Business To Business (B2B) E-Commerce Market Size 2024-2028

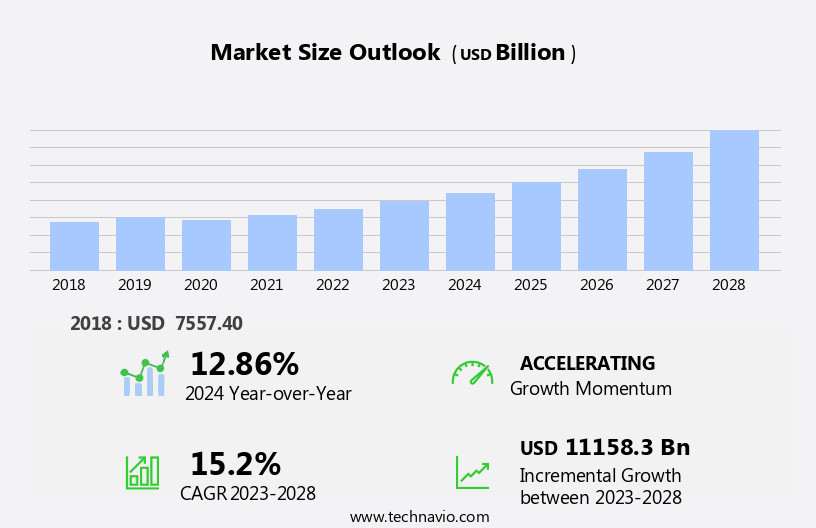

The business to business (b2b) e-commerce market size is forecast to increase by USD 11158.3 billion, at a CAGR of 15.2% between 2023 and 2028.

- The Business-to-Business (B2B) E-commerce market is experiencing significant growth, particularly in developing countries where adoption is on the rise. This trend is driven by the increasing digitization of business processes and the convenience and efficiency gains offered by online platforms. Another key driver is the strategic collaboration among companies, who are recognizing the benefits of partnerships in expanding their reach and enhancing their offerings. However, this market is not without challenges. Data and cybersecurity concerns are becoming increasingly prevalent, as companies grapple with the complexities of securing sensitive business information in the digital realm.

- These challenges necessitate robust security measures and strategic planning to mitigate risks and maintain trust with business partners. Companies seeking to capitalize on the opportunities presented by the B2B E-commerce market must navigate these challenges effectively, while also staying abreast of the latest trends and collaborative opportunities.

What will be the Size of the Business To Business (B2B) E-Commerce Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

In the dynamic and ever-evolving business-to-business (B2B) e-commerce market, various entities interplay to facilitate seamless transactions and optimize operations. Channel management and supplier relationship management are crucial for effective procurement processes, ensuring a steady supply chain. Optimization of inventory management systems and demand planning enable businesses to maintain an adequate stock level, reducing the risk of stockouts or overstocking. Business intelligence and data analytics provide valuable insights, enabling sales forecasting and pricing strategies. E-commerce platforms serve as the backbone, integrating order management systems, payment terms, and invoice processing. Technical support and contract negotiation are essential for maintaining strong business relationships and resolving any disputes.

Fraud prevention measures, such as data encryption and compliance regulations, protect businesses from potential threats. Marketing automation and discounting strategies help attract and retain customers, while branding strategies and reputation management ensure a strong market presence. International trade and import/export procedures necessitate a deep understanding of various tax regulations and customs regulations. Sales automation and affiliate marketing expand reach and streamline operations, while predictive analytics and return management optimize customer service and account receivables. Warehouse management, shipping logistics, and negotiation tactics ensure efficient order fulfillment and risk management. Quality control and product returns maintain customer satisfaction, while company onboarding and supply chain finance facilitate smooth supplier relationships.

Email marketing, digital marketing, content marketing, and social media marketing are essential for lead generation and customer engagement. Legal frameworks and contract management ensure a solid foundation for business operations. In this continuously unfolding market, entities such as payment gateways, lead generation, and compliance regulations are integral components, shaping the B2B e-commerce landscape.

How is this Business To Business (B2B) E-Commerce Industry segmented?

The business to business (b2b) e-commerce industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Home and kitchen

- Beauty and personal care

- Consumer electronics

- Clothing and others

- Business Segment

- Small and medium enterprises

- Large enterprises

- Type

- Buyer-oriented

- Seller-oriented

- Intermediary-oriented

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Application Insights

The home and kitchen segment is estimated to witness significant growth during the forecast period.

The Business-to-Business (B2B) e-commerce market in the US has experienced significant growth, driven by various factors. Security protocols and order management systems ensure seamless transactions, while technical support facilitates smooth operations. Contract negotiation and marketing automation streamline business processes, enabling discounting strategies and compliance with regulations. International trade and sales forecasting expand market reach, with data encryption safeguarding sensitive information. Branding strategies and supplier relationship management foster long-term partnerships, and risk management mitigates potential threats. Pricing strategies, channel management, and supply chain optimization improve efficiency, and customer service enhances satisfaction. Account receivables and warehouse management optimize cash flow, and business intelligence informs strategic decision-making.

E-commerce platforms, payment terms, and fraud prevention streamline transactions, while online catalogs and sales automation simplify purchasing processes. Affiliate marketing, predictive analytics, invoice processing, and shipping logistics further boost efficiency. Negotiation tactics, quality control, product returns, and b2b marketplaces manage returns and demand. Procurement processes, supply chain finance, company onboarding, tax regulations, email marketing, digital marketing, content marketing, payment gateways, legal frameworks, social media marketing, reputation management, data analytics, contract management, and customer reviews ensure effective operations. The integration of these entities propels the B2B e-commerce market forward, enabling businesses to expand their reach and streamline their operations.

The Home and kitchen segment was valued at USD 2849.90 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 37% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In the dynamic landscape of Business-to-Business (B2B) e-commerce, the APAC region is making significant strides, fueled by a burgeoning economy, expanding internet connectivity, and the rising demand for digital services. Security protocols and order management systems are essential components of this market, ensuring seamless transactions and data protection. Technical support and contract negotiation are also critical, enabling businesses to efficiently communicate and agree on terms. Marketing automation and discounting strategies are key differentiators, helping companies reach broader markets and build customer loyalty. Compliance regulations and international trade present complex challenges, requiring sophisticated supply chain optimization and risk management. Pricing strategies, channel management, and inventory management systems are crucial for maintaining competitiveness.

Customer service, account receivables, and warehouse management are essential for ensuring customer satisfaction and operational efficiency. Business intelligence, e-commerce platforms, payment terms, and fraud prevention are integral to the market's success. Predictive analytics and invoice processing streamline operations, while shipping logistics and negotiation tactics ensure timely deliveries and favorable agreements. Quality control, product returns, and return management are essential for maintaining customer trust and reducing operational costs. B2B marketplaces and demand planning facilitate procurement processes and supply chain finance. company onboarding and tax regulations require careful consideration. Email marketing, digital marketing, content marketing, payment gateways, legal frameworks, social media marketing, reputation management, and data analytics are essential for effective marketing and customer engagement.

In the APAC region, mobile technology is revolutionizing B2B e-commerce, with mobile apps and online marketplaces simplifying transactions and creating new business models and revenue streams. As more businesses embrace mobile devices, the market is poised for continued growth and innovation.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

In the dynamic and evolving business landscape, the business-to-business (B2B) e-commerce market plays a pivotal role, offering streamlined procurement solutions for companies worldwide. This marketplace facilitates seamless transactions, enabling businesses to buy and sell goods and services efficiently. B2B e-commerce platforms leverage advanced technologies like artificial intelligence, machine learning, and big data analytics to optimize supply chain management, inventory control, and customer relationship management. These platforms provide a wide range of features, including customizable pricing, bulk order processing, and secure payment gateways, catering to diverse industry needs. Moreover, they foster global connectivity, enabling businesses to expand their reach beyond geographical boundaries. The B2B e-commerce marketplace is a game-changer, offering cost savings, increased productivity, and enhanced collaboration opportunities for businesses in today's interconnected world.

What are the key market drivers leading to the rise in the adoption of Business To Business (B2B) E-Commerce Industry?

- The surge in B2B E-commerce adoption in developing countries is the primary market driver. This trend is significantly influencing the global business landscape, particularly in regions where traditional trading methods have been prevalent. The convenience, efficiency, and cost savings offered by B2B E-commerce platforms are increasingly appealing to businesses in these countries, leading to a steady growth in market penetration.

- B2B e-commerce has witnessed notable growth in developing countries, as businesses recognize the advantages of online trading. These benefits include cost savings, improved efficiency, and expanded market reach. The global competitive landscape is a significant driver of this trend, as businesses seek to expand beyond their local markets. Security protocols are a critical consideration in B2B e-commerce, ensuring the protection of sensitive business information. Order management systems facilitate seamless transactions, while technical support addresses any issues that may arise. Contract negotiation can be streamlined through digital channels, and marketing automation enables targeted campaigns. Discounting strategies and pricing models are essential tools for businesses looking to remain competitive.

- Compliance regulations and international trade requirements must also be addressed, necessitating robust supplier relationship management and risk management practices. Sales forecasting relies on accurate data analysis, which is facilitated by advanced data encryption technologies. Branding strategies can be enhanced through digital channels, and businesses can effectively manage their online reputation. In conclusion, the B2B e-commerce market is dynamic and complex, requiring businesses to stay informed about the latest trends and technologies. By focusing on security, order management, technical support, contract negotiation, marketing automation, discounting strategies, compliance regulations, international trade, sales forecasting, data encryption, branding strategies, supplier relationship management, risk management, and pricing strategies, businesses can effectively navigate this evolving landscape.

- Recent research indicates that this trend is set to continue, with the market expected to grow significantly in the coming years.

What are the market trends shaping the Business To Business (B2B) E-Commerce Industry?

- The trend in B2B E-commerce is shifting towards more strategic collaborations among companies. This increasing collaboration is a significant market development.

- In the Business-to-Business (B2B) e-commerce sector, collaboration among companies is a strategic priority to enhance offerings and improve customer experience. This trend is driven by the need for businesses to cater to specific industry requirements and expand their market reach. companies can collaborate on product development to create innovative solutions, leading to more comprehensive offerings for diverse target audiences. Strategic partnerships can also enable businesses to enter new markets by leveraging local companies' established networks and customer bases. Moreover, B2B e-commerce platforms are essential for optimizing supply chain operations, managing warehouses, and processing invoices. These platforms offer business intelligence tools, sales automation, and predictive analytics to streamline processes and gain valuable insights.

- Customer service is another critical aspect of B2B e-commerce, and companies must provide flexible payment terms, fraud prevention measures, and online catalogs to meet the unique needs of their clients. Affiliate marketing is also a popular strategy for expanding reach and increasing sales. Effective channel management is crucial for managing these partnerships and ensuring seamless integration with the company's systems. Overall, collaboration, innovation, and technology are key drivers of growth in the B2B e-commerce market.

What challenges does the Business To Business (B2B) E-Commerce Industry face during its growth?

- The escalating number of data and cybersecurity concerns poses a significant challenge to the growth of B2B E-commerce, mandating robust security measures to protect sensitive business information and maintain customer trust.

- The Business-to-Business (B2B) e-commerce market is experiencing significant growth, presenting both opportunities and challenges for US businesses. Negotiation tactics and demand planning are crucial elements in B2B procurement processes, enabling businesses to secure favorable prices and manage inventory effectively. Shipping logistics is another vital aspect, requiring efficient management to ensure timely delivery and minimize costs. Quality control and product returns are essential in maintaining customer satisfaction and trust. B2B marketplaces offer a platform for streamlined return management, simplifying the process and reducing administrative burdens. company onboarding and supply chain finance are also critical components, enabling businesses to manage their financial relationships with suppliers and optimize cash flow.

- Tax regulations and compliance are essential considerations in B2B e-commerce, requiring businesses to stay informed and adapt to changing regulations. Digital marketing strategies, including email and content marketing, can help businesses reach and engage their target audience effectively. Implementing robust security measures is essential to protect sensitive business information from cyber threats and data breaches. Overall, understanding these market dynamics and implementing best practices can help businesses successfully navigate the B2B e-commerce landscape. In conclusion, the B2B e-commerce market presents both opportunities and challenges for US businesses. Effective negotiation tactics, demand planning, shipping logistics, quality control, product returns, and company onboarding are essential components of successful B2B procurement processes.

- Tax regulations, digital marketing, and robust security measures are also crucial considerations for businesses looking to thrive in this dynamic market.

Exclusive Customer Landscape

The business to business (b2b) e-commerce market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the business to business (b2b) e-commerce market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, business to business (b2b) e-commerce market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Alibaba Group - This company specializes in business-to-business (B2B) ecommerce solutions, providing a platform akin to Alibaba.Com for seamless transactions between businesses. Our service facilitates global connectivity, enabling buyers and sellers to efficiently trade goods and services online. With a focus on user-friendly interfaces, robust security, and extensive market reach, this platform empowers businesses to expand their customer base and streamline their procurement processes. By leveraging advanced technology and data analytics, we ensure a reliable and efficient trading experience for all participants.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alibaba Group

- Amazon Business

- Ariba (SAP)

- Coupang

- Coupa Software

- EC21

- Epicor Software Corporation

- Global Sources

- IndiaMART

- JD.com

- Made-in-China

- MageWorx

- Mercateo

- NetSuite (Oracle)

- Rakuten

- Salesforce

- ThomasNet

- TradeIndia

- Tradeshift

- Walmart Marketplace

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Business To Business (B2B) E-Commerce Market

- In January 2024, Amazon Business, a leading B2B e-commerce platform, announced the launch of its new product line, Amazon Business Industrial and Scientific, catering to the specific needs of the industrial and scientific communities (Amazon Business Press Release). In March 2024, Alibaba Group, the Chinese multinational conglomerate, entered into a strategic partnership with IBM to strengthen its B2B e-commerce platform, Alibaba.Com, by integrating IBM's AI and cloud technologies (Alibaba Group Press Release).

- In April 2025, JD.Com, China's second-largest e-commerce company, completed the acquisition of a significant stake in Walmart's B2B e-commerce unit, Marketplace, to expand its global reach and enhance its offerings (JD.Com Press Release). In May 2025, the European Commission approved the merger of American Express Global Business Travel and Carlson Wagonlit Travel, creating a leading B2B travel platform, subject to certain conditions to ensure fair competition (European Commission Press Release). These developments underscore the dynamic nature of the B2B e-commerce market, with key players investing in new product offerings, strategic partnerships, and mergers and acquisitions to gain a competitive edge.

Research Analyst Overview

- The Business-to-Business (B2B) e-commerce market is witnessing significant advancements, with API integrations streamlining business processes and enabling seamless data exchange. Pricing models are evolving, shifting towards subscription services and pay-as-you-go options. Order fulfillment and logistics optimization are crucial, with SAAS solutions and big data analytics enhancing efficiency. Target marketing and personalization strategies are gaining traction, utilizing customer segmentation and AI-driven recommendations. Delivery management and e-commerce security are essential concerns, with advancements in VR, AR, and blockchain technology offering solutions. Technical support and customer service are paramount, with cloud computing and machine learning enhancing capabilities.

- Digital transformation is driving innovation, incorporating omni-channel retailing, inventory control, and supply chain visibility. Fraud detection and data security are essential, with ML and AI-driven solutions safeguarding against threats. Mobile commerce is on the rise, requiring optimization and integration with other channels.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Business To Business (B2B) E-Commerce Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

159 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 15.2% |

|

Market growth 2024-2028 |

USD 11158.3 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

12.86 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Brazil, Egypt, UAE, Oman, Argentina, KSA, UAE, Brazil, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Business To Business (B2B) E-Commerce Market Research and Growth Report?

- CAGR of the Business To Business (B2B) E-Commerce industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the business to business (b2b) e-commerce market growth of industry companies

We can help! Our analysts can customize this business to business (b2b) e-commerce market research report to meet your requirements.