Bicycle Carbon Wheel Market Size 2024-2028

The bicycle carbon wheel market size is forecast to increase by USD 1.94 billion, at a CAGR of 26.63% between 2023 and 2028.

- The market is experiencing significant growth due to several key trends. The increasing number of bicycle sports events, such as the Tour de France and other races, is driving market demand. Additionally, the popularity of bicycle rental services, particularly in urban areas, is contributing to market growth, with bearings and steel components playing a crucial role in enhancing the durability and performance of the bicycles. However, the market also faces challenges, including the increasing number of bicycle accidents, which may lead to higher demand for safer and more durable carbon wheels. Prospective market participants should closely monitor these trends and challenges to capitalize on opportunities and mitigate risks. Overall, the market is expected to witness strong growth in the coming years.

What will be the Size of the Bicycle Carbon Wheel Market During the Forecast Period?

- The bicycle carbon wheel market in the United States is experiencing significant growth, with carbon fiber wheels gaining increasing popularity among professionals and enthusiasts. Carbon fiber wheels offer several advantages over traditional steel, alloy, or wooden wheelsets. They are lighter, providing improved acceleration and overall performance. Tubeless carbon wheels, in particular, have gained traction due to their enhanced aerodynamic qualities and ability to maintain tire pressure more effectively. Metro cities and tourist destinations are major contributors to this trend, as consumers seek high-performance bicycle parts for use in bicycle renting applications. Modern carbon wheels feature metal hubs, carbon fiber frames and forks, and pneumatic rubber tires.

- Wire tension spokes and wired wheels have largely been replaced by more advanced technologies. GPS tracking systems are also being integrated into bicycle wheel systems for enhanced functionality and convenience. Carbon fiber's flex characteristics and the resulting energy transfer efficiency make carbon wheels a preferred choice for road races and mountain biking. The application based cycle systems incorporate various components such as wheelset, axle, alloy wheel, wired wheel, frame, fork, and bicycle tires, with wood sometimes used in the frame for aesthetic or lightweight purposes. The global bicycle carbon wheel market is expected to continue its growth trajectory, driven by advancements in technology and the increasing demand for high-performance bicycle parts.

How is this Bicycle Carbon Wheel Industry segmented and which is the largest segment?

The bicycle carbon wheel industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- On-road and track performance

- Off-road bicycle or mountain performance

- X-road and hybrid bicycles performance

- Distribution Channel

- Offline

- Online

- Geography

- APAC

- China

- Japan

- Europe

- Germany

- France

- North America

- US

- South America

- Middle East and Africa

- APAC

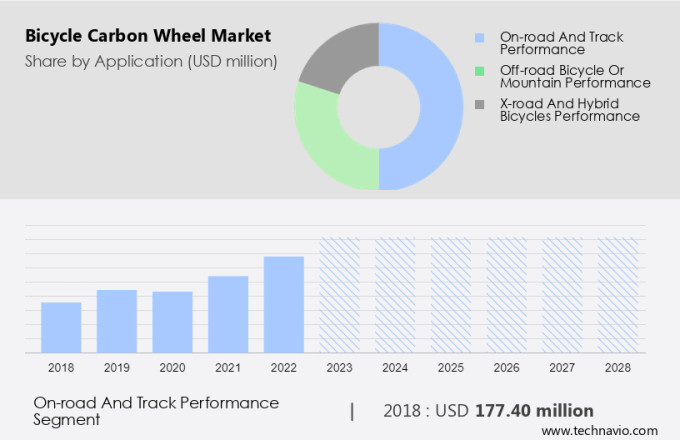

By Application Insights

- The on-road and track performance segment is estimated to witness significant growth during the forecast period.

On-road bicycles, including road bikes, gravel, cyclo-cross, and track bikes, are designed for paved surfaces with thin tires and lightweight frames. These bicycles prioritize efficiency and speed through optimized geometry and handlebars that allow riders to assume an aerodynamic position. Road bikes are ideal for experienced cyclists seeking to cover long distances at high speed, while gravel and cyclo-cross bikes offer versatility for various terrain types. Track bikes are specifically engineered for racing on outdoor tracks or velodromes. Beyond the performance benefits, on-road bicycles contribute to improved cardiovascular fitness, joint mobility, bone strengthening, stress reduction, and weight management. In today's remote work culture, cycling is a popular activity for maintaining health and wellness, as well as an effective mode of transportation during sports activities and cycling events.

Additionally, women's participation in cycling continues to grow, making these bicycles accessible to a diverse range of riders. Environmental schemes and traffic congestion reduction initiatives further highlight the importance of cycling as a sustainable and efficient transportation alternative. As a result, the market for on-road bicycles, including carbon wheel options, is expected to grow steadily, offering opportunities for manufacturers and retailers alike.

