Battery Aluminum Foil Market Size 2024-2028

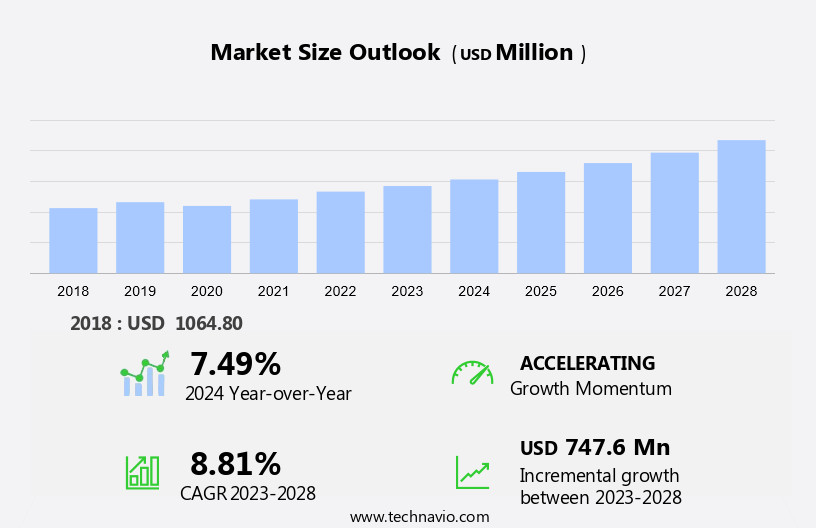

The battery aluminum foil market size is forecast to increase by USD 747.6 million at a CAGR of 8.81% between 2023 and 2028.

- The market is experiencing significant growth, driven primarily by the increasing demand from the automobile industry for lightweight and high-performance batteries. Additionally, the transition towards renewable energy sources and the adoption of aluminum foil in solar panels and fuel cells are contributing to market expansion. However, fluctuations in aluminum prices pose a challenge to market growth, as aluminum is a key raw material in battery foil production. The market trends also include the development of advanced battery technologies, such as solid-state batteries and lithium-sulfur batteries, which are expected to increase the demand for battery aluminum foil In the future. Overall, the market is poised for growth, driven by the automobile industry, renewable energy sector, and advancements in battery technology.

What will be the Size of the Battery Aluminum Foil Market During the Forecast Period?

- The market is witnessing significant growth due to the increasing demand for lightweight materials In the aircraft industry. The use of aluminum foil as a cathode current collector in batteries helps reduce the weight of aircraft, thereby decreasing fuel consumption. The thin aluminum sheets used in battery manufacturing, with thicknesses ranging from less than 10 um to above 15 um, are essential for high performance in batteries. Aircraft manufacturers are focusing on fuel efficiency and sustainable energy solutions, making the adoption of battery aluminum foil increasingly popular. The material's versatility extends beyond the aviation sector, with applications in electric vehicles, energy storage systems, and various industrial equipment.

- In the electronics sector, aluminum electrolytic capacitors are widely used in consumer electronics, further fueling the demand for battery aluminum foil. Battery aluminum foil plays a crucial role as a cathode current collector in batteries, providing excellent conductivity and durability. Its use in capacitors also enhances their performance and efficiency. As the world transitions towards sustainable energy solutions, the market is expected to grow steadily, offering significant opportunities for manufacturers and suppliers.

How is this Battery Aluminum Foil Industry segmented and which is the largest segment?

The industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Consumer electronics

- Automotive

- Industrial

- Aerospace and defense

- Others

- Geography

- APAC

- China

- India

- North America

- US

- Europe

- Germany

- UK

- South America

- Middle East and Africa

- APAC

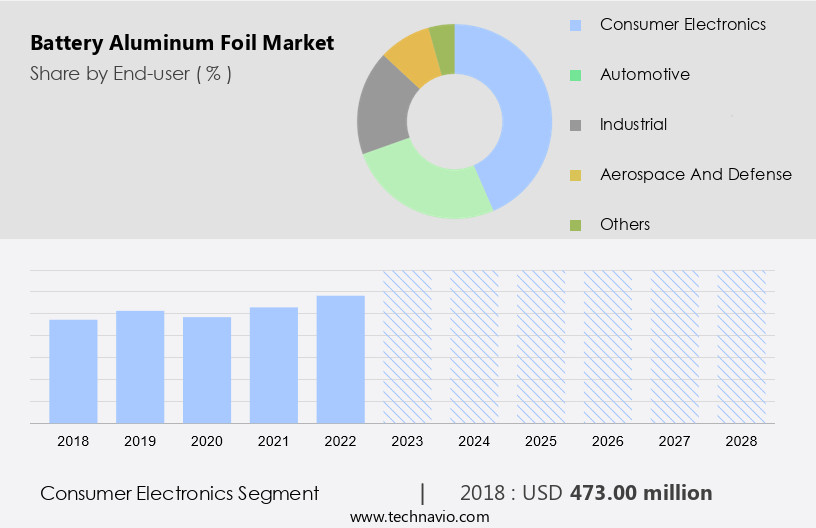

By End-user Insights

- The consumer electronics segment is estimated to witness significant growth during the forecast period. The market is experiencing significant growth due to its utilization in various industries, particularly In the electronics sector and aircraft manufacturing. In consumer electronics, aluminum electrode foil is employed as a current collector in capacitors such as aluminum electrolytic capacitors and lithium-ion batteries.

