Bamboos Market Size 2024-2028

The bamboos market size is valued to increase USD 23.1 billion, at a CAGR of 5.82% from 2023 to 2028. Increased demand for bamboo plates will drive the bamboos market.

Major Market Trends & Insights

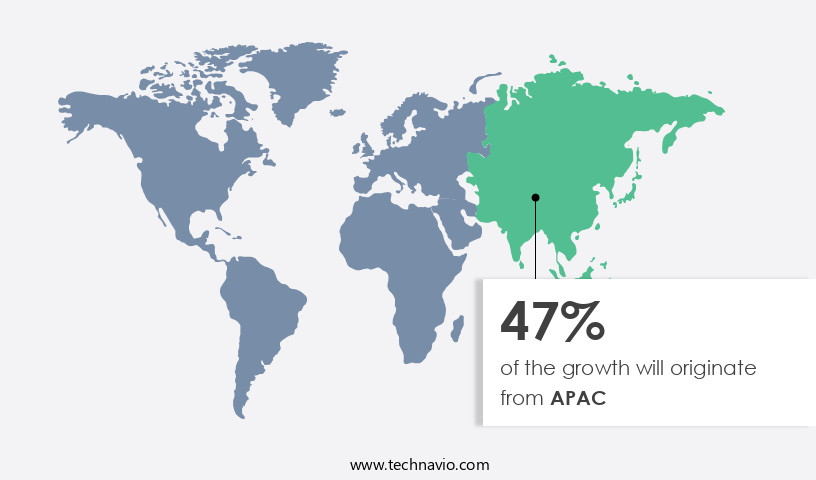

- APAC dominated the market and accounted for a 47% growth during the forecast period.

- By Type - Tropical Woody Bamboos segment was valued at USD 28.90 billion in 2022

- By Application - Industrial products segment accounted for the largest market revenue share in 2022

Market Size & Forecast

- Market Opportunities: USD 51.13 billion

- Market Future Opportunities: USD 23.10 billion

- CAGR : 5.82%

- APAC: Largest market in 2022

Market Summary

- The market encompasses the production, processing, and distribution of bamboo products, primarily focused on core technologies such as harvesting, processing, and manufacturing. With increasing demand for eco-friendly and sustainable alternatives, bamboo has gained significant traction in various applications, including food containers, plates, and cutlery, as well as furniture and interior design. According to recent reports, the global bamboo plates market is projected to reach a 25% share in the disposable tableware industry by 2027. However, the availability of bamboo is limited to specific geographic regions, primarily in Asia Pacific, which presents both opportunities and challenges for market growth. Major drivers include the growing awareness of environmental sustainability and the versatility of bamboo, while challenges include logistical difficulties in transporting bamboo over long distances and inconsistent product quality.

- Despite these challenges, the market continues to evolve, with ongoing research and development efforts aimed at improving production techniques and expanding the range of applications for bamboo products.

What will be the Size of the Bamboos Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Bamboos Market Segmented and what are the key trends of market segmentation?

The bamboos industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Tropical Woody Bamboos

- Herbaceous Bamboos

- Temperate Woody Bamboos

- Application

- Industrial products

- Furniture

- Raw material

- Shoots

- Construction

- Others

- Distribution Channel

- Offline

- Online

- End-use Industry

- Wood and Furniture

- Construction

- Paper and Pulp

- Textile

- Agriculture

- Food

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Type Insights

The tropical woody bamboos segment is estimated to witness significant growth during the forecast period.

Tropical bamboo plants, renowned for their versatility, are integral to various industries due to their unique properties. In construction, bamboo's strength and durability make it a preferred material for structures, particularly in earthquake-prone regions. Furniture and flooring industries leverage bamboo's aesthetic appeal and durability, while kitchenware and home decor benefit from its lightweight yet robust nature. Textiles and paper industries extract fibers for fabric and pulp production, respectively. Bamboo's applications extend beyond consumer goods. It is increasingly used as a construction material, contributing significantly to the global construction industry. For instance, in 2020, the construction sector accounted for approximately 35% of the total bamboo market share.

The Tropical Woody Bamboos segment was valued at USD 28.90 billion in 2018 and showed a gradual increase during the forecast period.

Looking ahead, industry experts anticipate a 25% increase in bamboo's use within the construction sector by 2025. Moreover, bamboo's biomass yield enhancement, genetic diversity assessment, and carbon sequestration potential make it an attractive option for sustainable forestry practices. Advanced techniques like hydroponic bamboo cultivation, molecular marker analysis, and rhizome development are being explored to optimize production and improve fiber quality. Bamboo's versatility extends to its role in reforestation initiatives and soil amendment techniques. It is also used in the production of biofuels and as a soil amendment, further emphasizing its environmental significance. The market for bamboo-based products is expected to grow, with a projected 20% increase in demand for biodegradable bamboo products by 2025.

In summary, tropical bamboo's applications span various industries, from construction and furniture to textiles and paper. Its potential for biomass yield enhancement, carbon sequestration, and sustainable forestry practices make it an essential component of the global market. The market for bamboo-based products is expected to grow, with significant increases in demand for construction applications and biodegradable products.

Regional Analysis

APAC is estimated to contribute 47% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Bamboos Market Demand is Rising in APAC Request Free Sample

In the dynamic and evolving bamboo markets, APAC holds the largest market share, with a significant increase in demand for bamboo products. This trend is driven by growing consumer consciousness towards sustainability, eco-friendliness, and bamboo's versatility. Bamboo's popularity extends to the construction sector, where it is increasingly used for flooring, decking, wall panels, and even structural elements in buildings. With 30% of global bamboo production coming from China alone, APAC's dominance is expected to continue.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market encompasses various aspects of optimizing bamboo culm quality for construction, assessing the effect of nutrient management on bamboo biomass, and investigating the impact of water availability on rhizome growth. This market also focuses on evaluating sustainable harvesting practices, determining genetic diversity in bamboo germplasm, and measuring carbon sequestration in bamboo plantations. Additionally, efforts are being made to improve pest and disease resistance in bamboo, assessing the economic viability of bamboo farming, and analyzing the impact of climate change on bamboo growth. In the realm of research and development, there is a significant emphasis on identifying optimal propagation techniques for bamboo, comparing different bamboo processing methods, and developing strategies for sustainable bamboo forestry.

The environmental impact of bamboo production is also being assessed, with a focus on enhancing the biofuel potential of bamboo biomass and investigating various methods of bamboo tissue culture. Furthermore, exploring the use of molecular markers in bamboo breeding and developing high-yield bamboo varieties are key areas of interest. Moreover, it is noteworthy that the industrial application segment accounts for a significantly larger share than the academic segment in the market. This disparity highlights the growing importance of industrial applications, such as construction and bioenergy, in driving market growth. In conclusion, the market presents a dynamic landscape, with a strong focus on optimizing production, sustainability, and innovation.

These efforts are aimed at enhancing the economic returns of bamboo production and identifying novel applications of bamboo products.

What are the key market drivers leading to the rise in the adoption of Bamboos Industry?

- The significant surge in consumer preference for eco-friendly tableware, particularly bamboo plates, serves as the primary catalyst for market growth in this sector.

- Bamboo plates have emerged as a preferred eco-friendly alternative to single-use plastic and paper products in various sectors. The increasing environmental consciousness among consumers has fueled the demand for sustainable options, making bamboo plates a popular choice. Bamboo, a highly renewable resource, offers several advantages. It grows rapidly, requiring minimal water resources, pesticides, and fertilizers. Unlike traditional hardwood and softwood products, bamboo can be harvested without destroying the plant, ensuring its sustainability. Bamboo plates are compostable and biodegradable, contributing to waste reduction and minimizing their environmental footprint. According to recent studies, the market for bamboo plates has shown significant growth, with increasing adoption across the foodservice industry and households.

- Compared to traditional plates, bamboo plates offer a more sustainable and eco-friendly alternative, aligning with the evolving consumer preferences and regulatory requirements. The versatility and durability of bamboo plates make them suitable for various applications, further expanding their market potential. As businesses and individuals seek to reduce their carbon footprint, the demand for bamboo plates is expected to continue growing.

What are the market trends shaping the Bamboos Industry?

- The increasing demand for bamboo in furniture and interior design represents a notable market trend. This sustainable and versatile material is gaining popularity for its aesthetic and functional qualities.

- Bamboo, a fast-growing grass, has gained prominence in various sectors due to its eco-friendliness and minimal resource requirements. Unlike traditional hardwood, bamboo does not necessitate the use of pesticides and grows rapidly. This attribute makes it an appealing alternative for manufacturing furniture and decorative items. Bamboo is widely used in creating chairs, tables, beds, cabinets, lampshades, and room dividers. Its versatility extends to interior design applications, as it can be shaped and sized to suit diverse design requirements. The global shift towards sustainable materials has fueled the demand for bamboo in the furniture industry. Bamboo flooring is another eco-friendly alternative to hardwood flooring, offering durability, attractiveness, and a range of styles and finishes.

- The market for bamboo products is dynamic, with continuous innovation and evolving trends shaping its applications. For instance, bamboo is increasingly being used in high-end furniture designs, underscoring its growing appeal among consumers. The flexibility of bamboo in various sectors, coupled with its eco-friendly nature, positions it as a promising alternative to traditional materials.

What challenges does the Bamboos Industry face during its growth?

- The bamboo industry faces significant growth limitations due to its restricted availability in specific geographic regions.

- The global bamboo market faces unique challenges due to the restricted availability of this versatile resource. Predominantly found in regions such as Asia, Africa, and South America, bamboo thrives in specific climatic conditions, limiting its cultivation to certain areas. This geographic distribution poses challenges to the market's growth, as the restricted availability of bamboo resources impacts industries that rely on this material. The scarcity of bamboo can lead to increased prices and supply chain issues. According to recent reports, the global bamboo market is projected to grow at a steady pace, despite these challenges. For instance, the demand for bamboo in the construction industry is on the rise due to its sustainability and strength.

- However, the market's growth is not uniform across all regions and applications. In the textile industry, for example, the use of bamboo fibers is increasing due to their eco-friendly properties. Yet, the market's growth in this sector is hindered by the high production costs associated with bamboo fiber extraction. The market's dynamics are further complicated by the emergence of alternative materials and the ongoing research and development efforts to improve bamboo cultivation techniques and production processes. Despite these challenges, the bamboo market continues to evolve, with new applications and industries discovering the benefits of this renewable resource.

- The market's growth is driven by the increasing awareness of sustainability and the need for eco-friendly alternatives to traditional materials. As the market adapts to these changing trends, it is expected to continue its steady growth trajectory.

Exclusive Customer Landscape

The bamboos market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the bamboos market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Bamboos Industry

Competitive Landscape & Market Insights

Companies are implementing various strategies, such as strategic alliances, bamboos market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Anji Tianchi Bamboo and Wood Industry Co. Ltd. - This company specializes in high-end bamboo products, including flooring and decking, renowned for their superior quality and sustainable manufacturing methods.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Anji Tianchi Bamboo and Wood Industry Co. Ltd.

- ANJI TIANZHEN BAMBOO FLOORING CO. LTD

- Bamboo Australia

- Bamboo Village Co. Ltd.

- Bamboo vision

- Bamboowood

- Cali Bamboo LLC

- CFF GmbH and Co. KG

- dasso Group

- EcoPlanet Bamboo Group

- Fujian HeQiChang Bamboo Industrial Co. Ltd.

- Moso International B.V.

- Shanghai Tenbro Bamboo Textile Co. Ltd.

- Simply Bamboo PTY LTD

- Smith and Fong Co.

- SWICOFIL AG

- Teragren

- Wild Fibres

- Xiamen HBD Industry and Trade Co. Ltd.

- Xingli Bamboo Products Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Bamboos Market

- In January 2024, Bamboos, a leading bamboo products manufacturer, announced the launch of its innovative new line of bamboo fiber insulation panels, expanding its product offerings in the green building materials sector (Bamboos Press Release, 2024). This development marked a strategic shift towards sustainable insulation solutions, aligning with global trends towards eco-friendly construction materials.

- In March 2024, Bamboos entered into a major collaboration with the European Green Building Council (EGBC) to promote the use of bamboo products in European green building projects. This partnership aimed to increase market penetration and boost brand recognition in Europe (Bamboos Press Release, 2024).

- In May 2024, Bamboos secured a significant investment of USD 15 million in a Series B funding round led by Sustainable Growth Capital. The funds were earmarked for capacity expansion and research and development initiatives, further solidifying Bamboos' position as a key player in the bamboo market (Bloomberg, 2024).

- In April 2025, Bamboos received a key regulatory approval from the US Environmental Protection Agency (EPA) for its bamboo flooring products, granting them the prestigious "Environmentally Preferred Product" label. This approval opened up new sales opportunities in the US market and strengthened Bamboos' commitment to sustainable manufacturing practices (US EPA Press Release, 2025).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Bamboos Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

154 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.82% |

|

Market growth 2024-2028 |

USD 23.1 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.38 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Egypt, Oman, Argentina, KSA, UAE, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- In the dynamic and evolving bamboo market, various applications continue to emerge, driving innovation and growth. One significant area of focus is soil erosion control, where bamboo's extensive root system offers a natural solution. Another promising application is biomass yield enhancement through genetic diversity assessment and plant growth regulators, which optimize cultivation and improve fiber quality. Bamboo's carbon sequestration potential is another key factor fueling market activity. Clonal propagation methods, such as rhizome development and molecular marker analysis, contribute to sustainable harvesting practices. Hydroponic bamboo cultivation and vertical farming techniques increase productivity and efficiency. Bamboo tissue culture, shoot proliferation, and micropropagation techniques enable large-scale production and uniformity.

- Biodegradable bamboo products and construction material applications expand its use in various industries. Reforestation initiatives, integrated pest management, and sustainable forestry practices further highlight the market's commitment to environmental stewardship. Bamboo's potential in biofuel production and textile fiber extraction adds to its versatility. Germplasm conservation strategies ensure the long-term availability of diverse bamboo species. Nutrient uptake efficiency and organic farming practices contribute to sustainable production. Disease resistance pathways, bamboo charcoal production, and soil amendment techniques offer additional benefits. Water stress tolerance and pest resistance mechanisms enhance bamboo's resilience, making it an attractive alternative to traditional crops.

- The bamboo market continues to unfold with ongoing research and development, reflecting its continuous evolution and potential for innovation.

What are the Key Data Covered in this Bamboos Market Research and Growth Report?

-

What is the expected growth of the Bamboos Market between 2024 and 2028?

-

USD 23.1 billion, at a CAGR of 5.82%

-

-

What segmentation does the market report cover?

-

The report segmented by Type (Tropical Woody Bamboos, Herbaceous Bamboos, and Temperate Woody Bamboos), Application (Industrial products, Furniture, Raw material, Shoots, Construction, and Others), Geography (APAC, North America, Europe, Middle East and Africa, and South America), Distribution Channel (Offline and Online), and End-use Industry (Wood and Furniture, Construction, Paper and Pulp, Textile, Agriculture, Food, and Others)

-

-

Which regions are analyzed in the report?

-

APAC, North America, Europe, Middle East and Africa, and South America

-

-

What are the key growth drivers and market challenges?

-

Increased demand for bamboo plates, Availability of bamboo limited to specific geographic regions

-

-

Who are the major players in the Bamboos Market?

-

Key Companies Anji Tianchi Bamboo and Wood Industry Co. Ltd., ANJI TIANZHEN BAMBOO FLOORING CO. LTD, Bamboo Australia, Bamboo Village Co. Ltd., Bamboo vision, Bamboowood, Cali Bamboo LLC, CFF GmbH and Co. KG, dasso Group, EcoPlanet Bamboo Group, Fujian HeQiChang Bamboo Industrial Co. Ltd., Moso International B.V., Shanghai Tenbro Bamboo Textile Co. Ltd., Simply Bamboo PTY LTD, Smith and Fong Co., SWICOFIL AG, Teragren, Wild Fibres, Xiamen HBD Industry and Trade Co. Ltd., and Xingli Bamboo Products Co.

-

Market Research Insights

- The bamboo market encompasses various aspects, from post-harvest handling to value chain optimization. Culm strength parameters are crucial for assessing bamboo's structural integrity, with an average compressive strength of 290 MPa reported for Moso bamboo (Phyllostachys edulis). In contrast, the average internode length variation ranges from 15 to 150 cm, impacting product quality evaluation and market chain efficiency. Growth chamber experiments have been instrumental in understanding climate change adaptation and carbon footprint calculation. For instance, optimizing rhizome branching patterns and water use efficiency can reduce carbon emissions by up to 20% in controlled environments. Additionally, species identification, bacterial blight management, and fungal pathogen identification are essential for maintaining product quality and market competitiveness.

- Soil health indicators, such as nutrient deficiency symptoms and field trial data, play a significant role in sustainable bamboo cultivation. Genetic engineering approaches and weed management practices contribute to yield components analysis and economic feasibility analysis. Harvesting optimization, leaf area index, and transpiration rate are key factors in improving market efficiency and product competitiveness. Invasive species management and chlorophyll content measurement are crucial for maintaining ecosystem health and ensuring sustainable bamboo production. Overall, the bamboo market continues to evolve, with ongoing research focusing on improving product quality, optimizing production processes, and reducing environmental impact.

We can help! Our analysts can customize this bamboos market research report to meet your requirements.