Banana Paper Market Size 2024-2028

The banana paper market size of the market is forecast to increase by USD 70.6 million, at a CAGR of 5.31% between 2023 and 2028. The market is experiencing significant growth, driven by various factors. One key factor is the expanding scope of banana paper applications, which include packaging, textiles, and filtration. Another influential factor is the environmental concern surrounding conventional paper production, leading to a shift towards more sustainable alternatives. Additionally, the reduced production cost of banana paper, derived from agricultural waste, further boosts its market potential. This eco-friendly and cost-effective alternative is poised to disrupt traditional paper markets, offering a sustainable solution to the increasing demand for environmentally responsible products. However, increasing awareness among consumers of the harmful effects of plastic consumption has triggered the demand for eco-friendly packaging methods, thereby driving the demand for banana paper.

What will the Size of the Market be During the Forecast Period?

To learn more about this report, Download Report Sample

Market Dynamics

Banana plant fibers are increasingly utilized in producing natural banana paper, offering processed banana paper as a sustainable alternative in the paper industry. This shift towards eco-friendly alternatives aligns with growing consumer demand for eco-friendly paper product across various sectors, including sanitary and food package. Companies like Ace Matrix are at the forefront, leveraging leading and emerging technologies to innovate within this space. Research and development focus on both organic developments and inorganic developments, shaping a competitive scenario where niche insights drive strategic decision-making processes. This historic backdrop of innovation underscores the potential of banana plant fibers in creating environmentally sound solutions for the paper industry. The incorporation of sustainability principles into the development of eco-friendly paper products requires meticulous research design and a strategic decision-making process, especially in sectors like food packaging where environmental impact is critical.

Key Market Driver

The increased use of banana paper is notably driving the market growth. Banana paper is an eco-friendly paper produced either from the fiber inside the pseudo-stem or from the bark of the banana plant. Banana plants produce fruits once a year, thereby leaving abundant waste or byproducts after the harvest. The leftover waste severely impacts the surrounding ecosystem by polluting water bodies and underground water. The leftover stems of banana plants contain more than 90% water, 3% resins, and 2% glucose. The availability of these pseudo-stems without any significant commercial value offers a great opportunity to vendors operating in the market to produce eco-friendly paper.

Moreover, banana paper is eco-friendly and is used in making business cards, tape, envelopes, wrapping paper, memo cards, paper pens, greeting cards, wine labels, packaging, stickers, wallets, notebooks, and sketchbooks. Banana stems contain more than 4% of the usable fiber to manufacture banana paper, thereby providing a recyclable, eco-friendly, and economical solution for manufacturing paper. In addition, chemicals are not used for processing during the production of paper from banana fiber. Therefore, the production of paper from banana fiber has a minimal impact on the environment. The entire process of banana paper production utilizes less energy and water than that consumed in ordinary paper production.

Significant Market Trends

The growth of the banana production industry is the primary trend driving the market growth. Banana is recognized as one of the major fruit crops produced in more than 120 countries globally, with Asia, South America, and Africa as the major banana producers. The global annual production of bananas increased by 59.48% during 2000-2019. The global production of bananas and tropical fruits is projected to grow at 1.8% annually between 2019 and 2028. The largest suppliers of these fruits are expected to continue to be those in Asia, and the region was projected to account for 55% of the global output of tropical fruit in 2018. Global exports of bananas, excluding plantain, reached a new record high with an estimated 21 million tonnes in 2019, marking an increase of 10.2% over that in 2018.

Moreover, in Asia, India and China are recognized as the major producers of bananas. In 2019, India exported around 174.1 thousand tonnes of bananas. Central and South America were the major exporters of bananas globally. Annually, the top 15 banana-producing countries process more than 40 million tons of bananas and discrete waste such as damaged bananas and pinzote (banana stems). More than nine million metric tons of pinzote are released into local rivers or dumped in landfills. The continuous rise in and generation of waste banana products can be put to productive use by using it for manufacturing banana paper, thereby driving market growth further.

