Trend

Technological developments in the taxi market is the key trend driving the cab services market growth. In April 2016, the world’s first self-driving taxi service was launched by Singapore-based nuTonomy, which is an autonomous vehicle software startup. The company started this service with a small fleet of six cars in 2016. During the trial period, nuTonomy modified Renault Zoe and Mitsubishi i-MiEV electrics. In this self-driven taxi, each car is fitted with six sets of Lidar, which is a detection system that uses lasers to operate like radar, including one that constantly spins on the roof. In addition, there are two cameras on the dashboard that are used to scan for obstacles and detect changes in traffic lights. These product launches and product innovations are driving the cab services market growth during the forecast period.

Key Cab Services Market Challenge

The major challenge impeding the cab services market growth is the threat from the regional cab service providers. The ride-hailing business depends on the scale for which substantial investment is required. Building a right-sized population of owner-drivers, according to customer demand in the region and the confidence of sufficient work, which will earn their required wages, is a costly process for e-hailing companies. In 2016, Uber pulled out of China due to the increased competition from local cab service provider Didi Chuxing. Didi Chuxing acquired the Chinese operations of Uber in 2016, and after the acquisition, Didi Chuxing combined with Uber’s Chinese unit was valued at more than $35 billion.

This cab services market analysis report also provides detailed information on other upcoming trends and challenges that will have a far-reaching effect on the market growth. The actionable insights on the trends and challenges will help companies evaluate and develop growth strategies for 2021-2025.

Parent Market Analysis

Technavio categorizes the global cab services market is a part of the global trucking market. Our research report has extensively covered external factors influencing the parent market growth potential in the coming years, which will determine the levels of growth of the cab services market during the forecast period.

Who are the Major Cab Services Market Vendors?

The report analyzes the market’s competitive landscape and offers information on several market vendors, including:

- ANI Technologies Private Ltd.

- Beijing Xiaoju Technology Co. Ltd.

- BiTaksi Mobil Teknoloji AS

- BMW Group

- Daimler AG

- Grab Holdings Inc.

- GT Gettaxi (UK) Ltd.

- Lyft Inc.

- Maxi Mobility Spain SL

- Uber Technologies Inc.

This statistical study of the cab services market encompasses successful business strategies deployed by the key vendors. The cab services market is fragmented and the vendors are deploying organic and inorganic growth strategies to compete in the market.

Product Insights and News

- ANI Technologies Private Ltd. - The company offers cab services under the brand, Ola.

To make the most of the opportunities and recover from post COVID-19 impact, market vendors should focus more on the growth prospects in the fast-growing segments, while maintaining their positions in the slow-growing segments.

The cab services market forecast report offers in-depth insights into key vendor profiles. The profiles include information on the production, sustainability, and prospects of the leading companies.

Cab Services Market Value Chain Analysis

Our report provides extensive information on the value chain analysis for the cab services market, which vendors can leverage to gain a competitive advantage during the forecast period. The end-to-end understanding of the value chain is essential in profit margin optimization and evaluation of business strategies. The data available in our value chain analysis segment can help vendors drive costs and enhance customer services during the forecast period.

The report has further elucidated on other innovative approaches being followed by service providers to ensure a sustainable market presence.

Which are the Key Regions for Cab Services Market?

For more insights on the market share of various regions Request for a FREE sample now!

56% of the market’s growth will originate from APAC during the forecast period. China and India are the key markets for the cab services market in APAC. Market growth in this region will be faster than the growth of the market in other regions.

Taxi cabs are common across the region with the regional players dominating the e-hailing cab services market. They have a GPS navigation system, which is available on the mobile app, and passengers can book the nearby available taxi according to their location. This will facilitate the cab services market growth in APAC over the forecast period. This market research report entails detailed information on the competitive intelligence, marketing gaps, and regional opportunities in store for vendors, which will assist in creating efficient business plans.

COVID Impact and Recovery Analysis

The outbreak of the COVID-19 pandemic disrupted the growth of the cab services market in the region. The economic recession owing to the business restrictions imposed and the lack of economic growth brought about by the outbreak of COVID-19 in APAC were the primary factors that adversely impacted the demand for cab services in APAC. However, the market in focus in the region is expected to rebound in 2021-2025, with the gradual economic recovery and re-starting of the economy and control in the spread of the pandemic. This, in turn, will drive the growth of the market in focus in APAC during the forecast period.

What are the Revenue-generating Type Segments in the Cab Services Market?

To gain further insights on the market contribution of various segments Request for a FREE sample

The cab services market share growth by the e-hailing segment will be significant during the forecast period. E-hailing companies are aiming to improve vehicle utilization by allowing their users to book the service online for their customized trips. By e-hailing platforms, passengers can book their ride on the online application of the company, thereby selecting their routes. The passengers can track the location of the cab through the cab service provider application interface. These benefits will drive the segment growth during the forecast period.

This report provides an accurate prediction of the contribution of all the segments to the growth of the cab services market size and actionable market insights on post COVID-19 impact on each segment.

|

Cab Services Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

120 |

|

Base year |

2020 |

|

Forecast period |

2021-2025 |

|

Growth momentum & CAGR |

Decelerate at a CAGR of 18.96% |

|

Market growth 2021-2025 |

$ 224.05 billion |

|

Market structure |

Fragmented |

|

YoY growth (%) |

25.55 |

|

Regional analysis |

APAC, North America, Europe, MEA, and South America |

|

Performing market contribution |

APAC at 56% |

|

Key consumer countries |

China, US, India, UK, and Russian Federation |

|

Competitive landscape |

Leading companies, Competitive strategies, Consumer engagement scope |

|

Key companies profiled |

ANI Technologies Private Ltd., Beijing Xiaoju Technology Co. Ltd., BiTaksi Mobil Teknoloji AS, BMW Group, Daimler AG, Grab Holdings Inc., GT Gettaxi (UK) Ltd., Lyft Inc., Maxi Mobility Spain SL, and Uber Technologies Inc. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID 19 impact and recovery analysis and future consumer dynamics, Market condition analysis for forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Cab Services Market Report?

- CAGR of the market during the forecast period 2021-2025

- Detailed information on factors that will drive cab services market growth during the next five years

- Precise estimation of the cab services market size and its contribution to the parent market

- Accurate predictions on upcoming trends and changes in consumer behavior

- The growth of the cab services industry across APAC, North America, Europe, MEA, and South America

- A thorough analysis of the market’s competitive landscape and detailed information on vendors

- Comprehensive details of factors that will challenge the growth of cab services market vendors

We can help! Our analysts can customize this report to meet your requirements. Get in touch