Batteries For Smart Wearables Market Size 2025-2029

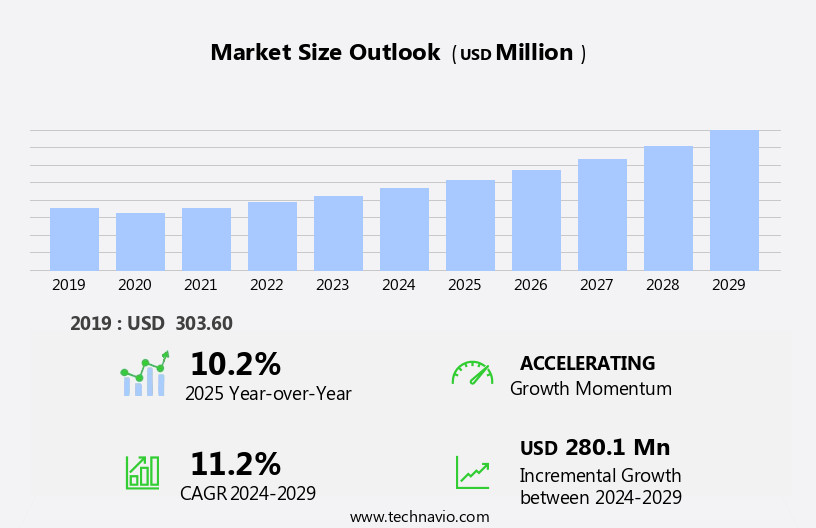

The batteries for smart wearables market size is forecast to increase by USD 280.1 million, at a CAGR of 11.2% between 2024 and 2029.

- The market is witnessing significant growth, driven by the increasing popularity of wearable devices and the rising trend of raising capital for product development via crowdfunding campaigns. This dynamic market landscape presents both opportunities and challenges for key players. The widening product portfolio of smart wearables, from fitness trackers to health monitors and smartwatches, is fueling the demand for advanced batteries that can support extended usage and diverse features. However, the challenge of low battery life remains a significant obstacle, as users seek devices with longer battery life to minimize frequent charging.

- To capitalize on this market potential, companies must focus on developing batteries with improved energy density, fast charging capabilities, and efficient power management systems. By addressing these challenges, players can differentiate their offerings and cater to the evolving needs of the smart wearables market.

What will be the Size of the Batteries For Smart Wearables Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by technological innovations and consumer preferences. Lithium polymer batteries are commonly used due to their lightweight properties and energy efficiency. However, power management and quality control are crucial for ensuring optimal battery life and consumer satisfaction. Health data security is a significant concern, leading to the integration of biometric authentication and encryption technologies. Supply chain management and product lifecycle management are essential for maintaining regulatory compliance and reducing return rates. Wearable sensors, such as heart rate monitors and SpO2 sensors, require reliable power sources for continuous health monitoring. Bluetooth connectivity and mobile app integration enable seamless data transfer and real-time coaching.

The market dynamics are shaped by consumer preferences for comfort and ergonomics, design aesthetics, and user interface. Warranty programs and customer support are essential for building brand loyalty and addressing any issues that may arise. OLED and AMOLED displays offer vibrant colors and high contrast, enhancing the user experience. Wi-Fi connectivity and NFC technology enable contactless payments and expanded functionality. Product differentiation is achieved through technological innovation and software updates, ensuring a competitive advantage. Energy efficiency and wearable sensors are key areas of focus for improving battery life and expanding health monitoring capabilities. The market for smart wearables is diverse, encompassing activity trackers, sleep trackers, fitness coaches, and health monitors.

GPS tracking and heart rate sensors are common features, while some devices offer advanced capabilities such as payment systems and notification alerts. The ongoing unfolding of market activities highlights the importance of continuous product development and adaptability to consumer needs. Regulatory compliance and data privacy are critical considerations for companies operating in this dynamic market.

How is this Batteries For Smart Wearables Industry segmented?

The batteries for smart wearables industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Li-ion battery

- Li-Po battery

- Others

- Application

- Smartwatches

- Wireless headphones

- Head mounted display (HMDs)

- Others

- End-user

- Consumer electronics

- Healthcare

- Industrial

- Others

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- APAC

- Australia

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Product Insights

The Li-ion battery segment is estimated to witness significant growth during the forecast period.

The market experiences continuous growth, driven by the increasing popularity of devices such as activity trackers, sleep trackers, and smartwatches. Lithium polymer batteries have emerged as the preferred choice due to their high energy density, longer lifespan, and lightweight properties. These batteries enable smart wearables to offer extended usage hours and support advanced features like wi-fi connectivity, heart rate sensors, and GPS tracking. Consumer preferences prioritize long battery life, ensuring a strong demand for high-quality batteries with efficient power management. Case materials and design aesthetics are essential factors in consumer decision-making, with water resistance and ergonomic straps being desirable features.