Major Market Challenge

Lack of product awareness and product penetration is the major challenge impeding the market growth. Despite the increased demand for banana paper, the overall performance of the market has been modest. The slow growth of the market can be attributed to the low awareness of the product. It has been noted that many buyers are more aware of and interested in purchasing other types of paper, such as mango and sugarcane-based paper. India is recognized as the major producer of banana paper. However, the domestic consumption of banana paper is relatively less than that of other types of handmade paper. Of all the banana paper products produced in India, a large proportion accounts for exports to developed countries and that too in the form of value-added products.

However, to increase the consumption of banana paper, vendors are heavily investing in marketing and promotional activities. They are focused on consumer engagement, reinforcement of brand relevance, brand awareness, and guiding consumers to stores or shopping websites. They use various methods, such as direct marketing, including e-mail, print advertising, catalogues, and brochures; in-store events; and Internet marketing techniques, to increase their brand equity and promote their products. However, the lack of awareness and product penetration of banana paper, especially in developing countries, is expected to hinder the growth of the market during the forecast period.

Key Market Customer Landscape

The banana paper report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their growth strategies.

Market Customer Landscape

Who are the Major Market Companies?

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Green Banana Paper - The company offers banana paper such as PETA-approved handmade banana fiber paper under its unified segment. The company derives its products from agricultural banana waste.

The report also includes detailed analyses of the competitive landscape of the market and information about 15 market companies, including:

- Bhawarlal Kalyan Mal Group

- Blick Art Materials LLC

- Bluecat Paper

- Donahue Paper Emporium

- Ecoideaz

- EcoPaper

- Go Green Agri Solutions

- Graphic Products Corp.

- Hussain Hand Made Paper

- Legion Paper

- One Planet Cafe Co. Ltd.

- Papyrus Australia Ltd.

- Two Hands Paperie

- Utsav Exim Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Market Segmentation

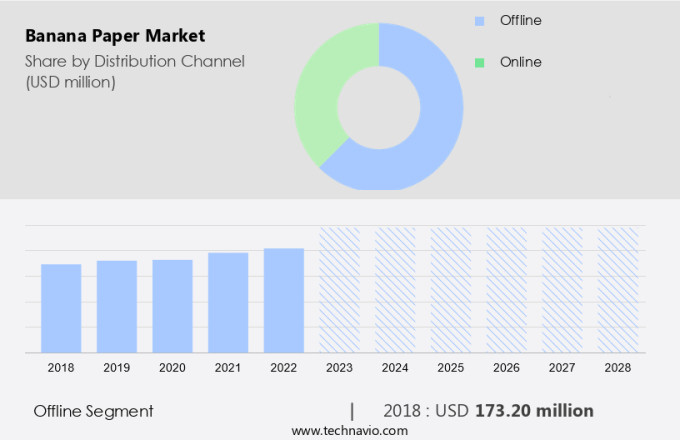

By Distribution Channel

The market share growth by the offline segment will be significant during the forecast period. The offline segment of the global market held the largest market share in 2022. The revenue from the offline distribution channel has been declining gradually owing to the growing preference for online shopping. To overcome this challenge, major retailers are expanding their stores in local and regional markets. The revenue of the offline distribution channel comes from the sales of products through speciality store; hypermarkets, supermarkets, convenience stores, clubhouse stores; and department stores. Supermarket and hypermarket chains are focusing on increasing the number of stores. For instance, in September 2019, Kroger Co. opened a new 52,000 sqft urban format store in the US. Such expansions of supermarket and hypermarket chains will enhance the accessibility of customers and increase the sales of banana paper.

Get a glance at the market contribution of various segments Request a PDF Sample

The offline segment showed a gradual increase in market share with USD 173.20 million in 2018. Vendors should resort to the online-to-offline (O2O) business strategy to enhance sales from the offline distribution channel and promote the digital experience of buyers. They should adopt omnichannel commerce and multi-marketing strategies. The offline channel provides various benefits to buyers, including in-store pickup of goods purchased online, the purchase of goods online while being at the physical store, and the return of products purchased online to preferred stores. Adopting these strategies will help vendors increase their market shares and expand their consumer base during the forecast period.

By Region

For more insights on the market share of various regions Request PDF Sample now!

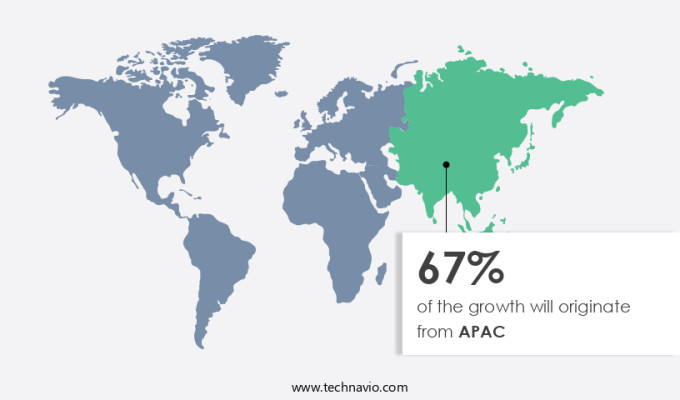

APAC is projected to contribute 67% by 2028. Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. Globally, India and China are the largest producers of banana crops. Factors such as increased literacy rate, the high rate of deforestation, and rising demand for craft paper have spurred the demand for handmade paper varieties, including banana paper, in APAC. For instance, during 2015-2018, more than 20,000 hectares of forest land in India were diverted for various developmental activities, including papermaking. The increased awareness about the disadvantages of using plastic for packaging has further widened the market's growth prospects. More than 40% of the plastic produced in India is used for packaging.

Segment Overview

The market research report provides comprehensive data (region wise segment analysis), with forecasts and estimates in "USD Million" for the period 2024 to 2028, as well as historical data from 2018 to 2022 for the following segments.

- Distribution Channel Outlook

- Offline

- Online

- Product Type Outlook

- Machine made

- Handmade

- Region Outlook

- APAC

- China

- India

- North America

- The U.S.

- Canada

- Europe

- The U.K.

- Germany

- France

- Rest of Europe

- Middle East & Africa

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

- South America

- Brazil

- Argentina

- Chile

- APAC

Market Analyst Overview

In the realm of sustainability, the shift towards eco-friendly paper products is gaining traction due to heightened awareness of environmental impact. While conventional papers still dominate various sectors, handmade papers are emerging for their artistic purposes, appeal, and reduced ecological footprint. Effective inventory managing and product sourcing play pivotal roles in promoting sustainable practices. Companies like BG Handpaper and One Planet Café exemplify this commitment through initiatives that integrate food packaging solutions with eco-friendly materials. To achieve these goals, robust research design and a strategic decision-making process are essential, facilitating import export analysis and driving major developments in sustainable paper manufacturing.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

156 |

|

Base year |

2023 |

|

Historic period |

2018 - 2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.31% |

|

Market growth 2024-2028 |

USD 70.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.93 |

|

Regional analysis |

APAC, North America, Europe, Middle East and Africa, and South America |

|

Performing market contribution |

APAC at 67% |

|

Key countries |

US, China, India, Germany, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Bhawarlal Kalyan Mal Group, Blick Art Materials LLC, Bluecat Paper, Donahue Paper Emporium, Ecoideaz, EcoPaper, Go Green Agri Solutions, Graphic Products Corp., Green Banana Paper, Hussain Hand Made Paper, Legion Paper, One Planet Cafe Co. Ltd., Papyrus Australia Ltd., Two Hands Paperie, and Utsav Exim Ltd. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, Market growth and Market Forecasting, COVID 19 impact and recovery analysis and future consumer dynamics, Market condition analysis for Market forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting of the market between 2024 and 2028

- Precise estimation of the market size and its contribution to the parent market

- Accurate predictions about upcoming market trends and analysis and changes in consumer behavior

- Growth of the market across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough market growth analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive market analysis and report on the factors that will challenge the market research and growth of market companies

We can help! Our analysts can customize this report to meet your requirements. Get in touch