Automotive Windshield Market Size 2024-2028

The Automotive Windshield Market size is forecast to increase by USD 7.06 billion, at a CAGR of 7.7% between 2023 and 2028. Several factors are crucial to the market's growth. These include the increasing adoption of advanced automotive windshields, driven by technological innovations that enhance safety and performance. Additionally, there is a significant emphasis on lightweighting in the automotive sector, which improves fuel efficiency and reduces emissions. The rising demand for automotive windshields from the EV industry is also a key driver, as electric vehicles continue to gain popularity. This demand is fueled by the need for specialized windshields that cater to the unique requirements of EVs, such as enhanced durability and energy efficiency. Collectively, these factors are shaping the future of the market.

What will be the Size of the Market During the Forecast Period?

For More Highlights About this Report, Download Free Sample in a Minute

Market Dynamic and Customer Landscape

The market encompasses the production and sales of laminated safety glass for various vehicle types, including passenger cars, light commercial vehicles, heavy commercial vehicles, and electric vehicles. These windshields consist of multiple glass layers with a plastic interlayer, ensuring occupant safety against external factors such as dust, rain, insects, wind, and hydrogenpowered vehicles' environmental elements. Automotive glass plants worldwide produce different glass types to cater to diverse vehicle requirements. Head-up display integration in windshields is a significant trend, enhancing safety and environmental concerns in the global vehicle sales market. Leading competitors in the market trajectory focus on innovations to meet the evolving needs of consumers. Occupant safety remains a top priority, with windshields providing structural integrity during collisions. Sidelights integrated into windshields offer additional visibility, improving overall vehicle safety. The market for automotive windshields is expected to grow, driven by increasing global vehicle sales and the demand for advanced safety features. The Automotive Sun Visor Market is experiencing steady growth due to increasing demand for enhanced driver and passenger comfort and safety. Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Key Market Driver

The increasing adoption of advanced automotive windshields is notably driving market growth. The market is experiencing significant growth due to the integration of advanced technologies and materials. Laminated safety glass, comprised of multiple glass layers with a plastic interlayer, ensures the protection of vehicle occupants from external factors such as dust, rain, insects, wind, and other environmental elements. The use of thermoset materials and thermoplastic materials in windshield production enhances durability and resistance to breakage. Automotive windshields are no longer mere barriers between the vehicle and the outside world. They serve as essential components of vehicle safety and comfort. Head-up displays (HUD) and augmented reality windshields project critical information directly onto the windshield, enhancing navigation and safety. Self-healing coatings and dynamic tinting technologies further improve windshield functionality and durability. Market statistics indicate a growing trend towards the adoption of advanced windshield features.

Further, safety regulations mandate the use of laminated glass and tempered glass in windshield production. Urbanization and the increasing popularity of autonomous vehicles have led to the development of connectivity features and sustainable materials in windshield manufacturing. Karma Automotive, a leading automaker, has introduced advanced sensors and Gorilla Glass in its windshields for enhanced safety and durability. Electric vehicles (EVs) and hydrogen-powered vehicles are also adopting these advanced windshield technologies to meet safety and environmental standards. Innovations such as self-healing coatings, dynamic tinting technologies, and advanced sensors are revolutionizing the market. These technologies not only improve vehicle safety and comfort but also contribute to the overall sustainability of the automotive industry. Such factors drive the market growth during the forecast period.

Significant Market Trends

Innovations in automotive technologies are an emerging trend shaping market growth. In the market, laminated safety glass plays a significant role in ensuring the safety of vehicle occupants while providing durability and resistance to breakage. Traditional laminated glass consists of multiple glass layers with a plastic layer sandwiched in between. This design offers superior resistance to external factors such as dust, rain, insects, wind, and other environmental elements. Advancements in windshield technology include the use of thermoset materials and thermoplastic materials for enhanced durability and resistance to breakage. For instance, Corning Inc.'s Gorilla Glass hybrid technology, which has been adopted by Ford Motor Co., offers lightweight and thinner glass options for windshield positions. This innovation positively impacts vehicle safety, comfort features, and environmental factors by improving the center of gravity, acceleration, braking performance, and fuel economy. Market statistics indicate a growing trend towards the adoption of advanced sensors, electric vehicles (EVs), and sustainable materials in windshield production. Safety regulations and urbanization are key drivers for this growth, as autonomous vehicles and connectivity features become increasingly common.

Moreover, head-up displays, augmented reality windshields, self-healing coatings, and dynamic tinting technologies are some of the innovative solutions that are transforming the market. Karma Automotive and other manufacturers are exploring hydrogen-powered vehicles as a sustainable alternative to traditional gasoline-powered vehicles. These advancements in vehicle technology will further impact the windshield market, as manufacturers seek to optimize weight, durability, and performance for various vehicle types. In summary, the market is evolving to meet the demands of safety regulations, vehicle production, and consumer preferences for comfort and sustainability. Innovations in glass technology, such as Gorilla Glass, and the integration of advanced sensors and connectivity features are driving growth in this sector. Such factors drive the market growth during the forecast period.

Major Market Challenge

Increased production cost associated with automotive windshields is a significant challenge hindering market growth. The market experiences complexities in penetrating cost-sensitive markets, such as India, due to the integration of advanced technology and high-quality materials. These innovations, which include laminated safety glass with plastic layers and glass layers, cater to the needs of vehicle occupants and protect against environmental elements like dust, rain, insects, and wind. However, the use of thermoset materials and thermoplastic materials for laminated glass and tempered glass, as well as vinyl layers, enhances durability and resistance to breakage. Despite these benefits, market statistics indicate that consumers and producers in price-sensitive economies prioritize affordability over advanced features. For instance, head-up displays and augmented reality windshields, which improve driving experience and safety, come with additional costs.

However, as the automotive industry evolves, there is a growing demand for comfort features, safety standards, and connectivity in vehicles. Urbanization, autonomous vehicles, and safety and environmental regulations are driving this trend. Sustainable materials, such as self-healing coatings and dynamic tinting technologies, are gaining popularity due to their eco-friendly nature. Advanced sensors, like those made from Gorilla Glass, are essential for vehicle safety and are increasingly being integrated into windshields. Electric vehicles (EVs) and hydrogen-powered vehicles are also influencing the market, with Karma Automotive and other manufacturers focusing on safety and environmental concerns. In conclusion, the market faces challenges in penetrating cost-sensitive markets due to the integration of advanced technology and high-quality materials. Such factors hinder the market growth during the forecast period.

Market Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Who are the Major Market Companies?

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

AGC Inc. - The company offers automotive windshield such as laminated glass windshield and tempered glass windshield.

The market research and growth report also includes detailed analyses of the competitive landscape of the market and information about 20 market companies, including:

- AGP Group

- Carlex Glass America LLC

- Central Glass Co. Ltd.

- Compagnie de Saint Gobain

- Corning Inc.

- Dongguan Benson Automobile Glass Co. Ltd.

- Fuyao Glass Industry Group Co. Ltd.

- Glaston Oyj Abp

- Koch Industries Inc.

- LKQ Corp.

- Magna International Inc.

- Nippon Sheet Glass Co. Ltd.

- Olimpia Auto Glass Inc.

- PPG Industries Inc.

- Saudi Basic Industries Corp.

- Shiloh Industries LLC

- TURKIYE SISE VE CAM FABRIKALARI AS

- Vitro SAB De CV

- Xinyi Glass Holdings Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

What is the Largest-Growing Segments in the Market?

The OEM segment is estimated to witness significant growth during the forecast period. The market is experiencing significant growth, particularly in the OEM end-user segment. This trend is driven by various factors, including the increasing demand for vehicles due to consumer needs and fleet modernization. OEMs are integral to the integration of advanced technology into windshields, such as laminated safety glass with embedded sensors for driver assistance systems and heads-up displays, enhancing vehicle safety and operation. The growing usage of electric vehicles (EVs) also contributes to the demand for OEM windshields.

Get a glance at the market contribution of various segments Download the PDF Sample

The OEM segment was the largest and was valued at USD 7.57 billion in 2018. Moreover, OEMs are focusing on lightweight materials and aerodynamic designs, which necessitates the use of new windshield materials and manufacturing techniques. Laminated glass, consisting of glass layers with a plastic interlayer, offers durability and resistance to breakage, making it a popular choice. Thermoset materials and thermoplastic materials are also used in windshield production for their unique properties. Vehicle occupants require windshields that offer protection from environmental elements, such as dust, rain, insects, wind, and external factors. Laminated glass and tempered glass provide the necessary durability and resistance to these elements. In addition, comfort features, urbanization, and the advent of autonomous vehicles are driving the market. Safety regulations mandate the use of specific windshield materials and positions. Market statistics indicate a steady increase in vehicle production and sales, leading to a corresponding rise in windshield demand. Safety and environmental considerations are also influencing the market, with a shift towards sustainable materials and advanced sensors. Gorilla Glass and dynamic tinting technologies are gaining popularity due to their ability to enhance windshield functionality and durability. Self-healing coatings and augmented reality windshields are also emerging trends. As the automotive industry evolves, the windshield market is expected to continue its growth trajectory, with key players like Karma Automotive and manufacturers of hydrogen-powered vehicles contributing to the trend.

Which are the Key Regions for the Market?

For more insights on the market share of various regions Download PDF Sample now!

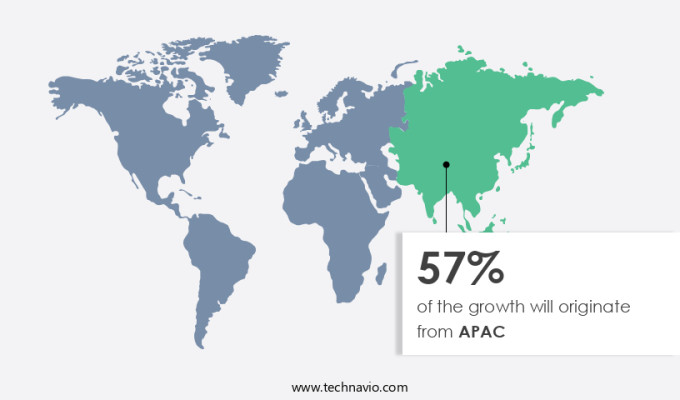

APAC is estimated to contribute 57% to the growth of the global market during the forecast period. Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. The market in APAC is experiencing significant growth, driven by several key factors. Integration of head-up displays in vehicles is a notable trend, enhancing safety and convenience for occupants. Global vehicle sales, particularly in China, Japan, and India, are crucial to market expansion due to high production volumes. Increasing income levels and expanding middle-class populations in emerging economies, such as India and Indonesia, fuel the demand for automobiles, including passenger cars, light commercial vehicles, heavy commercial vehicles, and electric vehicles. Market trajectory is influenced by the adoption of advanced technologies like autonomous vehicle systems and electric and hybrid vehicles. Smart glass and nanotechnology innovations offer improved windshield functionality and durability.

Further, geographical analyses reveal Japan and South Korea as significant markets, while China continues to dominate in terms of volume. The competitive environment is shaped by leading competitors, such as Asahi Glass Co., AGC Inc., and Nippon Sheet Glass Co. Market growth is also influenced by the establishment of automotive glass plants and the production of various glass type, including sidelight, windshields, and rear windows, for different vehicle types. In summary, the market in APAC is experiencing robust growth, driven by factors like head-up display integration, global vehicle sales, and advanced technologies. Geographical analyses, competitive environment, and consumer demand for safety and convenience continue to shape market dynamics.

Segment Overview

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD Billion" for the period 2024 to 2028, as well as historical data from 2018 to 2022 for the following segments

- End-user Outlook

- OEM

- Aftermarket

- Type Outlook

- Laminated glass

- Tempered glass

- Others

- Region Outlook

- North America

- The U.S.

- Canada

- South America

- Chile

- Brazil

- Argentina

- Europe

- U.K.

- Germany

- France

- Rest of Europe

- APAC

- China

- India

- Middle East & Africa

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

- North America

Market Analyst Overview

The market is a significant segment in the automotive industry, encompassing various layers and technologies. These components provide protection to vehicle occupants from external elements, ensuring safety and enhancing vehicle aesthetics. The market consists of various players specializing in the production and distribution of windshields. Automotive windshields are made using advanced materials like laminated glass and tempered glass. These materials offer superior strength, durability, and resistance to impact. The market for these components is driven by factors such as increasing vehicle production, stringent safety regulations, and growing consumer preference for advanced safety features. The Automotive Glass Market is expanding due to rising vehicle production and advancements in glass technology.

Moreover, technological advancements in the automotive industry have led to the development of innovative windshields with features like rain sensing, heating, and integrated heads-up displays. These features offer convenience and enhance the driving experience for consumers. The market for automotive windshields is expected to grow significantly due to the increasing demand for safety and comfort features in vehicles. Additionally, the adoption of electric and autonomous vehicles is also expected to create new opportunities for market players. In conclusion, the market is a dynamic and evolving industry, driven by factors such as safety regulations, consumer preferences, and technological advancements. Players in this market must stay updated with the latest trends and technologies to remain competitive. The Automotive Window Power Sunshade Market is growing rapidly, driven by increasing consumer demand for enhanced comfort and convenience in vehicles.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

170 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.7% |

|

Market Growth 2024-2028 |

USD 7.06 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.36 |

|

Regional analysis |

APAC, Europe, North America, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 57% |

|

Key countries |

US, China, Japan, India, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

AGC Inc., AGP Group, Carlex Glass America LLC, Central Glass Co. Ltd., Compagnie de Saint Gobain, Corning Inc., Dongguan Benson Automobile Glass Co. Ltd., Fuyao Glass Industry Group Co. Ltd., Glaston Oyj Abp, Koch Industries Inc., LKQ Corp., Magna International Inc., Nippon Sheet Glass Co. Ltd., Olimpia Auto Glass Inc., PPG Industries Inc., Saudi Basic Industries Corp., Shiloh Industries LLC, TURKIYE SISE VE CAM FABRIKALARI AS, Vitro SAB De CV, and Xinyi Glass Holdings Ltd. |

|

Market dynamics |

Parent market growth analysis, Market Forecasting, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, and Market condition analysis for the market forecast period. |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the market size and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- A thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements.