Biodegradable Packaging Material Market Size 2024-2028

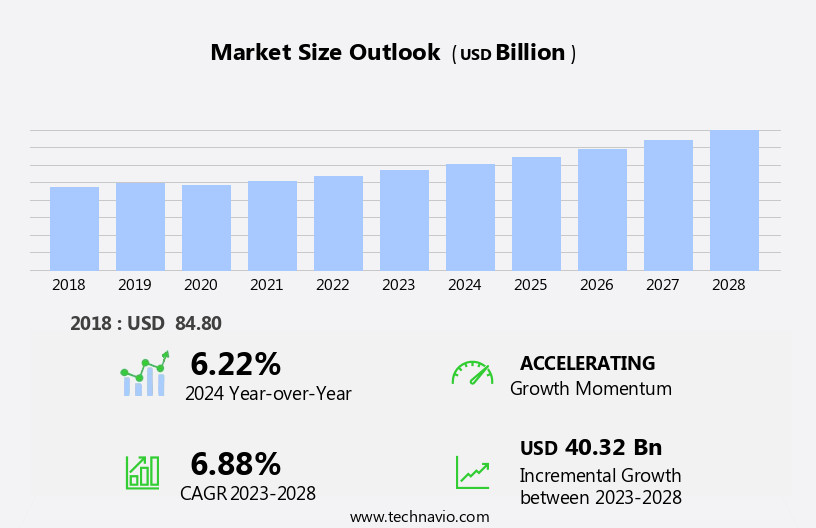

The biodegradable packaging material market size is forecast to increase by USD 40.32 billion at a CAGR of 6.88% between 2023 and 2028.

What will be the Size of the Biodegradable Packaging Material Market During the Forecast Period?

How is this Biodegradable Packaging Material Industry segmented and which is the largest segment?

The biodegradable packaging material industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Food

- Beverage

- Pharmaceutical

- Personal and home care

- Others

- Product

- Paper

- Bioplastics

- Geography

- Europe

- Germany

- UK

- North America

- Canada

- US

- APAC

- China

- Middle East and Africa

- South America

- Europe

By Application Insights

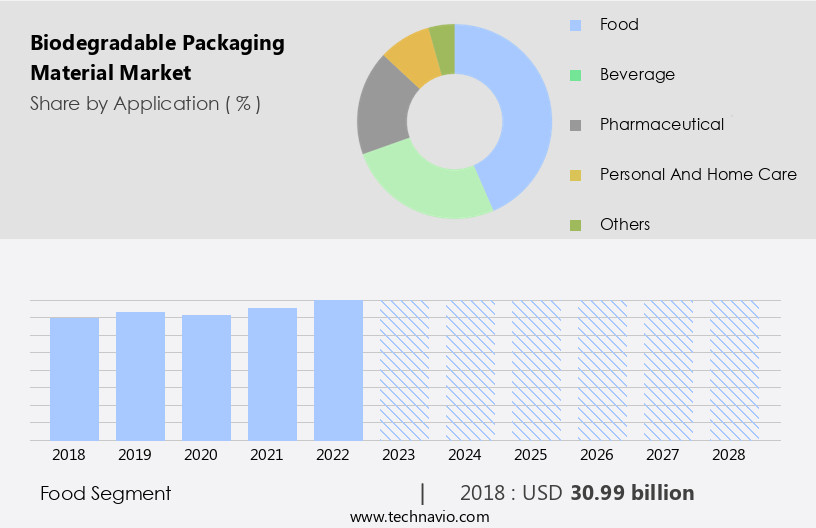

- The food segment is estimated to witness significant growth during the forecast period.

The market is experiencing significant growth due to increasing consumer awareness and regulatory initiatives toward reducing plastic waste. This market encompasses various materials such as Flexible packaging, pouches, metal, glass, paper & paper board, bio-plastic, starch, and glue. In the food packaging sector, biodegradable packaging is gaining popularity due to its ability to extend the shelf life of perishable items and reduce carbon footprints. Materials like bagasse, wood pulp, plant-based components, and cellulose are commonly used. Compostable packaging, including coffee capsules, zipper bags, mesh packaging, and resealable plastic containers, is also gaining traction. The market is influenced by various factors, including legislation, waste management, sustainable packaging, e-commerce, corporate social responsibility, and agriculture.

Renewable energy sources like wind power and the logistics industry's shift towards recycled materials are also contributing to the market's growth. The compostable packaging market and recycled packaging market are expected to witness substantial growth due to their cost benefits and environmental sustainability. Biodegradable plastics, such as bio-friendly plastics, are increasingly being used to reduce the reliance on oil-based polymers and fossil fuel-based plastic. The food packaging sector is a major contributor to plastic waste generation, and biodegradable packaging offers a viable solution to minimize the impact on the environment. Political collaborations and the emergence of new markets are further driving the growth of the market.

Get a glance at the Biodegradable Packaging Material Industry report of share of various segments Request Free Sample

The Food segment was valued at USD 30.99 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

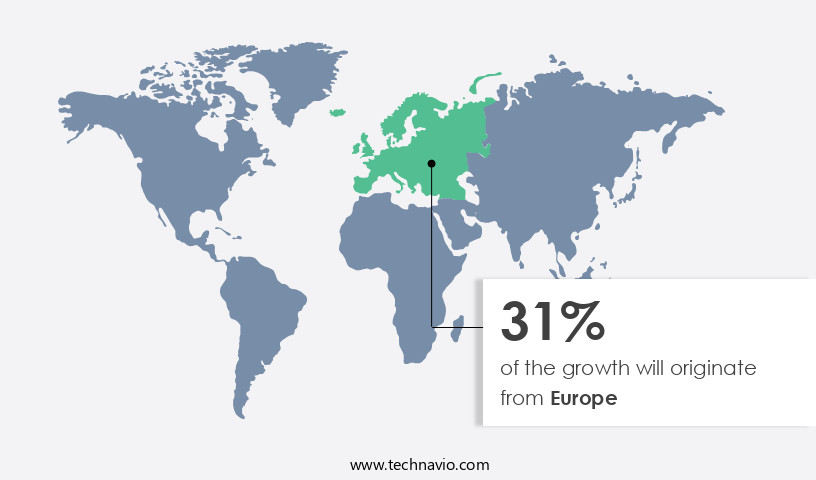

- Europe is estimated to contribute 31% to the growth of the global market during the forecast period.

Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The European biodegradable packaging materials market is projected to expand significantly due to the region's high demand for eco-friendly packaging solutions. With a growing focus on reducing plastic waste and increasing sustainability, the packaging industry in Europe is transitioning from oil-based polymers to biodegradable alternatives, such as paper-based packaging and bioplastics. Key contributors to the European the market include the UK, Germany, Italy, France, and Sweden. These countries have implemented stringent regulations on single-use plastic products and have shown a preference for recycled and compostable packaging. The market is further driven by political collaborations, new markets, and corporate social responsibility initiatives.

Materials such as bagasse, paper & paper board, starch, and bio-plastics derived from plant-based components, cellulose, and microorganisms are gaining popularity. Renewable energy sources, like wind power, are used In the production process to reduce carbon footprints. The biodegradable packaging market encompasses various categories, including flexible packaging, pouches, metal, glass, and plastic. The food packaging sector is a significant end-user, contributing to the market's growth. The compostable packaging market, including coffee capsules, zipper bags, mesh packaging, and resealable plastic containers, is expected to experience substantial growth as well. The recycled materials segment, which includes recycled paper, plastic, and glass, is also a key contributor to the market.

Environmental conservation efforts, cost benefits, and the recycled packaging market's growth further fuel the demand for biodegradable packaging materials.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Biodegradable Packaging Material Industry?

Shift toward use of bioplastic packaging by end-users is the key driver of the market.

What are the market trends shaping the Biodegradable Packaging Material Industry?

Market expansion is the upcoming market trend.

What challenges does the Biodegradable Packaging Material Industry face during its growth?

High cost of biodegradable packaging is a key challenge affecting the industry growth.

Exclusive Customer Landscape

The biodegradable packaging material market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the biodegradable packaging material market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, biodegradable packaging material market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Amcor Plc - The market showcases the NaturePlus Compostable PLA solution as a leading choice for eco-friendly packaging. Renewable and compostable, this packaging alternative boasts exceptional clarity and rigidity, making it a viable option for various industries. PLA, or Polylactic Acid, is derived from renewable resources such as corn starch and sugarcane, ensuring a reduced carbon footprint. Its compostability aligns with the growing demand for sustainable solutions, allowing it to decompose naturally within industrial composting facilities. This innovative packaging material offers a professional and original response to the market's increasing focus on environmentally responsible practices.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amcor Plc

- BASF SE

- BioPak Pty Ltd.

- Elevate Packaging Inc.

- Georgia Pacific

- Holmen AB

- Hood Packaging Corp.

- International Paper Co.

- Kruger Inc.

- Mayr-Melnhof Karton AG

- Mondi Plc

- NatureWorks LLC

- Novamont S.p.A.

- Oji Holdings Corp.

- PMMI Media Group

- Smurfit Kappa Group

- Stora Enso Oyj

- Tetra Pak Group

- WestRock Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The biodegradable packaging market represents a significant shift In the packaging industry, driven by growing concerns over plastic waste and the need for more sustainable solutions. This market encompasses a range of materials, including paper and paper board, bio-plastics, and plant-based components. Paper and paper board have long been staples In the packaging industry, and their biodegradable counterparts offer a viable alternative to traditional plastic packaging. These materials are renewable, recyclable, and offer a lower carbon footprint compared to oil-based polymers. Moreover, they can be derived from various sources, such as bagasse, sugarcane, and sorghum. Bio-plastics, another key segment of the biodegradable packaging market, offer a more plastic-like alternative to traditional packaging.

These materials can be derived from various sources, including starch, cellulose, and microorganisms. They offer similar properties to oil-based polymers but have the added benefit of being biodegradable. The shift towards biodegradable packaging is being driven by various factors, including environmental conservation, corporate social responsibility, and new markets. The e-commerce industry, in particular, has seen a surge in demand for sustainable packaging solutions. Brands are recognizing the importance of reducing their carbon footprint and addressing the issue of plastic waste. The logistics industry is also playing a role In the growth of the biodegradable packaging market. With the increasing focus on reducing the environmental impact of transportation, biodegradable packaging offers a more sustainable alternative to traditional plastic packaging.

The recycled materials segment of the biodegradable packaging market is also gaining traction. Recycled materials offer cost benefits and reduce the need for virgin raw materials. Moreover, the use of recycled materials in biodegradable packaging can help to reduce the overall carbon footprint of the packaging industry. The food packaging sector is a significant contributor to plastic waste generation. Biodegradable packaging offers a viable alternative to single-use plastic products, such as coffee capsules, zipper bags, and mesh packaging. These biodegradable alternatives offer similar functionality to their plastic counterparts but have the added benefit of being biodegradable. Regulations are also playing a role In the growth of the biodegradable packaging market.

Governments and regulatory bodies are implementing regulations to reduce plastic waste and promote the use of sustainable packaging solutions. These regulations are driving innovation In the biodegradable packaging market and creating new opportunities for companies. The biodegradable packaging market is expected to continue to grow as more companies adopt sustainable packaging solutions. The market dynamics are driven by various factors, including environmental concerns, cost benefits, and new markets. The shift towards biodegradable packaging is a positive step towards reducing plastic waste and promoting sustainability.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

172 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.88% |

|

Market growth 2024-2028 |

USD 40.32 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.22 |

|

Key countries |

US, UK, China, Germany, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Biodegradable Packaging Material Market Research and Growth Report?

- CAGR of the Biodegradable Packaging Material industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the biodegradable packaging material market growth of industry companies

We can help! Our analysts can customize this biodegradable packaging material market research report to meet your requirements.