Automotive Steering Torque Sensor Market Size 2024-2028

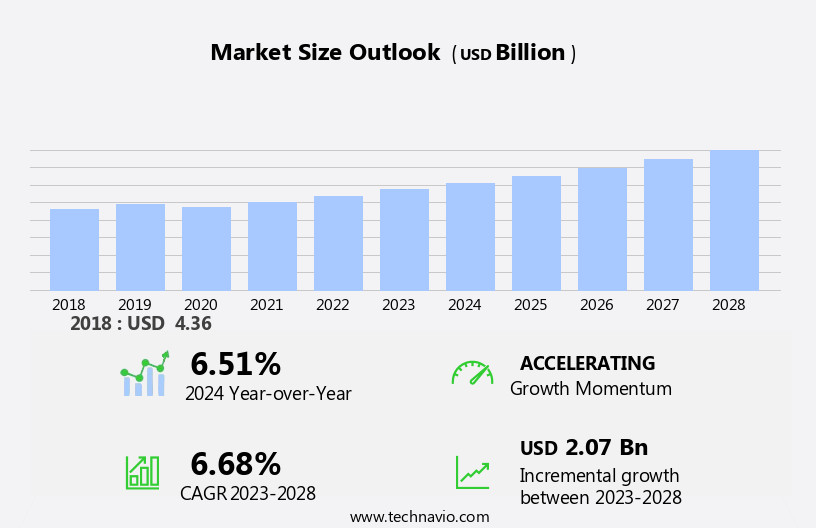

The automotive steering torque sensor market size is forecast to increase by USD 2.07 billion at a CAGR of 6.68% between 2023 and 2028.

- The market is experiencing significant growth due to the increasing penetration of Electric Power Steering (EPS) systems in Passenger Vehicles (PVs) and Light Commercial Vehicles (LCVs). The adoption of EPS systems is driving the demand for torque sensors, as they play a crucial role in ensuring optimal steering performance and fuel efficiency.

- Furthermore, the advent of new and innovative torque sensors is adding to the market's growth. However, the high initial capital investment required for the production and implementation of these sensors poses a challenge to market growth. Overall, the market is expected to witness steady growth in the coming years, driven by the increasing demand for advanced safety features and fuel efficiency in vehicles.

What will be the Automotive Steering Torque Sensor Market Size During the Forecast Period?

- The automotive industry is witnessing significant advancements in technology, particularly in the areas of heavy commercial vehicles and autonomous driving. Two key trends driving this transformation are electrification and autonomous vehicles. These innovations bring new demands for precise and efficient steering systems, leading to the growing importance of steering torque sensors in the automotive industry. Steering torque sensors play a crucial role in enabling advanced driver assistance systems (ADAS) and autonomous driving technologies. They measure the torque applied to the steering wheel, providing essential data for vehicle control during turning maneuvers and traffic sign recognition. This information is vital for collision avoidance systems and the overall safety of vehicles. The integration of steering torque sensors in electromechanical power steering systems and advanced steering systems has become increasingly common. These sensors use various technologies, such as strain gauges, hall-effect sensors, and magnetic sensing, to record the torque data. The rotating system of the steering wheel is monitored to ensure accurate and reliable measurements. The production of vehicles, particularly heavy commercial ones, is undergoing a significant shift towards automation.

- Furthermore, steering torque sensors are essential components in these processes, ensuring the smooth operation of power steering systems and enhancing vehicle safety. As the demand for autonomous driving technologies continues to grow, the role of steering torque sensors in the automotive industry will become even more prominent. In conclusion, the automotive industry is experiencing a technological revolution, with electrification and autonomous driving at the forefront. Steering torque sensors are playing a pivotal role in this transformation, enabling advanced driver assistance systems, enhancing vehicle safety, and contributing to the automation of vehicle production. The importance of these sensors will only continue to grow as the industry moves towards a more connected, efficient, and autonomous future.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Passenger cars

