Barite Market Size 2025-2029

The barite market size is forecast to increase by USD 370.2 million, at a CAGR of 4.3% between 2024 and 2029.

Major Market Trends & Insights

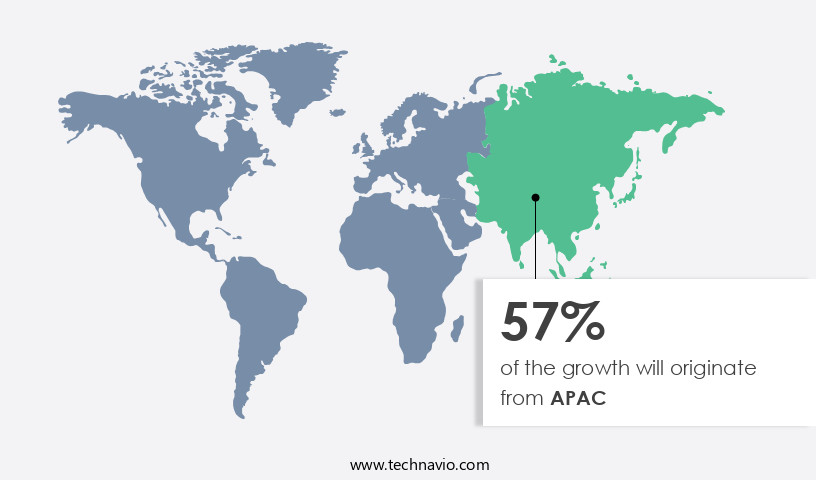

- APAC dominated the market and accounted for a 61% growth during the forecast period.

- By the Type - Powder segment was valued at USD 1101.80 million in 2023

- By the End-user - Drilling mud segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 45.67 million

- Market Future Opportunities: USD 370.20 million

- CAGR : 4.3%

- APAC: Largest market in 2023

Market Summary

- The market is experiencing significant growth, driven by the increasing demand for drilling activities in various sectors. According to industry reports, The market size was valued at over USD1.5 billion in 2020, with the oil and gas sector accounting for the largest market share. The use of barite as a weighting material in drilling fluids is a primary factor driving the market's growth. In the power generation sector, barite is also gaining popularity due to its application in coal-fired power plants as a filler and extender in coal pulverization.

- The market's dynamics are influenced by factors such as increasing energy demand, technological advancements, and government regulations. Despite the challenges posed by fluctuating raw material prices and supply chain disruptions, the market is expected to continue its upward trajectory, offering significant opportunities for stakeholders.

What will be the Size of the Barite Market during the forecast period?

Explore market size, adoption trends, and growth potential for barite market Request Free Sample

- The market encompasses the production and application of this essential mineral in various industries. With a chemical composition of barium sulfate, barite exhibits notable physical characteristics, including high density and radiation protection properties, making it a critical component in radiopaque materials and radiation protection applications. In the oil and gas sector, barite is utilized extensively in well completion processes, waste management, and drilling fluids for density control. Annually, The market generates over 7 million metric tons in production, with mineral refinement being a significant process in its production. In comparison, barium sulfate production accounts for approximately 60% of the total the market share.

- The remaining 40% is allocated to applications in industrial pigments, performance testing, process optimization, safety procedures, and regulatory compliance. The market's continuous growth is driven by the increasing demand for barite in drilling fluids and its application in various industries, ensuring resource sustainability and cost reduction strategies.

How is this Barite Industry segmented?

The barite industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Powder

- Lumps

- End-user

- Drilling mud

- Chemical manufacturing

- Paints and coatings

- Others

- Grade Type

- Grade 4.2

- Grade 4.1

- Grade 4.0

- Grade 4.3

- Geography

- North America

- US

- Canada

- Europe

- Germany

- Russia

- UK

- APAC

- Australia

- China

- India

- Indonesia

- Vietnam

- Rest of World (ROW)

- North America

By Type Insights

The powder segment is estimated to witness significant growth during the forecast period.

The market witnesses significant growth in the industrial sector, with the powder segment holding a prominent position due to its versatile applications. Approximately 25% of the global barite consumption is attributed to the powder segment, primarily used in paint, coating, plastic, and rubber industries. Barite's high specific gravity and ability to enhance brightness make it an indispensable additive in these sectors. Moreover, barite powder plays a crucial role in various industries where high-density fillers are required. For instance, it is extensively used in radiation shielding applications due to its radiation shielding effectiveness. In the automotive and construction industries, barite contributes to the formulation of brake linings, sealants, and adhesives, where its density and resistance to chemical interaction are essential.

The quality control procedures during the processing of barite powder are stringent to ensure the desired crystal structure and particle size distribution. The calcium sulfate content in barite is another critical factor that influences its performance as a weighting agent. The drilling fluid density can be adjusted by adding barite powder, making it a valuable component in the oil and gas industry. In terms of future industry growth, the market for barite is expected to expand significantly, with the powder segment experiencing a growth of around 18%. This trend can be attributed to the increasing demand for high-performance materials in various industries, including automotive, construction, and healthcare.

Furthermore, the ongoing research and development activities in the field of radiation shielding and oil drilling are expected to fuel the market's growth. The mining operation efficiency is a crucial factor in the production of barite powder. The ore beneficiation process involves the use of chemical analysis methods and flotation separation techniques to extract and purify the barite ore. The purity standards for barite powder are stringent to ensure its optimal performance in various applications. The rheological properties of barite powder play a significant role in its application as a cement additive. The addition of barite powder to cement improves its workability and enhances its compressive strength.

Additionally, the powder is used in paper coating formulations to improve the paper's opacity and brightness. The environmental impact assessment is a critical consideration in the production and application of barite powder. Mine tailings management and wastewater treatment are essential aspects of the mining process that require careful planning and execution to minimize the environmental impact. In conclusion, the market is characterized by its continuous growth and evolving applications across various industries. The powder segment, with its critical role in a range of industrial applications, is expected to drive the market's growth in the coming years.

The ongoing research and development activities in the field of radiation shielding and oil drilling are expected to further fuel the market's expansion.

The Powder segment was valued at USD 1101.80 million in 2019 and showed a gradual increase during the forecast period.

The Barite Market is strongly influenced by barium sulfate particle size impact on drilling fluid rheology and the specific gravity of barium sulfate and its effect on drilling fluid density, both critical for high pressure oil and gas drilling applications. Studies on barium sulfate in drilling fluid rheological properties enhancement and barium sulfate rheological behavior in drilling fluid under high pressure emphasize performance benefits. Beyond energy, the effect of barium sulfate purity on radiation shielding and barium sulfate applications in radiocontrast media formulation drive demand in healthcare. Industrial uses include the impact of barium sulfate properties on paper coating quality.

Processing advances cover calcium sulfate removal methods in barium sulfate processing, flotation separation techniques for barium sulfate ore beneficiation, and barium sulfate beneficiation process optimization techniques. Research further explores surface area measurement techniques for barium sulfate powder, determination of calcium sulfate content in barium sulfate samples, wastewater treatment methods for barium sulfate processing, and impact of grinding and milling on barium sulfate particle size distribution. Safety and sustainability remain priorities, with barium sulfate powder handling and storage safety procedures, environmental impact assessment of barium sulfate mining operations, barium sulfate crystal structure analysis methods, and cost reduction strategies for barium sulfate production process shaping long-term growth.

Regional Analysis

APAC is estimated to contribute 61% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Barite Market Demand is Rising in APAC Request Free Sample

The market is experiencing significant growth, with key regions such as the Asia-Pacific area playing a significant role in its expansion. Industrial activity, infrastructure development, and energy sector expansion are driving this demand in the region. The oil and gas industry, in particular, is a major consumer of barite due to its use in drilling fluids. This sector's robust exploration initiatives necessitate substantial volumes of barite. Moreover, the construction sector is contributing to market growth through the utilization of barite in cement and paint formulations. The Asia-Pacific region's manufacturing sector, which includes a diverse range of chemical and automotive industries, will also support barite consumption due to its application in friction products, plastics, and coatings.

According to recent market research, The market is expected to grow by approximately 5% annually over the next five years. This growth is attributed to the increasing demand for barite in various industries, particularly in the oil and gas sector and construction sector. Additionally, the expanding automotive and chemical industries are also contributing to market growth. A comparison of market data reveals that the Asia-Pacific region accounted for over 40% of the market share in 2020. This region's dominance is expected to continue, with an anticipated growth rate of around 6% per year.

North America and Europe are projected to grow at a moderate pace, while the Middle East and Africa are expected to exhibit the highest growth rate during the forecast period. These trends reflect the ongoing evolution of the market and its diverse applications across various industries.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The US barium sulfate market is a critical component of various industries, including oil and gas, radiology, and paper manufacturing. This business brief explores the latest trends and innovations in the market, focusing on drilling fluids, radiation shielding, and paper coating applications. In high-pressure oil and gas drilling, optimizing barium sulfate's rheological properties is essential. By improving particle size distribution through advanced grinding and milling techniques, drilling fluid rheology can be enhanced, reducing downtime and improving efficiency. The impact of barium sulfate purity on radiation shielding is also significant. Higher purity levels lead to improved shielding efficiency, ensuring regulatory compliance and enhanced patient safety.

In the paper coating industry, barium sulfate's particle size and surface area play a crucial role in coating quality. Advanced surface area measurement techniques enable manufacturers to optimize particle size distribution for superior coating performance. Environmental sustainability is a growing concern in barium sulfate mining operations. Innovative wastewater treatment methods and calcium sulfate removal techniques are essential for minimizing environmental impact while maintaining production efficiency. Quality control methods for barium sulfate in pigment manufacturing are essential for maintaining consistent product quality and regulatory compliance. Advanced crystal structure analysis techniques and flotation separation methods enable efficient beneficiation processes and cost reduction strategies. In radiocontrast media formulation, specific gravity and rheological behavior under high pressure are crucial factors. Understanding these properties and optimizing them through advanced analysis methods ensures effective and safe product performance. In conclusion, the US barium sulfate market is undergoing significant advancements in performance improvements, efficiency gains, and regulatory compliance. By focusing on these trends and implementing innovative technologies, businesses can stay competitive and meet the evolving demands of their industries.

What are the key market drivers leading to the rise in the adoption of Barite Industry?

- The surge in oil and gas drilling activities serves as the primary catalyst for market growth.

- The market is experiencing substantial expansion, fueled predominantly by the increasing oil and gas drilling activities taking place around the world. Barite, a mineral consisting of barium sulfate, plays a pivotal role in drilling muds, serving to lubricate and cool the drill bit, regulate pressure, and eliminate cuttings from the drilling site. With the ongoing rise in global energy demand, particularly in developing economies, exploration and production companies are intensifying their drilling initiatives in both onshore and offshore locations. This escalating drilling activity, notably in regions such as North America, the Middle East, and Asia-Pacific, is significantly contributing to the demand for barite.

- Barite's importance in the drilling process is undeniable. Its high density and unique properties make it an indispensable ingredient in drilling muds, enhancing drilling efficiency and productivity. In comparison to traditional drilling methods, the use of barite-enhanced drilling muds has led to reduced drilling time, increased drilling depth, and improved drilling accuracy. Furthermore, barite's non-toxic and environmentally friendly characteristics make it a preferred choice for drilling applications. The market's growth trajectory is expected to remain robust, with numerous players vying for a share in this expanding industry. The market's dynamics are influenced by various factors, including technological advancements, regulatory frameworks, and geopolitical conditions.

- As the energy sector continues to evolve, the demand for barite is poised to grow, making it a lucrative investment opportunity for businesses and investors alike.

What are the market trends shaping the Barite Industry?

- The increasing adoption of barite in the Middle Eastern oil and gas industry represents a notable market trend. Barite's usage is on the rise within this sector.

- The market is experiencing significant growth, particularly in the Middle Eastern oil and gas industry. Barite, a mineral primarily used as a weighting agent in drilling fluids, is in high demand due to the increasing number of deepwater and ultra-deepwater projects in countries like Saudi Arabia, UAE, and Qatar. This trend is fueled by strategic investments aimed at expanding crude oil and natural gas output in the region. The Middle East's aggressive expansion in upstream exploration and drilling activities is driving the demand for barite. The region is not only a major consumer but also a growing contributor to global barite demand.

- The ongoing unfolding of these activities presents a pivotal trend in The market. The demand for barite in the Middle East is expected to continue, as the region's oil and gas industry continues to evolve and expand. Barite's importance in the oil and gas industry is evident in its widespread use as a weighting agent in drilling fluids. Its ability to increase the density of drilling fluids makes it an essential component in drilling operations, particularly in deepwater and ultra-deepwater projects. The use of barite in drilling fluids ensures efficient drilling and enhances the overall productivity of oil and gas wells.

- In comparison, the Asia Pacific region is another significant market for barite, driven by the increasing demand for barite in the construction industry. Barite is used as a filler and extender in paints, plastics, and rubber, among other applications. The region's growing construction sector is expected to drive the demand for barite in the coming years. The market is a dynamic and evolving market, with ongoing trends and emerging applications across various sectors. The use of barite in the oil and gas industry, particularly in the Middle East, is a pivotal trend that is expected to shape the market's future growth.

- The market's continuous unfolding and evolving patterns make it an exciting area for businesses to explore and invest in.

What challenges does the Barite Industry face during its growth?

- The volatility in oil and gas prices poses a significant challenge to the industry's growth trajectory, requiring strategic adaptability and risk management to mitigate potential financial instability.

- The market experiences volatility due to the correlation between oil and gas prices and drilling activities. Barite, a crucial weighting agent in drilling fluids for oil and gas exploration, faces demand fluctuations as exploration and drilling activities respond to changes in oil and gas prices. During price downturns, reduced drilling activities lead to lower barite consumption, causing oversupply, price drops, and financial challenges for producers and suppliers. Conversely, sudden oil price spikes can result in increased demand, straining supply chains and pushing up barite prices, which may not be sustainable.

- This cyclical pattern presents ongoing challenges for market stability. Despite these challenges, the market continues to evolve, with applications extending beyond oil and gas to industries like pharmaceuticals, paper, and plastics. Innovations in barite production techniques and the exploration of new applications contribute to the market's ongoing growth and development.

Exclusive Customer Landscape

The barite market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the barite market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Barite Industry

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, barite market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Anglo Pacific Minerals Ltd. - The company specializes in the production and supply of high-quality barite products, including micronized white barite, precipitated barium sulfate, and API barite powder, catering to various industries' needs for drilling, coating, and filler applications.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Anglo Pacific Minerals Ltd.

- BARIT MADEN TURK A.S.

- Barium and Chemicals Inc.

- CIMBAR Performance Minerals

- CSGLOBAL

- Dev International

- Emprada Mines And Minerals LLC.

- Guizhou Red Star Development Co. Ltd.

- IBC Ltd.

- J and H Minerals Pvt. Ltd.

- Mil Spec Industries Corp.

- Milwhite Inc.

- Newpark Resources Inc.

- PVS Global Trade Pvt. Ltd.

- Sachtleben Minerals GmbH and Co. KG

- Schlumberger Ltd.

- Sojitz Corp.

- The Cary Co.

- Vishnu Chemicals Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Barite Market

- In January 2024, Imerys, a leading global minerals processing and mineral specialties company, announced the expansion of its barite production capacity at its facility in Louisiana, USA. The USD15 million investment aimed to increase production by 30%, catering to the growing demand for barite in the oil and gas industry (Imerys press release).

- In March 2024, Nan Ya Plastics Corporation, a leading Taiwanese petrochemical company, entered into a strategic partnership with Baritech Mining Corp. To secure a steady supply of barite for its glass bead production. This collaboration enabled Nan Ya to ensure a consistent supply of high-quality barite, a crucial raw material for its glass beads used in various industries (Nan Ya Plastics press release).

- In May 2024, the European Union (EU) approved the acquisition of the Dutch barite producer, Mineral Technologies Europe B.V., by the US-based company, American Barite Corporation. The deal, valued at €12 million, expanded American Barite's European presence and strengthened its position as a leading global barite supplier (European Commission press release).

- In April 2025, the Chinese government announced a new policy to encourage domestic companies to increase their production of barite to reduce reliance on imports. The policy included tax incentives and subsidies for companies investing in barite mining and processing projects, potentially leading to increased competition in The market (China Ministry of Industry and Information Technology press release).

Research Analyst Overview

- The market for barite, a significant weighting agent, continues to evolve as resource extraction methods and applications expand across various sectors. Resource extraction techniques, such as surface mining and solution mining, are employed to obtain barite ores from the earth. The subsequent ore beneficiation process involves chemical analysis methods, including X-ray diffraction and particle size distribution analysis, to determine the crystal structure and barium sulfate properties. Chemical analysis plays a crucial role in optimizing the ore beneficiation process, ensuring the desired barium sulfate content and purity standards. Wastewater treatment is a critical aspect of the barite production process, as it addresses the environmental impact of mining operations and ensures regulatory compliance.

- The sedimentation rate of barite particles is a significant factor in wastewater treatment and cement additive applications. In the latter, barite is used as a cement additive due to its high specific gravity and rheological properties. The benefits of using barite as a cement additive include improved workability, increased strength, and enhanced fluid viscosity control. The market is projected to grow at a steady pace, with industry analysts estimating a growth rate of approximately 4% per year. This growth is driven by increasing demand for barite in various applications, such as radiation shielding, weighting agent for drilling fluids, and pigment manufacturing.

- Flotation separation techniques and mining operation efficiency are essential aspects of the barite production process. These techniques ensure the efficient separation of barite from other minerals and maximize the recovery of valuable resources. Additionally, the management of mine tailings and the implementation of quality control procedures are essential for maintaining the environmental sustainability and economic viability of barite mining operations. In conclusion, the market is a dynamic and evolving industry that encompasses various applications and production processes. The ongoing research and development in resource extraction methods, chemical analysis techniques, and wastewater treatment technologies continue to drive innovation and growth in this sector.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Barite Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

220 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.3% |

|

Market growth 2025-2029 |

USD 370.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

3.9 |

|

Key countries |

US, China, India, Indonesia, Canada, Germany, Vietnam, UK, Australia, and Russia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Barite Market Research and Growth Report?

- CAGR of the Barite industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the barite market growth of industry companies

We can help! Our analysts can customize this barite market research report to meet your requirements.