Biorefinery Market Size 2024-2028

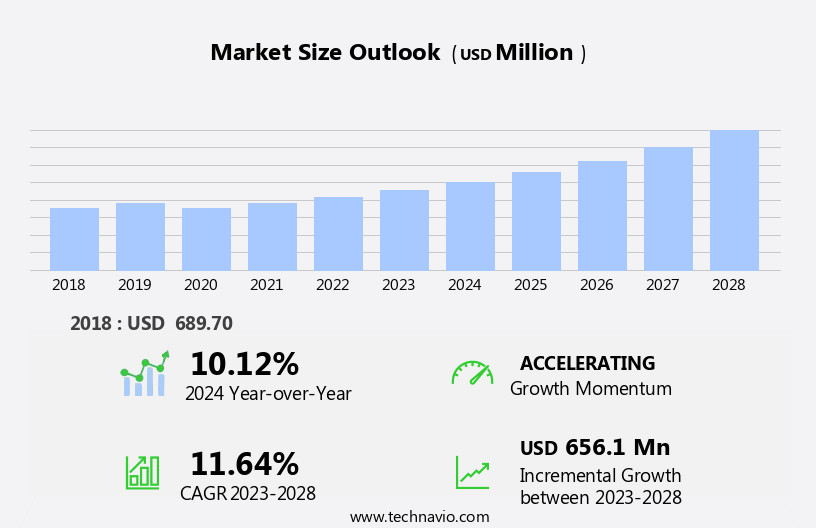

The biorefinery market size is forecast to increase by USD 656.1 million, at a CAGR of 11.64% between 2023 and 2028.

- The market is experiencing significant growth, driven by the increasing demand for sustainable energy resources. As the world shifts towards renewable energy sources to reduce reliance on fossil fuels and promote energy independence, biorefineries are gaining traction as a viable solution. However, this market landscape is not without challenges. An unexpected plunge in crude oil and natural gas prices poses a significant threat to the competitiveness of biorefineries. Despite this, companies can capitalize on the market's potential by focusing on innovation and efficiency.

- For instance, the integration of advanced technologies, such as enzyme engineering and microbial optimization, can enhance the production process and reduce costs. Additionally, partnerships and collaborations between industry players and research institutions can lead to breakthroughs in biorefinery technology and sustainability. Navigating these challenges and seizing opportunities requires a strategic approach, with a focus on continuous improvement and adaptation to market dynamics.

What will be the Size of the Biorefinery Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, driven by advancements in various sectors. Supply chain management plays a crucial role in optimizing the production and distribution of lignocellulosic biomass, such as corn stover and agricultural residues, for biomass conversion. Hydrothermal liquefaction and pretreatment processes are refined to enhance the efficiency of enzyme production from lignocellulosic biomass, which is essential for the conversion of cellulosic ethanol and biocrude oil. Profitability analysis and investment analysis are integral to the biorefinery industry, as they influence feedstock sourcing and capacity utilization. Biogas refinement and biogas production from waste biomass, including wood chips and sugarcane bagasse, contribute to the reduction of carbon footprint and the generation of renewable energy.

Process economics and biomass conversion technologies, such as enzymatic hydrolysis and fermentation technologies, are continually improving to increase the economic viability of biorefineries. The integration of genetic engineering and metabolic engineering in the production of biofuels, such as vegetable oils, animal fats, and algae biofuels, is revolutionizing the industry. Biorefineries also address environmental concerns by converting waste biomass into valuable products, including biogas upgrading and energy efficiency improvements. Regulatory compliance and biorefinery optimization are essential to ensure the long-term sustainability and profitability of these operations. The ongoing evolution of the market reflects the dynamic nature of the industry and its commitment to innovation and sustainability.

How is this Biorefinery Industry segmented?

The biorefinery industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Technology

- Industrial biotechnology

- Physico-chemical

- Thermochemical

- Geography

- North America

- US

- Canada

- Europe

- UK

- APAC

- China

- Japan

- Rest of World (ROW)

- North America

By Technology Insights

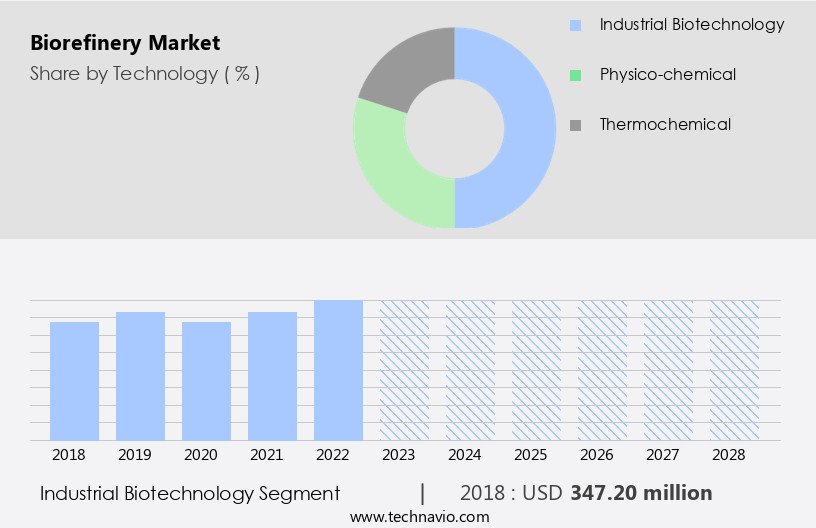

The industrial biotechnology segment is estimated to witness significant growth during the forecast period.

The market is witnessing significant growth, driven by the industrial biotechnology segment. According to the Biotechnology Innovation Organization, this sector is projected to reach USD 852.55 billion by 2030. Hydrothermal liquefaction, pretreatment processes, enzyme production, and biomass conversion are integral parts of industrial biotechnology, which plays a crucial role in the biorefinery industry. Lignocellulosic biomass, such as corn stover and wood chips, serves as a primary feedstock for biorefineries. Enzymatic hydrolysis and fermentation technologies are employed to convert this feedstock into biofuels like cellulosic ethanol and biogas. Genetic engineering and metabolic engineering are employed to optimize microorganisms and microbes for improved enzyme production and biomass conversion efficiency.

Animal fats, vegetable oils, and municipal solid waste are also utilized as feedstocks for biorefineries, contributing to the market's diversity. Biogas production from agricultural residues and wastewater treatment is another application of biorefinery technology, which is gaining traction due to its environmental benefits. Investment analysis, process economics, and regulatory compliance are essential factors influencing the market. Renewable diesel, energy efficiency, and biocrude oil are emerging areas of focus, offering potential for increased profitability. Biogas upgrading and anaerobic digestion are crucial processes in biorefineries, ensuring the production of high-quality biogas and reducing the carbon footprint. Process integration and optimization are key trends in the biorefinery industry, enabling efficient conversion of various feedstocks into valuable bio-based products and fuels.

Algae biofuels, although still in the development stage, hold immense potential for the future of the market. Overall, the market is a dynamic and evolving industry, driven by technological advancements, economic viability, and environmental concerns.

The Industrial biotechnology segment was valued at USD 347.20 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

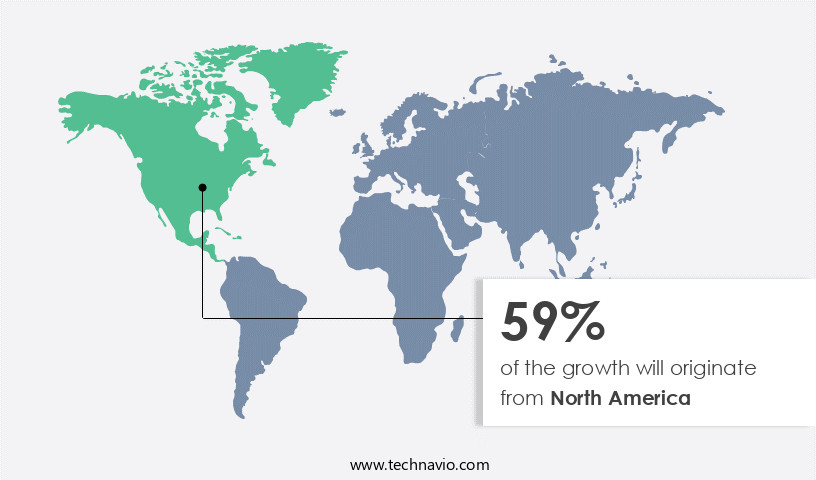

North America is estimated to contribute 59% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The North American market is poised for significant growth due to increasing environmental concerns and stringent regulations aimed at reducing greenhouse gas emissions and limiting the consumption of non-renewable products. This region is a major hub for bio-based products, including biofuels and biochemicals. The presence of numerous recognized manufacturers and technological advancements in the US, the largest market in the region, further bolsters market growth. Lignocellulosic biomass, such as corn stover and wood chips, is a primary feedstock in the biorefinery industry. Pretreatment processes and enzymatic hydrolysis are crucial steps in converting this biomass into biofuels and biochemicals.

Hydrothermal liquefaction and biomass conversion technologies play a significant role in this process. Profitability analysis and investment analysis are essential aspects of the market. Feedstock sourcing and capacity utilization are critical factors in ensuring the economic viability of biorefineries. Regulatory compliance is another significant challenge, as biorefineries must adhere to strict environmental regulations. Genetic engineering and metabolic engineering are used to improve strains for increased productivity and efficiency in the production of biofuels and biochemicals. Animal fats, vegetable oils, and municipal solid waste are other feedstocks used in the biorefinery industry. Biogas production from agricultural residues, wastewater treatment, and anaerobic digestion are integral parts of the biorefinery process.

Biogas refinement, energy efficiency, and biogas upgrading are essential to optimize biogas production and reduce the carbon footprint. Cellulosic ethanol, renewable diesel, and biocrude oil are some of the biofuels produced in biorefineries. Algae biofuels and metabolic engineering are emerging trends in the industry. Fermentation technologies and process control are essential to ensure the efficient production of these biofuels. Process integration and optimization are crucial for maximizing the efficiency and profitability of biorefineries. The market is expected to continue evolving as technological advancements and regulatory requirements shape the industry landscape.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Biorefinery Industry?

- The surge in demand for renewable energy sources serves as the primary market catalyst.

- The global population is projected to grow by 34% from 2015 to 2050, reaching 9.2 billion, according to the World Bank Group. Simultaneously, urbanization rates are escalating, leading to a significant rise in energy demand. IRENA's recent data indicates a 48% increase in global energy demand by 2041. To meet this growing energy demand while reducing environmental impact, the market is gaining traction. Biorefineries convert agricultural residues into renewable diesel, biogas upgrading, biocrude oil, and other bio-based products through anaerobic digestion and biorefinery optimization.

- This process integration enhances energy efficiency and reduces greenhouse gas emissions. Biorefineries contribute to economic viability by generating revenue from waste and reducing reliance on fossil fuels. The environmental benefits of biorefineries include a decrease in carbon footprint and the production of renewable energy. These factors make biorefineries a promising solution to meet the world's increasing energy demands while minimizing environmental impact.

What are the market trends shaping the Biorefinery Industry?

- Energy independence is gaining significant traction as the next market trend. It refers to the ability of a country or organization to produce all the energy it needs, reducing reliance on external sources.

- Biorefineries have emerged as a promising solution for energy-independent nations, focusing on the conversion of lignocellulosic biomass into biofuels and value-added products. The global market for biorefineries is experiencing significant growth due to the increasing demand for sustainable energy sources and the environmental benefits of biomass utilization. The biorefinery process involves various stages such as feedstock sourcing, pretreatment processes, enzyme production, hydrothermal liquefaction, and biogas refinement. Effective supply chain management is crucial for the profitability analysis of biorefineries, ensuring the availability and cost-effectiveness of feedstocks. Pretreatment processes, including enzymatic hydrolysis, are essential for breaking down the complex structure of lignocellulosic biomass into simpler sugars, facilitating the fermentation process.

- Capacity utilization is another critical factor in the profitability of biorefineries, as underutilized capacity can lead to increased operational costs. Investment analysis plays a significant role in the development of biorefineries. Governments and private investors are investing heavily in this sector to reduce their dependence on energy imports and contribute to a more sustainable energy future. The production of enzymes and biogas refinement are also essential components of the biorefinery value chain, contributing to the overall profitability and sustainability of the process.