- Commercial vehicles

- Type

- Rotary torque sensors

- Reaction torque sensors

- Geography

- APAC

- China

- India

- Japan

- Europe

- Germany

- North America

- US

- South America

- Middle East and Africa

- APAC

By Application Insights

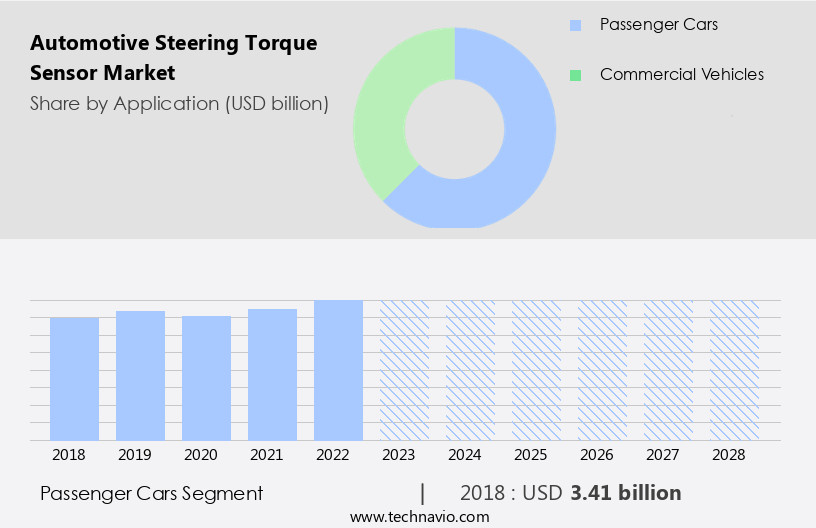

- The passenger cars segment is estimated to witness significant growth during the forecast period.

The market is significantly driven by the growing demand for passenger vehicles, particularly in developing economies. The passenger vehicle segment is the largest in the automotive industry, with its value and volume significantly influencing economic development. The Asia-Pacific region is expected to lead the passenger car market due to rapid economic growth and an increasing middle-class population. Over the past decade, there has been a shift from mechanically driven vehicles to advanced, electronically influenced, or electric vehicles, with a focus on safety, security, propulsion, and connectivity features. Fuel efficiency and the increasing adoption of electric vehicles are also key factors driving the market. Steering torque sensors, which include accelerometers, gyroscopes, and wheel speed sensors, play a crucial role in automotive steering systems by providing real-time data for improved vehicle stability, handling, and safety.

Get a glance at the market report of share of various segments Request Free Sample

The passenger cars segment was valued at USD 3.41 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

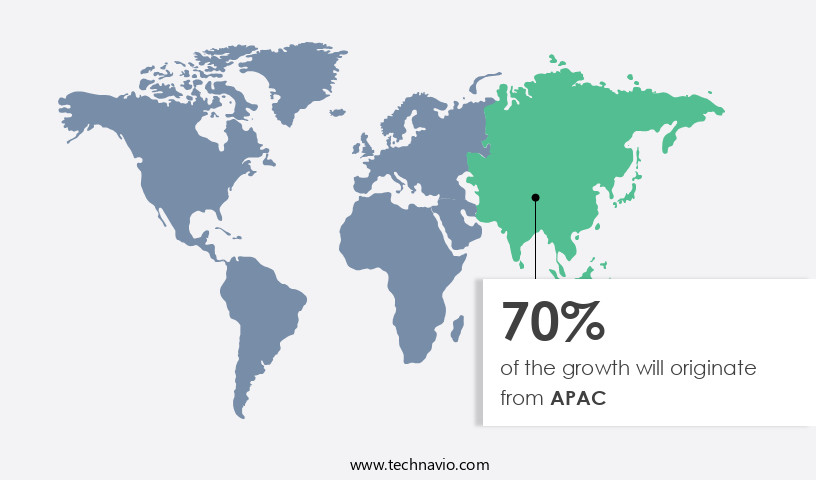

- APAC is estimated to contribute 70% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The Asia Pacific (APAC) region is experiencing rapid economic growth, primarily driven by countries such as China, India, Indonesia, and South Korea. This economic expansion has significantly increased per-capita income and consumer purchasing power, leading to a growth in automobile sales. In response, automotive sensor manufacturers have identified APAC as a key market due to its vast growth potential. Infrastructure and industrial development in the region are also driving demand for commercial vehicles (CVs). The automotive industry's focus on electrification, autonomous driving, and advanced driver assistance systems is further boosting the demand for torque sensors in CVs. APAC will remain a significant market for all players in the automotive value chain due to the anticipated production volume growth during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Automotive Steering Torque Sensor Market?

High penetration of EPS systems in PVs and LCVs is the key driver of the market.

- The market encompasses sensors utilized in steering systems of passenger cars, light commercial vehicles, and heavy commercial vehicles. These sensors measure the steering torque and facilitate advanced driver assistance systems, such as collision avoidance and adaptive cruise control. The market is driven by the electrification trend in the automotive industry, with Electric Power Steering (EPS) systems becoming increasingly popular due to their fuel efficiency and integration with autonomous driving technologies. EPS systems incorporate a torque sensor, which is positioned along the steering column to detect the force applied by the driver on the wheel. The sensor data is processed by electronic control units and used to regulate the electric motor or hydraulic pump to assist the steering effort.

- Furthermore, the growing adoption of EPS, Steer-by-Wire systems, and autonomous vehicles is propelling the demand for steering torque sensors. Additionally, sensor fusion technologies, such as accelerometers, gyroscopes, wheel speed sensors, and non-contact torque sensors (e.G., Magnetic sensing, Strain gauge bridges), are enhancing the functionality of automotive steering systems. The market is further influenced by the increasing vehicle production, especially in emerging economies, and the integration of steering systems with collision avoidance systems and other safety features. Despite the challenges posed by extreme vibrations, shocks, and temperature variations, steering torque sensors are essential components of modern automotive systems, enabling improved vehicle safety, automation, and fuel efficiency.

What are the market trends shaping the Automotive Steering Torque Sensor Market?

The advent of new and innovative torque sensors is the upcoming trend in the market.

- The market has experienced significant growth due to the increasing adoption of advanced steering systems in heavy commercial vehicles, electrification, and autonomous driving technologies. Electronic control units (ECUs) in motor and pump-assisted power steering systems, such as Electric Power Steering (EPS) and Steer-by-Wire systems, rely on torque sensors for precise measurement and control. OEMs are integrating these systems into heavy-duty (HD) trucks, commercial vehicles, and passenger cars to enhance fuel efficiency and vehicle safety. Sensor technology, including non-contact torque sensors using magnetic sensing or strain gauge bridges, plays a crucial role in recording steering torque data. These sensors enable automakers to develop driver assistance systems, such as collision avoidance systems, adaptive cruise control, and autonomous driving technologies.

- Furthermore, extreme vibrations, shocks, and temperature variations are common challenges in steering systems, necessitating the use of strong and reliable torque sensors. The integration of torque sensors in automotive systems is essential for maintaining vehicle stability during turning maneuvers and responding to traffic signs. The increasing adoption of EVs and the focus on fuel efficiency have further boosted the demand for torque sensors in electromechanical power steering systems. Sensor fusion technologies, such as accelerometers, gyroscopes, and wheel speed sensors, are also being employed to improve the overall performance of steering systems. In conclusion, the market is poised for continued growth due to the increasing demand for fuel-efficient automobiles, advanced steering systems, and autonomous driving technologies. The market dynamics are driven by the need for high-precision torque measurement in various automotive applications, including heavy commercial vehicles, light commercial vehicles, and passenger cars.

What challenges does Automotive Steering Torque Sensor Market face during the growth?

High initial capital investment is a key challenge affecting market growth.

- The market is witnessing significant growth due to the increasing adoption of advanced steering systems in heavy commercial vehicles, electrification, and autonomous driving technologies. These systems require high-precision measurement of steering torque to ensure efficient turning maneuvers and improved vehicle safety. Electronic control units (ECUs) in motor and pump-assisted Electric Power Steering (EPS) systems utilize torque sensors to record steering torque data. OEMs are integrating Steer-by-Wire systems, such as UD Active Steering, which rely on electric motors instead of hydraulic steering gears. The demand for fuel-efficient automobiles and commercial vehicles is driving the market for power steering systems and steering systems.

