Blue Laser Diode Market Size 2025-2029

The blue laser diode market size is forecast to increase by USD 424.8 million at a CAGR of 16.6% between 2024 and 2029.

- The market is experiencing significant growth, driven by advances in laser projector technology and the increasing popularity of high-power blue laser diodes. These diodes offer superior brightness and efficiency compared to traditional red and green laser diodes, making them ideal for various applications, including medical equipment, 3D sensing, and high-definition projectors. However, the market faces challenges due to the declining demand for Blu-Ray disc players and DVD players, which have historically been major consumers of blue laser diodes. Moreover, Gallium nitride, a semiconductor material, is widely used in the production of blue laser diodes. These diodes are also employed in laser lighting, laser microscopy, and laser trapping.

- To capitalize on market opportunities, companies must focus on expanding their applications beyond entertainment and exploring new industries, such as industrial automation and defense. Additionally, investing in research and development to improve the efficiency and affordability of blue laser diodes will be crucial for market success. Overall, the market presents significant growth potential for those able to navigate these challenges and capitalize on emerging applications.

What will be the Size of the Blue Laser Diode Market during the forecast period?

- The blue laser diode market encompasses the fabrication, industry, trends, applications, manufacturing, hazards, regulations, future, specifications, safety, performance, development, technology, advancements, risks, standards, research, limitations, and patents of blue lasers. Blue lasers, a crucial technology, have gained significant attention due to their numerous advantages in various industries. Blue laser technology continues to evolve, driving innovation in areas such as manufacturing, medical, and telecommunications. Applications include disc manufacturing, material processing, and spectroscopy. However, safety and regulatory considerations are essential, as blue lasers pose specific hazards.

- Blue laser development and advancements aim to address limitations, such as efficiency and cost. company offerings to the market's growth. Blue laser design and patents play a vital role in the technology's evolution. In the blue laser future, performance and safety improvements, along with expanding applications, are expected to propel market growth. Despite risks, the benefits of blue lasers far outweigh the challenges.

How is this Blue Laser Diode Industry segmented?

The blue laser diode industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Single-mode

- Multi-mode

- Application

- Bio/medical

- Laser projectors and scanner

- Blu-ray devices

- Others

- Material

- Gallium nitride (GaN)

- Indium gallium nitride (InGaN))

- Product Type

- Continuous wave (CW)

- Pulsed

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Russia

- UK

- Middle East and Africa

- APAC

- China

- India

- Japan

- South Korea

- South America

- Rest of World (ROW)

- North America

By Type Insights

The single-mode segment is estimated to witness significant growth during the forecast period. The global market for blue laser diodes witnessed notable expansion in the single-mode segment in 2024. This growth can be attributed to the superior performance characteristics of single-mode blue laser diodes, which include high beam quality, narrow linewidth, and excellent coherence. These diodes are increasingly utilized in industries such as healthcare for Medical Diagnostics, advanced manufacturing for precision applications like high-resolution printing, and automotive for head-up displays (HUDs). Furthermore, the demand for efficient and compact laser sources in scientific research and telecommunications is driving the adoption of single-mode blue laser diodes. In the automotive sector, these diodes contribute to the production of high-definition projectors and optical storage devices.

The expanding applications in Consumer Electronics and scientific research are also fueling market growth. Single-mode blue laser diodes are also gaining traction in the semiconductor industry for epitaxial growth, crystal growth, and laser processing. Additionally, they are employed in various fields such as quantum computing, quantum wells, and laser communication for laser manipulation, laser cooling, laser-induced fluorescence, laser rangefinders, fluorescence microscopy, optical coherence tomography, data storage, laser lighting, laser spectroscopy, and laser metrology. The high-power and laser efficiency of these diodes make them a preferred choice for various industries, including biomedical imaging, laser cutting, laser-based sensors, and laser trapping. The versatility and high performance of single-mode blue laser diodes are expected to continue driving market growth in the coming years.

Get a glance at the market report of share of various segments Request Free Sample

The Single-mode segment was valued at USD 169.10 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

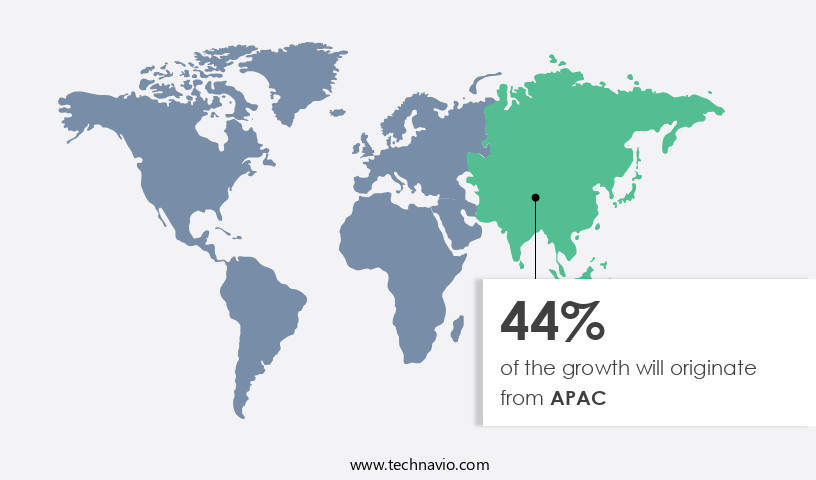

APAC is estimated to contribute 44% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market in Asia Pacific is experiencing significant growth due to the increasing demand for advanced laser projector technology. China is a key market for laser projectors in the region, driven by the high demand for Home Theater and cinema systems. Companies like Xiaomi are offering affordable laser projectors, utilizing blue laser diodes for projection through their ALPD 3.0 technology. These innovations, including ALPD 3.0, SOLID SHINE, and laser phosphor technologies, have significantly enhanced the performance of both professional and consumer laser projectors. In semiconductor processing, blue laser diodes are essential components for various applications such as flow cytometry, quantum wells, and laser manipulation.

Their high power and laser efficiency make them ideal for power consumption reduction in semiconductor materials processing. Additionally, blue laser diodes are used in laser communication systems, optical storage, and medical diagnostics for applications like laser cooling, laser-induced fluorescence, and laser spectroscopy. Moreover, blue laser diodes play a crucial role in crystal growth, biomedical imaging, and quantum computing.

Laser diodes, a type of blue laser diode, are used in various industries, including data storage, HD DVD, and laser cutting. They offer high brightness and are integral components of optical coherence tomography, laser projection, and laser scanning. Furthermore, laser diodes are essential in laser rangefinders, laser pointers, and laser engraving systems. With ongoing research and development, the potential applications of blue laser diodes are expected to grow further.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Blue Laser Diode Industry?

- Advances in laser projectors is the key driver of the market. The market is experiencing significant growth due to the increasing adoption of innovative technologies in laser projectors by leading companies. To enhance display quality, particularly in 4K content, these firms are shifting from traditional lamps to laser phosphor as a light source. Blue laser diodes are integral to this technology, as they are used to project the blue laser onto a phosphor wheel, which in turn produces the red, green, and blue colors on the screen.

- This technology offers several advantages over conventional projectors, including improved brightness, longer lamp life, and increased energy efficiency. As a result, The market is poised for steady expansion.

What are the market trends shaping the Blue Laser Diode Industry?

- The growing popularity of high-power blue laser diodes is the upcoming market trend. The market growth has experienced a deceleration due to the limited innovation in this sector. However, the increasing utilization of high-power blue laser diodes in various industries is projected to stimulate market expansion. Notable companies like USHIO and OSRAM have introduced high-power blue laser diode series, capable of delivering a maximum power of 250 W at a 450 nm wavelength. These high-power diodes generate less heat, ensuring high operational efficiency.

- Blue laser diodes also possess a superior absorption capacity, enabling them to cut through metals such as copper and gold, which is not feasible with red or green laser diodes. This unique property makes blue laser diodes indispensable in numerous applications, thereby fueling market growth.

What challenges does the Blue Laser Diode Industry face during its growth?

- Declining demand for Blu-Ray disc players and DVD players is a key challenge affecting the industry's growth. The market faces a significant challenge due to the decreasing demand for Blu-Ray disc players and DVD players. Blue laser diodes are essential components in these devices, enabling data reading and writing on Blu-Ray discs and DVDs.

- However, the rise of online Video Streaming services like Netflix and Amazon Prime, along with the popularity of portable data storage devices such as pen drives and hard disk drives, has led to a decline in the demand for physical data storage media. Consumers can now easily access audio and video content online, eliminating the need for Blu-Ray discs or DVDs. This shift in consumer behavior negatively impacts the market.

Exclusive Customer Landscape

The blue laser diode market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the blue laser diode market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, blue laser diode market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ams OSRAM AG - The company offers blue laser diode such as single mode laser diodes and multi mode laser diodes.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ams OSRAM AG

- Coherent Corp.

- Egismos Technology Corp.

- Exaktera LLC

- Frankfurt Laser Co.

- IADIY Photonics

- Laser Components GmbH

- Laserex Technologies Pty Ltd.

- Laserline GmbH

- Nichia Corp.

- NUBURU Inc.

- Omicron-Laserage Laserprodukte GmbH

- Panasonic Holdings Corp.

- Renesas Electronics Corp.

- RPMC Lasers Inc.

- Sharp Corp.

- Tomorrows System Sp zoo

- TOPTICA Photonics AG

- Ushio Inc.

- Vortran Laser Technology Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Blue laser diodes have emerged as a significant technological advancement in the field of optoelectronics, offering unique advantages over their red and infrared counterparts. These devices, which utilize semiconductor materials such as gallium nitride, exhibit high brightness and efficiency, making them indispensable in various applications. The demand for blue laser diodes is driven by their extensive use in diverse industries, including energy consumption, flow cytometry, and laser communication. In the realm of energy consumption, these diodes are employed in powering high-efficiency solar cells and improving the performance of photovoltaic systems. In flow cytometry, blue lasers enable the detection of a broader range of fluorescent markers, enhancing the accuracy and sensitivity of this analytical technique.

Blue laser diodes also play a pivotal role in laser marking, a process used to permanently mark materials with high-resolution, intricate designs. This technique is widely adopted in industries such as electronics manufacturing, automotive, and aerospace for part identification and traceability. Moreover, blue laser diodes find extensive applications in quantum wells, a critical component in quantum computing and quantum cascade lasers. These devices are essential in the development of advanced technologies, such as high-speed data processing and secure communication systems. In semiconductor processing, blue laser diodes are employed for laser manipulation, laser cooling, and laser-induced fluorescence. These techniques facilitate the precise control and monitoring of semiconductor materials during fabrication, ensuring optimal device performance and yield.

The Blue Laser Diode Market has witnessed significant growth in recent years, driven by advancements in laser diode technology and the increasing demand across various laser applications. Deep blue lasers, a subset of semiconductor lasers, are especially valued for their high precision and efficiency in diverse fields, including laser imaging, laser telecommunications, and laser medicine. One of the key factors influencing market expansion is the continual laser diode research and laser diode development aimed at enhancing laser reliability, laser beam quality, and extending laser diode lifetime. Emerging laser diode innovations and laser diode advancements have paved the way for cutting-edge products tailored for applications like laser printing, laser display, and laser surgery. The integration of laser beam shaping, laser beam steering, and laser beam control further boosts performance standards and laser diode specifications.

Manufacturers focus on improving laser diode fabrication, laser diode packaging, and laser diode manufacturing to meet stringent laser regulation and laser safety protocols. The production of laser diode chips and laser diode arrays plays a pivotal role in reducing laser diode cost while maintaining exceptional quality for applications such as laser machining, laser welding, laser drilling, laser cleaning, and laser holography. The market is also witnessing growth due to developments in areas like laser diagnostics, laser dermatology, laser dentistry, laser ophthalmology, and laser therapy, showcasing the wide-ranging influence of blue laser diodes across laser medicine. As the demand grows, stakeholders prioritize improving laser diode standards, laser diode performance, and the overall laser lifetime, ensuring and reliable solutions for industries worldwide.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

229 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 16.6% |

|

Market growth 2025-2029 |

USD 424.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

13.9 |

|

Key countries |

US, Germany, China, UK, Canada, Japan, Russia, France, India, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Blue Laser Diode Market Research and Growth Report?

- CAGR of the Blue Laser Diode industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the blue laser diode market growth and forecasting

We can help! Our analysts can customize this blue laser diode market research report to meet your requirements.