What challenges does the Biorefinery Industry face during its growth?

- The unexpected plunge in crude oil and natural gas prices poses a significant challenge to the industry's growth trajectory. This downturn in energy commodity markets requires companies to adapt and innovate in order to mitigate the financial impact and maintain profitability.

- The market faces challenges due to fluctuating prices of crude oil, coal, and natural gas. These fossil fuels significantly impact the economics of biomass conversion processes in biorefineries. The COVID-19 pandemic led to a decrease in industrial production and oil consumption, causing a further decline in crude oil prices in 2020. The volatility in crude oil prices, resulting from ongoing trade tensions between major economies, has negatively influenced the growth of the market. Despite a recent revival in crude oil prices, the unexpected price drop is likely to have lasting effects on the industry.

- Biomass feedstocks, such as corn stover, wood chips, sugarcane bagasse, waste biomass, vegetable oils, and biogas production, offer sustainable alternatives to fossil fuels in biofuel production. Genetic engineering and advanced bioconversion technologies are essential to optimizing process economics and reducing the carbon footprint of biorefineries. Key feedstocks and technologies continue to evolve, ensuring the industry's long-term growth and innovation.

Exclusive Customer Landscape

The biorefinery market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the biorefinery market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, biorefinery market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Abengoa SA - This company specializes in constructing biorefineries, transforming diverse feedstocks such as urban waste, wood, agriculture, livestock, agrifood, and industrial waste into valuable bioenergy, biofuels, heat, cold, and electricity.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Abengoa SA

- ALTO INGREDIENTS Inc.

- BP Plc

- Cargill Inc.

- Darling Ingredients Inc.

- Honeywell International Inc.

- Neste Corp.

- POET LLC

- Renewable Energy Group Inc.

- Sinopec Shanghai Petrochemical Co. Ltd.

- Valero Energy Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Biorefinery Market

- In January 2024, Danish biotech company Novozymes and Dutch chemical company DSM announced a strategic partnership to jointly develop and commercialize enzyme technologies for the production of bio-based chemicals and materials (Novozymes Press Release, 2024).

- In March 2024, LanzaTech, a global leader in gas fermentation technology, raised USD 120 million in a Series E funding round, led by Siemens Energy and Temasek, to accelerate the commercialization of its Gas2Chem technology (LanzaTech Press Release, 2024).

- In May 2024, DuPont announced the acquisition of Danish biotech firm Mycobacterium Production A/S, a leading producer of single-cell proteins for animal nutrition, to expand its biotech capabilities and enter the animal nutrition market (DuPont Press Release, 2024).

- In February 2025, the European Commission approved the â¬2.2 billion Bio-based Industries Joint Undertaking (BBI JU) for the period 2021-2027, which aims to support the development and implementation of advanced biorefining technologies in Europe (European Commission Press Release, 2025).

Research Analyst Overview

- The market is experiencing significant activity and trends, driven by the convergence of energy security, technological innovation, and environmental sustainability. Ionic liquids are emerging as key players in the production of bio-based chemicals and materials, offering advantages in process intensification and resource efficiency. The market penetration of bio-based plastics and bio-based products is gaining momentum, driven by the circular economy and green chemistry. Infrastructure development and investment opportunities abound in the areas of hydrogen production, carbon sequestration, and biomass gasification, enabling the production of syngas and bio-based chemicals through Fischer-Tropsch synthesis.

- Policy and regulation are shaping the market, with a focus on supercritical fluids and solid-acid catalysts to optimize industrial symbiosis and enhance sustainability. The integration of renewable energy sources and the pursuit of sustainable development continue to shape the biorefinery landscape, providing ample opportunities for innovation and growth.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Biorefinery Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

154 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 11.64% |

|

Market growth 2024-2028 |

USD 656.1 million |

|

Market structure |

Concentrated |

|

YoY growth 2023-2024(%) |

10.12 |

|

Key countries |

US, Canada, China, Japan, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Biorefinery Market Research and Growth Report?

- CAGR of the Biorefinery industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the biorefinery market growth of industry companies

We can help! Our analysts can customize this biorefinery market research report to meet your requirements.