Warranty programs and customer support are crucial elements in maintaining customer satisfaction and loyalty. Technological innovation in charging technology, sensor integration, and energy efficiency continues to shape the market landscape. Competitive advantage is achieved through product differentiation, offering features like biometric authentication, NFC technology, and mobile app integration. Data privacy and regulatory compliance are essential considerations, with health data security being a significant concern for consumers. Manufacturers focus on product lifecycle management and supply chain optimization to ensure efficient production and timely delivery. OLED and AMOLED displays, along with comfortable and ergonomic strap materials, contribute to the overall user experience.

GPS chipsets and heartrate sensors are essential components for fitness enthusiasts, while payment systems and notification alerts cater to the convenience-driven consumer. In the evolving smart wearables market, battery technology plays a pivotal role in enabling advanced functionalities and enhancing user experience. The market's future growth is expected to be influenced by factors like software updates, health monitoring, and wearable sensor integration.

The Li-ion battery segment was valued at USD 168.90 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 35% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in the Asia Pacific region is experiencing significant growth, driven by increasing demand from both developed and developing countries such as China, Japan, South Korea, and India. The large population base in APAC presents a substantial target audience for companies looking to expand their revenue and market presence. The region's growth is further fueled by the rising disposable income and widespread smartphone penetration. However, the high price point of smart wearables remains a challenge in the region. To address consumer preferences, companies are focusing on advanced charging technology, lightweight materials, and longer battery life.

Lithium polymer batteries are increasingly being adopted due to their energy efficiency and lightweight properties. Power management systems and quality control measures are also crucial to ensure optimal battery performance and user satisfaction. Wearable technology continues to evolve, with fitness coaching, heart rate monitors, and sleep trackers gaining popularity. Wi-fi connectivity, Bluetooth, and NFC technology enable seamless mobile app integration and real-time data transfer. Wearables with OLED and AMOLED displays offer enhanced user interfaces and design aesthetics. Data privacy and regulatory compliance are critical concerns for consumers. Companies are implementing biometric authentication, health data security, and return rate management to build trust and loyalty.

Product lifecycle management and supply chain optimization are essential for maintaining a competitive advantage. Advancements in sensor technology, energy efficiency, and technological innovation are driving product differentiation. Features such as GPS tracking, wearable sensors, and SPO2 sensors offer valuable health monitoring capabilities. Companies are also integrating payment systems, notification alerts, and software updates to enhance user experience. Comfort and ergonomics are essential considerations for wearable devices. Water resistance and durable case materials ensure the longevity of the devices. Companies are exploring various strap materials and GPS chipsets to cater to diverse consumer preferences. In conclusion, the market in APAC is expected to continue its growth trajectory, driven by consumer preferences, technological innovation, and a large target audience.

Companies must focus on delivering high-quality products, ensuring data privacy, and maintaining competitive pricing strategies to capture market share.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

In the dynamic world of technology, batteries play a pivotal role in powering the functionality of smart wearables, from fitness trackers and smartwatches to augmented reality glasses and hearables. The market is witnessing significant growth, fueled by advancements in battery technology and the increasing popularity of wearable devices. Lithium-ion batteries, with their high energy density and long life span, dominate this market. However, other types, such as solid-state and kinetic energy batteries, are gaining traction due to their unique benefits. Size, weight, and compatibility are crucial factors in this market, as batteries must efficiently power devices while remaining compact and lightweight. Additionally, factors like charging speed, durability, and environmental sustainability are driving innovation in battery technology. The future of batteries for smart wearables promises longer battery life, faster charging, and eco-friendly solutions, making these devices more convenient and accessible to consumers.

What are the key market drivers leading to the rise in the adoption of Batteries For Smart Wearables Industry?

- Crowdfunding campaigns serve as a crucial avenue for securing capital for product development in the market. This financing method has emerged as a significant key driver, enabling entrepreneurs and businesses to bring innovative ideas to fruition.

- The smart wearables market, including sleep trackers, is experiencing significant growth due to increasing customer demand for advanced health monitoring and convenience. Crowdfunding platforms, such as Kickstarter and Indiegogo, have emerged as a popular funding source for new product development in this industry. These platforms enable companies to reach their target audience directly, creating awareness and resulting in lower customer acquisition costs compared to traditional channels. Moreover, the interaction between manufacturers and potential customers during the product development stage allows for valuable feedback and product customization. This customer engagement contributes to higher customer satisfaction and brand loyalty.

- Key features of smart wearables, such as user interface, operating systems, comfort and ergonomics, display technology, data privacy, regulatory compliance, GPS tracking, and wearable sensors, are essential factors driving market growth. Companies prioritize these aspects to ensure their products cater to consumers' needs and preferences. Pricing strategies also play a crucial role in the market's dynamics. Companies must balance affordability with advanced features to attract and retain customers. Additionally, ensuring data privacy and regulatory compliance are essential for maintaining customer trust and market acceptance. In conclusion, the smart wearables market, driven by innovative product development, customer engagement, and advanced features, continues to expand, offering numerous opportunities for businesses.

What are the market trends shaping the Batteries For Smart Wearables Industry?