- Its high conductivity and flexibility make it an ideal choice for compact form factor electronic circuits, energy storage devices, and filtering applications. In the aviation industry, lightweight materials like aluminum metal are increasingly being used to reduce aircraft weight and improve fuel efficiency. Battery aluminum foil, with its thin sheet and excellent barrier properties against moisture, light, and bacteria, is a preferred material for food packaging and preserving perishable goods. Moreover, its high surface area and capacitance make it suitable for use in high-frequency circuits, power electronics, and carbon-based materials like graphite foil and carbon nanotubes in energy storage devices and batteries.

Get a glance at the market report of share of various segments Request Free Sample

- The consumer electronics segment was valued at USD 473.00 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

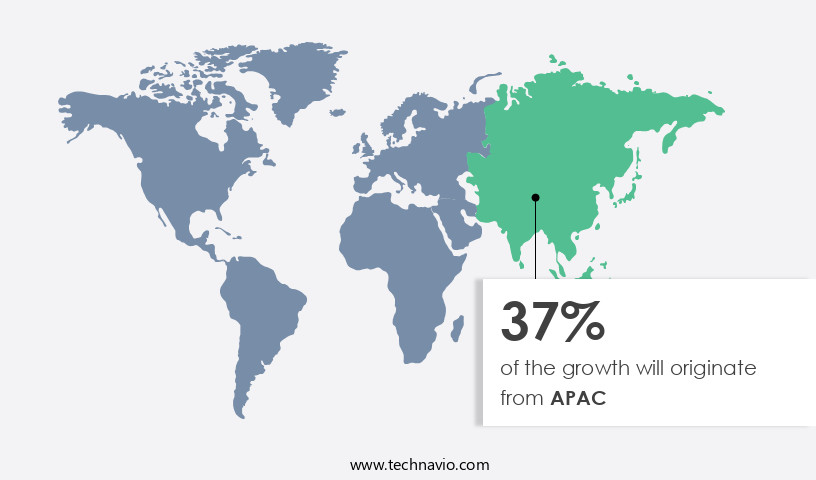

- APAC is estimated to contribute 37% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. The Aluminum Foil market encompasses the production and application of lightweight Aluminum electrode foil in various industries. This material is increasingly being adopted In the aircraft industry due to its ability to reduce aircraft weight, thereby decreasing fuel consumption. Aircraft manufacturers utilize Aluminum metal In the form of thin sheets as current collectors in capacitors, such as Aluminum electrolytic capacitors and capacitors for electronics and industrial equipment. These components play a crucial role in electrical energy storage and filtering, signal coupling, and power electronics.

For more insights on the market size of various regions, Request Free Sample

- In the electronics sector, Aluminum electrode foil is employed in lithium ion batteries as a current collector and in capacitors due to its barrier properties, flexibility, and high conductivity. Its usage extends to the food packaging industry for preserving perishable goods by maintaining a large surface area for better gas barrier properties against moisture, light, and bacteria. Moreover, Aluminum foil is also used in high frequency circuits and power electronics, often replacing Copper foil due to its compact form factor and compatibility with Carbon based materials like Graphite foil and Carbon nanotubes in energy storage devices.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Battery Aluminum Foil Industry?

- The demand from the automobile industry is the key driver of the market. The market is experiencing significant growth due to its increasing utilization in various energy storage applications, particularly in supercapacitors and batteries. In batteries, aluminum foil serves as both anode and cathode current collectors, contributing to the enhancement of power density and energy efficiency. The adoption of battery aluminum foil is not limited to stationary energy storage systems but also extends to portable electronic devices, renewable energy technologies, hybrid vehicles, and electric vehicles. The lightweight property of aluminum foil, which is less than 10 um thick for battery applications, is a key factor driving its demand In the automotive industry.

- This property results in reduced vehicle weight, leading to fuel savings, decreased greenhouse gas emissions, and improved overall vehicle performance. Moreover, aluminum's corrosion resistance and ease of recyclability make it an ideal choice for battery manufacturing In the context of sustainable energy solutions. The renewable energy sector, including solar energy and regenerative braking systems, is another significant market for battery aluminum foil. The increasing adoption of renewable energy sources necessitates efficient energy storage systems, and aluminum foil's high performance materials offer a cost-effective and eco-friendly solution. The demand for battery aluminum foil is expected to grow at a rapid pace, particularly In the transportation sector, as the shift towards electric and hybrid vehicles continues.

What are the market trends shaping the Battery Aluminum Foil Industry?

- Alternative energy generation is the upcoming market trend. It plays a significant role in various energy storage applications, including supercapacitors, solar energy, and renewable energy technologies. In supercapacitors, aluminum foil serves as both anode and cathode current collectors, enhancing power density and energy efficiency. For lithium-ion batteries, aluminum foil is used as anode and cathode current collectors in lithium cobalt oxide and lithium iron phosphate batteries. Battery aluminum foil is also crucial in battery management systems for electric vehicles and hybrid vehicles, ensuring optimal battery performance. With the growing demand for portable electronic devices and energy storage solutions, the market is expected to expand.

- The foil's ability to sustain in harsh outdoor environments makes it suitable for use in regenerative braking systems and solar panels. Aluminum foil's thinness, with thicknesses ranging from less than 10 um to above 15 um, makes it a high-performance material for various energy applications. Its good heat conductivity and sustainability make it an eco-friendly and sustainable solution for energy storage systems and renewable energy sources. In the context of solar energy, battery aluminum foil is used In the production of solar panels due to its ability to concentrate and reflect light, contributing to the efficient conversion of solar energy into electricity.

What challenges does the Battery Aluminum Foil Industry face during its growth?

- The fluctuations in aluminum prices is a key challenge affecting the industry growth. The market is experiencing significant growth due to the increasing demand for energy storage solutions in various sectors, including supercapacitors, solar energy, and renewable energy technologies. Aluminum foil is a crucial component In the manufacturing of both anode and cathode foils for batteries, such as lithium cobalt oxide and lithium iron phosphate. Battery management systems also utilize aluminum foil as a cathode current collector. The price of aluminum, a primary raw material, significantly influences the market's dynamics. Fluctuations in aluminum prices pose challenges for companies In the market. The growing demand for portable electronic devices, electric vehicles, hybrid vehicles, and regenerative braking systems has led to an increasing consumption of battery aluminum foil.

- Moreover, the adoption of aluminum foil in high-performance materials for energy storage systems and sustainable energy solutions further boosts the market's growth. The market segmentation is based on the thickness of the aluminum foil, with less than 10 um and above 15 um being the major categories. The market caters to various industries, including automotive, consumer electronics, aerospace, and defense, making aluminum's price volatility a critical factor.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, market growth and forecasting, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry. The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Dunmore Corp.

- Furukawa Electric Co. Ltd.

- Granges AB

- Haomei Aluminum

- HD METAL M Co. Ltd.

- Henan Mingtai Aluminum Industry Co. Ltd.

- Henan Tendeli Metallurgical Materials Co. Ltd.

- Jiangsu Dingsheng New Energy Materials Co. Ltd.

- Lotte Aluminum Co. Ltd.

- Luoyang Wanji Aluminum Processing Co. Ltd.

- MTI Corp.

- NANOGRAFI Co. Inc.

- Nanoshel LLC

- Nippon Light Metal Holdings Co. Ltd.

- Resonac Holdings Corp.

- Shandong Nanshan Aluminium Co. Ltd.

- Shanghai Metal Corp.

- Shantou Wanshun New Material Group Co. Ltd.

- UACJ Corp.

- Xiashun Holdings Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The aluminum foil market in the field of energy storage, particularly in batteries, has gained significant traction due to its unique properties as a lightweight material. Aluminum electrode foil, a thin sheet of aluminum metal, is widely used as a current collector in various types of batteries, including lithium-ion batteries. The use contributes to fuel efficiency in aircraft and industrial equipment by reducing overall weight and improving electrical energy storage capacity. In the electronics sector, aluminum electrolytic capacitors are extensively used due to their high capacitance and compact form factor. Aluminum foil's flexibility, barrier properties, and resistance to moisture, light, and bacteria make it an ideal material for food packaging and preserving perishable goods.

Moreover, aluminum foil's high conductivity and compatibility with high-frequency circuits and power electronics make it a popular choice in various industries. The market is expected to grow as researchers explore the potential of carbon-based materials, such as graphite foil and carbon nanotubes, in enhancing the performance of energy storage devices. Copper foil, while having high conductivity, faces competition from aluminum foil due to its higher cost and limited flexibility. Overall, the demand in batteries, capacitors, and other energy storage devices is expected to remain strong due to the increasing focus on fuel efficiency, energy storage, and compact form factors.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

159 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.81% |

|

Market growth 2024-2028 |

USD 747.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.49 |

|

Key countries |

US, China, Germany, India, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the market growth of industry companies

We can help! Our analysts can customize this market research report to meet your requirements.