Get a glance at the Bicycle Carbon Wheel Industry report of share of various segments Request Free Sample

The on-road and track performance segment was valued at USD 177.40 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

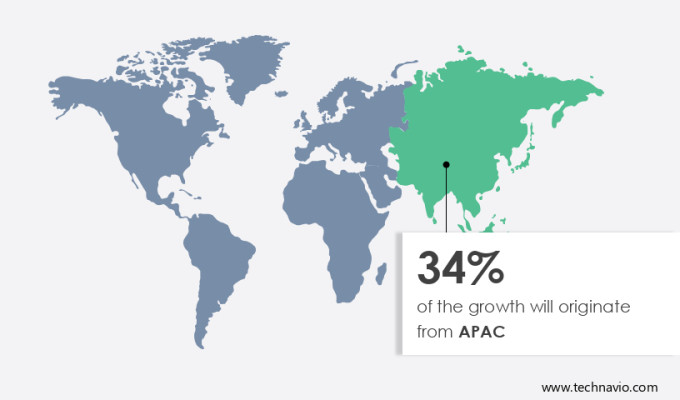

- APAC is estimated to contribute 34% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The APAC market is poised for substantial expansion over the forecast period. Factors such as the expanding bicycle market, rising health consciousness, increasing environmental awareness, urbanization, and the preference for personal transportation are driving market growth. In countries like China, Japan, India, and New Zealand, the health-conscious population is opting for bicycles instead of traditional vehicles. Cycling events, including road and track marathons, are being organized by cycling clubs in collaboration with international and national organizations. Carbon wheels offer a superior strength-to-weight ratio, rigidity, and aerodynamic qualities, making them popular choices for various cycling disciplines, including road bikes, mountain bikes, cyclo-cross bikes, and track bikes. These attributes contribute to enhanced riding experiences on pavement, dirt trails, and the velodrome.

Market Dynamics

Our bicycle carbon wheel market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of the Bicycle Carbon Wheel Industry?

The increasing number of bicycle sports events is the key driver of the market.

- The market encompasses high-performance wheelsets for various types of bicycles, including Road Bikes, Mountain Bikes, Gravel, Cyclo-cross Bikes, and Track Bikes. Carbon wheels offer several advantages over traditional steel, alloy, or wooden wheelsets. They provide a superior strength-to-weight ratio, rigidity, and aerodynamic qualities due to the use of carbon fiber. Carbon wheels are increasingly popular among professionals and enthusiasts due to their high-performance attributes. These wheels are designed with advanced technologies such as Finite Element Analysis, Wind Tunnel Testing, and Computer-Aided Design to optimize power transfer, driving stability, and rolling resistance. Carbon wheels are suitable for various cycling applications, including racing bicycle wheels, mountain bike wheels, BMX wheels, and bicycle equipment for small wheel bicycles, folding bikes, and portable bikes.

- They cater to diverse riding experiences, from recreational riding on pavement to off-road adventures on dirt trails. Carbon wheels are also gaining popularity in metro cities due to their eco-conscious appeal, as they contribute to reducing traffic congestion and promoting cardiovascular fitness, joint mobility, and bone strengthening. They also help in stress reduction and weight management, making them an attractive option for the tech-savvy customer base. The market for carbon wheels is driven by increasing participation in cycling events, such as road bike races, mountain biking, triathlons, and cyclocross competitions. The market is further fueled by government schemes and environmental initiatives encouraging the use of bicycles for transportation and leisure activities.

What are the market trends shaping the Bicycle Carbon Wheel Industry?

The increasing popularity of bicycle rental services is the upcoming trend in the market.

- The global bicycle carbon wheel market is witnessing significant growth due to various factors. Increasing health consciousness among consumers, especially in metro cities, is driving demand for high-performance bicycle parts such as carbon wheelsets. These wheels offer benefits like strength-to-weight ratio, rigidity, and aerodynamic qualities, making them popular among road bikers, mountain bikers, and cyclo-cross bikers. Tubeless wheels and spokes wheels are gaining popularity due to their ability to provide increased comfort, less rolling resistance, and tubeless operation. Manufacturing industries and bicycle competition events are major end-users of carbon wheels. Carbon fiber, a modern material used in the manufacturing of these wheels, provides high durability and weight reduction.

- The market is also witnessing innovation with the introduction of smart technologies such as Global Positioning System (GPS) and disc brakes. Bicycle renting applications have gained traction in recent years, especially among tourists and individuals adapting to remote work culture. These rentals offer flexibility, energy efficiency, and reduced environmental impact. The market caters to various types of bicycles, including racing bicycle wheels, mountain bike wheels, BMX wheels, and small wheel bicycles like folding bikes and portable bikes. Government schemes and environmental initiatives are further fueling the growth of the market. For instance, in the US, some cities have implemented bike-sharing programs to reduce traffic congestion and promote cardiovascular fitness, joint mobility, and stress reduction.

What challenges does the Bicycle Carbon Wheel Industry face during its growth?

An increase in several bicycle accidents is a key challenge affecting the industry's growth.

- The market has witnessed significant growth due to the increasing popularity of cycling for various applications, including leisure activities, commuting, and competitive events. Wheelsets for road bikes, mountain bikes, gravel, cyclo-cross bikes, and track bikes have seen increased demand, with carbon wheels becoming a preferred choice for their high strength-to-weight ratio, rigidity, and aerodynamic qualities. Tubeless wheels and spokes wheels have gained traction due to their increased comfort, less rolling resistance, and tubeless operation. Manufacturing industries and bicycle renting applications in metro cities cater to the needs of tech-savvy customers who value high-performance bicycle parts. The rise of remote work culture and increasing awareness of chronic diseases, such as cardiovascular fitness, joint mobility, and stress levels, have led to an eco-conscious customer base seeking lightweight and efficient designs.

- The market dynamics are influenced by factors such as driving stability, high-quality products, and smart technologies like Global Positioning System (GPS) integration. Carbon fiber, modern materials, and computer-aided design have revolutionized the manufacturing process, resulting in lighter, stronger, and more durable wheelsets. Bicycle equipment for women's participation, small wheel bicycles, folding bikes, and portable bikes have also gained popularity. Disk brakes, wet and dry conditions, and tire compatibility are essential considerations for cycling in various conditions. The market is segmented into deep-section rims, wider rims, and shallower rim depths, with layup methods and rim design playing a crucial role in performance.

Exclusive Customer Landscape

The bicycle carbon wheel market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry. The bicycle carbon wheel industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alexrims

- BOYD cycling

- Campagnolo Srl

- DT Swiss

- Easton Cycling

- Enve Composites

- FFWD Wheels

- Fulcrum Wheels s.r.l.

- Giant Manufacturing Co. Ltd.

- Hayes Performance Systems Inc.

- HED Cycling Products Inc.

- MAVIC Group

- Prime Bike Components

- Pro lite International Ltd.

- Profile Design

- Santa Cruz Bicycles LLC

- SHIMANO INC.

- SRAM LLC

- Trek Bicycle Corp.

- Hunt Bike Wheels.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The bicycle carbon wheel market is a dynamic and evolving landscape, with continuous advancements in technology driving innovation and growth. Among the various wheel types, carbon wheels have emerged as a popular choice for both professional cyclists and enthusiasts due to their exceptional strength-to-weight ratio, rigidity, and aerodynamic qualities. Carbon wheels, crafted from carbon fiber, offer a unique blend of properties that cater to the diverse needs of various cycling disciplines. These high-performance bicycle parts have gained significant traction in road biking, mountain biking, cyclocross, and track racing.

Moreover, the market is fueled by several factors, including the increasing popularity of cycling as a recreational activity and a means of transportation. With the rise of remote work culture and the desire for eco-conscious and tech-savvy customer bases, the demand for lightweight, efficient, and durable bicycle components, such as carbon wheels, is on the rise. Carbon wheels provide numerous benefits for riders. Their lightweight design enhances acceleration and efficient climbing, while their aerodynamic qualities reduce wind resistance and improve driving stability. Additionally, carbon wheels offer increased comfort and less rolling resistance, making them an attractive option for riders seeking improved performance and a smoother riding experience.

Furthermore, the market caters to various cycling applications, including racing bicycles, mountain bikes, gravel bikes, and cyclocross bikes. Carbon wheels for road bikes are designed with deep-section rims and narrow tires for optimal aerodynamics, while mountain bike wheels feature wider rims and knobby tires for improved traction and durability. Manufacturers employ advanced technologies, such as finite element analysis, wind tunnel testing, and computer-aided design, to create high-quality carbon wheels that cater to the specific demands of various cycling disciplines. These technologies enable manufacturers to optimize rim design, spoke technology, and layup methods for enhanced performance and structural integrity.

|

Bicycle Carbon Wheel Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

151 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 26.63% |

|

Market Growth 2024-2028 |

USD 1.94 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

26.05 |

|

Key countries |

US, China, Japan, Germany, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the Bicycle Carbon Wheel industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of industry companies

We can help! Our analysts can customize this market research report to meet your requirements.