- Smart wearables are gaining popularity in the market, with an increasing trend towards expanding product portfolios in this sector. To stay competitive, companies are continuously introducing new and advanced wearable devices.

- The market for batteries in smart wearables is experiencing significant growth due to the increasing popularity of devices such as heart rate monitors, fitness trackers, and payment systems. These gadgets offer features like mobile app integration, notification alerts, and sensor technology, making them essential for tech-savvy consumers. NFC technology is also gaining traction, providing contactless payment solutions and enhancing product differentiation. Energy efficiency is a key consideration for battery manufacturers, as users demand long-lasting power sources that do not compromise design aesthetics or technological innovation.

- As the competition intensifies, companies are focusing on developing advanced battery solutions to gain a competitive advantage. The integration of heart rate sensors and other sensor technologies further increases the demand for reliable and efficient batteries in smart wearables.

What challenges does the Batteries For Smart Wearables Industry face during its growth?

- A low battery life is a significant challenge that can hinder industry growth by limiting the usage and effectiveness of technological devices.

- Smart wearables, including those with SP O2 sensors and Bluetooth connectivity, continue to gain popularity for health monitoring and convenience. However, one challenge persists: battery life. Despite advancements in display technology, using features such as OLED and AMOLED, and the addition of biometric authentication and water resistance, battery capacity has remained stagnant. For instance, a typical smartwatch may last only five hours with GPS and music enabled, requiring frequent charging. This inconvenience can lead to underutilization of the device's capabilities.

- With battery capacities ranging from 150 mAh to 300 mAh, the size of batteries in these compact devices has not significantly changed due to unaltered density rates. Effective product lifecycle management, including software updates, and supply chain optimization are crucial to mitigate the impact of this limitation. Health data security is another essential consideration in the development and implementation of these devices.

Exclusive Customer Landscape

The batteries for smart wearables market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the batteries for smart wearables market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, batteries for smart wearables market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Apple Inc. - Energizer's 357, 303, 371, and 390 batteries deliver reliable power, enhancing user experience. My research focuses on maximizing efficiency and extending device life.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Apple Inc.

- Artek Energy Pvt. Ltd.

- Energizer Holdings Inc.

- Enfucell

- GMB CORP.

- Ilika

- Imprint Energy

- ITEN

- Jenax Inc.

- LiPol Battery Co. Ltd.

- Molex LLC

- Montana Tech Components AG

- Panasonic Holdings Corp.

- Samsung Electronics Co. Ltd.

- Shenzhen Grepow Battery Co. Ltd.

- STMicroelectronics NV

- TDK Corp.

- The Duracell Co.

- Ultralife Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Batteries For Smart Wearables Market

- In January 2024, Samsung SDI, a leading global battery manufacturer, announced the mass production of its new 1.6 Ah, 5.2V lithium-ion batteries for smart wearables, boasting a 20% increase in capacity compared to its previous models (Samsung SDI Press Release).

- In March 2024, Apple and Panasonic formed a strategic partnership to collaborate on the development and production of solid-state batteries for future Apple Watch models. This partnership aimed to improve the wearable's battery life and miniaturize the battery design (Apple Investor Relations).

- In April 2025, CATL (Contemporary Amperex Technology Co. Limited), the world's largest lithium-ion battery manufacturer, raised USD 3 billion in a funding round to expand its production capacity and invest in research and development for batteries tailored to the smart wearables market (Reuters).

- In May 2025, the European Union approved the "Battery Regulation" that sets strict safety, environmental, and recycling standards for batteries used in wearable devices, aiming to ensure consumer safety and reduce the environmental impact of battery production and disposal (European Commission Press Release).

Research Analyst Overview

- The smart wearables market is experiencing dynamic growth, integrating advanced features such as augmented reality and virtual reality for enhanced user experience. Mental health monitoring, medication reminders, and personalized wellness programs are becoming essential components, driven by cloud computing and big data analytics. Device management platforms ensure seamless integration with healthcare systems, telemedicine, and emergency SOS features. Machine learning and artificial intelligence enable medical-grade accuracy in blood pressure monitoring, stress level detection, and fall detection. Sustainability initiatives are prioritized with the use of recyclable materials and ethical sourcing. Product recall management and over-the-air updates maintain consumer trust.

- Smart home integration and remote camera control add convenience, while predictive analytics offer proactive health risk assessments. Electrocardiogram (ECG) and electrodermal activity (EDA) monitoring provide valuable health insights. Voice assistants streamline daily tasks, and healthcare and smart home integration offer a holistic approach to wellness. Remote patient monitoring and emergency SOS features ensure peace of mind for users and caregivers alike.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Batteries For Smart Wearables Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

232 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 11.2% |

|

Market growth 2025-2029 |

USD 280.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

10.2 |

|

Key countries |

US, China, Japan, Canada, India, South Korea, Australia, Mexico, UK, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Batteries For Smart Wearables Market Research and Growth Report?

- CAGR of the Batteries For Smart Wearables industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the batteries for smart wearables market growth of industry companies

We can help! Our analysts can customize this batteries for smart wearables market research report to meet your requirements.