- However, the initial capital investment required for manufacturing torque sensors is high, posing a challenge for companies. Volatile raw material prices and the need for precise measurement in harsh environmental conditions further complicate matters. Sensor Technology advancements, including non-contact torque sensors using Magnetic sensing, Strain gauge bridges, Accelerometers, Gyroscopes, and Wheel speed sensors, are crucial for meeting the demands of various industries. These sensors are essential for collision avoidance systems, automotive systems, and driver assistance systems. Extreme vibrations, shocks, and temperature variations are common challenges in torque sensor applications.

- In conclusion, the adoption of EVs and the focus on fuel efficiency are expected to boost the market. Sensor fusion, using multiple sensors, is gaining popularity to enhance the accuracy and reliability of torque measurement. The aftermarket for passenger cars and light commercial vehicles is also growing, offering opportunities for companies. Adaptive cruise control, autonomous driving technologies, and vehicle safety are key areas where high-precision torque sensors are essential.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market. The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ABB Ltd.

- Advanced Micro Electronics Co. Ltd.

- AVL List GmbH

- Bourns Inc.

- DENSO Corp.

- Eltek Systems

- FUTEK Advanced Sensor Technology Inc.

- HELLA GmbH and Co. KGaA

- Hitachi Ltd.

- Honeywell International Inc.

- Hottinger Bruel and Kjaer GmbH

- Infineon Technologies AG

- Kistler Holding AG

- Methode Electronics Inc.

- Novanta Inc.

- Racelogic

- Robert Bosch GmbH

- SENSOTEC INSTRUMENTS S.A

- TE Connectivity Ltd.

- Valeo SA

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The automotive industry is witnessing significant advancements in technology, with a focus on electrification, autonomous driving, and fuel efficiency. One essential component of modern vehicles, particularly heavy commercial vehicles, is the steering system. The steering torque sensor plays a vital role in ensuring precise and efficient vehicle control. Steering torque sensors are crucial components of advanced steering systems, such as electric power steering (EPS) and steer-by-wire systems. These sensors measure the amount of force applied to the steering wheel by the driver and transmit this information to the electronic control units (ECUs) in the vehicle. The ECUs then adjust the steering assist to provide the desired level of steering effort, improving fuel efficiency and enhancing vehicle handling. Electrification is a major trend in the automotive industry, and it is significantly impacting the steering torque sensor market. Electric power steering systems have replaced traditional hydraulic steering systems in most vehicles due to their energy efficiency and improved performance.

In heavy commercial vehicles, electric motors and pumps are used to power the steering system, making it more fuel-efficient and reducing emissions. Autonomous driving technologies are another driving force behind the growth of the steering torque sensor market. Self-driving vehicles require precise steering control to navigate complex environments and perform turning maneuvers. Steering torque sensors play a critical role in enabling these vehicles to respond to traffic signs, collision avoidance systems, and other road conditions. Advanced steering systems, such as UD Active Steering and steer-by-wire systems, also rely on steering torque sensors to provide real-time feedback and ensure accurate vehicle control. These systems use non-contact torque sensors, such as magnetic sensing or strain gauge bridges, to measure torque without physical contact. This not only improves system reliability but also reduces the risk of wear and tear. Sensor fusion technology, which combines data from multiple sensors, is another trend that is gaining popularity in the automotive industry.

In conclusion, this technology is used to improve the accuracy and reliability of steering torque sensors by integrating data from accelerometers, gyroscopes, wheel speed sensors, and other sensors. This information is then used to provide more precise steering control and enhance vehicle safety. The market is expected to grow significantly in the coming years due to the increasing demand for fuel-efficient automobiles and advanced driver assistance systems. However, the market faces challenges such as extreme vibrations, shocks, and temperature variations, which can affect the accuracy and reliability of steering torque sensors. In conclusion, the market is a dynamic and evolving industry that is being driven by trends such as electrification, autonomous driving, and fuel efficiency. Steering torque sensors play a critical role in ensuring precise and efficient vehicle control, and their importance will only continue to grow as the automotive industry continues to innovate and push the boundaries of technology.

|

Automotive Steering Torque Sensor Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

179 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.68% |

|

Market growth 2024-2028 |

USD 2.07 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.51 |

|

Key countries |

US, China, Japan, India, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch