Blueberry Market Size 2025-2029

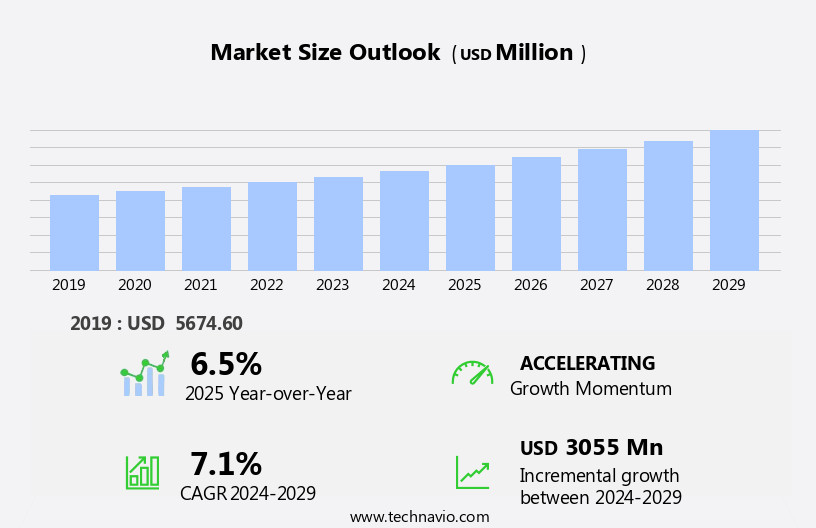

The blueberry market size is forecast to increase by USD 3.06 billion, at a CAGR of 7.1% between 2024 and 2029.

- The market is experiencing significant shifts, driven by the increasing penetration of online retailing and e-commerce platforms. This trend is transforming the way consumers purchase and receive fresh produce, including blueberries, leading to increased convenience and accessibility. Another key driver is the rising focus on advanced packaging solutions to maintain the freshness and quality of blueberries during transportation and storage. However, the market also faces challenges, such as stringent food safety regulations, which require producers and suppliers to adhere to strict standards to ensure the safety and health of consumers. Meeting these regulations adds complexity and cost to the supply chain, necessitating strategic planning and innovation to maintain competitiveness.

- Companies seeking to capitalize on market opportunities and navigate challenges effectively should prioritize investment in advanced packaging technologies and robust food safety protocols. Additionally, exploring partnerships with e-commerce platforms and adopting digital marketing strategies can help expand market reach and meet the evolving demands of consumers.

What will be the Size of the Blueberry Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, with dynamic shifts in production, processing, and consumption patterns shaping the industry's landscape. Blueberry processing is a critical component, as innovations in technology and techniques drive efficiency and product diversity. Pest control and disease management remain ongoing concerns, with continuous research and development in sustainable solutions. Rabbiteye blueberries and southern highbush blueberries are gaining popularity due to their unique characteristics and adaptability to various climates. Price fluctuations, influenced by supply and demand dynamics, impact the profitability of blueberry growers. Industry associations play a vital role in fostering collaboration and knowledge-sharing among stakeholders.

Organic blueberry production is on the rise, driven by consumer preferences for healthier and more sustainable food options. Blueberries find applications in various sectors, from muffins and pies to jams, smoothies, and supplements. Planting and fertilization practices are continually refined to optimize yields and improve sustainability. Blueberries' health benefits, including their rich antioxidant content, fuel demand and innovation in the market. Irrigation, pruning, and storage techniques are essential for maintaining blueberry quality standards. The industry's focus on research and development, safety regulations, and cultivar breeding ensures a vibrant future for this versatile fruit.

How is this Blueberry Industry segmented?

The blueberry industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Food and beverages

- Bakery and confectionary

- Others

- Type

- Organic

- Conventional

- Product

- Fresh

- Frozen

- Dried

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- Spain

- UK

- APAC

- China

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Application Insights

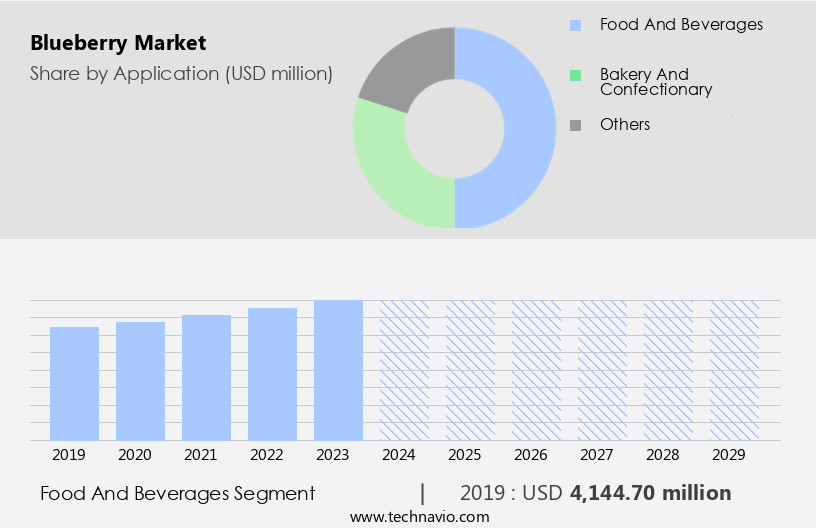

The food and beverages segment is estimated to witness significant growth during the forecast period.

Blueberries are a popular superfruit used extensively in the food and beverage industry, particularly in snacks, ice creams, jams, and various beverages such as juices, soft drinks, smoothies, and wine. The nutritional value of blueberries is significant, as they contain polysaccharides, phytonutrients, enzymes, and antioxidants like glutathione, flavonoids, carotenoid pigments, and polyphenols. Blueberries are highly sought after due to their health benefits and are increasingly being incorporated into healthier snack options in response to the growing demand for nutritious diets. Additionally, the popularity of blueberries in ice cream production is contributing to the growth of the food and beverage segment.

Blueberry farming practices include pruning, irrigation, and disease management to ensure optimal yield and quality. Innovations in blueberry cultivation, such as highbush and southern highbush varieties, have increased supply and improved sustainability. Blueberries are also processed into supplements, jams, and juices, which require careful handling and certification programs to ensure safety and quality. The market trends reflect a focus on organic production, as well as research into the potential health benefits of blueberries and their antioxidants. Blueberry industry associations play a crucial role in promoting the industry and addressing challenges, such as price fluctuations and pest control.

Overall, the market is dynamic and evolving, driven by consumer demand for healthier food options and the ongoing research and innovation in blueberry cultivation and processing.

The Food and beverages segment was valued at USD 4.14 billion in 2019 and showed a gradual increase during the forecast period.

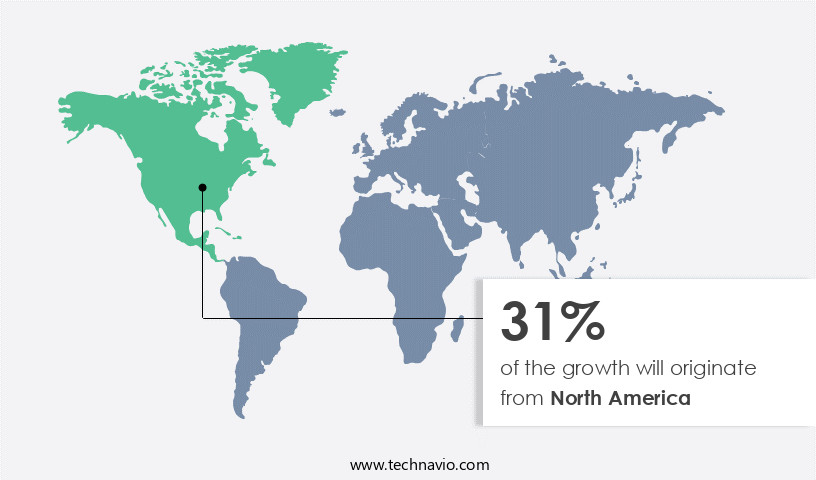

Regional Analysis

North America is estimated to contribute 31% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is witnessing significant growth, with North America leading the charge. Blueberries are increasingly used in the food and beverage industry for various applications due to their high nutritional value. This trend is particularly prominent in North America, where the demand for blueberries is on the rise. Blueberry farming practices, such as pruning, irrigation, and disease management, ensure a consistent supply of high-quality blueberries. Innovations in blueberry breeding have led to the development of new cultivars, including rabbiteye and southern highbush blueberries, which are well-suited to different climates and regions. Blueberries are used in various forms, including fresh, frozen, dried, and processed.

Processed blueberries are used to make jams, juices, and supplements. Blueberry pies and muffins are popular baked goods, while blueberry yogurt and smoothies are popular beverages. Blueberry certification programs ensure the production of organic and sustainably grown blueberries. Blueberry storage and transportation methods have also improved, ensuring the freshness and quality of the fruit. Blueberries are known for their antioxidant properties, making them a popular choice for health-conscious consumers. Blueberry health benefits include improved heart health, cognitive function, and digestive health. Blueberry research continues to uncover new health benefits, driving demand for the fruit. Blueberry industry associations promote best practices and standards for blueberry cultivation, processing, and consumption.

Blueberry farming practices, such as pruning, irrigation, and disease management, are essential to ensure the profitability of blueberry production. Blueberry supply and demand dynamics are influenced by various factors, including weather conditions, crop yields, and market trends. Price fluctuations can impact the profitability of blueberry farmers, making it essential to stay informed about market trends and consumer preferences. Blueberry cultivation and propagation techniques have evolved to meet the increasing demand for the fruit. Blueberry bushes are grown using various methods, including planting, fertilization, and propagation. Blueberry harvesting methods have also improved, ensuring the efficient and high-quality production of the fruit.

In conclusion, the market is experiencing significant growth, driven by increasing demand from the food and beverage industry and health-conscious consumers. Blueberries are used in various forms, from fresh to processed, and are known for their health benefits and versatility. Blueberry farming practices, research, and industry associations play a crucial role in ensuring the sustainability and profitability of the market.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Blueberry Industry?

- The significant expansion of online retailing and e-commerce sectors is the primary market catalyst, driving growth in this industry.

- Blueberries are gaining popularity in the global market due to their numerous health benefits and increasing consumer awareness towards healthy living. companies are leveraging online channels to market blueberries and their related products, such as blueberry supplements, to a wider audience. This trend enables companies to deliver from a central location, reaching consumers globally. The rising demand for blueberries is driven by their nutritional value and versatility in various applications, including blueberry smoothies and other food products. Blueberry cultivation requires careful pruning, irrigation, and adherence to quality standards to ensure optimal growth and yield. Sustainable farming practices are essential to maintain the long-term profitability of blueberry farming.

- The market for blueberries is expected to continue its growth trajectory, with an emphasis on improving cultivar selection and production efficiency. Consumers are increasingly seeking high-quality blueberries for their health benefits, making it crucial for companies to prioritize product quality and consistency.

What are the market trends shaping the Blueberry Industry?

- Advanced packaging is gaining significant attention in the market, with an increasing focus on this technology trend. It entails the integration of advanced features into packaging designs to enhance product protection, extend shelf life, and improve consumer experience.

- Blueberries are a popular fruit in the US market, known for their health benefits and versatility in various food products. The blueberry industry is dynamic, with ongoing research and innovation driving growth. Blueberries are used in various forms, including blueberry yogurt, juice, and transportation as fresh or frozen berries. Safety regulations play a crucial role in the blueberry supply chain to ensure the highest quality and food safety. Blueberry research focuses on improving propagation techniques, harvesting methods, and developing new blueberry varieties. Highbush blueberries are the most commonly cultivated variety, but other types like rabbiteye and wild blueberries also have a presence in the market.

- Packaging is essential for blueberries, as it preserves their freshness, flavor, and texture. Advanced packaging technologies like individual quick freezing (IQF) and modified atmosphere packaging (MAP) help extend the shelf life and maintain the nutritional value of the berries. New packaging techniques for blueberries, such as sliced berries and IQF, are gaining popularity in the market. These innovations cater to consumers' increasing demand for convenient and healthy food options. Blueberries are rich in antioxidants, making them a preferred choice for health-conscious consumers. The market is expected to continue growing due to the increasing awareness of their health benefits and the availability of new products and packaging technologies.

What challenges does the Blueberry Industry face during its growth?

- The stringent food safety regulations pose a significant challenge to the industry's growth, requiring companies to invest heavily in compliance measures and adherence to rigorous standards.

- Blueberries are gaining popularity in the food and beverage industry due to their nutritional benefits. This trend has led to an increase in the use of blueberries as an active ingredient in various food and beverage products, including baked goods, juices, and beverages. However, the market for blueberry processing faces challenges in terms of food safety regulations. These regulations ensure the production of high-quality products while maintaining consumer health. Compliance with these regulations can increase manufacturing costs for food manufacturers. In the blueberry industry, both rabbiteye and southern highbush blueberries are commonly used. Blueberry pest control and disease management are crucial aspects of blueberry planting and cultivation.

- Organic blueberry production is also gaining traction due to increasing consumer demand for organic food products. The organic production process requires specific farming practices and adherence to strict regulations. Blueberry fertilization is essential for optimal plant growth and yield. Despite these challenges, the demand for blueberries continues to grow, with applications extending beyond traditional food and beverage products to include cosmetics and pharmaceuticals. The blueberry industry associations play a vital role in promoting research and development, advocating for industry policies, and providing resources and education to members.

Exclusive Customer Landscape

The blueberry market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the blueberry market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, blueberry market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AGRANA Beteiligungs-AG - The company specializes in providing top-tier blueberries in various forms, including fresh and frozen, to meet diverse consumer preferences and culinary applications.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AGRANA Beteiligungs-AG

- Arctic Flavours Association

- Ardo Coordination Center NV

- Berry Plantation BETEC

- BerryWorld Ltd.

- Bio Botanica Inc.

- BlueBerry LLC

- Dealul cu Afine SRL

- Dole plc

- Driscolls Inc.

- Earthbound Farm

- Harbin Gaotai Food Co. Ltd.

- Hortifrut SA

- J.R. Simplot Co.

- JWM Asia

- MBG Marketing

- Naturipe Berry Growers Inc.

- Scenic Fruit Co.

- SunOpta Inc.

- Van Drunen Farms.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Blueberry Market

- In January 2024, leading blueberry producer, Sunny Blueberries, announced a strategic partnership with Wholesome Harvest, a major distributor, to expand their reach in the US market (Sunny Blueberries Press Release, 2024).

- In March 2024, OceanaBlue, a blueberry processing company, raised USD15 million in a Series B funding round, enabling them to expand their production capacity and strengthen their market position (OceanaBlue Press Release, 2024).

- In April 2025, the European Union approved the import of blueberries from Canada under a new trade agreement, boosting prospects for Canadian blueberry exporters (European Commission Press Release, 2025).

- In May 2025, Del Monte Fresh Produce N.A., Inc. Launched a new line of organic blueberries, responding to growing consumer demand for organic produce (Del Monte Fresh Produce N.A., Inc. Press Release, 2025).

Research Analyst Overview

- The international market experiences dynamic shifts driven by global demand, agricultural technology, and environmental sustainability. Food safety and packaging innovations have become crucial in addressing consumer preferences for safe and high-quality produce. Fruit cultivation adapts to climate change impacts through advanced crop management techniques and plant breeding programs. Economic impact analysis reveals the significance of supply chain management in ensuring food security and efficient distribution. Nutritional value, food regulations, and antioxidant properties contribute to the market's growth. Sustainable agriculture practices, such as organic farming and integrated pest management, are increasingly adopted to meet consumer demands.

- Food preservation and food processing technologies enhance the shelf life of blueberries, while food labeling transparency fosters trust among consumers. Agricultural research and soil science continue to play essential roles in improving berry production and addressing food safety standards. Genetic engineering and plant science advancements offer opportunities for innovation in the market.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Blueberry Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

205 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.1% |

|

Market growth 2025-2029 |

USD 3055 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.5 |

|

Key countries |

US, Canada, Germany, France, China, Italy, Spain, Japan, UK, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Blueberry Market Research and Growth Report?

- CAGR of the Blueberry industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the blueberry market growth of industry companies

We can help! Our analysts can customize this blueberry market research report to meet your requirements.