Balsa Core Materials Market Size 2024-2028

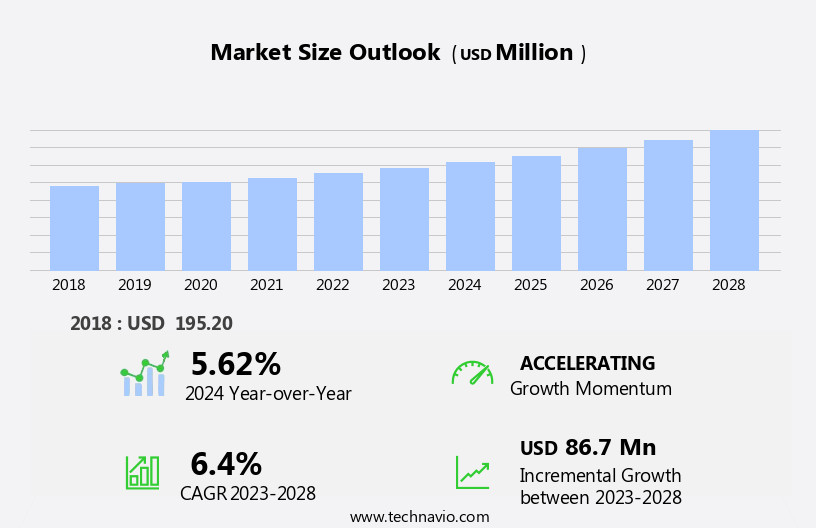

The balsa core materials market size is forecast to increase by USD 86.7 million at a CAGR of 6.4% between 2023 and 2028.

What will be the Size of the Balsa Core Materials Market During the Forecast Period?

How is this Balsa Core Materials Industry segmented and which is the largest segment?

The balsa core materials industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Monolayer

- Multilayer

- End-user

- Wind energy

- Aerospace

- Marine

- Others

- Geography

- APAC

- China

- India

- Europe

- Germany

- France

- North America

- US

- South America

- Middle East and Africa

- APAC

By Type Insights

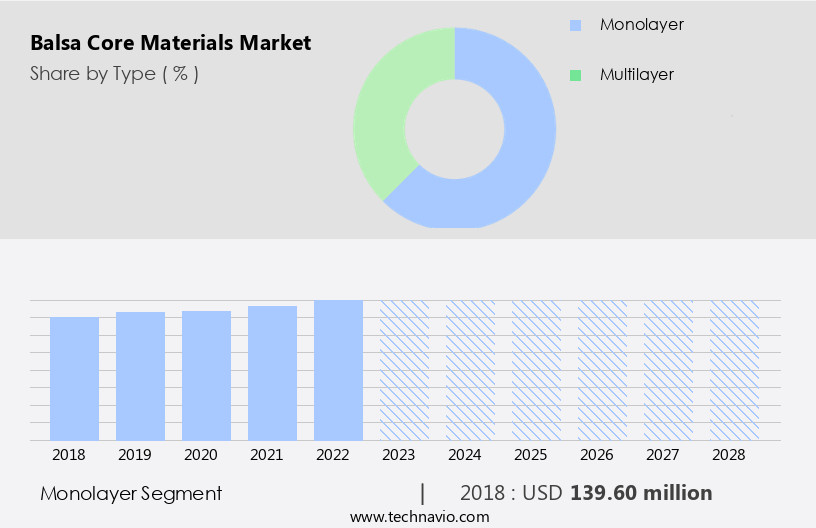

- The monolayer segment is estimated to witness significant growth during the forecast period.

Balsa core materials, specifically monolayer balsa, offer versatility and excellent bonding properties when combined with resins or adhesives. These lightweight, sustainable materials serve various industries, including wind energy, aerospace, construction, marine, and transportation. Monolayer balsa core materials provide insulation, fire resistance, and noise reduction. They exhibit high chemical resistance, particularly to styrene. In wind energy, balsa core is utilized for wind turbine blades and structural composite panels. In aerospace, it is used for boats, wind energy installations, and aircraft structures like boats, helicopters, and aircraft. In the construction sector, it is used for floor panels and other applications. In the automotive industry, balsa core materials are employed for engine covers, panel structures, and interior structures.

Other industries, such as medical equipment and sports equipment, also benefit from its shock absorption properties. Balsa core materials contribute to reducing CO2 emissions and align with renewable energy objectives.

Get a glance at the Balsa Core Materials Industry report of share of various segments Request Free Sample

The Monolayer segment was valued at USD 139.60 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

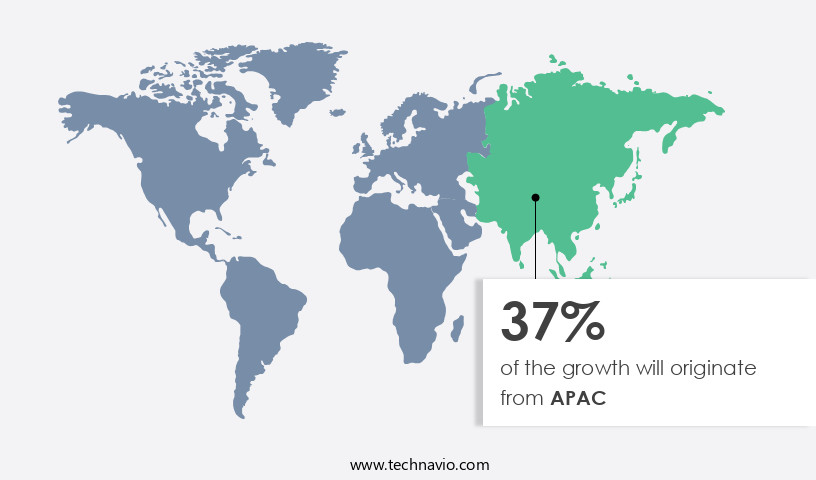

- APAC is estimated to contribute 37% to the growth of the global market during the forecast period.

Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

Balsa core materials, derived from Balsa wood and its honeycomb structure, are gaining significant traction in various industries due to their lightweight properties and high strength-to-weight ratio. These materials are extensively used in boats, wind turbine blades, structural composite panels, hovercraft, aircraft, and helicopters. The thicknesses and densities of balsa core materials vary, offering customized solutions for diverse applications. Shear strength and stiffness are notable characteristics, ensuring durability and stability. In the shipbuilding sector, the increasing demand for efficient and sustainable materials is driving the adoption of balsa core materials. Similarly, In the wind energy industry, balsa core materials are essential for wind turbine blades due to their low weight and high strength.

The transportation sector, including the marine, aerospace, and construction industries, also benefits from these materials due to their ability to reduce overall weight and improve fuel efficiency. The use of high-strength core materials, such as polyethylene terephthalate (PET) and carbon core materials, in monolayer and multilayer configurations, is a growing trend. Rigid EndGrain and Contoured EndGrain balsa core structures are popular choices for wind energy installations, renewable energy objectives, and offshore wind energy projects. The recyclable and renewable nature of balsa core materials aligns with the industry's focus on sustainable materials and forestry practices. Balsa core materials are also used in various applications outside of traditional industries, such as solar panels, shock absorption in medical equipment, and sports equipment.

As the energy mix shifts towards renewable sources, the wind energy industry's growth is expected to continue, further increasing the demand for balsa core materials.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Balsa Core Materials Industry?

Growth of shipbuilding industry is the key driver of the market.

What are the market trends shaping the Balsa Core Materials Industry?

Rising number of offshore wind farm installations is the upcoming market trend.

What challenges does the Balsa Core Materials Industry face during its growth?

Presence of substitutes for balsa core materials is a key challenge affecting the industry growth.

Exclusive Customer Landscape

The balsa core materials market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the balsa core materials market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, balsa core materials market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Adhesive Technologies NZÂ Ltd. - Balsa core materials, including end grain and micro-honeycomb structures, are lightweight and high-strength options for various industries. End grain balsa offers superior strength and dimensional stability, making it ideal for use in aerospace, marine, and model making applications. Micro-honeycomb balsa, with its unique cellular structure, provides exceptional strength-to-weight ratio and excellent insulation properties, making it a popular choice for automotive and construction industries. These materials offer versatility and reliability, contributing to their widespread usage in various sectors.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Adhesive Technologies NZÂ Ltd.

- Allred and Associates Inc.

- Bodotex AS

- Carbon Core Corp.

- Composite Envisions LLC

- CoreLite

- Diab Group

- Gurit Holding AG

- I Core Composites LLC

- LBI Inc.

- Nord Compensati Srl

- Schweiter Technologies AG

- Sicomin Epoxy Systems

- Specialized Balsa Wood LLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Balsa core materials have gained significant attention in various industries due to their unique properties. These materials are known for their lightweight nature and high strength-to-weight ratio, making them ideal for use in aerospace, marine, transportation, and construction applications. Balsa core materials are typically made from balsa wood, which possesses a honeycomb structure that provides excellent shear strength and stiffness. The balsa core material market encompasses a wide range of products, including structural composite panels, monolayer and multilayer balsa cores, rigid endgrain balsa, and contoured endgrain balsa. These materials find extensive use in various end uses such as boats, wind turbine blades, hovercraft, aircraft, helicopters, and structural composite panels.

Lightweight materials have become increasingly important in various industries as the demand for reducing carbon footprint and improving fuel efficiency grows. Balsa core materials offer a sustainable solution as they are derived from renewable resources. Sustainable forestry practices ensure a steady supply of balsa wood, making it an eco-friendly alternative to non-renewable materials. Balsa core materials are also used In the wind energy industry, where they are utilized In the production of rotor blades and photovoltaic panels. The use of balsa core materials in wind energy installations contributes to the renewable energy objectives of reducing carbon emissions and increasing the energy mix from renewable sources.

In the aerospace industry, balsa core materials are used In the construction of aircraft and helicopters due to their high strength-to-weight ratio and excellent shock absorption properties. These materials are also used In the defense industry for the production of lightweight and durable components. The marine industry also benefits from the use of balsa core materials In the construction of boats and ships. The lightweight nature of these materials reduces the overall weight of the vessel, leading to improved fuel efficiency and reduced operational costs. Balsa core materials are also used In the production of high-strength core materials for various applications, including sports equipment and medical equipment.

The honeycomb structures of these materials provide excellent shock absorption properties, making them ideal for use in protective gear and medical devices. Recycling of balsa core materials is an essential aspect of their sustainability. These materials can be recycled and reused in various applications, reducing the need for virgin materials and minimizing waste. The use of recyclable balsa core materials in composite materials further enhances their sustainability credentials. In conclusion, balsa core materials offer a versatile and sustainable solution for various industries, including aerospace, marine, transportation, construction, wind energy, and renewable energy. Their unique properties, such as high strength-to-weight ratio, excellent shock absorption, and recyclability, make them an attractive alternative to non-renewable materials.

The use of balsa core materials contributes to reducing carbon emissions and improving fuel efficiency, making them an essential component of the energy mix In the future.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

151 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.4% |

|

Market growth 2024-2028 |

USD 86.7 million |

|

Market structure |

Concentrated |

|

YoY growth 2023-2024(%) |

5.62 |

|

Key countries |

China, US, Germany, France, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Balsa Core Materials Market Research and Growth Report?

- CAGR of the Balsa Core Materials industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the balsa core materials market growth of industry companies

We can help! Our analysts can customize this balsa core materials market research report to meet your requirements.